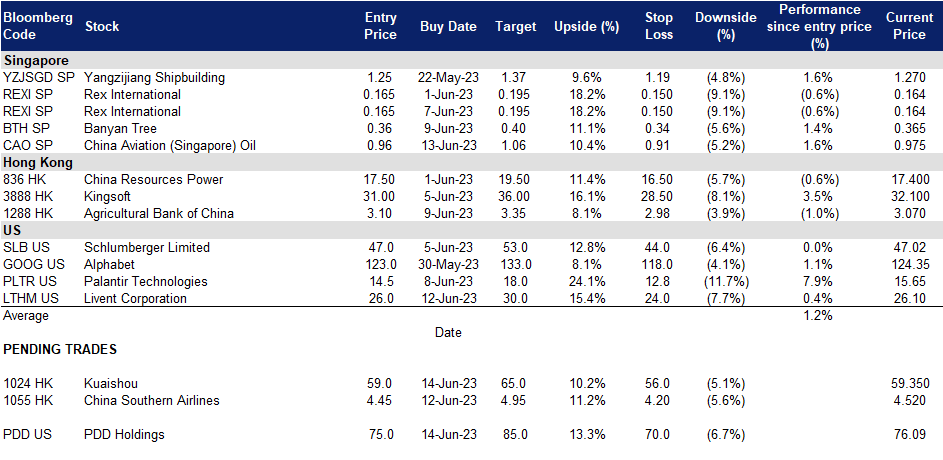

14 June 2023: China Aviation Oil Singapore Corp. Ltd. (CAO SP), China Southern Airlines Co. Ltd. (1055 HK), Livent Corporation (LTHM US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

China Aviation Oil Singapore Corp. Ltd. (CAO SP): Jet fuel demand to surge in the upcoming summer vacation

- BUY Entry 0.96 – Target – 1.06 Stop Loss – 0.91

- China Aviation Oil Singapore Corporation Limited supplies jet fuel to foreign and domestic airlines flying through China’s airports. The Company also trades in other oil products such as fuel oil, gas oil, crude oil, and petrochemical products, including physical and paper swaps, and futures trading.

- Expecting travelling demand surge in the upcoming summer. The summer vacation is generally a travelling peak season as fresh graduates from primary/secondary/high schools and colleges go travelling with friends and families before they move to new schools in September. The upcoming summer is the first long holiday season after China’s full-blown reopening, and tourism is expected to brace a pent-up demand from fresh graduates and their families. Overseas travelling is poised to further recover due to the pent-up demand.

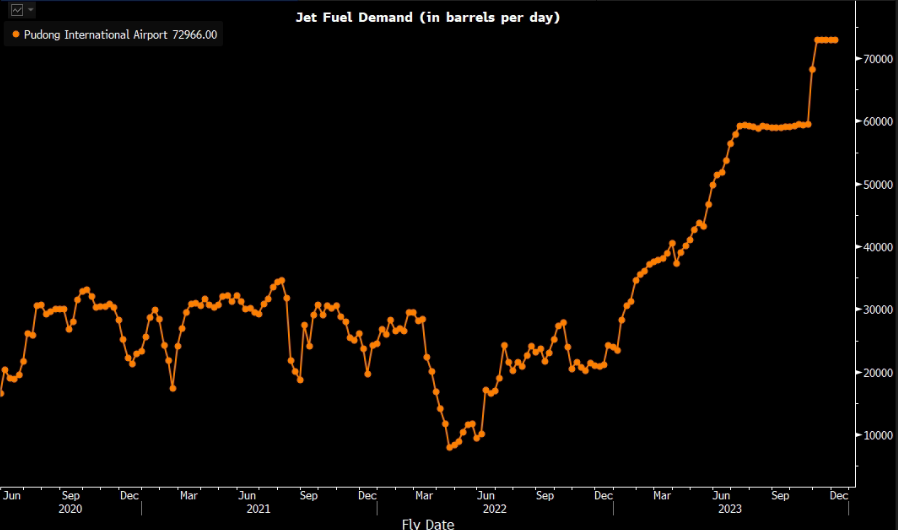

- Promising recovery in aircraft movement at Shanghai Pudong International Airport. According to the latest announcement, April aircraft movement at Pudong International Airport jumped by 726% YoY to 29074 flights. April passenger throughput jumped by 8155.9% YoY to 3.52mn. April freight throughput jumped by 145.8% YoY to 274.3 thousand tonnes.

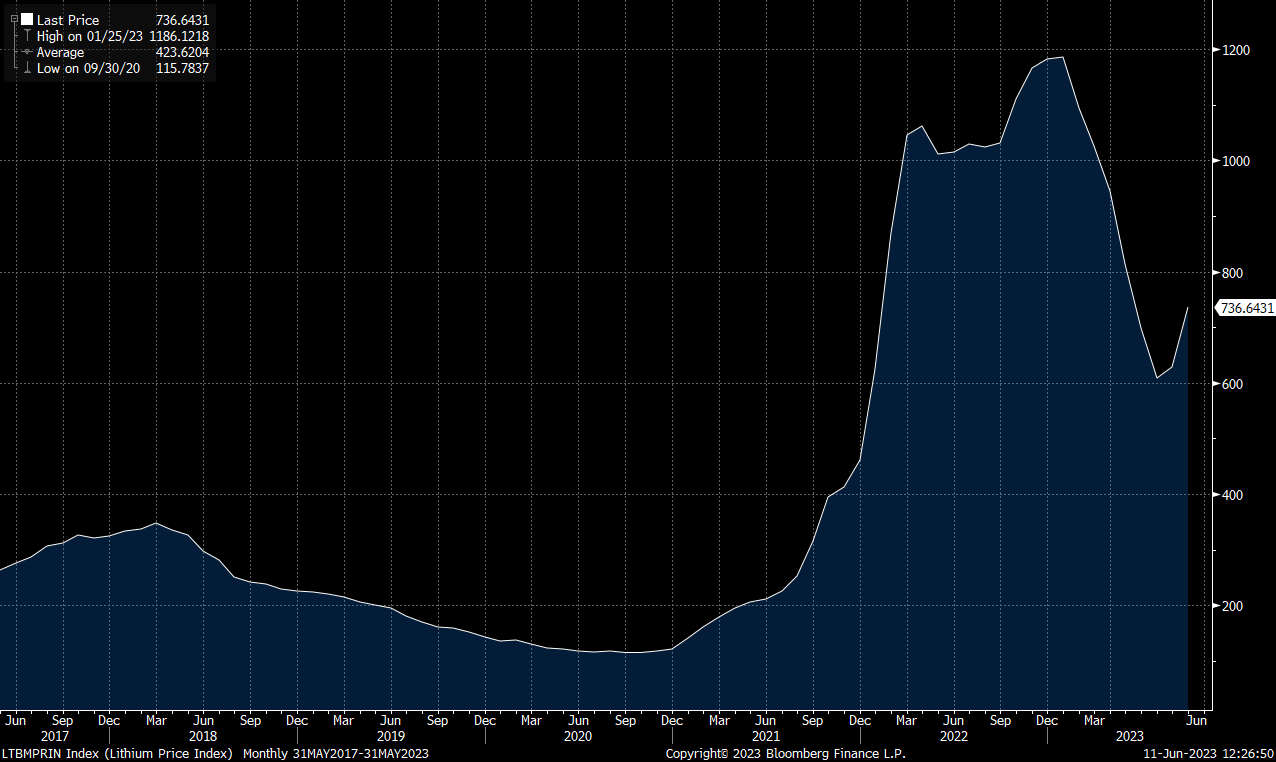

Scheduled jet fuel demand at Pudong International Airport

(Source: Bloomberg)

(Source: Bloomberg)

- FY22 results review. Revenue for FY22 fell by 6.65% to US$16.46bn. Gross profit rose by 15.29% YoY to US$35.39mn. Total supply and trading volume decreased by 40.60% YoY to 20.26mn tonnes. Net profit decreased by 17.75% YoY to US$33.19mn.

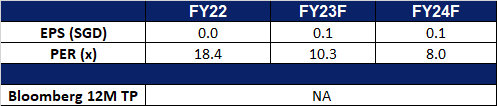

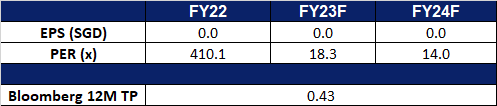

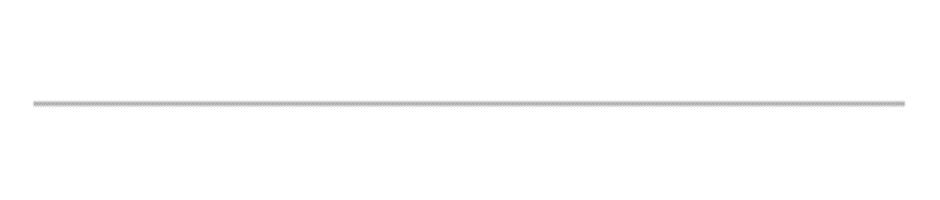

- Market consensus.

(Source: Bloomberg)

Banyan Tree Holdings Ltd. (BTH SP): Summer vacation to drive further recovery

Banyan Tree Holdings Ltd. (BTH SP): Summer vacation to drive further recovery

- RE-ITERATE BUY Entry 0.360 – Target – 0.400 Stop Loss – 0.340

- Banyan Tree Holdings Limited operates as a holding company. The Company, through its subsidiaries, owns and manages hotel groups. The Company focuses on hotels, resorts, spas, galleries, golf courses, and residences, as well as provides investments, design, construction, and project management services. Banyan Tree Holdings serves customers worldwide.

- Summer vacation coming. As the summer season approaches, popular destinations in South East Asia and other parts of Asia such as Japan, anticipate a surge in tourist arrivals. This presents an opportunity for international travel and tourism businesses, like BTH, to attract visitors looking for high-quality experiences. By highlighting its enhanced offerings and service levels, BTH can position itself as a preferred choice for travellers seeking unique and tailored accommodation options. With a strong presence in Southeast Asia, particularly in Thailand, BTH is well-positioned to capitalise on the growing interest in the region and cater to the needs of discerning tourists.

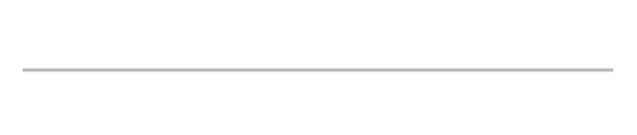

- Appeal to Chinese tourists. Thailand’s tourism industry has experienced a remarkable recovery in Chinese tourist arrivals since reopening its borders. In the first five months of the year, the country welcomed one million Chinese visitors, signalling a significant increase compared to the previous year. The Thai government has set a target of attracting five million Chinese tourists in 2023, with an expected expenditure of 446 billion baht (US$13.18 billion). This resurgence highlights the importance of the Chinese market and its contribution to Thailand’s overall tourism sector. With the approach of China’s summer holiday season and the majority of properties located in Southeast Asia, particularly in popular destinations like Thailand, the company is well-positioned to appeal to Chinese tourists seeking overseas trips.

China outbound tourist growth – Thailand

(Source: Bloomberg)

- FY22 results review. Revenue for FY22 increased 23% to S$271.3mn, from S$221.2mn a year ago. Return to profitability in 2022, from the previous year’s loss after tax and minority interests of S$55.2mn to a profit of S$0.8mn.

- Market consensus.

- Read the full fundamentals-based report here.

(Source: Bloomberg)

Kuaishou Technology (1024 HK): Expecting a sales boom in the upcoming online shopping spree

- RE-ITERATE BUY Entry – 59.0 Target – 65.0 Stop Loss – 56.0

- Kuaishou Technology is a China-based investment holding company mainly engaged in the operation of content communities and social platforms. The Company mainly provides live streaming services, online marketing services and other services. The online marketing solutions include advertising services, Kuaishou fans headline services and other marketing services. Other services include e-commerce, online games and other value-added services. The Company mainly conducts business within the domestic market.

- Online live-streaming sales growth. The online live-streaming shopping market in China is experiencing significant growth, reaching a total of $497 billion in 2022, as reported by Coresight Research. This upward trend can be attributed to consumers who are increasingly valuing their time and opting for the convenience of watching live stream shopping from anywhere, rather than simply browsing products online or visiting physical stores for purchases.

- Upcoming June 18th shopping festival. In anticipation of the annual June 18 shopping carnival, major e-commerce platforms in China have already initiated presales. This year, these platforms have introduced more extensive promotional events and direct subsidies, streamlining their promotional methods. Buyers no longer need to perform complex calculations or combine multiple orders to avail discounts. Additionally, live-streaming sessions continue to play a crucial role during the June 18 shopping festival. Short-video platforms like Douyin and Kuaishou have increased subsidies in an effort to attract more traffic and compete with e-commerce platforms. Overall, this promotional event is expected to stimulate consumption growth in the second quarter.

- 1Q23 earnings. The company swung to an adjusted net profit of 42mn yuan (HK$46.8mn) in the first quarter, the first time since its listing in Hong Kong in 2021, compared to a net loss of 3.7bn yuan a year ago. Revenue rose to 25.2bn yuan, a 20% increase YoY. The company also revealed plans to buy back up to HK$4 bn worth of shares over the period till the conclusion of the company’s AGM.

- Market Consensus

(Source: Bloomberg)

China Southern Airlines Co. Ltd. (1055 HK): Incoming peak travelling season

- RE-ITERATE BUY Entry – 4.45 Target – 4.95 Stop Loss – 4.20

- China Southern Airlines Company Limited is principally engaged in the operation of civil aviation, including the provision of passenger, cargo, mail delivery and other extended transportation services. The Company operates through two business segments, including Airline Transportation segment and Other segment. Airline Transportation segment consist of passenger and cargo and mail operations. Other segment includes hotel and tour operation, ground services, cargo handling and other miscellaneous services. . The Company also provides services of general aviation and aircraft maintenance. The Company acts as an agency of domestic and foreign airlines, and other aviation and related business, such as personal accident insurance and agency business.

- More International flights. China Southern Airlines has recently unveiled a new flight route that connects Beijing and London. This development is part of the Chinese airlines’ ongoing efforts to expand their overseas routes in the wake of the pandemic. Operating seven times a week, the route departs from Beijing Daxing International Airport and arrives at London Heathrow Airport. It marks the first direct route operated by a Chinese airline between these two airports and offers a travel time of approximately 10 hours to reach London. This signifies the growing international travel demand worldwide, driven by China’s recovering economy and the gradual relaxation of post-pandemic restrictions.

- Peak travelling season. As the summer season approaches, many popular destinations in South East Asia and other parts of Asia such as Japan, anticipate a surge in tourist arrivals. Bookings in China for trips abroad have surge as China’s economy re-opens and consumers release their pent-up demand for travelling, presenting a increased in demand for international flights.

- 1Q23 earnings. The company saw a rise in Revenue to RMB34.06mn (+58.61% YoY), compared to RMB21.47mn in 1Q2022. Net Income rose 57.8% You to -RMB1.9bn. Basic EPS eased to -RMB0.1 compared to -RMB0.27 a year ago.

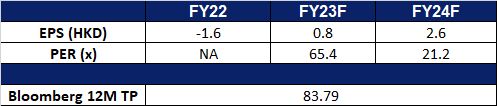

- Market Consensus.

(Source: Bloomberg)

Livent Corporation (LTHM US): High in demand

- RE-ITERATE BUY Entry – 26 Target – 30 Stop Loss – 24

- Livent Corporation produces and distributes lithium compounds. The Company offers lithium products for applications in batteries, agrochemicals, aerospace alloys, greases, pharmaceuticals, polymers, and various industrial applications. Livent serves customers worldwide.

- Federal tax credit for electric vehicles (EV) in the US. Tesla’s Model 3 sedans, have become eligible for the full US tax credit under new criteria for battery-sourcing set by the US Treasury Department. This is part of the Biden administration’s plan to promote the adoption of electric vehicles. The updated eligibility now includes a total of 22 EV models, encompassing offerings from General Motors, Ford, Volkswagen, and other companies. As a result, this expansion of the tax credit availability to Tesla and other manufacturers is expected to have a positive impact on the demand for lithium and other materials used in EV battery production.

- Easier access to EV chargers. General Motors (GM) has announced a partnership with Tesla to gain easier access to the electric vehicle (EV) leader’s charging network and technologies. Through this deal, GM vehicles will be able to utilize Tesla’s fast chargers using an adapter and GM’s EV charging app, starting in 2023. Additionally, GM will adopt Tesla’s North American Charging Standard (NACS) instead of the current industry-standard CCS for its EVs from 2025 onwards. This collaboration is a significant win for Tesla and its charging technology, placing pressure on other automakers and the U.S. government to consider adopting Tesla’s approach. The partnership is expected to double the availability of fast chargers for GM and Ford customers, leading to increased demand for EVs and subsequently driving up the demand for lithium. Tesla’s extensive Supercharger network, which has approximately 45,000 connectors worldwide, will contribute to enhancing the public charging infrastructure, addressing a major concern for potential EV buyers and encouraging further adoption of electric vehicles.

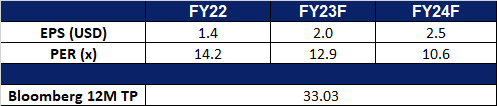

Lithium Price Index

(Source: Bloomberg)

- Increased demand for lithium batteries. As more EVs are being purchased, there is a greater demand for lithium batteries that are used to power these EVs. Tesla Inc reported a 2.4% increase in China-made EV deliveries in May compared to April, while sales rose by 142% on a yearly basis. Chinese automaker BYD Co Ltd also experienced a 14% sales growth in May for its EVs and hybrid vehicles. This surge in sales reflects the recovery in consumer spending and manufacturing activity in China, supported by favourable policies to boost vehicle consumption. The sales of new energy vehicles (NEVs) continue to rise, with significant growth seen in both NEV sales and vehicle charging equipment sales. This trend highlights the growing demand for EVs and the corresponding need for lithium batteries to power these vehicles.

- 1Q23 earnings review. Revenue rose 77% YoY to US$253.5mn, beating estimates by US$23.56mn. GAAP EPS of $0.55 beat expectations by $0.15.

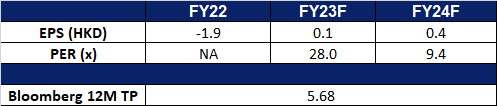

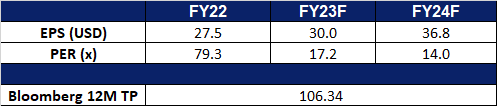

- Market consensus.

(Source: Bloomberg)

PDD Holdings Inc (PDD US): 618 “fire sale”

PDD Holdings Inc (PDD US): 618 “fire sale”

- RE-ITEREATE BUY Entry – 75 Target – 85 Stop Loss – 70

- PDD Holdings Inc. is a multinational commerce group that owns and operates a portfolio of businesses. The Company focuses on digital economy so that local communities and small businesses can benefit from the increased productivity and new opportunities. PDD Holdings has built a network of sourcing, logistics, and fulfillment capabilities for its underlying businesses.

- Expecting high volume from 618 sales. The ongoing 618 mid-year sales event in China is anticipated to generate high sales volumes for domestic e-commerce platforms. This shopping festival, following the country’s adjustment of COVID-19 measures, signals a recovery in consumer spending and reflects the rising demand for high-quality products. Chinese consumers, who have become more discerning, seek value for money and prioritise quality at reasonable prices. With attractive discounts and vouchers offered by domestic e-commerce platforms and brands, increased sales are expected, driven by pent-up demand and the preference for high-quality and new-generation products. The reported success of major Chinese e-commerce platforms during this event further affirms the recovery in consumer spending and manufacturing activity in China. PDD platform’s focus on fast-moving consumer goods (FMCG) and its unique approach of encouraging customers to join together in purchasing groups to maximise savings through bulk purchases will further contribute to its anticipated success during this sales period.

- Extra discounts. In preparation for the 618 shopping festival, PDD introduced a 10 bn yuan subsidy program targeting home appliances and consumer electronics. This program, launched on April 6th, includes major domestic and international brands such as Apple, Huawei, Xiaomi, Midea, Sony, Nintendo, Dyson, and more. PDD has also partnered with brands like Haier, Vivo, TCL, Asus, and others to offer factory-direct products, combining subsidies with direct sales to provide consumers with better discounts and benefits. By connecting popular factory products directly to consumers through subsidies and direct sales, this initiative aims to stimulate both the supply and demand sides, offering competitive prices to consumers and boosting the recovery of the manufacturing sector.

- Expansion to the West. Temu, PDD’s e-commerce platform, made its entry into the US market in September 2022. This Chinese-owned marketplace connects predominantly Chinese merchants with customers in the US, Canada, Europe, and Australia. Temu distinguishes itself with its focus on ultra-low prices, achieved by reducing supply chain inefficiencies and passing the savings to consumers. Its website and app heavily emphasize deals and discounts, with products often marked down by up to 80%. This approach has led some consumers to compare Temu to a dollar store. The platform has gained significant traction, surpassing popular platforms like Amazon, TikTok, and Instagram in download charts, indicating its appeal to budget-conscious customers seeking affordable goods online. Temu’s success lies in serving this specific customer segment and filling a void in the discount market.

- 1Q23 earnings review. Revenue rose 58% year-over-year to US$5.48bn, beating estimates by US$920mn. Non-GAAP EPADS of $1.01 beat expectations by $0.38.

- Market consensus.

(Source: Bloomberg)

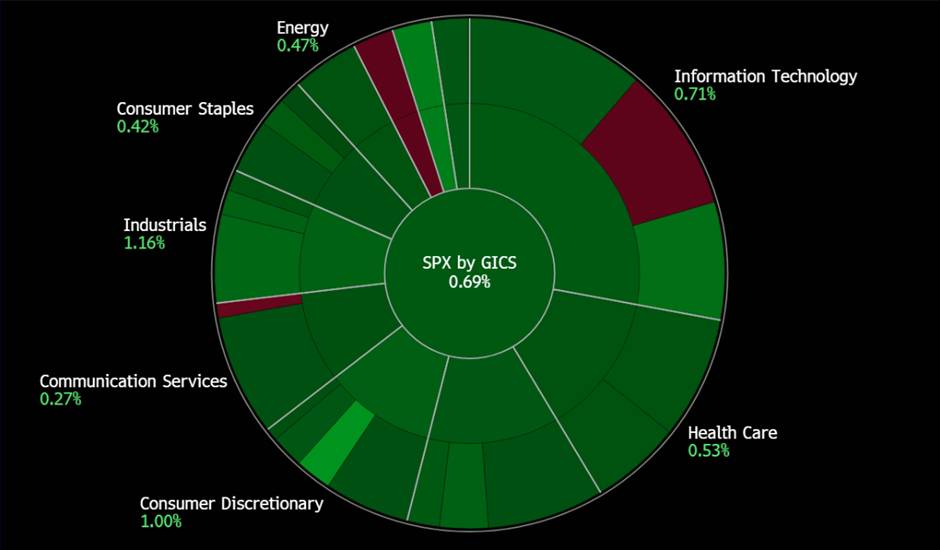

United States

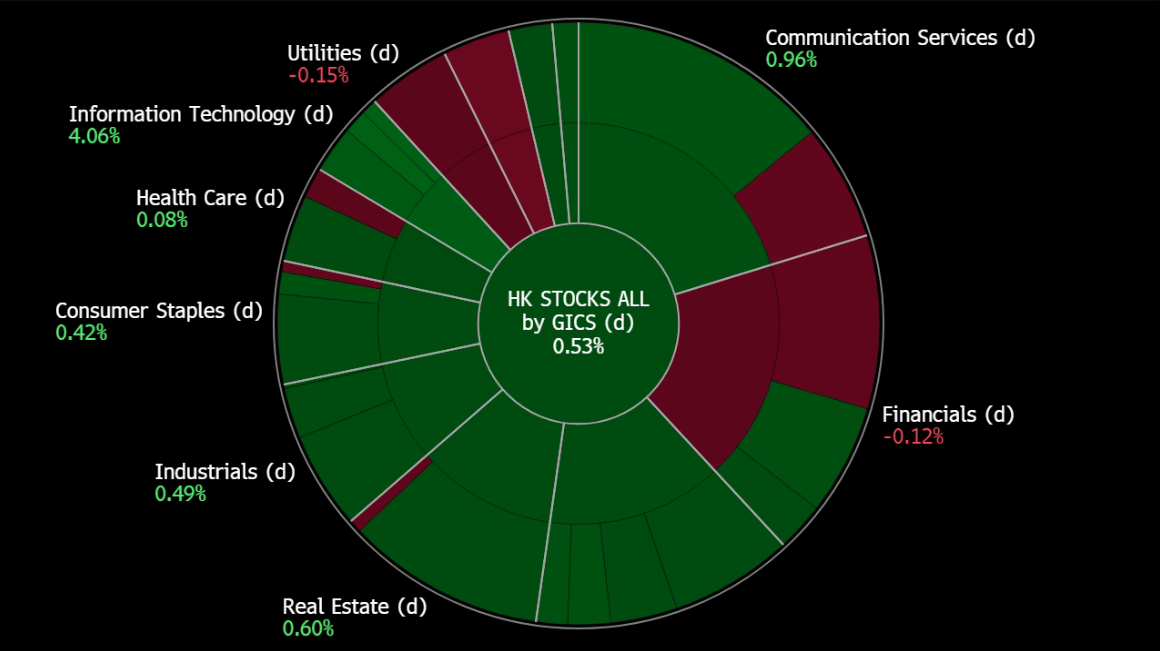

Hong Kong

Trading Dashboard Update: Add China Aviation Oil (CAO SP) at S$0.96 and Livent Corp (LTHM US) at US$26. Take profit on Wilmar Int (WIL SP) at S$4.0 and HSBC Holdings (5 HK) at HK$60. Cut loss on Enphase Energy (ENPH US) at US$170.