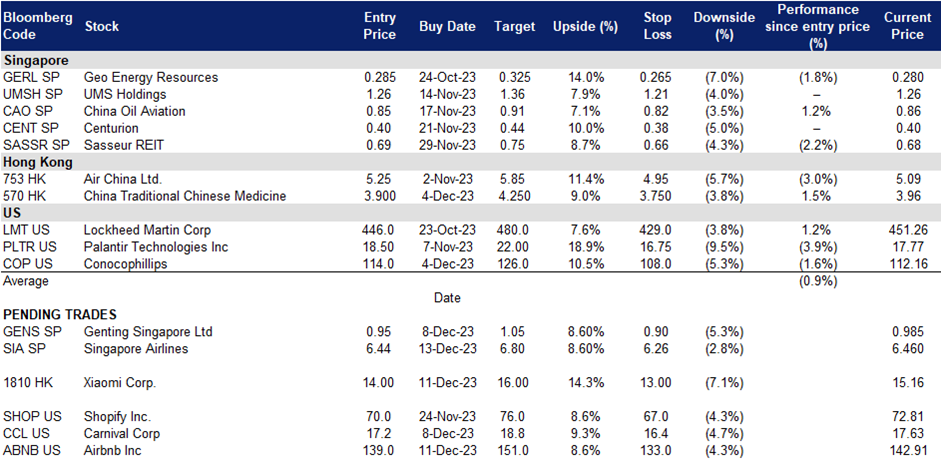

13 December 2023: Genting Singapore Ltd (GENS SP), Xiaomi Corp. (1810 HK), Airbnb Inc (ABNB US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

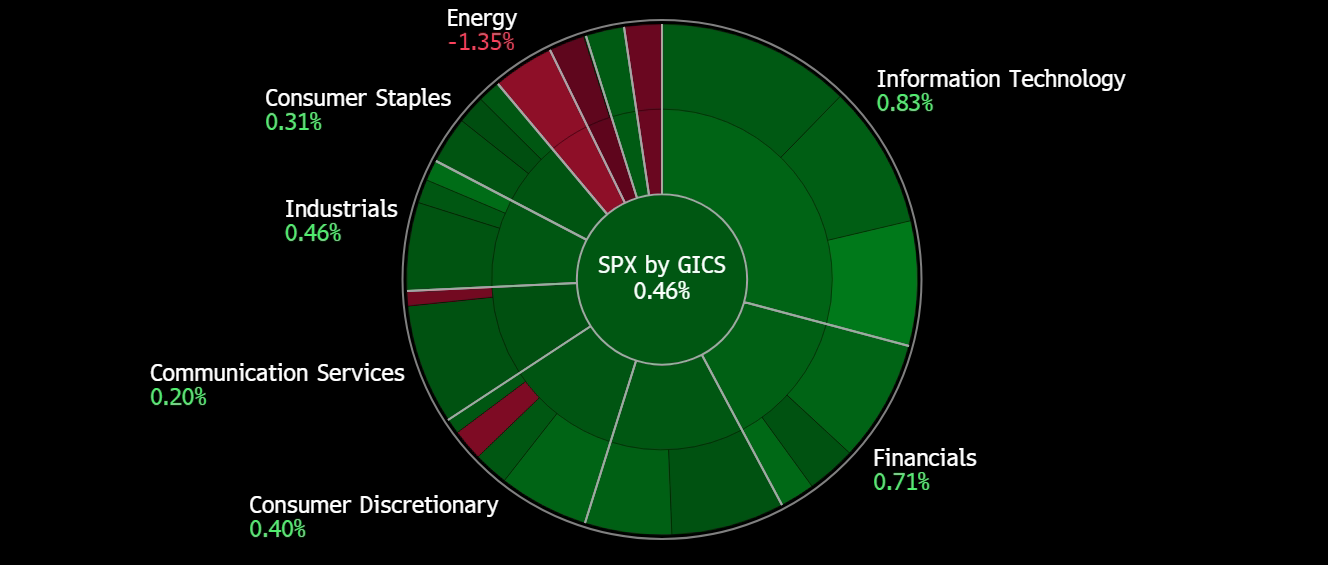

United States

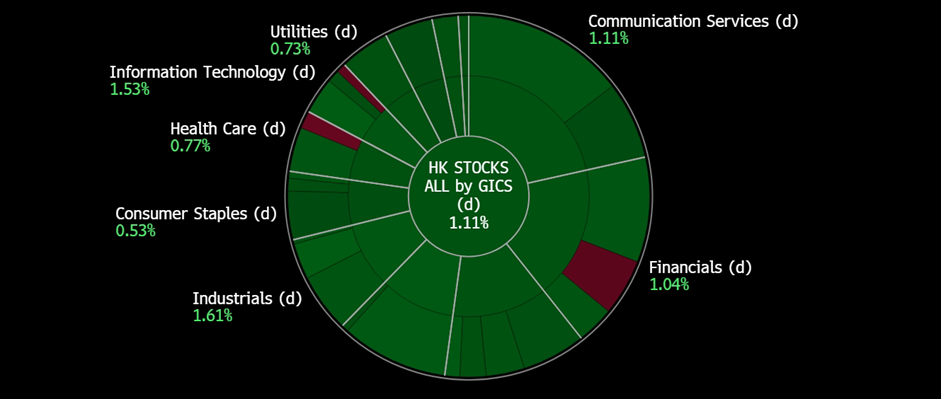

Hong Kong

Genting Singapore Ltd (GENS SP): China-Singapore mutual visa-free in 2024

- RE-ITERATE BUY Entry 0.95 – Target – 1.05 Stop Loss – 0.90

- Genting Singapore Limited, through its subsidiaries, develops resort properties as well as operates casinos. The Company has casinos and integrated resorts in different parts of the world, including Australia, the Americas, Malaysia, the Philippines and the United Kingdom.

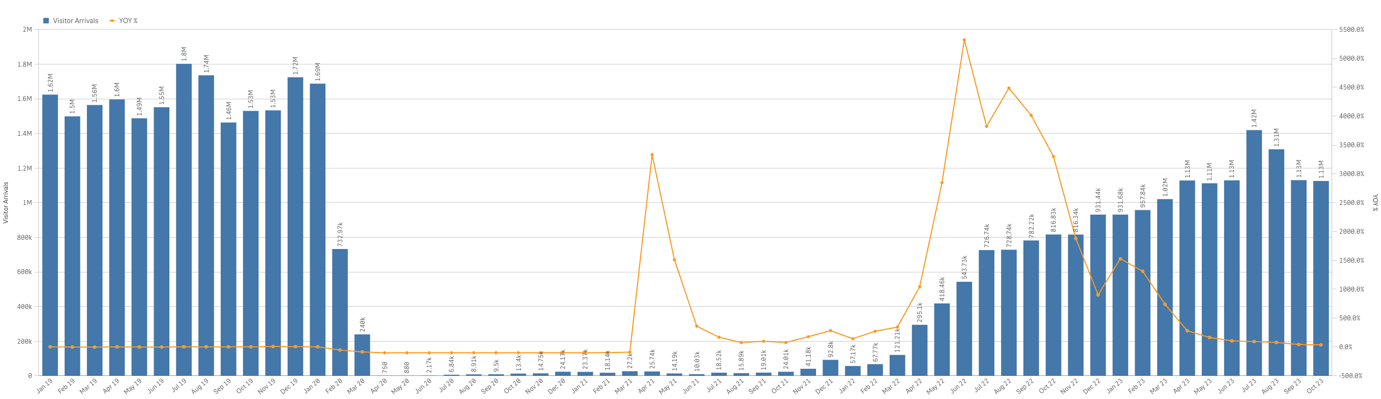

- 30-day mutual visa-free between Singapore and China. During the 19th Joint Council for Bilateral Cooperation, Singapore and China achieve a 30-day mutual visa-free arrangement. The implementation is expected to be in early 2024. Accordingly, Chinese visitor arrivals are estimated to further increase. Hence, Singapore Resorts World Sentosa shall see improvements in its revenue streams in 2024.

- Still has room for visitor arrivals to recover. Visitor arrivals to Singapore further improved in 2023. However, recent figures show that the number of visitors travelling to Singapore has flattened. Compared to the pre-CVOID level, tourism has not fully recovered. There is room for recovery as the average number of arrivals was above 1.5mn per month while the YTD number is around 1.1mn per month.

Singapore monthly visitor arrivals trend (2019-2023)

(Source: Singapore Tourism Analytics Network)

- Correlation between tourists and revenue. Genting Singapore reported a significant increase in net profit and revenue for 1H23. The company attributed this improved performance to an increase in foreign visitor arrivals to Singapore, despite challenges such as limited air capacity from certain regional countries and higher airfares affecting leisure travel. Resorts World Sentosa (RWS) saw a 37% growth in adjusted earnings in 2Q23, mainly due to a rebound in the non-gaming business, a strong VIP win rate, and a recovery in regional gaming activities. Gross gaming revenue also rose 3% on a hold-normalised basis, reaching $547.9mn. We anticipate continued growth in Genting’s revenue from the increase in visitor arrivals in 2H23 alongside its strong VIP gaming segment and keys added to its newly refurbished Ora Hotel.

- Project timeline. Genting Singapore previously mentioned that it aims to begin construction in FY24 after government approvals on the new Waterfront building, the Equarius Hotel extension and the Health and Wellness Centre.

- 1H23 earnings. The company revenue rose to S$1,080.4mn, +63% YoY compared to 1H22. The company’s net profit for the period was S$276.7mn, more than 3 times the net profit in 1H22 of S$84.4mn. Basic earnings per share were S$2.29 cents compared to the previous S$0.70 cents in 1H22. It also paid out an interim dividend of S$1.5cents on 22 September 2023.

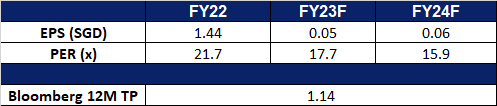

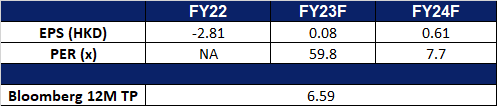

- Market Consensus.

(Source: Bloomberg)

Singapore Airlines Ltd. (SIA SP): Upbeat outlook in 2024

Singapore Airlines Ltd. (SIA SP): Upbeat outlook in 2024

- Entry 6.44 – Target – 6.80 Stop Loss – 6.26

- Singapore Airlines Limited provides air transportation, engineering, pilot training, air charter, and tour wholesaling services. The Company’s airline operation covers Asia, Europe, the Americas, South West Pacific, and Africa.

- Exceeded 2023 expectations. According to the International Air Transport Association (IATA), airline profitability in 2023 exceeded expectations, with revenues projected to reach US$896bn, US$93bn higher than anticipated. Expenses also rose to US$855bn, US$74bn above the previous forecast. This resulted in a net profit of US$23.3bn, significantly surpassing the June forecast of US$9.8bn. However, the net profit margin is just 2.6%, equating to an average of US$5.44 per passenger carried in 2023. The improvement was mainly driven by the passenger business, which saw a US$96bn increase in revenues. Cargo revenues slightly underperformed, reaching US$134.7bn instead of the expected US$142.3bn.

- Expected 2024 record highs. IATA anticipates a YoY increase in 2024 net profits, reaching US$25.7bn with a 2.7% net profit margin. Operating profits are projected at US$49.3bn. Record-breaking revenues of US$964bn are expected, with passenger revenues at US$717bn and cargo revenues at US$111bn, impacted by belly capacity growth. Despite challenges like rising fuel prices and supply chain issues, the industry’s recovery remains robust, emphasising resilience while acknowledging ongoing challenges and the need for regulatory improvements. Furthermore, the Airports Council International (ACI) has indicted strong passenger growth, positioning the industry for global passenger traffic recovery in 2024. According to a Skyscanner report, 87% of Singapore’s travellers plan equal or more trips abroad in 2024 than 2023, with 48% citing flight ticket costs as a significant factor. Travel demand is expected to stay high in the coming year.

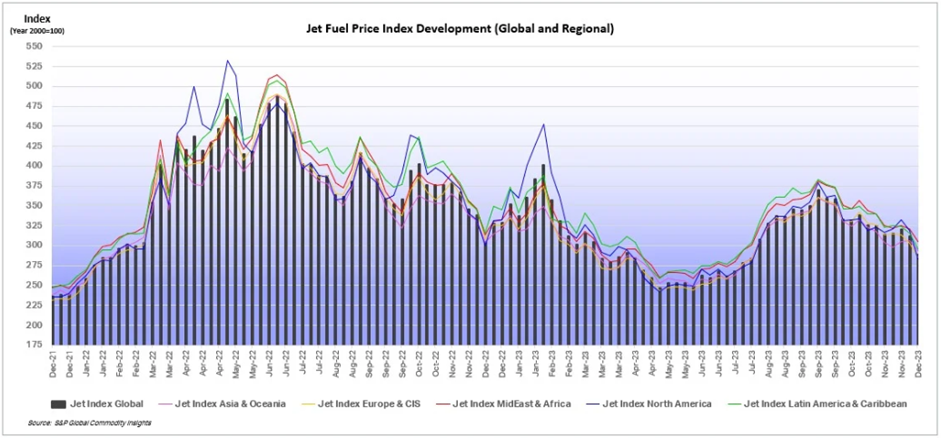

Jet Fuel Price Trend

(Source: International Air Transport Association)

- Lower jet fuel prices. On the week ending 8 Dec, the global average jet fuel price dropped by 7.5% to US$105.30/bbl. Oil prices fell due to increased production in the US and other non-OPEC countries, along with reduced demand from China. Jet fuel prices in Europe continued to decline due to air traffic remaining below 90% of pre-pandemic levels. The US also experienced lower jet fuel prices due to a combination of decreased demand and increased refinery output. The lower jet fuel prices are benefiting airlines, improving their operating margins.

- A380 back in the lineup. Singapore Airlines has effectively reintroduced all its Airbus A380 aircraft into service, coinciding with the continued revival of air travel demand in Southeast Asia. Airlines in Southeast Asia aim for a 90% capacity rebound by the end of 2023 post-pandemic. This positions SIA to address the surge in travel demand and utilise these aircrafts with more seating capacity for its busier and longer-haul flights.

- 1H24 earnings. The company revenue rose to S$9,162mn, +8.9% YoY compared to 1H23. The company’s net profit for the period was S$1,441mn, a 55.4% increase YoY. SIA and Scoot carried 17.4mn passengers in 1H24, an increase of 52.3% YoY. Passenger traffic grew 38.0% from a year before, outpacing the capacity expansion of 29.0%. As a result, the Group passenger load factor (PLF) improved by 5.8 percentage points to 88.8%, the highest ever half-yearly PLF. SIA and Scoot achieved record PLFs of 88.0% and 91.3% respectively. The Company declared an interim dividend of 10 cents per share, amounting to S$297mn, for 1H24 which will be paid on 22 December 2023 for shareholders as of 7 December 2023.

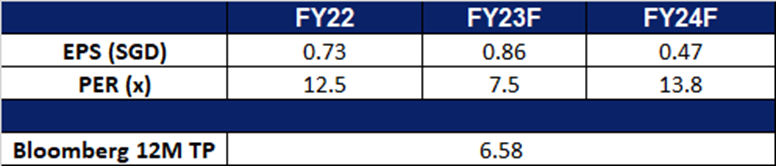

- Market Consensus.

(Source: Bloomberg)

Xiaomi Corp. (1810 HK): New products to lift the top line

- BUY Entry – 14.0 Target – 16.0 Stop Loss – 13.0

- XIAOMI CORPORATION is a China-based investment holding company principally engaged in the research, development and sales of smartphones, Internet of things (IoTs) and lifestyle products, the provision of Internet services, and investment business. The Company mainly conducts its businesses through four segments. The Smartphone segment is engaged in the sales of smartphones. The IoT and Lifestyle product segment is engaged in the sales of other in-house products, including smart televisions (TVs), laptops, artificial intelligence (AI) speakers and smart routers; ecosystem products, including IoT and other smart hardware products, as well as certain lifestyle products. The Internet service segment is engaged in the provision of advertising services and Internet value-added services. The Others segment is engaged in the provision of repair services for its hardware products. The Company distributes its products in domestic market and to overseas markets.

- Tapping into the EV market. As part of the company’s effort to create a seamless ecosystem, the company has engaged with several carmakers about possible partnerships to build EVs. The company has also recently secured approval from the National Development and Reform Commission (NDRC) to manufacture 100,00 vehicles annually, marking a major milestone for the company’s venture into EV manufacturing. Xiaomi’s founder, Lei Jun has also previously announced an investment of $10bn into the EV space over the next ten years, and aims to mass produce its first cars by 1H2024.

- Surging sales of Xiaomi 14 and 14Pro. Xiaomi just released it Xiaomi 14 and 14Pro last week, marking them as the world’s first smartphones powered by the Snapdragon 8 Gen 3 chipset. The Xiaomi 14 series broke the company’s previous year’s record on all its major Chinese online retail platforms, selling out within the first four hours of its initial sales. Consumers were attracted to the series 14 impressive design, the enhanced iteration of the Xiaomi 13 series, the incorporation of the Snapdragon 8 Gen 3 chipset, and the introduction of the all-new HyperOS user experience, alongside having a Leica-optimized Light Hunter 900 primary camera in addition to a unique Leica Summilux lens, providing a high-quality photography experience.

- Integration of new operating system. Xiaomi announced recently its new operating system, the Xiaomi HyperOS. This operating system is made available to consumers together with the sales of Xiaomi’s latest phone, the 14 series, as well as other latest wearables and TV sets in China on 31st Oct 23. This shift into a new operating system also marks a strategic move of the company’s vision into creating a seamless smart ecosystem, “Human x Car x Home”. This ecosystem is bound to entice consumers to purchase Xiaomi’s other products as well.

- 2Q23 earnings. Revenue fell 4.0% YoY to RMB67.4bn in 2Q23, compared with withRMB70.2bn in 2Q22. Adjusted Net profit was RMB5.14bn in 2Q23, increasing 147% YoY compared to RMB2.08bn in 2Q22. Basic earnings per share was RMB0.15 in 2Q23, compared to RMB0.06 in 2Q22.

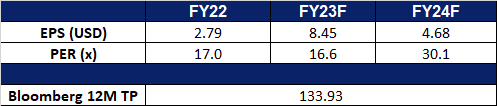

- Market consensus.

(Source: Bloomberg)

Air China Ltd. (753 HK): Flights to increase going forward

- RE-ITERATE BUY Entry – 5.25 Target – 5.85 Stop Loss – 4.95

- Air China Limited is a China-based company principally engaged in the provision of air passenger transportation, freight transportation, postal transportation and maintenance services in Mainland China, Hong Kong, Macau and foreign regions. The Company is also engaged in domestic and international business aviation businesses, plane business, aircraft maintenance, airlines business agents, ground and air express services related to main businesses, duty free on boards, retail business on boards and aviation accident insurance sales agents business.

- Returning to Profit. Air China returned to profitability during the initial nine months of the year, driven by a substantial increase in business and leisure travel after Beijing eased stringent COVID-19 restrictions. With the increase in deployment of transportation capacity by the company, and driven by the increase in both passenger load factor and price, the loss decreased significantly with growth in profit.

- More flights between China and the US. The US Department of Transportation announced that flights between China and the US will increase to 70 a week starting on 9 November, from the current 48 a week. The average flights between the two counties averaged 340 a week in the pre-COVID period. Recently, China and the US top officials started visiting each other, signalling some improvements in China-US relations.

- Rising seasonal travel demand. With the peak travel season coming up in November, travel demand is bound to pick up as consumers make their plans to travel for the end of the year, to escape the winter cold, or to experience the winter season. This winter holiday is also the first winter holiday since China’s reopening in Jan earlier this year, and hence is likely to see a rise in travel volume over the period. Chinese airlines have also seen a rise in scheduled flights for winter-spring, scheduling 96,651 domestic cargo and passenger flights each week for the upcoming winter-spring season, an increase of 33.95% from the same period in 2019-2020, according to the Civil Aviation Administration of China (CAAC). 516 new domestic routes will also be opened from Oct 29 to March 30 next year,, providing 7,202 flights each week, according to the CAAC. In terms of international flights, 150 domestic and foreign airlines plan to arrange 16,680 flights per week, reaching 68 foreign countries.

- 3Q23 earnings. Revenue rose to RMB45.86bn, up 152.89% YoY. Net profit was RMB 4.07bn, returning to profit for the first time for the year. Basic earnings per share was RMB0.28.

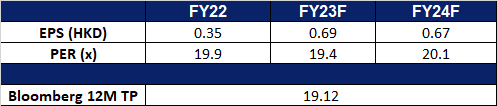

- Market Consensus.

(Source: Bloomberg)

Airbnb Inc (ABNB US): 2024 bookings to rise

- BUY Entry – 139 Target – 151 Stop Loss – 133

- Airbnb, Inc. operates an online marketplace for travel information and booking services. The Company offers lodging, home-stay, and tourism services via websites and mobile applications. Airbnb serves clients worldwide.

- 2024 demand expected to grow. Skyscanner CEO anticipates a 10% to 15% growth in travel demand for 2024, especially in Asia, building on the post-COVID-19 “revenge travel” trend. The travel trends report for 2024 highlights cultural exploration as a priority for travellers, with cost considerations remaining crucial. Despite concerns about the high cost of living, travel demand has remained resilient throughout the year, showing promising signs for the industry’s outlook in 2024. The use of technology, such as artificial intelligence AI, is expected to enhance travel experiences and help users plan more unique and personalised trips. With higher demand for travel, Airbnb is sure to see an uptick in revenue for the next year.

- Benefitting from the Olympics. Paris is set to host the 2024 Summer Olympics, with nearly 10mn visitors expected. However, the surge in demand for lodging has led to a 519% and 829% increase in Airbnb and Vrbo rates, respectively. Short-term rental prices have already doubled, averaging $932 per night during the event. Hosts in France, the second-largest Airbnb market, are capitalising on the opportunity, with some moving in with family to rent out their properties. Airbnb CEO has encouraged Parisians to list their homes, aiming to keep prices reasonable. The company anticipates over half a million visitors using Airbnb during the games, generating €1bn in economic benefits for France.

- Potential regulation. Industry players in Malaysia are urging the government to regulate Airbnb swiftly as hotel prices are expected to rise by 30% due to an increase in the sales and services tax (SST) from 6% to 8% next year. The Malaysia Budget and Business Hotel Association (MyBHA) president argues that Airbnb poses a significant threat to the hotel industry’s survival, as Airbnb rates will not be affected by the tax hike since they are not registered as businesses. He claims that Airbnb operates illegally without business licenses and pays residential rates for utilities, giving them a competitive advantage. Airbnb’s public policy head for Southeast Asia, India, Hong Kong, and Taiwan, disputed these claims, stating that Airbnb complies with relevant tax laws and contributes significantly to Malaysia’s GDP and job creation. The increase in SST is expected to impact hotel prices, making Airbnb more appealing to cost-conscious travellers. Industry leaders emphasise the need for regulatory measures to address the challenges posed by Airbnb to the hotel sector and the broader tourism industry.

- 3Q23 results. Revenue rose 18.1% YoY, to US$3.4bn. GAAP EPS beat estimates by US$4.53 at US$6.63. Expect nights booked growth to moderate in Q4 compared to Q3. For 4Q23, the company expects to deliver revenue of US$2.13bn to US$2.17bn, a YoY growth between 12% and 14%.

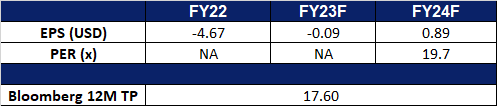

- Market consensus.

(Source: Bloomberg)

Carnival Corp (CCL US): Sailing round the world

- RE-ITERATE BUY Entry – 17.2 Target – 18.8 Stop Loss – 16.4

- Carnival Corporation owns and operates cruise ships offering cruises to all major vacation destinations including North America, United Kingdom, Germany, Southern Europe, South America, and Asia Pacific. The Company, through a subsidiary also owns and operates hotels and lodges. Dually-listed company with CCL LN.

- Heightened travel demand for the holidays. With the holiday season approaching, the travel industry is gearing up for a festive season bonanza. Eager travellers, flush with disposable income and a thirst for adventure, are setting their sights on exciting vacations and memorable cruises. This presents a perfect storm of opportunity for investors to navigate the high seas of profit with Carnival Corporation, the undisputed champion of the global cruise industry. With a market share of roughly 48%, CCL is the market leader in the cruise industry and therefore stands to benefit the most from this uptick in demand. So far, bookings have exceeded pre-pandemic levels, showcasing the company’s resilience and continued appeal.

- Partnership with Neuron. On December 5th, CCL entered into a strategic partnership with Neuron, a leading connectivity management platform. The collaboration is geared towards elevating onboard connectivity across CCL’s extensive global fleet of cruise ships. By leveraging Neuron’s advanced connectivity management tools and business intelligence solution, CCL aims to deliver an enhanced internet experience, ensuring faster and more reliable connectivity for both guests and crew. This partnership underscores CCL’s dedication to providing the utmost in-sea connectivity and prioritizing guest satisfaction.

- 3Q23 results. Carnival Cruise Line reported robust financial performance for 3Q23, with a revenue of $6.85bn, marking a significant 59.2% YoY increase. The company achieved notable operating income and net income of $1.62bn and $1.07bn, respectively, a substantial improvement from the previous year’s quarter, which saw an operating loss of $279mn and a net loss of $770mn. Furthermore, CCL’s earnings per share (EPS) stood at $0.79, a positive turnaround from the loss per share of $0.65 the year before. Looking ahead, CCL’s revenue is expected to grow 37.1% YoY, reaching $5.26bn and it is also projected to show an 83.8% YoY improvement in EPS.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Cut loss on Kuaishou (1024 HK) at HK$53.