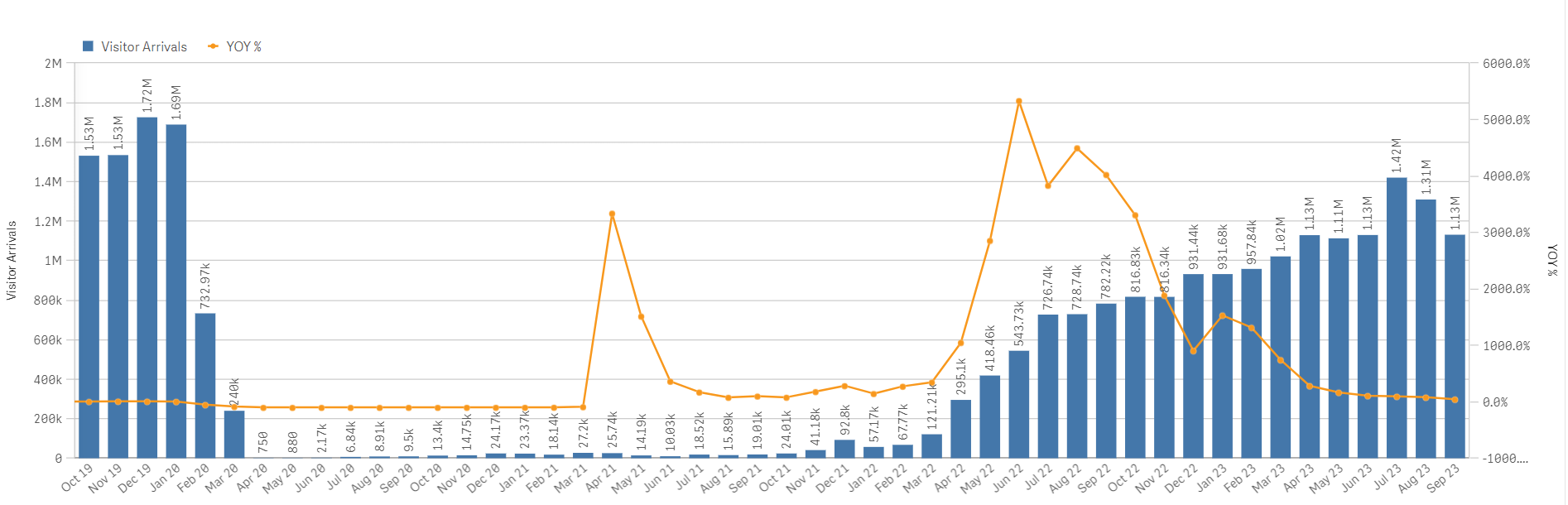

11 October 2023: Singapore Airlines Ltd. (SIA SP), Yankuang Energy Group Co. Ltd. (1171 HK), Coinbase Global Inc (COIN US)

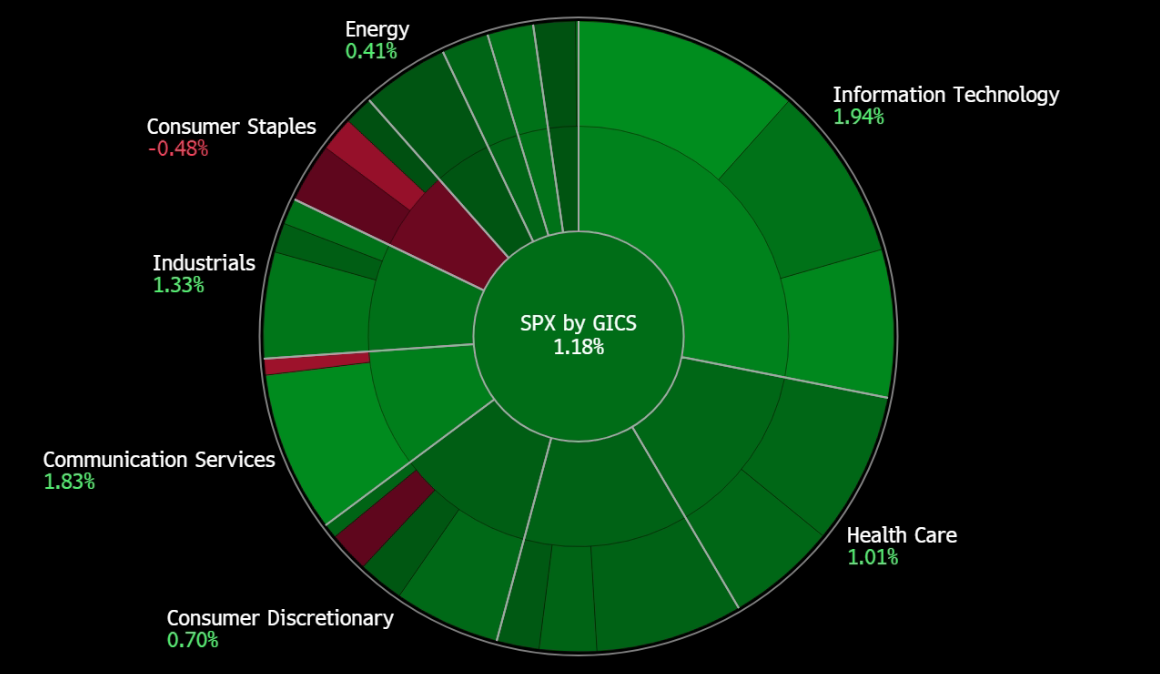

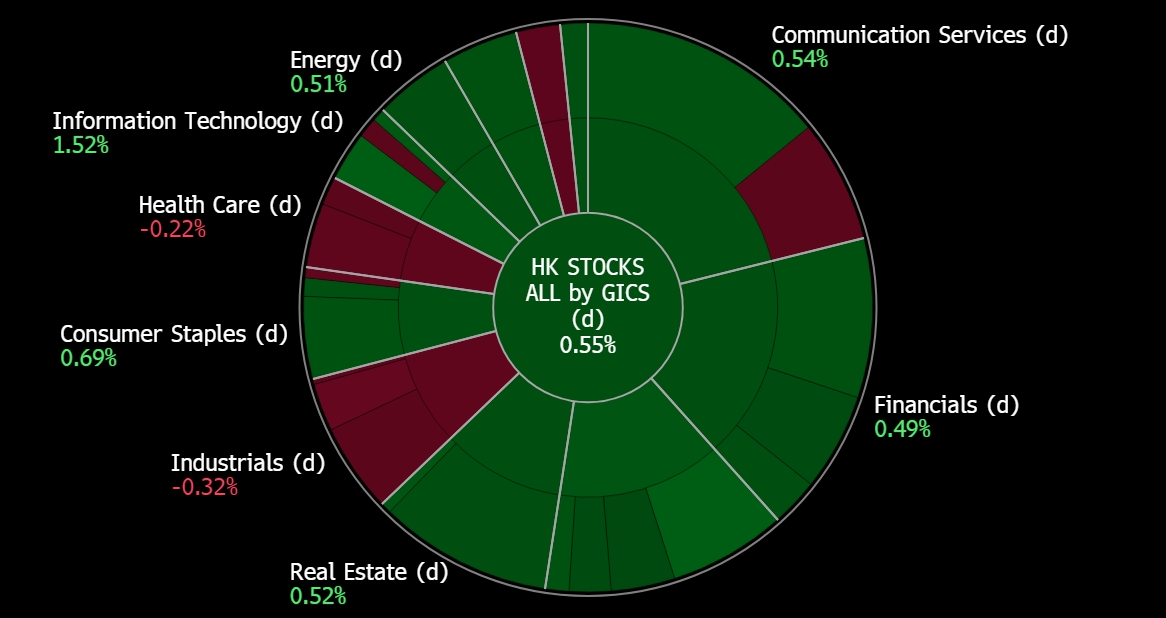

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

Singapore Airlines Ltd. (SIA SP): Expecting a seasonal rebound

- RE-ITERATE BUY Entry 6.50 – Target – 6.90 Stop Loss – 6.30

- The Singapore Airlines Group has over 20 subsidiaries, covering a range of airline-related services, from cargo to engine overhaul. Its subsidiaries also include SIA Engineering Company, Scoot, Tiger Airways, Singapore Flying College and Tradewinds Tours and Travel. Principal activities of the Group consist of air transportation, engineering services and other airline-related activities.

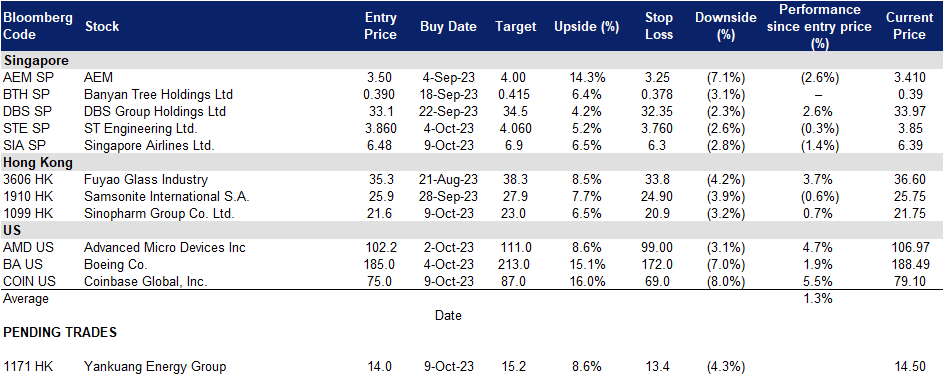

- Still more room for visitor arrivals recovery. In September, there were 1.13mn visitor arrivals to Singapore, which is still far below the pre-COVID level, compared to 1.69mn visitors in January 2020. This represents around 66.8% of visitor arrivals compared with pre-pandemic levels, hence showing a lot of room for upsides. The average monthly visitor arrivals in 2019 was above 1.5mn. Therefore, the normalisation of tourist visits is still on track.

Visitor arrivals trend

(Source: Singapore Tourism Analytics Network)

- To ride on the positive seasonality. The upcoming winter vacation (November to February) is on of the peak travelling season within a year. The recent 8-days holiday in China sparked a travel boom in China, showcasing the recovery of travel demand from China, especially with China recent’s re-opening a few months back. This pent-up demand for travelling is expected to continue for over the winter vacation as people seeks refuge from the winter cold or vice versa. Travel demand is also expected to be higher as the year reaches the end and working adults look for ways to clear their leaves as more borders re-open. Singapore is expected to see more visitors from China as well as around the world, as Singapore is a sweet spot of overseas traveling for families.

- Year end promo fares. Many flight operators including Singapore Airline has started promotional fares for the upcoming peak travelling season to entice consumers to travel abroad with their airline, so as to capture the heightened demand of travelling. With prices starting as low as $168, this is bound to attract consumers to travel during the upcoming travel season.

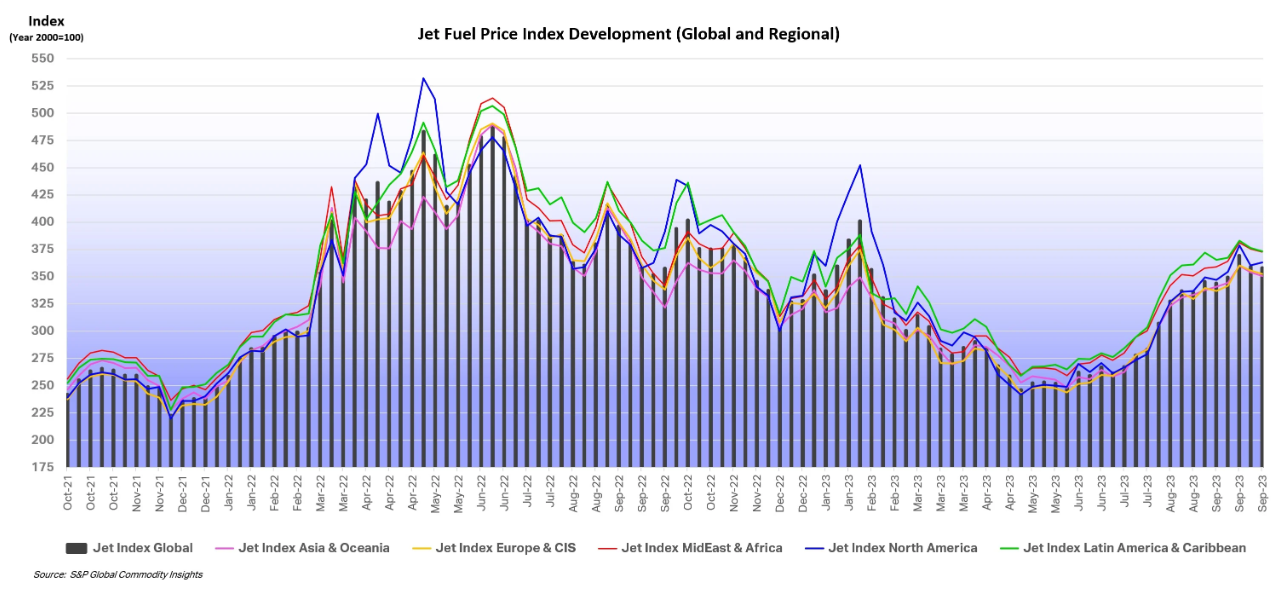

Jet fuel price trend

(Source: IATA, S&P Global)

- 1Q24 results. Revenue increased by 14.0% YoY to S$4.48bn in 1Q24, compared to S$3.93bn in 1Q23, continued strength in travel demand drives record load factors. Net profit rose to S$734mn, increasing by 98.4% YoY, compared to S$370mn in 1Q24.

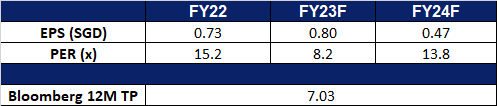

- Market consensus.

(Source: Bloomberg)

ST Engineering Ltd. (STE SP): Expanding services

ST Engineering Ltd. (STE SP): Expanding services

- RE-ITERATE BUY Entry 3.86 – Target – 4.06 Stop Loss – 3.76

- ST Engineering Ltd is a global technology, defence, and engineering group. The Company uses technology and innovation to solve problems and improve lives through its diverse portfolio of businesses across the aerospace, smart city, defence, and public security segments. ST Engineering serves clients worldwide.

- Increasing MRO support. The company recently announced that its Commercial Aerospace business has secured multi-year contracts to provide Japan Airlines with its component Maintenance-By-the-Hour (MBH) solutions, strengthening a longstanding relationship with the airline in integrated MRO support. The company also recently secured a contract with Lion Air, setting in stone a 5-year contract to provide MRO solutions for Lion Air Group’s fleet of Boeing 737 MAX aircraft.

- New airframe MRO facility. The company recently announced that the company has begun to build its 4th airframe MRO facility in Singapore at a cost of around S$170mn, following the company’s announcement that it secured new MRO contracts with Japan Airlines and Lion Air. The new facility would include three maintenance bays designed to accommodate widebody aircraft, along with a fourth line equipped for both painting and maintenance tasks. ST Engineering anticipates that the initial maintenance line will become operational by mid-2025, with the entire facility being fully operational a year thereafter.

- 1H23 results review. 1H23 revenue increased by 13.9% to S$4.86bn, compared to S$4.27bn in 1H22. Net profit rose by 1.1% YoY to S$285.4mn, compared to S$282.4mn in 1H22. Diluted EPS rose to 8.95 SG cents, compared to 8.93 SG cents in 1H22.

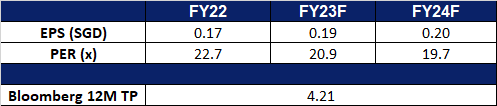

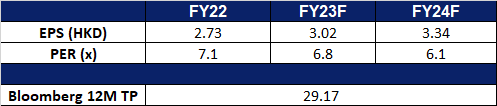

- Market consensus. FY23F/24F dividend yield is 4.14% and 4.24% respectively.

(Source: Bloomberg)

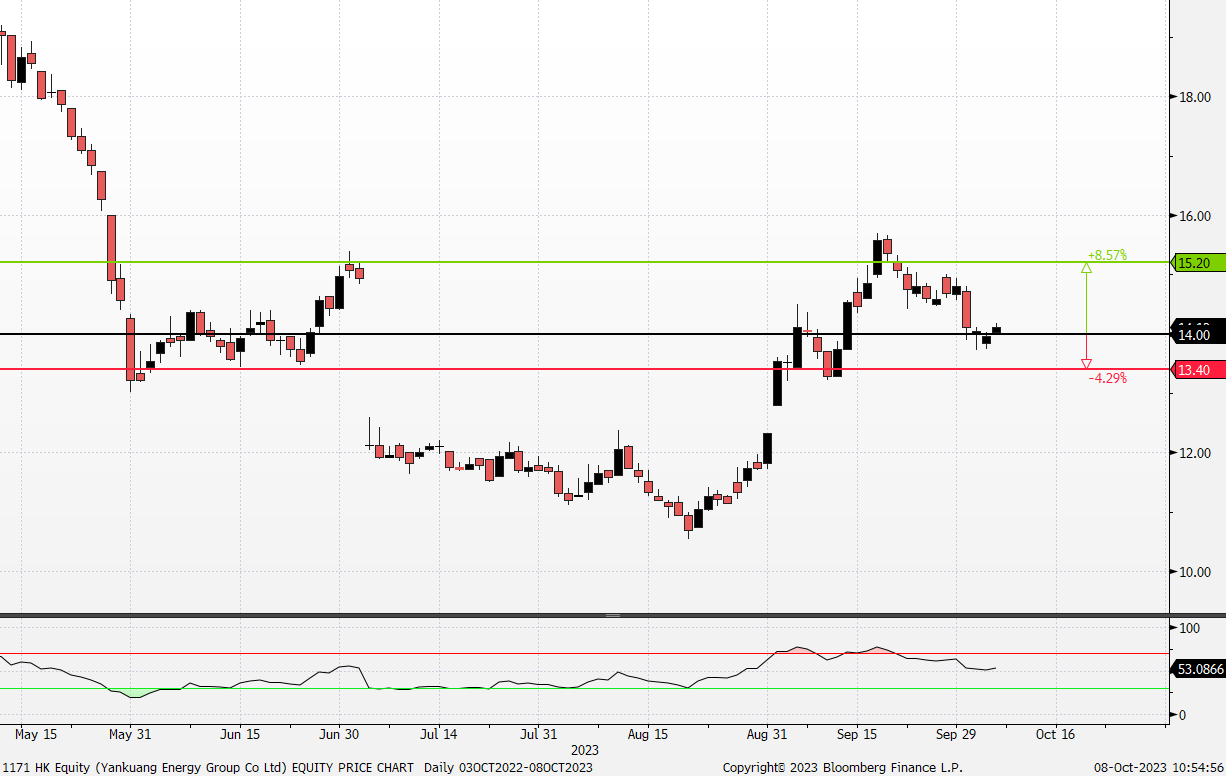

Yankuang Energy Group Co. Ltd. (1171 HK): Winter is coming

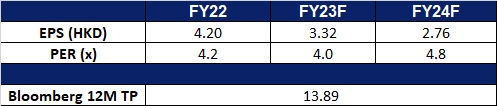

- RE-ITERATE BUY Entry – 14.0 Target – 15.2 Stop Loss – 13.4

- Yankuang Energy Group Co Ltd is a China-based international comprehensive energy company engaged in coal and coal chemical industry. The Company operates in five segments. The Coal Mining segment is engaged in underground and open-cut mining, preparation and sale of coal and potash mineral exploration. The Smart Logistics segment provides railway transportation services. The Electricity and Heating Supply segment provides electricity and related heat supply services. The Equipment Manufacturing segment is engaged in the manufacture of comprehensive coal mining and excavating equipment. The Chemical Products segment is engaged in the production and sale of chemical products. The coal products mainly include thermal coal, pulverized coal injection (PCI), and coking coal. The coal chemical products mainly include methanol, ethylene glycol, acetic acid, ethyl acetate and crude liquid wax, among others. The Company distributes products in the domestic market and to overseas markets.

- China’s high demand for coal continues to drive coal output. As the continued drought in China severely reduced hydroelectric power in the southern provinces, the country has increased its reliance on coal-fired power generation. The upcoming winter season is likely to drive the demand for electricity up, and as a result, driving up the demand for coal as well. China’s coal output in August also increased by 2% YoY to 380mn tonnes in August compared to 2022. The growth in production was 1.9pp higher than that in July, signalling a modest rebound after safety measures had restricted mining operations the previous month.

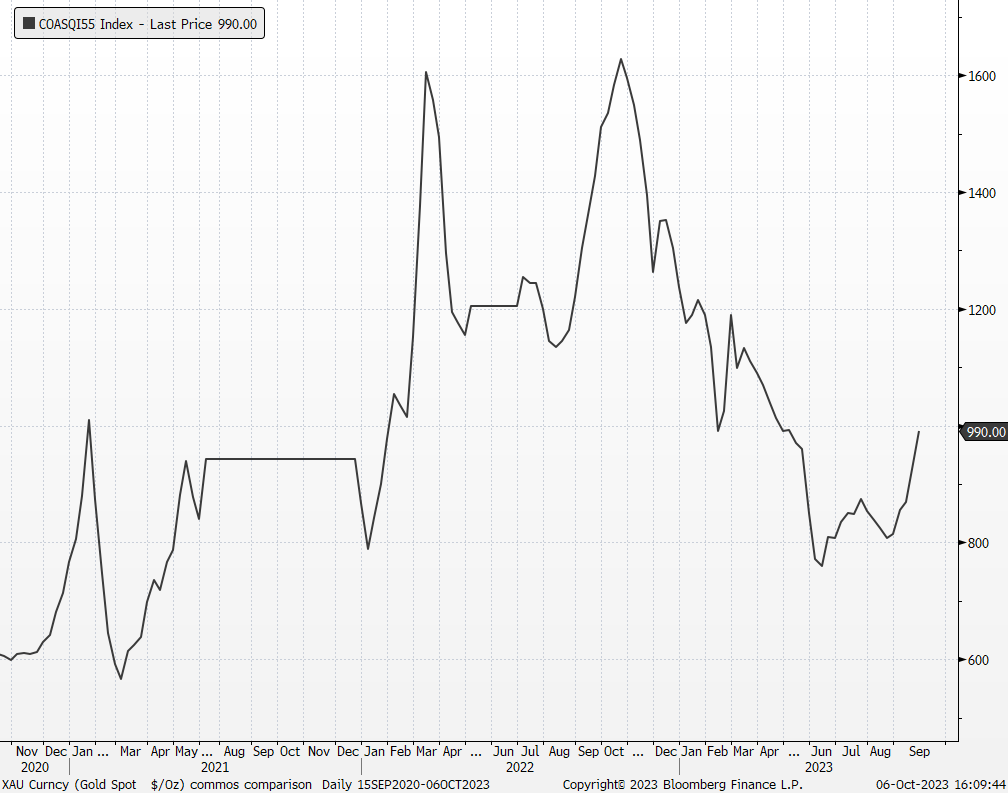

- Coal prices rebounding. Coal prices on the global market have risen to their highest level in 5 months, driven by a surge in activity at Chinese coal-fired power plants, as Chinese power plants burn more coal to make up for the shortage of hydroelectricity caused by the drought. The Russio-Ukrainian war entering the 2nd year of cold snap has also contributed to bringing coal prices up to high since May 2023. Coal mining companies such as Yankuang Energy Group is likely to benefit from this surge in coal prices.

China Qinhuangdao thermal port coal 5,500 GAR spot price

(Source: Bloomberg)

- Yancoal’s improving operational efficiency. Yancoal Australia, a subsidiary of Yankuang Energy Group, recently announced that they have entered into a partnership with TPG Telecom to deploy a private mobile network at its Hunter Valley mines. This is set to bolster Yancoal’s ability to track and communicate with vehicles, equipment, and personnel across the site, increasing the efficiency of the mines, and hence increasing production levels.

- 1H23 results. Revenue fell to RMB84.4bn, down 15.8% YoY, compared to RMB100.3bn in 1H22. Net profit attributable to shareholders fell to RMB10.2bn in 1H23, down 43.4% YoY, compared to RMB18.0bn in 1H22. Basic EPS was RMB2.09 in 1H23, compared to RMB3.70 in 1H22.

- Market Consensus.

(Source: Bloomberg)

Sinopharm Group Co. Ltd. (1099 HK): Staying defensive

- RE-ITERATE BUY Entry – 21.6 Target – 23.0 Stop Loss – 20.9

- Sinopharm Group Co Ltd is a China-based company principally engaged in pharmaceutical and medical devices distribution business. The Company operates its business through four segments. Pharmaceutical Distribution segment is engaged in the distribution of pharmaceutical products to hospitals, other distributors, retail pharmacy stores and clinics. Medical Devices segment is engaged in the distribution of medical devices, as well as provides installation and maintenance services. Retail Pharmacy segment is engaged in the operation of chain pharmacy stores. Other Business segment is engaged in the distribution of laboratory supplies, manufacture and distribution of chemical reagents, production and sale of pharmaceutical products.

- Extensive partnerships. Just last quarter, Sinopharm entered into a partnership with Malaysia’s EW Group. Sinopharm can leverage the knowledge and skills of the EW Group in research, development, formulation, and manufacturing of nutraceuticals, skincare, cosmeceuticals, and therapeutic products. Concurrently, Sinopharm can utilize its extensive global reach and distribution network to support EW Group’s global aspirations. As part of this partnership, more than 1,000 unique products from EW Group will be available for sale and distribution through Sinopharm. Earlier this year, Sinopharm also entered into a partnership with Pfizer, where the company would help Pfizer seek approval to market 12 innovation drugs in China through 2025.

- mRNA vaccines show positive effectiveness. A recent study showed that three types mRNA vaccines VGPox 1-3 developed by Sinopharm were able to provide effective protection against monkeypox. In August, China saw a persistent increase in monkeypox infections, with a total of 501 reported cases, including five involving females. The number of monkeypox infections in June and July was 106 and 491 respectively. This increase in monkeypox cases within China is bound to drive sales for Sinopharm as well.

- 1H23 earnings. Revenue rose by 15.10% YoY to RMB301.0bn, compared to RMB261.5bn in 1H22. Net profit rose 10.67% YoY to RMB6.89bn, compared to RMB6.22bn in 1H22. Basic EPS rose by 11.9% YoY to RMB1.32, compared to RMB1.18 in 1H22.

- Market Consensus. FY23F/24F dividend yield is 4.43% and 4.94% respectively.

(Source: Bloomberg)

Coinbase Global Inc (COIN US): Bull run could have begun

- RE-ITERATE BUY Entry – 75 Target – 87 Stop Loss – 69

- Coinbase Global, Inc. provides financial solutions. The Company offers platform to buy and sell cryptocurrencies. Coinbase Global serves clients worldwide.

- Major Payment Institution licence obtained. Coinbase Singapore obtained a Major Payment Institution license from the Monetary Authority of Singapore, allowing the exchange to expand its digital payment token services to individuals and institutions in Singapore.

- Bitcoin reclaimed US$28,000. After consolidating at round US$26,000, Bitcoin price edged up and ranged bound between US$27,000 and US$28,000. Bitcoin is halved every 4 years, and the next halving date is April 25 2024. Bitcoin halving leads to a slow-down in mining output. In other words, the supply of Bitcoin after the halving date will be less. Based on the previously two halvings, Bitcoin experienced bull cycles for 18 months (Previous two halving dates: July 9 2016 and May 11 2020). Historically, Bitcoin’s upward momentum started 6 months before the halving date. Therefore, the Bitcoin upcycle could have started currently.

Bitcoin Halving

(Source: Bloomberg)

- Priced in one more rate hike expectation. The current sell-off in growth/risky assets is attributable to prolonged high rate expectations. Given a robust labour market in the US and sticky inflation, the Fed is expected to hike another 25bps by the end of 2023. Meanwhile, the US 10-year government yield reanched near 4.9%, a high since 2007. However, the plunge in oil prices and the soft consumer spending mitigated the inflation pressure. Peak rate expectations remain, and risky assets are expected to rebound in the near term.

- 2Q23 results. Revenue rose to US$707.9mn, down 12.4% YoY, beating expectations by US$70.1mn. GAAP EPS beat estimates by US$0.36 at -US$0.42.

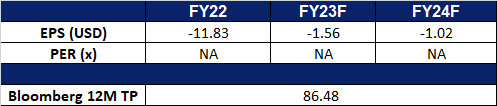

- Market consensus.

(Source: Bloomberg)

Boeing Co (BA US): Oversold

- RE-ITERATE BUY Entry – 185 Target – 213 Stop Loss – 172

- The Boeing Company, together with its subsidiaries, designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defence, human space flight and launch systems, and services worldwide.

- Plan to ramp up 737 production. The company plans to ramp up its bestselling 737 production to a minimum of 57 per month by July 2025. The plan revives the company’s unmet target before the COVID period. Currently, the company targets to produce 42 737 jets per month by the end of 2023.

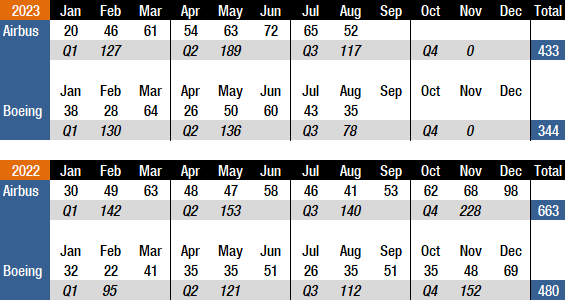

- Supply chain constraints led to August deliveries lower. The company delivered 35 aircraft in August, down from 43 in July, reaching the lowest level since April 2023. Management attributed the miss to supply chain disruptions which also occurred on Airbus. However, its CEO remained positive on the travel demand recovery which he believed was more resilient than expected, according to his interview on CNBC.

Airbus and Boeing aircraft deliveries

(Source: Flight Plan)

- Bad September hit again. The stock fell 14.44% last month, the worst-performing month in a year. Last September, the stock lost 24.44%. It only had two up days; the rest were down days last month. The plunge was similar to other tourism counters due to rising inflation concerns. Boeing is oversold and is expected to rebound in 4Q23.

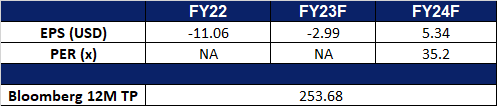

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Add Singapore Airlines Ltd (SIA SP) at S$6.48, Sinopharm Group Co. Ltd. (1099 HK) at HK$21.6 and Coinbase Global Inc (COIN US) at US$75. Cut loss on China Aviation Oil (CAO SP) at S$0.84.