11 August 2023: Seatrium Limited (STM SP), Air China Ltd. (753 HK), Amazon.com Inc (AMZN US)

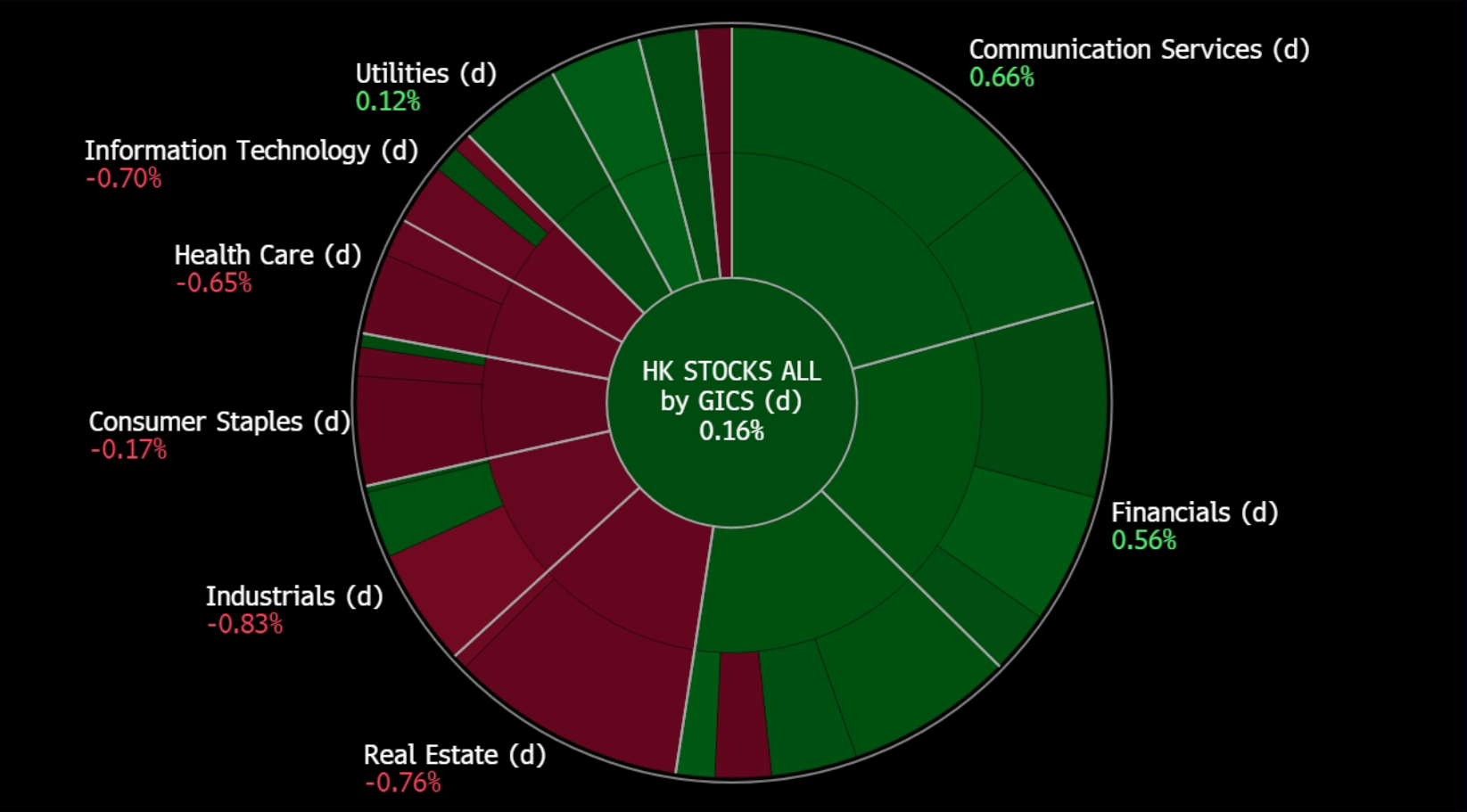

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

Seatrium Limited (STM SP): Oil recovers

- BUY Entry 0.134 – Target – 0.144 Stop Loss – 0.129

- Seatrium Limited provides offshore and marine engineering solutions. It operates through two segments: Rigs & Floaters, Repairs & Upgrades, Offshore Platforms, and Specialised Shipbuilding; and Ship Chartering.

- Order book remains strong. It secured new contract wins of S$4.3bn ytd with solid orders pipeline. It’s net order book of S$19.7bn with projects lined up to 2030, comprising 40% renewables and cleaner/green solutions. Additionally it showed strong operational performance with track record of projects delivered.

- Share buyback. Seatrium bought back shares for the second time. The company bought back 20mn shares on August 4 for 13.4 SG cents each. This follows its first buyback on June 12, when it bought 1.2mn shares for 12.4 SG cents each.

- Offshore market expected to strengthen. Seatrium is expected to benefit from the strengthening offshore market. The industry estimates that offshore oil and gas capital expenditure will continue to grow in 2023 and 2024, supported by data showing that day rates for latest generation drillships are now over $500,000 per day, and the number of active offshore rigs has increased by 8% YoY. The company has a strong order book, access to new markets, and the capacity to accept more projects and is looking to fill its 2028/29 production schedule. Furthermore, the normalisation of economic activity should also result in a greater volume of shipping activities, which will positively impact Seatrium’s repair/upgrade segment. These factors will help to drive Seatrium’s growth and share price in the future.

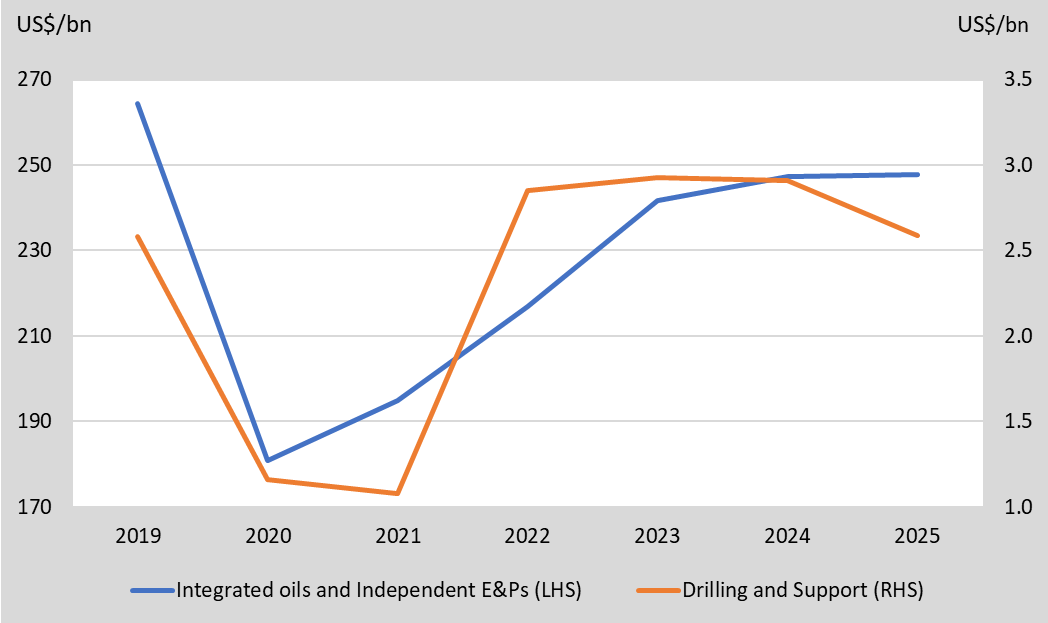

- Expecting mild growth in the upstream oil and gas capex. Oil prices have been showing signs of resilience despite a weakening economy, contribution by deflation in China. Yet, these concerns are offset by a steep drawdown in U.S. fuel stockpiles and Saudi and Russian output cuts, sending oil prices to a high since January 2023. The oil and gas upstream spending also continues. Oil majors accelerated to explore and develop oil resources outside Russia after the sanction. Hence, there still be mild growth in the upstream capex during 2023/2024.

Global upstream oil and gas capex

(Source: Bloomberg)

(Source: Bloomberg)

- 1H23 results review. Revenue rose 164% YoY to S$2.9bn from S$1.1bn the prior year. Net loss amounted to -S$264mn due to provision for contracts and merger expenses. The Group’s EBITDA of S$27mn in 1H2023 was higher than the negative S$19mn in the same period last year. EBITDA before provision for contracts and merger expenses amounted to a creditable S$258mn.

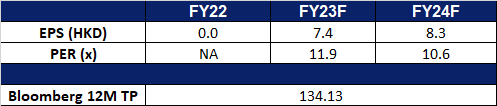

- Market consensus.

(Source: Bloomberg)

Oversea-Chinese Banking Corp Ltd (OCBC SP): Stellar results

- RE-ITERATE BUY Entry 12.90 – Target – 13.50 Stop Loss – 12.6

- Oversea-Chinese Banking Corporation Limited offers a comprehensive range of financial services. The Company’s services include deposit-taking, corporate, enterprise and personal lending, international trade financing, investment banking, private banking, treasury, stockbroking, insurance, credit cards, cash management, asset management and other financial and related services.

- Benefit from rate cut expectations. Even though it is uncertain when rates will start to decline, Singapore banks will continue to thrive in this volatile environment as our local banking system is heavily regulated and conditioned under various stresses by the Monetary Authority of Singapore (MAS). MAS has also expressed its readiness to provide liquidity to maintain financial stability and orderly market functions. The overall market believes that the Feds will start cutting rates in 2024, with interest rates expected to peak at 5.25% to 5.5%. The expected decrease in interest rates could result in borrowers refinancing their loans, which were granted at higher rates.

- Growing wealth segment. Singapore is seeing an influx of wealthy individuals and family offices, which has led to a rise in assets under management at the country’s banks. The Monetary Authority of Singapore estimated there were about 700 family offices in 2021, but the current estimate is around 1,400, with mainland Chinese being the biggest drivers of growth. Although the family offices generate jobs indirectly through external finance, tax, and legal professionals, little of the money is being invested in funds or private equity firms. Despite this, the influx of wealth will still benefit banks in Singapore, particularly with the tax exemption programs for family offices, which have led to higher assets under management at banks in the country. Furthermore, with fear brewing due to the deteriorating US-China ties, the ultra-rich in Taiwan are considering setting up family offices in Singapore to protect their wealth. BDO Tax Advisory has reported an increase in inquiries from the ultra-rich in Taiwan. OCBC’s wealth management income contributed 36.6% to the Group’s total income in 1H23. The group wealth management AUM was S$274bn as of 1H23, driven by continued growth in net new money inflows which offset negative market valuation. As Singapore continues to attract a growing number of wealthy individuals, the country’s banks are expected to receive a boost in assets and deposits.

- Dividend yield. The bank declared an interim dividend of S$0.4, and the ex-dividend date is 14th August. OCBC’s FY23F/24F dividend yield is 6.13%/6.29%.

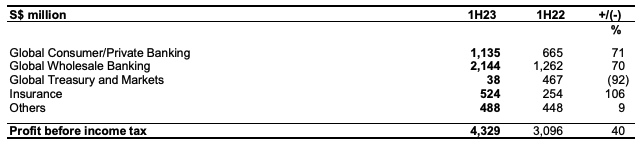

- 1H23 results review. PATMI jumped by 38.5% YoY to S$3.59bn. Net interest income surged by 47.6% YoY to S$4.73bn.

PBT by segment

(Source: Company)

(Source: Company)

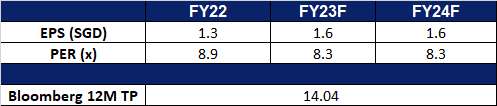

- Market consensus.

(Source: Bloomberg)

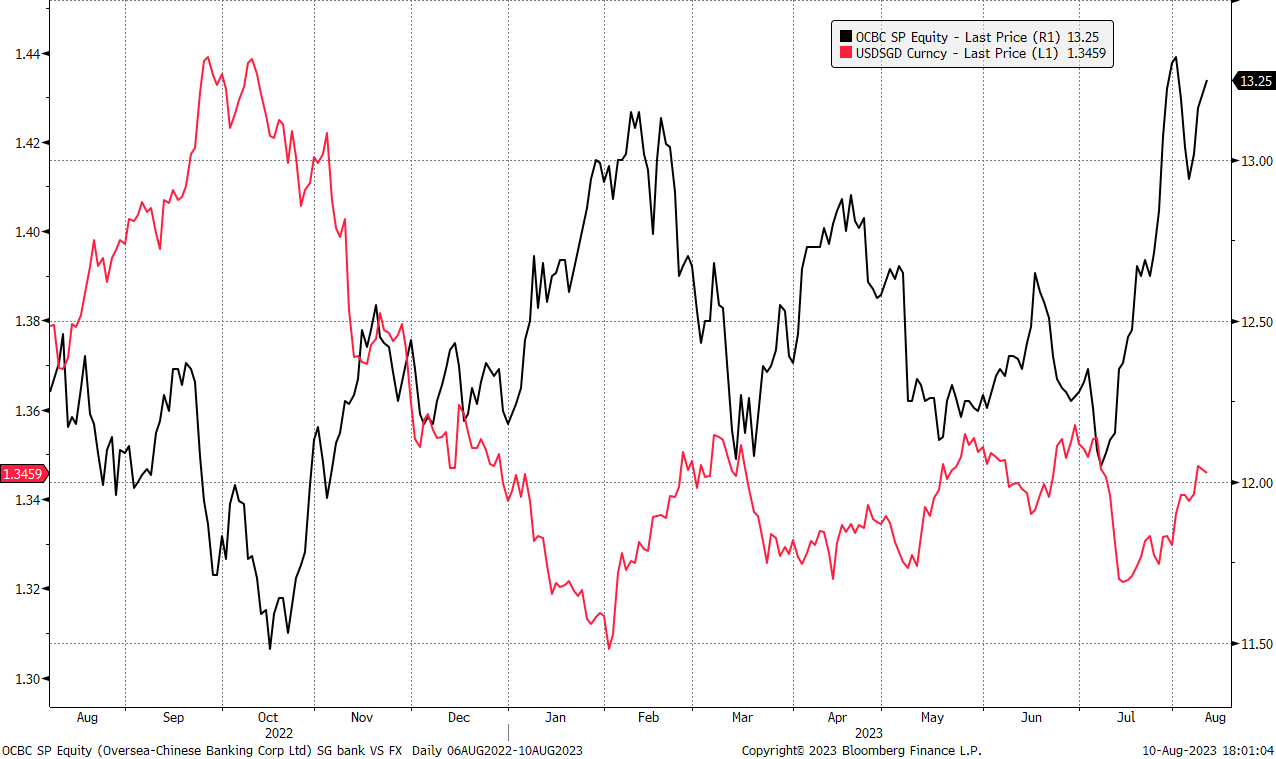

OCBC share price and USD/SGD comparison

(Source: Bloomberg)

Air China Ltd. (753 HK): Time to fly

- BUY Entry – 6.40 Target – 7.00 Stop Loss – 6.10

- Air China Limited is a China-based company principally engaged in the provision of air passenger transportation, freight transportation, postal transportation and maintenance services in Mainland China, Hong Kong, Macau and foreign regions. The Company is also engaged in domestic and international business aviation businesses, plane business, aircraft maintenance, airlines business agents, ground and air express services related to main businesses, duty free on boards, retail business on boards and aviation accident insurance sales agents business.

- Lifting of travel bans. China recently announced that it has lifted pandemic-era restrictions on group tours for more countries, including key markets such as the United States, Japan, South Korea and Australia in a potential boon for their tourism industries. This is the third list of countries to receive approvals, coming after 2 lists which consist of around 60 countries. With Korea and Japan being the more popular destinations amongst China tourists, the lifting of travel bans in these markets is likely to drive outbound tourism in China even more that its current level.

- More flight routes. China Air recently unveiled that the airline is set to launch commercial flights between Kaohsiung and Gimpo, South Korea, on Aug. 26 and between Taoyuan and Kumamoto, Japan, on Sept. 18, as the Taiwanese carrier continues to expand routes in the region. The airline has also recently announced more resumption of travel flights routes such as towards Milan, as well as daily flights to Beijing. This increased level of flight routes will allow the airline to capture the expected increase in demand now that travel restrictions are further lifted.

- FY22 earnings. Revenue rose to RMB25.1bn, up 94.1% YoY. Net loss was RMB 2.9bn, while basic earnings per share was -RMB0.19.

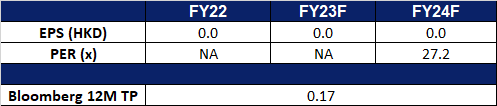

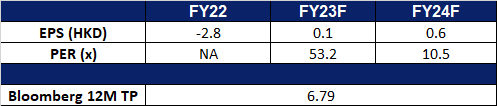

- Market Consensus.

(Source: Bloomberg)

Alibaba Group. (1928 HK): Increasing demand for cloud services

Alibaba Group. (1928 HK): Increasing demand for cloud services

- RE-ITERATE BUY Entry – 92 Target – 100 Stop Loss – 88

- Alibaba Group Holding Ltd provides technology infrastructure and marketing platforms. The Company operates through seven segments. China Commerce segment includes China retail commerce businesses such as Taobao, Tmall and Freshippo, among others, and wholesale business. International Commerce segment includes international retail and wholesale commerce businesses such as Lazada and AliExpress. Local Consumer Services segment includes location-based businesses such as Ele.me, Amap, Fliggy and others. Cainiao segment includes domestic and international one-stop-shop logistics services and supply chain management solutions. Cloud segment provides public and hybrid cloud services like Alibaba Cloud and DingTalk for domestic and foreign enterprises. Digital Media and Entertainment segment includes Youku, Quark and Alibaba Pictures, other content and distribution platforms and online games business. Innovation Initiatives and Others segment include Damo Academy, Tmall Genie and others.

- Expectations of rising demand for cloud services. Alibaba Cloud, the cloud computing division of the Chinese internet behemoth Alibaba Group, is experiencing a rise in demand across diverse sectors within the Malaysian market. Anticipating further demand growth from various industries, the company is committed to ongoing investment in the market, fostering the utilization of cutting-edge cloud computing solutions. This strategic approach enables businesses to embark on their digital transformation journey. As more enterprises prioritize cost efficiency, the trend leans towards partnering with cloud service providers like Alibaba Cloud rather than building individual servers. This shift is contributing to the escalating demand for cloud services.

- Large Language Model AI Race. Alibaba Cloud, the cloud computing arm of Alibaba Group, has introduced two open-source AI-powered large language models (LLMs), a move that experts say will enhance technological progress and practical use of LLMs. These models, named Qwen-7B and Qwen-7B-Chat, each feature 7 billion parameters and are available for commercial use. This is the first instance of a major Chinese tech company open-sourcing its LLMs. Alibaba Cloud highlights that these open-source LLMs will simplify model training and deployment for enterprises, enabling them to efficiently and affordably fine-tune the models to create their own high-quality AI models.

- Recovery of consumption levels in China. China announced a raft of measures last week to boost consumption as part of a package of measures to bolster domestic demand and shore up the world’s second-largest economy. These new measures aim to expand service-related consumption across different sectors such as catering, cultural, tourism, sports, and healthcare. The new measures also aim to promote rural consumption and put more effort into rural tourism. The expectation that the travel economy will perform better in the second half of the year is also likely to drive up the level of consumption within China.

- FY22 earnings. Revenue rose to RMB208.2bn, up 2.03% YoY. Net profit was RMB 23.5bn, compared to a net loss of RMB13.3 during the same period. Non-GAAP diluted earnings per share was RMB1.34, an increase of 35% YoY.

- Market Consensus.

Amazon.com Inc (AMZN US): Dip-buying opportunity

- BUY Entry – 132 Target – 142 Stop Loss – 127

- Amazon.com, Inc. is an online retailer that offers a wide range of products. The Company products include books, music, computers, electronics, and numerous other products. Amazon offers personalized shopping services, Web-based credit card payment, and direct shipping to customers. Amazon also operates a cloud platform offering services globally.

- Potential IPO anchor investor. Amazon is in talks to invest in Arm, a chip designer owned by SoftBank, as a cornerstone investors ahead of its IPO. Arm is expected to list on the Nasdaq in early September and is seeking to raise $8nn to $10nn. Amazon is one of about 10 technology companies that have been approached about investing in Arm. Amazon is interested in investing in Arm because it uses Arm’s chips in its cloud computing business. The IPO is expected to be a much-needed boon for SoftBank, which is battling to stabalise its massive Vision Fund.

- Leader in cloud. Amazon Web Services (AWS) revenue grew 12% YoY in 2Q23, beating analyst expectations. AWS is the leading cloud computing platform with a 40% market share in 2022, and it is still in the early stages of its growth. AWS is facing increasing competition from Microsoft Azure and Google Cloud Platform, but it is investing heavily in new technologies, such as generative AI, to stay ahead of the competition. AWS is also expanding its global footprint, with new regions opening up all the time. The most recent being, the $7.2bn investment in Israel through 2037. It includes opening AWS data centers in Israel, which will allow the Israeli government to run applications and store data in Israel; making it easier for Israeli companies to use AWS services, which are used by companies globally. Overall, AWS is still growing rapidly and is well-positioned to maintain its leadership position in the cloud infrastructure market.

- Introducing more services. Amazon Web Services (AWS) has expanded its Amazon Bedrock service to include new foundation model (FM) providers and a new capability for creating fully managed agents. This makes it easier for customers to build and scale generative AI applications with a wide range of FMs and to complete complex tasks that require access to external systems and up-to-date knowledge sources. Amazon Bedrock is a fully managed service that is secure, scalable, and easy to use, making it a great option for businesses of all sizes that want to get started with generative AI quickly and easily.

- 2Q23 earnings review. Revenue rose 10.8% YoY to $134.3bn, beating estimates by $2.96bn. Earning per share was $0.65, no comparable to expectations of $0.34.

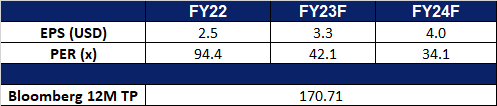

- Market consensus.

(Source: Bloomberg)

Boeing Co (BA US): Strong travel demand

Boeing Co (BA US): Strong travel demand

- RE-ITERATE BUY Entry – 230 Target – 250 Stop Loss – 220

- The Boeing Company, together with its subsidiaries, designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

- Strong international travel demand. Airlines are experiencing a strong recovery in both domestic and international travel demand, leading them to expand flights between countries and anticipate further sales growth in the coming months. Domestic air travel has fully rebounded, and international traffic is nearing pre-pandemic levels, resulting in a higher demand for commercial planes and aviation personnel. The surge in travel demand during the previous quarter has fueled airlines’ predictions for an increase in international travel. As a result, airlines are looking to acquire more commercial planes to meet the needs of global travellers. Boeing’s management foresees significant growth in various markets, including the world fleet, aircraft services, and the global cargo aircraft fleet, driven by factors like passenger traffic growth and the increasing popularity of e-commerce.

- Secured US Navy contract. Boeing has been awarded a firm-fixed-price order worth approximately $115.14mn for initial spares and repair equipment for the MQ-25A Stingray aircraft. This order supports the readiness, maintainability, and reliability of the aircraft for its first deployment. The work is scheduled to be completed by July 2026, and the Naval Air Systems Command is the contracting activity.

- Increased production. Boeing reported a substantial backlog of $440bn, which includes more than 4,800 commercial planes. The 737 program is gradually increasing production and aims to produce 38 planes per month, with plans to reach 50 per month by 2025/2026. This year, the program intends to deliver 400-450 planes. The 787 program has also boosted production to four planes per month and aims to reach five per month in late 2023, eventually reaching 10 per month by 2025/2026. The program plans to deliver 70-80 planes this year.

- New deliveries. Boeing plans to commence delivery of its smallest and largest B737 MAX variants to customers in the coming year, with expectations for B737-7 certification in 2023 and first deliveries in 2024, and B737-10 certification flight testing in 2023 and first deliveries also in 2024. The delays are attributed to stricter FAA requirements after the MAX aircraft’s worldwide grounding. Southwest Airlines is the major customer for the B737-7, ordering 207, followed by other airlines with smaller orders. The B737-10 has gained popularity with 1,018 orders across 19 customers, and United Airlines is set to be its launch customer. The FAA emphasises safety as the priority for certification projects, refraining from discussing ongoing processes.

- 2Q23 earnings review. Revenue rose 18.4% YoY to $19.75bn, beating estimates by $1.16bn. Non-GAAP earning per share was -$0.82, $0.07 above expectations.

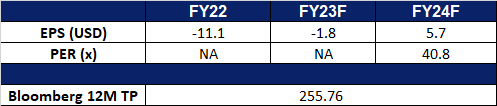

- Market consensus.

(Source: Bloomberg)

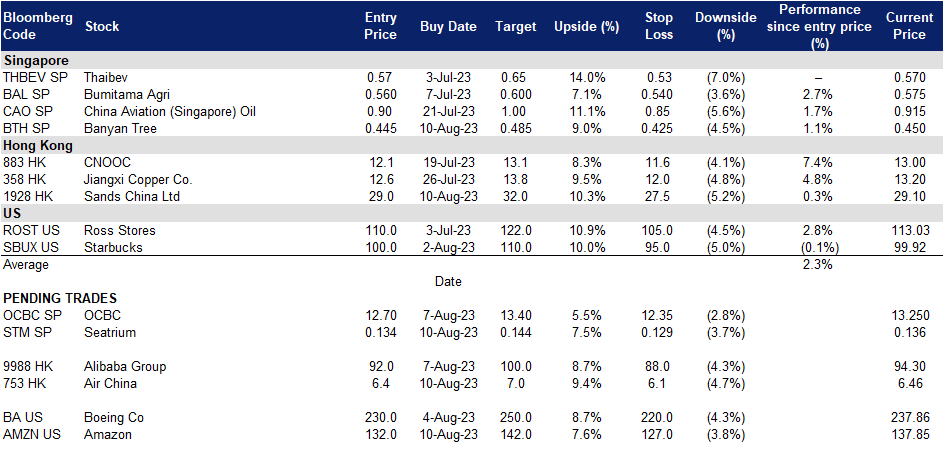

Trading Dashboard Update: Add Banyan Tree (BTH SP) at S$0.445, Sands China Ltd (1928 HK) at HK$29 and Cloudflare (NET US) at US$68. Cut loss on Li Ning (2331 HK) at HK$43, Rex International (REXI SP) at S$0.174, AEM (AEM SP) at S$3.63 and Cloudflare (NET US) at US$64.5.