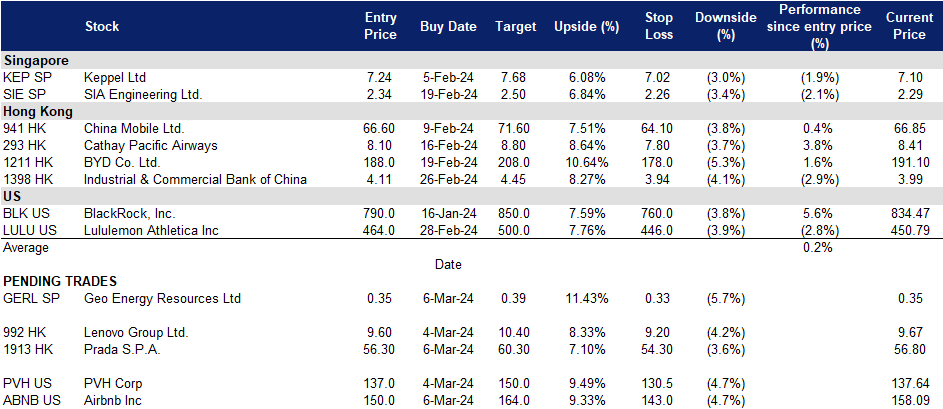

6 March 2024: Geo Energy Resources Ltd. (GERL SP), Prada S.P.A. (1913 HK), Airbnb Inc (ABNB US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

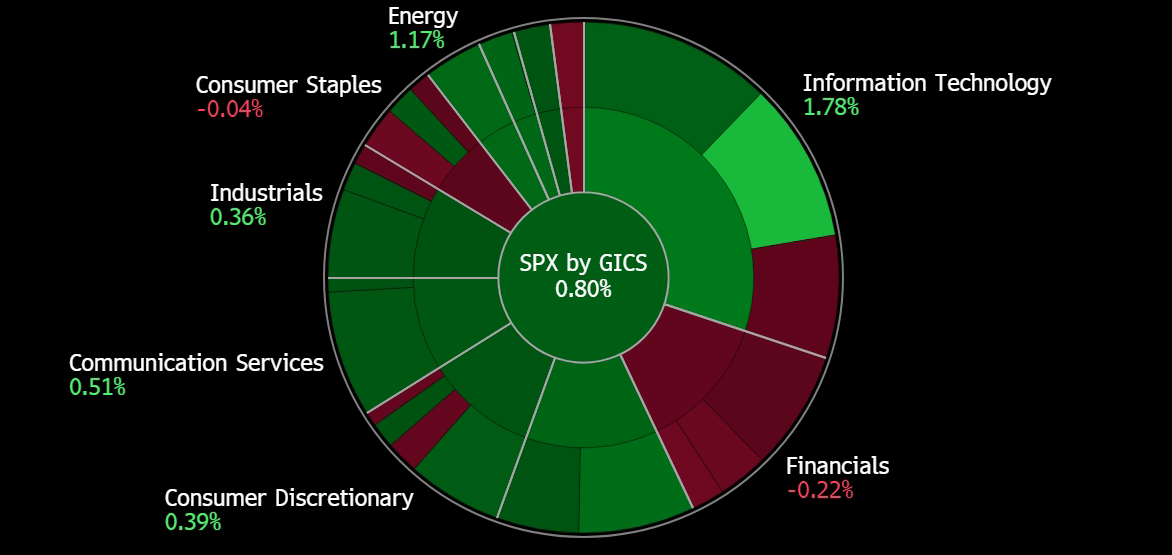

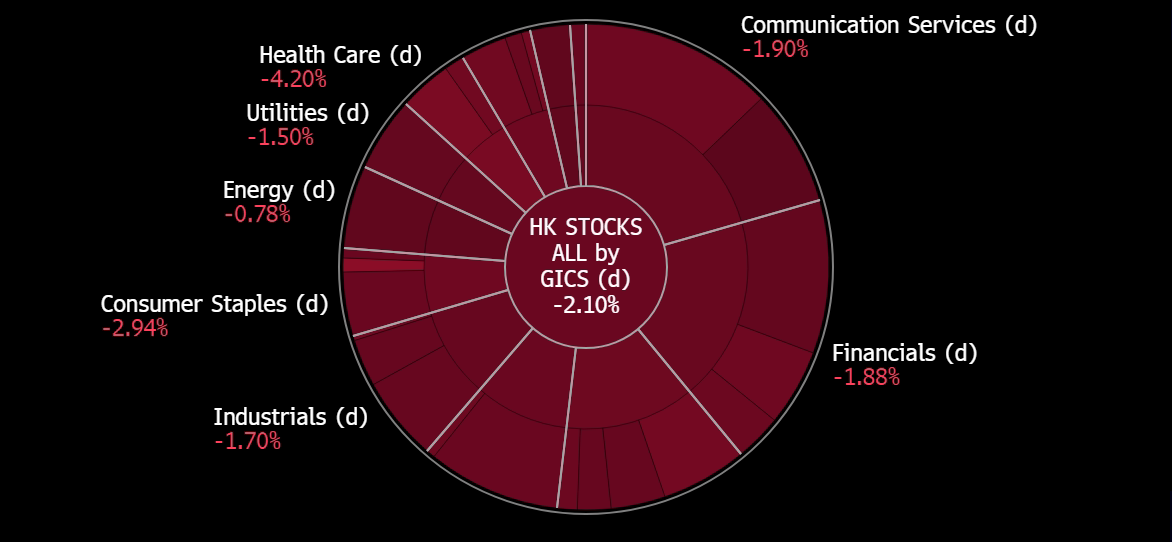

Hong Kong

Geo Energy Resources Ltd. (GERL SP): A good time to enter

- Entry – 0.35 Target– 0.39 Stop Loss – 0.33

- Geo Energy Resources Limited is an integrated coal mining specialist. The Company owns and operates coal mines, offers mine contracting services to third party mine owners, and sells coal to both coal traders and coal export companies.

- Dividend policy remained intact. Geo Energy’s FY23 results saw a 62% decline in net profit to US$62.7mn, reflecting the normalization of coal prices after a significant rise in FY22. Despite this decline, the company upheld its dividend policy by declaring a full-year dividend of S$0.02 per share, maintaining a total payout ratio of 33.7%. Production surpassed the initial target of 8Mt, reaching 8.4Mt, with the majority coming from the SDJ and TBR mines. The newly acquired TRA mine contributed 0.2Mt. While the reported net profit figure may be influenced by a one-off gain, the company demonstrated its commitment to shareholder value through its dividend policy.

- Production to rise. The acquisition of an 85% stake in the TRA mine significantly bolstered Geo Energy’s 2P reserves by over 275Mt. This expansion, combined with the mine’s low-ash, low-sulfur coal characteristics that command premium pricing, presents opportunities for increased production volume and potential revenue growth.

- FY23 results review. Revenue declined 33% YoY from US$733.5mn to US$489.0mn in FY23. This decline was due to the normalisation of coal prices, whereby the average ICI4 prices fell from US$86.06 in FY22 to US$70.46 in 1H23. 2H23 revenue also fell 32% YoY to US$249.2mn and net profit declined 40% YoY to US$34.7mn. Net profit tumbled 62% YoY to US$62.7mn from the previous year high of US$163.6mn. The net profit delivered was better than we anticipated due to a one-off gain on a bargain purchase line item. In 4Q23, Geo Energy proposed a final dividend of S$0.006 per share which results in a full-year dividend of S$0.02 per share. For FY23, the average ICI4 price fell to US$62.96 per tonne.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.72. Please read the full report here.

(Source: Bloomberg)

SIA Engineering Co Ltd (SIE SP): Aviation resilience

SIA Engineering Co Ltd (SIE SP): Aviation resilience

- RE-ITERATE Entry – 2.34 Target– 2.50 Stop Loss – 2.26

- SIA Engineering Co Ltd provides airframe and component overhaul services, line maintenance and technical ground handling services. The Company also manufactures aircraft cabin equipment, refurbishes aircraft galleys, repairs and overhauls hydromechanical aircraft equipment.

- Doubled in profits. SIA Engineering reported a significant increase in net profit to S$26.9mn for Q3 more than double compared to the same period last year. This growth was driven by a 40.2% YoY rise in revenue to S$291.7mn, attributed to healthy demand for aircraft maintenance services as global flight activities approached pre-pandemic levels. Despite supply-chain challenges affecting turnaround times and output rates, the line maintenance unit in Singapore saw a recovery to 94% of pre-pandemic levels. Increased expenditure, mainly due to higher manpower and material costs, was managed at a lower rate of 33.8%. For 9M24, net profit rose by 90.3% YoY to S$86.2mn, with revenue increasing by 41.3% YoY to S$805.7mn from S$570.3mn in 3Q23. During the quarter, SIA Engineering also established a third base maintenance hub in the Asia-Pacific region and acquired an additional 10% stake in Jamco Aero Design and Engineering to enhance cabin maintenance and retrofit services. Despite macroeconomic and geopolitical uncertainties, along with tight labour market conditions, impacting near-term operating margins, the company remains focused on cost management, productivity, and strategic investments to ensure sustainable growth.

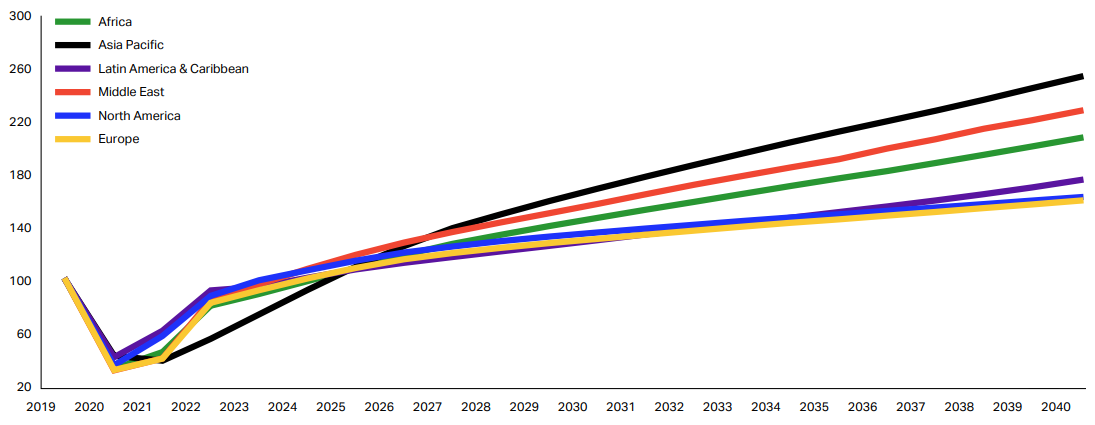

Yearly regional passenger totals (index 2019=100)

(Source: IATA – Global Outlook for Air Transport)

- Full recovery on the horizon. Global air travel is anticipated to surpass pre-Covid levels in 2024, with the Asia-Pacific region leading the recovery. Industry experts foresee strong demand driving profits for airlines, despite challenges such as persistent supply issues and thin profit margins. The International Air Transport Association (IATA) predicts airlines to generate US$25.7bn in profits in 2024, with Asia-Pacific projected to achieve full recovery in early 2024. While supply chain disruptions and production delays continue to constrain aircraft availability, demand remains resilient, although thin profit margins and external factors like fuel prices and regional conflicts may impact the industry’s fortunes in 2024. Overall, while challenges persist, the outlook for air travel recovery remains optimistic. This will be beneficial for SIA Engineering as it will be able to garner more business for its various service segments.

Monthly total flight count in Asia

- 2023 proven air travel demand. The International Air Transport Association (IATA) reported a significant recovery in global air travel demand in 2023, with total traffic reaching 94.1% of pre-pandemic levels. December 2023 traffic stood at 97.5% of December 2019 levels, indicating a strong rebound towards the end of the year. International traffic rose by 41.6% compared to 2022, reaching 88.6% of 2019 levels, while domestic traffic increased by 30.4% and surpassed 2019 levels by 3.9%. Asian-Pacific airlines experienced the strongest growth in international traffic, while Latin American airlines had the highest domestic load factor. Despite these positive trends, challenges such as supply-chain disruptions and geopolitical uncertainties persist.

- 3Q24 earnings. The company revenue for the period was S$291.7mn rising 40.2% YoY from the previous S$208.1mn. The company’s net profit rose to S$26.9mn, +110% YoY compared to S$12.8mn in 3Q23. Basic EPS rose from 1.14 cents in 3Q23 to 2.4 cents. The number of flights handled by its line maintenance unit in Singapore recovered to 94% of pre-pandemic levels compared to 75% a year ago.

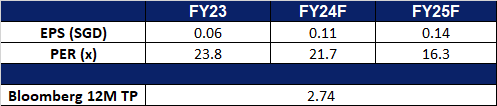

- Market Consensus.

(Source: Bloomberg)

Prada S.P.A. (1913 HK): Attractive Japanese luxury market

- BUY Entry – 56.30 Target – 60.30 Stop Loss – 54.30

- Prada SpA is an Italy-based company engaged in fashion industry. The Company is a parent of the Prada Group. The Company, along with its subsidiaries, is engaged in the design, production and distribution of leather goods, handbags, clothing, eyewear, fragrances, footwear and accessories. Prada SpA manufactures jackets, trousers, skirts, dresses, sweaters, blouses, as well as perfumes and watches, among others. The Company trades its products through several brands, such as Prada, Miu Miu, The Church and The Car Shoe. Prada SpA operates in approximately 70 countries through directly operated stores, franchise operated stores, a network of selected multi-brand stores and department stores. Prada Spa operates through a numerous subsidiaries, including Artisans Shoes Srl, Angelo Marchesi Srl, Prada Far East BV, Tannerie Megisserie Hervy SAS and Prada SA, among others.

- Attractive Japanese luxury goods market. With Japan being one of the world’s strongest luxury markets, a weaker Japanese yen has attracted many tourists looking for bargains for luxury goods. Domestic demand for luxury goods also remained strong. Other prominent luxury goods firms, including LVMH Moet Hennessy Louis Vuitton SE, Richemont, and Hermes International SCA, have likewise disclosed robust earnings driven by the expanding market in Japan. Notably, the resilience of luxury sales in Asia stands out amid the broader cyclical downturn within the sector, with Chinese consumers exercising caution and growth tapering off in other pivotal markets. Sales from the Japanese market currently make up around 10% of the group’s revenue and are expected to grow further given the growth of the luxury goods market in Japan.

- Partnership between Prada and L’Oreal. Prada has recently revealed a long-term licensing agreement with L’Oreal, marking a strategic partnership to globally create, develop, and distribute Miu Miu products. This collaboration aims to propel the brand’s growth, tapping into new markets and unlocking its full potential in the beauty industry. Utilizing this alliance, Miu Miu intends to enhance sales and broaden its footprint in the beauty market through the expertise of the renowned French cosmetic firm.

- Topping Lyst Index. Miu Miu, an Italian high fashion women’s clothing and accessory brand and a fully-owned subsidiary of Prada, topped the Lyst Index in 3Q2023, which is a quarterly ranking of fashion’s hottest brands and products. The formula behind The Lyst Index takes into account Lyst shoppers’ behaviours, including searches on and off the platform, product views, and sales. To track brand and product heat, the formula also incorporates social media mentions, activity, and engagement statistics worldwide, over three months. With Miu Miu still releasing several products such as the recent Wander matelassé nappa leather hobo bag, Miu Miu is likely to top the Lyst Index for 4Q2023.

- 9M23 earnings. Revenue rose by 10.3% YoY at constant exchange rates to €3.34bn in 9M2023, compared to €2.98bn in 9M22. Retail Sales rose 10.4% YoY at constant exchange rates to €298bn in 9M23, compared with €2.65bn in 9M22, driven by like-for-like and full-price sales.

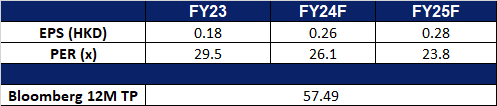

- Market consensus.

(Source: Bloomberg)

Lenovo Group Ltd. (992 HK): Expect an AI PC Boom

- RE-ITERATE BUY Entry – 9.60 Target – 10.40 Stop Loss – 9.20

- Lenovo Group Limited is an investment holding company principally engaged in personal computers and related businesses. The Company’s main products include Think-branded commercial personal computers and Idea-branded consumer personal computers, as well as servers, workstations and a family of mobile Internet devices, including tablets and smart phones. The Company operates its business through four geographical segments, including China, Asia Pacific (AP), Europe, the Middle East and Africa (EMEA) and Americas (AG). The Company also provides cloud service and other related services. The Company distributes its products in domestic market and to overseas markets.

- Unveiling suite of AI portfolio. Lenovo recently presented its cutting-edge portfolio of purpose-built AI devices, software, and infrastructure solutions at the highly anticipated Mobile World Congress (MWC) 2024 in Spain. Going beyond innovation, Lenovo introduced proof-of-concept devices that push the boundaries of traditional form factors. The global service provider unveiled the future of hybrid AI, driving multi-device, software, and service offerings for increased personalization, collaboration, and efficiency. A standout in their new lineup is the Lenovo ThinkBook Transparent Display Laptop, featuring a groundbreaking 17.3-inch Micro-LED transparent display. With a borderless screen, transparent keyboard area, and a seemingly floating footpad design, it effortlessly embodies high-tech simplicity, enhancing the overall user experience. Through the power of Artificial Intelligence Generated Content (AIGC), the transparent screen opens new avenues for work collaboration and efficiency by enabling interaction with physical objects and overlaying digital information to create unique user-generated content. Its transparency allows it to integrate seamlessly within its environment, highlighting AI’s potential within the PC market.

- PC demand recovery. PC demand has shown signs of recovery and is expected to continue recovering in 2024, after a demand slump in 2023. 4Q23 saw a continued recovery for the PC market, which ended the year with a 20% and 24% year-over-year gain in GPU and CPU shipments respectively, according to Jon Peddie Research. PC recovery is also boosted by the boom in AI technology, which increases the demand for PCs equipped with new AI technologies. Furthermore, suppliers are also gearing up more for replacement demand, where many consumers are expected to replace their PCs, accessories, and peripherals after more than 2 years of usage since the digital boom during the Covid-19 pandemic.

- Partnership with Baidu. Lenovo has recently revealed a collaboration with Baidu to integrate Baidu’s generative artificial intelligence (AI) technology into Lenovo’s smartphones. This strategic partnership aims to apply Baidu’s AI model practically. The global trend of selling smartphones featuring generative AI capabilities, including services like chatbots and real-time translation, gained popularity in late 2022 following the launch of ChatGPT. This collaboration presents a mutual benefit for both companies, allowing Lenovo to leverage the AI space to enhance the promotion of their smartphones.

- 3Q24 results. Revenue rose by 2.97% YoY to US$15.7bn in 3Q24, compared to US$15.3bn in 3Q23. Net profit fell by 22.8% YoY to US$337mn in 3Q24, compared to US$437mn in 3Q23. Basic EPS fell to US2.81cents in 3Q24, compared to US3.65cents in 3Q23.

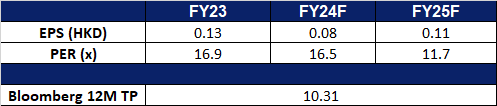

- Market consensus.

(Source: Bloomberg)

Airbnb Inc (ABNB US): Upgrading works in progress

- BUY Entry – 150 Target – 164 Stop Loss – 143

- Airbnb, Inc. operates an online marketplace for travel information and booking services. The Company offers lodging, home-stay, and tourism services via websites and mobile applications. Airbnb serves clients worldwide.

- Improvements being made. Airbnb is revamping its platform for quality with badges highlighting top listings and flagging low-quality ones. Stricter policies have slashed host cancellations by 36% in the recent quarter, and over 100,000 low-quality listings have been removed since April. Verification is ramping up and will include more countries, with approximately 20% of listings vetted already, and photo/video verification tools are on the horizon. The future promises AI-powered features like review summaries and an “ultimate concierge” service, further enhancing the guest experience.

- Good Q4 results. Airbnb announced a US$6bn share buyback program, signalling confidence in its business as it enters what it considers a turning point in 2024. The company plans to expand beyond holiday rentals into new areas while focusing on its core travel business initially. Initiatives like the “Guest Favourites” feature aim to attract more customers away from hotels by highlighting quality properties. Despite facing regulatory scrutiny and a slowing revenue growth rate, Airbnb reported a strong Q4 with record bookings, increased demand for long-term stays, and better-than-expected financial results. The company also hinted at potential acquisitions in the future but emphasized a cautious and strategic approach.

- 4Q23 earnings review. Revenue rose by 16.8% YoY to US$2.22bn, beating estimates by US$60mn. EPS was -US$0.55, not comparable to estimates of US$0.70. Nights and Experiences Booked increased 12% YoY to 98.8mn driven by growth in all regions, which also led to a modest increase in ADR to US$15.5bn of GBV in 4Q23. For 1Q24, the company expects to deliver revenue of US$2.03bn to US$2.07bn vs US$2.03bn consensus, which represents YoY growth of between 12% and 14%. Adjusted EBITDA margin in 1Q24 to expand relative to 1Q23, primarily due to the timing of expenses. For FY24, the company expects to continue to deliver adjusted EBITDA growth on a nominal basis, for both Q1 and the full year.

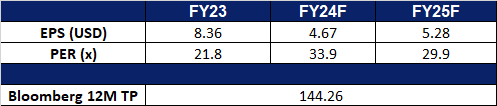

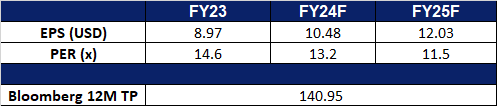

- Market consensus.

(Source: Bloomberg)

PVH Corp (PVH US): Making a comeback

- RE-ITERATE BUY Entry – 137.0 Target – 150.0 Stop Loss – 130.5

- PVH Corp. operates as a clothing and apparel accessories company. The Company designs, manufactures, and markets men’s, women’s, and children’s apparel, footwear, and accessories. PVH offers products such as dresses, shirts, sportswear, neckwear, and footwear.

- Revitalising the company. In the third quarter, PVH’s remarkable performance was driven by the strength of its iconic brands, Calvin Klein and Tommy Hilfiger, and the disciplined execution of the PVH+ Plan, revitalizing the company amidst challenging macroeconomic conditions. Despite facing headwinds, particularly in Europe, the company achieved revenue growth in line with guidance, expanded gross margins, and exceeded bottom-line expectations. There was also robust growth in the direct-to-consumer business, offsetting challenges in wholesale, and significant progress in driving profitability through increased EBIT margin. The company reaffirmed its commitment to long-term growth, emphasizing the importance of executing the PVH+ Plan across all regions and channels. Furthermore, strategic initiatives such as selling heritage brands and strengthening the management team underscore the company’s focus on its core brands and sustainable growth. Moving forward, we remain optimistic about PVH’s growth prospects, buoyed by the strong performance witnessed during Q3 and the ongoing execution of its growth strategy.

- Going according to plan. The PVH+ plan is seamlessly progressing as evidenced by recent high-profile brand campaigns featuring celebrities like Jennie Kim, Kendall Jenner, and Jungkook. Jennie Kim and Jungkook’s collaborations with Calvin Klein, alongside Kendall Jenner’s presence in Tommy Hilfiger’s spring campaign, highlight PVH Corp.’s strategic focus on product excellence and consumer engagement. These partnerships underscore the company’s commitment to modernizing classic American style and tapping into diverse global audiences, thereby driving brand visibility and growth across its portfolio. Additionally, Tommy Hilfiger’s recent partnership with F1 Academy, the women’s racing championship, further solidifies PVH Corp.’s dedication to promoting diversity and breaking barriers in traditionally male-dominated fields, reinforcing its position as a forward-thinking industry leader and further enhances the brand’s image and engagement with a global audience.

- 3Q23 earnings review. Revenue rose by 3.5% YoY to US$2.363bn, missing estimates by US$50mn. Non-GAAP EPS was US$2.90, beating estimates by $0.16. For FY23, revenue is projected to increase approximately 1% as compared to 2022, EPS GAAP about US$9.75 and Non-GAAP basis about $10.45 vs consensus of $10.35.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Add China Aviation Oil (CAO SP) at S$0.93 and Seatrium Ltd (STM SP) at S$0.09. Cut loss on China Aviation Oil (CAO SP) at S$0.90, Seatrium Ltd (STM SP) at S$0.09 and Tesla Inc (TSLA US) at US$190.