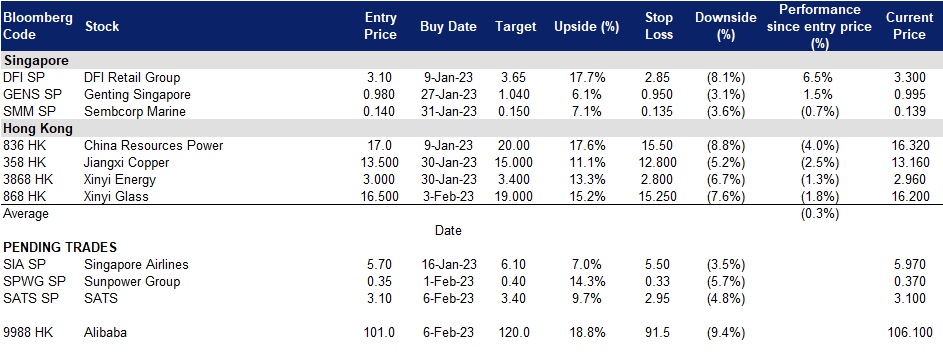

6 February 2023: SATS Ltd. (SATS SP), Alibaba Group Holding Ltd (9988 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SATS Ltd. (SATS SP): Tourism returning to Pre-Covid Levels driven by China’s re-opening

- Entry – 3.10 Target – 3.40 Stop Loss – 2.95

- SATS – Singapore Airport Terminal Services – is a provider of Airport Services and Food Solutions. Its comprehensive scope of airport services encompasses airfreight handling, passenger services, ramp handling, baggage handling, aviation security and aircraft interior cleaning, while its food solutions business comprises inflight catering, food distribution and logistics, industrial catering as well as chilled and frozen food manufacturing. Today, its network of ground handling and inflight catering operations spans nearly 40 airports in the Asia Pacific region.

- Singapore Expects full tourism recovery by 2024. With China’s border re-opening, the Southeast Asian country is expecting 12 to 14 million arrivals and up to S$21B in revenue in 2023. China was the largest contributor to Singapore’s tourism before the pandemic, with 3.6M visitors from China in 2019. The re-opening of China would bring more Chinese tourists back into Singapore and drive growth for SATS.

- Acquisition of Worldwide Flight Services. SATS is on track to complete a $1.29B purchase of air cargo handler Worldwide Flight Services as early as March. With this acquisition, SATS would be better positioned to provide their global customer base with end-to-end solutions.The acquisition will raise the revenue share to 30% from the U.S., and the share generated by Europe, the Middle East and Africa will climb to roughly 25%. The deal will also boost the revenue contribution of the cargo business to 50% from 15%. Consolidated earnings before interest, taxes, depreciation and amortization will increase roughly sevenfold as the result of the deal, according to SATS.

- Company Outlook. The company’s outlook is positive, as they are seeing a key re-opening play for the China market, bringing tourism back to pre-pandemic level by 2024, alongside a good acquisition move on Worldwide Flight Services. This suggests that the company’s performance is likely to continue to improve in the near future.

- The updated market consensus of the EPS growth in FY23/24 is -50.0%/1298.15% YoY respectively, which translates to 345.6x/24.7x forward PE. Bloomberg consensus average 12-month target price is $3.44.

(Source: Bloomberg)

Sunpower Group Ltd (SPWG SP): Manufacturing is back to expansion territory

Sunpower Group Ltd (SPWG SP): Manufacturing is back to expansion territory

- RE-ITERATE Entry – 0.35 Target – 0.40 Stop Loss – 0.33

- Sunpower Group Limited is a one-stop solution provider for energy conservation, waste-to-energy and renewable energy projects which specializes in the design, R&D, and manufacture of energy conservation products in China. The Company’s main businesses include environmental equipment manufacturing, EPC integrated solutions projects, and green investments with BOT/TOT/BOO models.

- Positive signs of economic recovery in China . With China’s manufacturing PMI toppiung 50 1st time in 4 months in January, China is showing positive signs of recovery with its economic activity swinging back to growth. China’s NBS Manufacturing PMI rose to 50.1 versus 49.7 market forecasts and 47.0 prior. Sunpower Group, whose key market lies in China, would be able to ride on this recovery within China and is expected to see revenue growth.

- Increasing demand for renewables within China market. China is increasing its use of renewable energy while putting the brakes on fossil fuel capacity. Developers installed 86 gigawatts of solar power capacity last year, up 62% from 2021, data published by the National Energy Administration shows. China is also expected to achieve its 2030 target of installing renewable energy capacity ahead of schedule by about five years. Sunpower can ride on China’s shift towards a more green environment within the economy itself.

- 3Q22 operation updates. Total steam sales volume rose 15.6% YoY to 6.79 million tons in 9M22 despite the pandemic and worldwide challenges, due to strong demand for clean steam, a non-discretionary input product. YTD performance strongly differentiated Sunpower as a company that can grow despite temporary headwinds.

- Company Outlook. The company’s outlook is positive, as they are seeing a key re-opening play for the China market, with manufacturing PMI topping over 50, as well as China’s shift towards renewable energy sources instead of fossil fuels. This suggests that the company’s performance is likely to continue to improve in the near future.

- The company’s trailing 12M PER is 6.9x, compared to the 5-year average PER of 12.2x.

(Source: Bloomberg)

Alibaba Group Holding Ltd (9988 HK): Make the elephant dance

- ITERATE BUY Entry – 101.0 Target – 120.0 Stop Loss – 91.5

- Alibaba Group Holding Ltd provides technology infrastructure and marketing platforms. The Company operates through seven segments. China Commerce segment includes China retail commerce businesses such as Taobao, Tmall and Freshippo, among others, and wholesale business. International Commerce segment includes international retail and wholesale commerce businesses such as Lazada and AliExpress. Local Consumer Services segment includes location-based businesses such as Ele.me, Amap, Fliggy and others. Cainiao segment includes domestic and international one-stop-shop logistics services and supply chain management solutions. Cloud segment provides public and hybrid cloud services like Alibaba Cloud and DingTalk for domestic and foreign enterprises. Digital Media and Entertainment segment includes Youku, Quark and Alibaba Pictures, other content and distribution platforms and online games business. Innovation Initiatives and Others segment include Damo Academy, Tmall Genie and others.

- China’s economic recovery. China’s policymakers plan to step up support for domestic demand this year, with top policymakers repeatedly signalling their intention to harvest the spending power of China’s 1.4 billion people, after economic growth in 2022 slumped to one of its weakest levels in nearly half a century. Some chinese banks have launched promotions and lowered lending rates to encourage more consumer spending in China. Many leading banks have cut their consumer lending rates to below 4 percent, some have even offered certain consumer lending products at the minimum rate of 3.65 percent, the benchmark lending rate of China’s central bank. With China’s efforts to expand domestic demand and consumption alongside its reopening, which would stimulate increased spending and household consumption, the company should expect higher consumer demand this year.

- Cloud segment growth. Cloud infrastructure and services are becoming a prominent part of any business that uses the web for its operations. Total revenue from its Cloud segment, before inter-segment elimination, which includes revenue from services provided to other Alibaba businesses, was RMB50,698mn (US$7,127mn), an increase of 5% compared to RMB48,448mn in the same period of 2021. YoY growth reflected the strong revenue growth from non-Internet industries driven by financial services, public services and telecommunication industries. With cloud services being an integral part of the operations of all three of these areas, it could lead to long-term recurring revenue for Alibaba. Additionally, with the global cloud computing market projected to reach over $1.7 trillion by 2029, Alibaba’s share of the cloud segment is expected to expand as well.

- 1H23 results. Revenue was RMB412,731mn (US$58,021mn), an increase of 2% year-over-year. Net income attributable to ordinary shareholders was RMB2,178mn (US$306mn), and net loss was RMB2,169mn (US$305mn), compared to net income of RMB46,212mn in the same period of 2021.

- The updated market consensus of the EPS growth in FY24/25 is 4.32%/14.59% YoY respectively, which translates to 13.62x/11.88x forward PE. Bloomberg consensus average 12-month target price is HK$142.63.

(Source: Bloomberg)

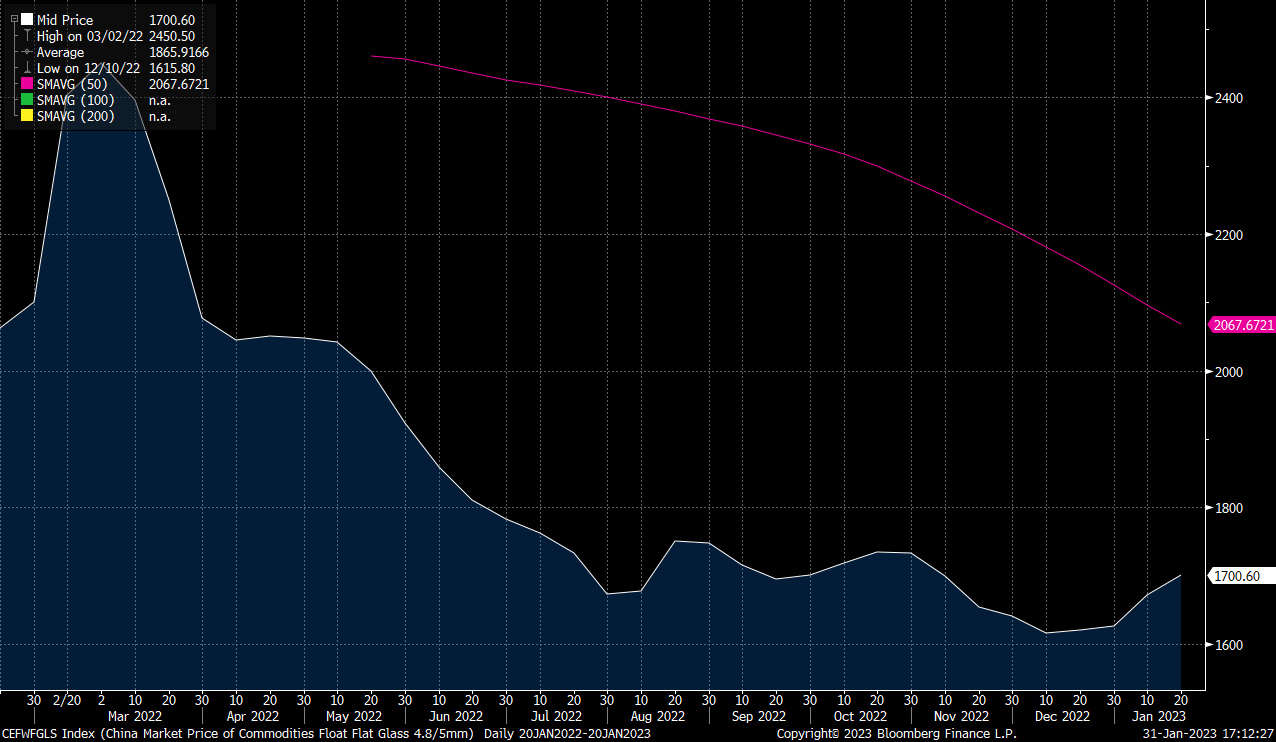

XINYI GLASS HOLDINGS LTD (868 HK): Float Glass prices bottoming out

XINYI GLASS HOLDINGS LTD (868 HK): Float Glass prices bottoming out

- RE-ITERATE BUY Entry – 16.50 Target – 19.00 Stop Loss – 15.25

- Xinyi Glass Holdings Ltd is an investment holding company principally engaged in manufacture and sales of glass. The Company operates its business through three segments. The Float Glass segment is engaged in the manufacture and sales of clear glass, F-green glass and European gray glass. The Automobile Glass segment is engaged in the manufacture and sales of glass in automobiles. The Construction Glass segment is engaged in the manufacture and sales of construction glass, such as tempered glass and laminated glass, among others. The Company is also involved in the manufacture and sales of rubber and plastic products and the provision of logistics services.

- Increase in Float Glass prices. The company’s float glass segment makes up approximately 68% of its revenue, while the automobile and architectural segments making up 21% and 11% respectively. Currently, Xinyi Glass’ float glass production capacity accounts for 13% of the domestic market share, ranking first. With the gradual recovery of the Chinese economy in FY23, float glass prices expected to improve. Furthermore, driven by sufficient project reserves and the policy of guaranteed delivery of buildings domestically, the demand for float glass will gradually increase.

Float Glass price rebounding  (Source: Bloomberg)

(Source: Bloomberg)

- FY22 profit warning. FY22 profit attributable to shareholders of the company is expected to decrease 55% to 65% YoY from HK$11.56bn in 2021, to between HK$4.04bn and HK$5.2bn. The decline in annual net profit is mainly due to the decrease is its average selling price of float glass products due to lowered demand in the domestic construction market and the continuous increase in raw material and energy costs during the year.

- The updated market consensus of the EPS growth in FY23/24 is -12.3%/5.2% YoY respectively, which translates to 9.1x/8.7x forward PE. The current PER is 7.1x. FY23F/24F dividend yield is 4.8%/5.6% respectively. Bloomberg consensus average 12-month target price is HK$18.09.

United States

Top Sector Gainers

|

Sector |

Gain |

Related News |

|

Telecommunications Equipment |

+1.91% |

Apple Blames Rotten Holiday Quarter on Supply Chain, Economy Apple Inc (AAPL US) |

|

Household/Personal Care |

+0.70% |

Clorox Boosts Full-Year Forecast on Price Hikes, Cost Cuts Procter & Gamble Co (PG US) |

|

Pharmaceuticals: Major |

+0.42% |

Drug, Chip Stocks Hit 52-Week Highs As One Breaks Out Of Bullish Chart Pattern Johnson & Johnson (JNJ US) |

Top Sector Losers

|

Sector |

Loss |

Related News |

|

Internet Retail |

-6.23% |

Amazon’s Slowing Cloud-Computing Sales Expected to Linger Amazon.com Inc (AMZN US) |

|

Precious Metals |

-4.02% |

Gold slides as robust jobs report stokes hawkish Fed fears Newmont Corp (NEM US) |

|

Internet Software/Services |

-2.70% |

Apple, Alphabet, Amazon Hurt as Economic Slump Crimps Demand Alphabet Inc (GOOG US) |

Hong Kong

Top Sector Gainers

|

Sector |

Gain |

Related News |

|

Cosmetics & Personal Care |

+1.93% | China’s Service Consumption Recovery Off to a Strong Start Hengan International Group Company Ltd.(1044 HK) |

|

Software |

+1.76% | Insilico Medicine opens largest AI-powered biotech research centre in Middle East SenseTime Group Inc.(0020 HK) |

|

E-Commerce & Internet Services |

+0.92% | China’s Tencent wants to expand its presence in Singapore — and Chinese tourists are a big reason Tencent Holdings Ltd.(0700 HK) |

Top Sector Losers

|

Sector |

Loss |

Related News |

|

Nonferrous Metal |

-2.51% | Press Metal shines as aluminium demand grows China Hongqiao Group Ltd.(1378 HK) |

|

Semiconductors |

-1.83% | Chinese foundries are quietly making equipment purchases Semiconductor Manufacturing International Corporation (0981 HK) |

|

Toys |

-1.50% | Govt hikes import duty on toys to 70% Pop Mart (9992 HK) |

Trading Dashboard Update: Add Xinyi Glass (868 HK) at HK$16.5.