5 June 2023: Rex International Holding Ltd (REXI SP), Kingsoft Corp. (3888 HK),Enphase Energy Inc (ENPH US)

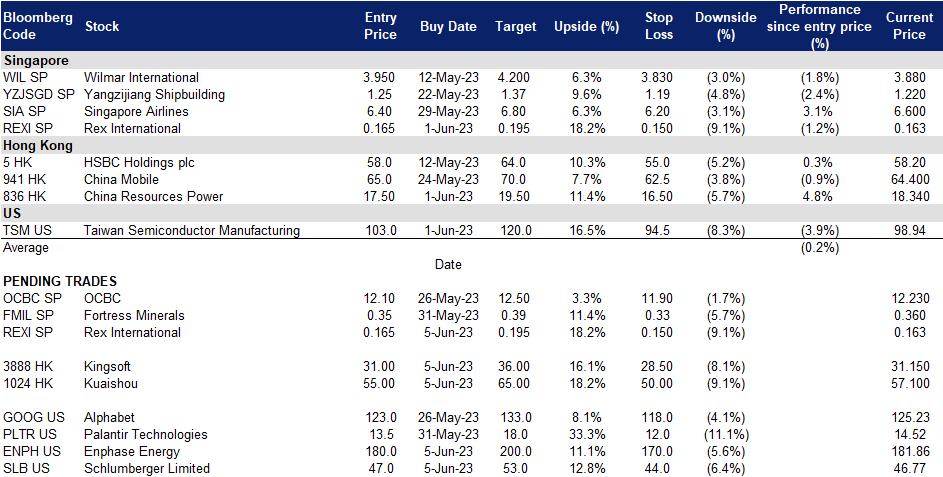

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

Rex International Holding Ltd (REXI SP): Oil rebounds

- BUY Entry 0.165 – Target – 0.195 Stop Loss – 0.150

- Rex International Holding Limited operates as an independent oil exploration and production company. It operates through Oil and Gas, and Non-Oil and Gas segments. The company offers Rex Virtual Drilling, a liquid hydrocarbon indicator, which uses seismic data to search for oil. The company is involved in the oil and gas exploration and production activities with a focus in Oman and Norway.

- Robust non-farm payroll fuels oil rebounding. Brent increased by 2.63% to US$76.20/bbl, and U.S. West Texas Intermediate rose 2.45% to US$71.83/bbl. The two days’ rebound is driven by the lifting of debt ceiling limit and the robust May non-farm payroll. The near-term US recession concerns are mitigated as the US labour market remains healthy, upholding better than expected oil demand outlook.

- Another 1mn bbls/d output cut. OPEC+ held a meeting in Vienna on Sunday to discuss the global oil outlook and the potential 1mn bbls/d output cut. On Monday morning, Saudi decided to cut 1mn bbls/d oil production. Previously, OPEC+ agreed to voluntarily cut by more than 1mn bbls/d in April.

- Oil and gas exploration in Norway. With the recent approval for REXI’s subsidiary Lime Petroleum AS for oil and gas exploration, the company would be able to find and tap into new sources of oil and gas in Norway. This would not only expand its Norwegian oil and gas supplies by tapping into new sources instead of solely depending on existing reserves, but it would also help improve its supply chain as it would now be less dependent on external stakeholders to source for oil and gas. Overall, while this approval may not result in immediate effects, it would be greatly beneficial for REXI in the long run.

- Plan to develop oil fields in Malaysia. A pact was made with Malaysia’s state-owned, Petronas regarding a project to develop oil fields in Malaysia. While the current costs do not allow REXI to effectively leverage the benefits of this agreement, we believe that it will be able to benefit from the developed oil fields in the future, allowing the firm to develop a competitive advantage over its peers.

- FY22 results review. Rex International posted a loss of US$1mn versus a net profit of US$67.2mn in 2021. Revenue for the financial year from crude oil sales was up 7% to US$170.3mn.

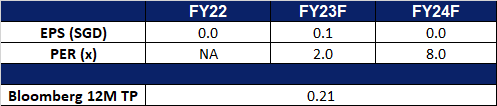

- Market Consensus.

(Source: Bloomberg)

Fortress Minerals Ltd. (FMIL SP): More resources to discover

- RE-ITERATE BUY Entry 0.35 – Target – 0.39 Stop Loss – 0.33

- Fortress Minerals Limited mines, processes, and distributes iron ore. The Company focuses on exploration, mining, production, and distribution of iron ore concentrates. Fortress Minerals serves customers in Singapore and Malaysia.

- Abundant Iron Ore Resources and Reserves. Fortress Mineral has crafted a solid foundation within the industry within the Southeast Asia region, with 2 current big projects at hand to drive revenue. Their mines at Bukit Besi and Mengapur make up a total of 1477.88ha of available mining and exploration land, an indicated and inferred iron resource of 8.83 MT, as well as an indicated and inferred copper resource of 35.89 MT. To date, about 15% of the surface has been explored at Bukit Besi, and only top layer of soil has been processed at its’ CASB mine.

- Potential to upscale. The company also announced 2 new projects in the state of Sabah, East Malaysia. This adds an additional exploration land of 44,000ha for the company, as well as 4 new key minerals to drive revenue in the future. This potentially provides the company with an additional 3000% of land space to generate more revenue streams for the company coming from the extraction of 4 new key minerals, alongside Iron Ore and Copper.

- Diversification of products. Fortress Minerals’ 2 new projects expose the company to new minerals in their portfolio, namely, Nickel, Cobalt, Zinc, and Galena, alongside the existing iron and copper. This adds the potential for new revenue drivers for the company in the long term. Fortress Minerals has plans to begin its sales of copper within 2 to 3 years as well, aside from its current sales of iron ore.

- FY23 results review. The company reported stronger FY2023 results on higher revenues and sales volumes. Revenue rose by 23.5% YoY to US$53.5mn, compared to US$43.4mn in revenue in FY2022. Sales volume rose 52.8% to 546,000 DMT in FY2023 compared to 357,000 DMT in FY2022 as production capabilities are normalized.

- Technical TP of S$0.35; fundamental TP of S$0.46. While we have a Technical TP of S$0.35 based on short-term technical factors, we maintain our fundamental-based TP of S$0.46 based on blended valuation, using Discounted Cash Flow (DCF), with a terminal growth rate of 2% and a WACC of 10%, as well as a comparable multiples Valuation using an industry EV/Resource multiple of 3.6x. Read the full fundamentals-based report here.

(Source: Bloomberg)

Kingsoft Corp. (3888 HK): Shift to local demand

- BUY Entry – 31.0 Target – 36.0 Stop Loss – 28.5

- Kingsoft Corporation Limited is an investment holding company. The Company operates its business through two segments. The Online Game segment mainly engages in the research, development and operation of online games and mobile games, as well as the provision of game licensing services. The Office Software and Services segment mainly engages in the design, research and development, and sales and marketing of the office software products and services. The Company also provides cloud services such as cloud computing, storage, delivery and comprehensive cloud-based solutions.

- Launch of Word Processing Software (WPS) AI. The company has recently revealed its upcoming launch of a generative AI tool called WPS AI. This innovative tool will be initially integrated into a new generation of online content collaborative editing tools known as “light document” and will eventually be incorporated into the entire range of Kingsoft Office products. With capabilities such as generating emails and articles based on prompts, performing multilingual translations, and crafting advertising slogans, this AI tool enables the company to capitalize on the growing demand for AI tools in the industry.

- Replacement of foreign software and hardware. Starting from 2022, the Chinese central government authorities issued a directive instructing government agencies, state-owned, and state-backed enterprises to discontinue the use of foreign-branded computers and software within a two-year timeframe. They are to be replaced with domestically developed hardware and software. This ambitious initiative aims to replace a minimum of 50 million PCs used solely by central government agencies. The objective behind this directive is to retain Chinese capital within the country and minimize its outflow to foreign companies. Additionally, it seeks to establish China’s self-reliance in technology development and manufacturing. As a result of this plan, the demand for domestically developed software in China is expected to surge, thereby driving revenue growth for Kingsoft in the software sector.

- 1Q23 earnings. The company saw a rise in revenue to RMB1.970bn (+6.0% YoY), compared to RMB1.853bn in 1Q21. Net Income rose to RMB192.3mn (+96.0% YoY), compared to RMB98.1mn in 1Q21. Basic EPS rose to RMB0.14, (+100.0% YoY) compared to RMB0.07 in 1Q21.

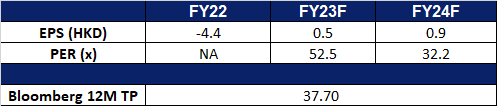

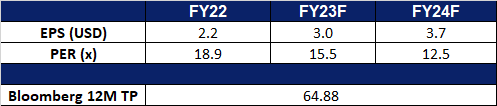

- Market Consensus

(Source: Bloomberg)

Kuaishou Technology (1024 HK): Expecting a sales boom in the upcoming online shopping spree

- RE-ITERATE BUY Entry – 54.0 Target – 59.0 Stop Loss – 51.5

- Kuaishou Technology is a China-based investment holding company mainly engaged in the operation of content communities and social platforms. The Company mainly provides live streaming services, online marketing services and other services. The online marketing solutions include advertising services, Kuaishou fans headline services and other marketing services. Other services include e-commerce, online games and other value-added services. The Company mainly conducts business within the domestic market.

- Online live-streaming sales growth. The online live-streaming shopping market in China is experiencing significant growth, reaching a total of $497 billion in 2022, as reported by Coresight Research. This upward trend can be attributed to consumers who are increasingly valuing their time and opting for the convenience of watching live stream shopping from anywhere, rather than simply browsing products online or visiting physical stores for purchases.

- Upcoming June 18th shopping festival. In anticipation of the annual June 18 shopping carnival, major e-commerce platforms in China have already initiated presales. This year, these platforms have introduced more extensive promotional events and direct subsidies, streamlining their promotional methods. Buyers no longer need to perform complex calculations or combine multiple orders to avail discounts. Additionally, live-streaming sessions continue to play a crucial role during the June 18 shopping festival. Short-video platforms like Douyin and Kuaishou have increased subsidies in an effort to attract more traffic and compete with e-commerce platforms. Overall, this promotional event is expected to stimulate consumption growth in the second quarter.

- 1Q23 earnings. The company swung to an adjusted net profit of 42mn yuan (HK$46.8mn) in the first quarter, the first time since its listing in Hong Kong in 2021, compared to a net loss of 3.7bn yuan a year ago. Revenue rose to 25.2bn yuan, a 20% increase YoY. The company also revealed plans to buy back up to HK$4 bn worth of shares over the period till the conclusion of the company’s AGM.

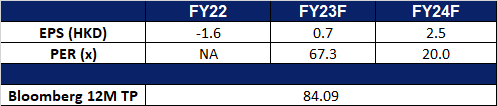

- Market Consensus

(Source: Bloomberg)

Enphase Energy Inc (ENPH US): Growing demand

- BUY Entry – 180 Target – 200 Stop Loss – 170

- Enphase Energy, Inc. manufactures solar energy equipment. The Company offers home and commercial solar and storage solutions. Enphase Energy serves clients in the United States.

- Expanding footprint in Europe. Enphase is expanding its relationship with Natec and efforts to meet the growing demand for its solar products in Europe. Enphase has partnered with Natec, a wholesaler of solar and battery products, to distribute IQ Microinverters and IQ Batteries across Europe. The company has increased its global capacity of microinverters through its contract manufacturer, Flex, in Romania. This expansion allows Enphase to improve delivery times to European customers and address the region’s increasing demand for residential solar. By collaborating with Natec and increasing production capacity, Enphase can generate more revenue, reduce costs associated with overseas shipments, shorten delivery times, and meet the growing demand for its products in Europe. Hence enabling contribution to the company’s overall growth in terms of both top and bottom lines.

- Biden-McCarthy debt ceiling bill passed. The bill to suspend the US$31.4tn debt ceiling was passed on 3 June 2023 (Saturday), allowing the federal government to avoid defaulting on its bills and temporarily removing the federal government’s borrowing limit through 1 Jan 2025. The bill includes various provisions such as capping government spending over the next two years, expediting the permitting process for certain energy projects, reclaiming unused COVID-19 funds, and expanding work requirements for food aid programs to include more recipients. This deal is advantageous for the renewable energy sector, as it maintains President Biden’s infrastructure and green-energy laws and imposes less severe spending cuts and work requirements compared to previous negotiations.

- Growth in global solar power investment. Global investment in the solar sector is projected to exceed spending on oil production for the first time. The International Energy Agency’s executive director, Fatih Birol, highlights that this development will contribute to the realisation of the 1.5°C climate goal. The growth of solar energy is attributed to strong subsidies, tax credits like the Inflation Reduction Act, increased policy alignment towards climate and energy security, and the improving economics of alternative power sources. Birol emphasizes the rapid progress of clean energy, with a significant shift in investment ratios from fossil fuels to clean energy over the past five years. This trend underscores the increasing momentum and potential of the clean energy market.

- New products introduced for the Australian market. Enphase has launched its latest home energy solutions for customers in Australia, which can be pre-ordered and are expected to be shipped from July 2023. The IQ Battery 5P is a modular energy storage solution that seamlessly integrates with solar panels, while the IQ8 Microinverter operates at the individual panel level, providing greater flexibility in system design and maintenance. These new home energy solutions from Enphase will give Australian customers looking to shift towards solar alternatives more options to customise and optimise their home energy systems.

- 1Q23 earnings review. Revenue rose 64.5% YoY to US$726.02mn, beating expectations by US$5.51 mn. Non-GAAP earnings per share came in at $1.37, beating estimates by $0.15. Total revenue remained flat on a QoQ basis, with sales in the US falling 9% while revenue in Europe rose 25%. 1Q23 IQ battery shipments fell to 102.4MWh from 122.1MWh in 4Q22.

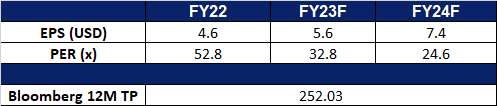

- Market consensus.

(Source: Bloomberg)

Schlumberger Limited (SLB US): OPEC+ supports oil prices

Schlumberger Limited (SLB US): OPEC+ supports oil prices

- BUY Entry – 47 Target – 53 Stop Loss – 44

- Schlumberger Limited engages in the provision of technology for the energy industry worldwide. The company operates through four divisions: Digital & Integration, Reservoir Performance, Well Construction, and Production Systems.

- Oil prices rebound. Oil prices rose about 2% on Friday after the U.S. Congress passed a debt ceiling deal, and positive job data suggested a possible pause in interest rate hikes. Brent futures increased by 2.4% to $76.08 a barrel, and U.S. West Texas Intermediate (WTI) crude rose 2.3% to $71.68. Open interest in futures contracts reached the highest levels in months. The U.S. Senate’s debt ceiling deal eased concerns of a government default, however, the upcoming OPEC+ meeting is being closely watched. Energy firms in the U.S. have reduced the number of oil rigs, and China’s heatwaves strain power grids due to increased air conditioner usage. Oil prices continued its uptrend on Monday, rising 2.5% after Saudi Arabia pledged more voluntary production cuts in July. Global benchmark Brent futures were up 2.4% at $78.00 a barrel Monday during early Asia trade, while U.S. West Texas Intermediate futures rose 2.5% to $73.53 per barrel.

- Possible production cut. OPEC+ held a meeting on Saturday to finalise their decision. OPEC+ collectively contribute 40% of global crude oil production, giving their choices significant influence in the oil market. The meeting was held to address declining oil prices and concerns of an oversupply by considering potential production cuts of up to 1mn bbls/d. In addition to the existing reductions of 2mn bbls/d and voluntary cuts of 1.6mn bbls/d, resulting in a total reduction of 4.66mn bbls/d or about 4.5% of global demand. The figure of 1mn bbls/d is premature with no official discussion. While previous cuts announced in April failed to sustain oil prices due to worries about weakening demand and economic growth, the International Energy Agency predicts a rise in global oil demand in the second half of 2023, which could support prices. OPEC+ cuts amounting to 3.66mn bbls/d which were previously valid till the end of 2023 have been extended till the end of 2024, with no further additions to the cuts. The group will also reduce overall production targets from January 2024 by a further 1.4mn bbls/d versus current targets to a combined 40.46mn bbls/d. Saudi Arabia made a shocking announcement that it would decrease its output to 9mn bbls/d starting in July from the 10mn bbls/d in May, in order to boost oil prices.

- 1Q23 earnings review. Revenue jumped by 30% YoY to US$7.7bn, beating estimates by US$240mn. Non-GAAP EPS of $0.63 beat expectations by $0.02. Previously, the company projected revenues to grow at least 45% by 2025 and full-year EBITDA to grow more than 60%.

- Market consensus.

(Source: Bloomberg)

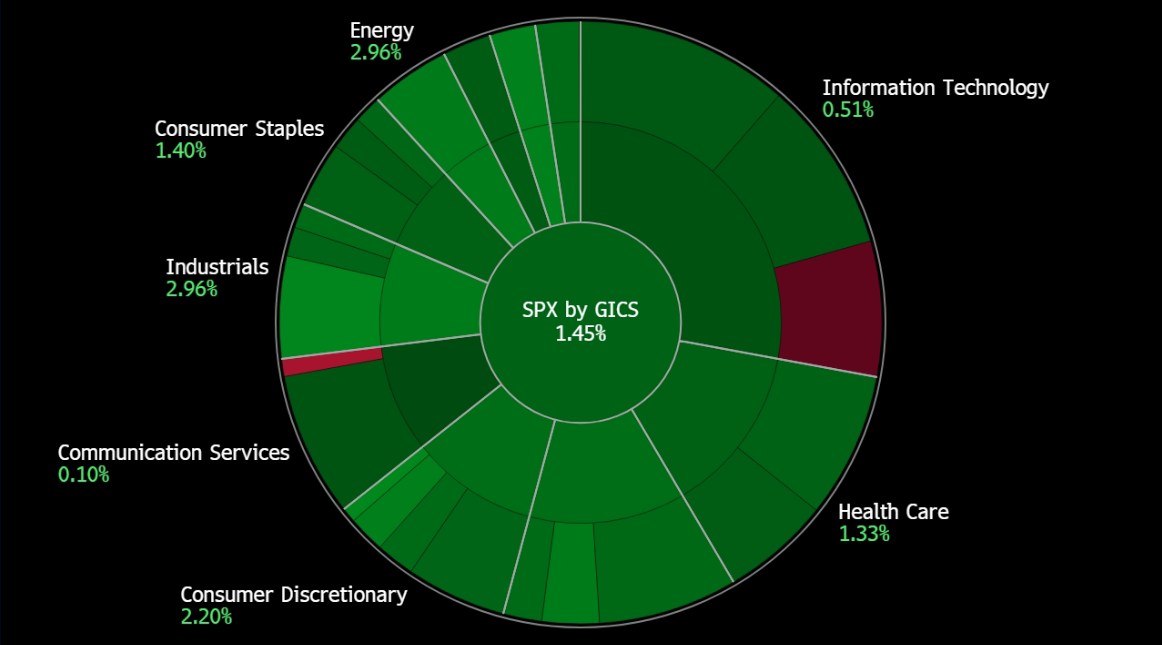

United States

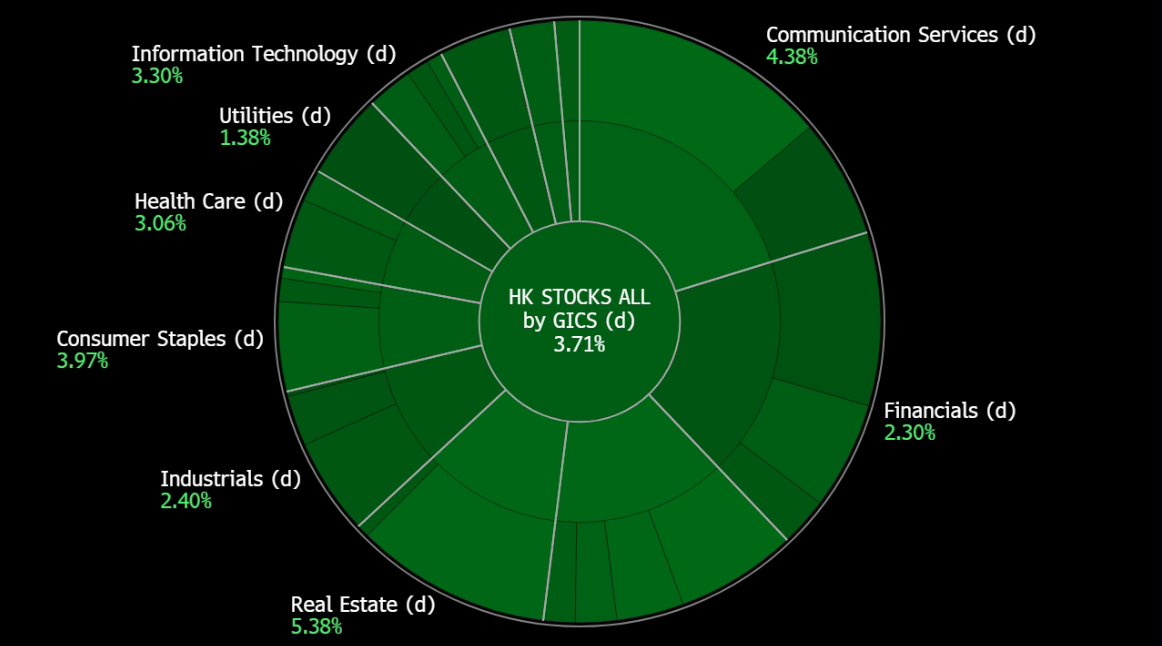

Hong Kong

Trading Dashboard Update: Add Rex International (REXI SP) at S$0.165, China Resources Power (836 HK) at HK$17.5 and Taiwan Semiconductor (TSM US) at US$103. Take profit on Netflix (NFLX US) at US$390.