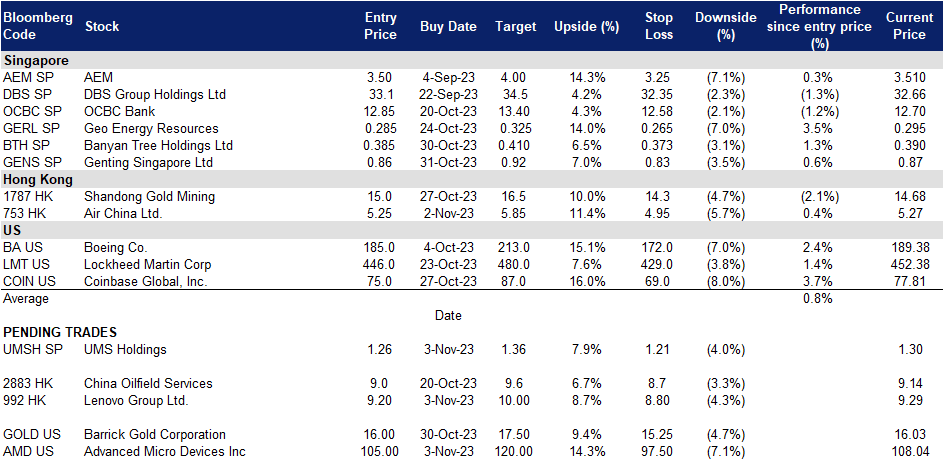

3 November 2023: UMS Holdings (UMSH SP), Lenovo Group Ltd. (992 HK), Advanced Micro Devices Inc (AMD US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

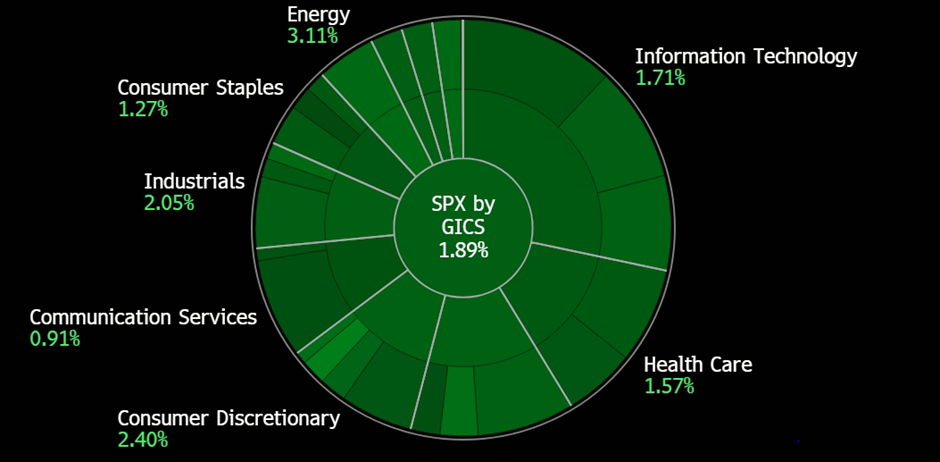

United States

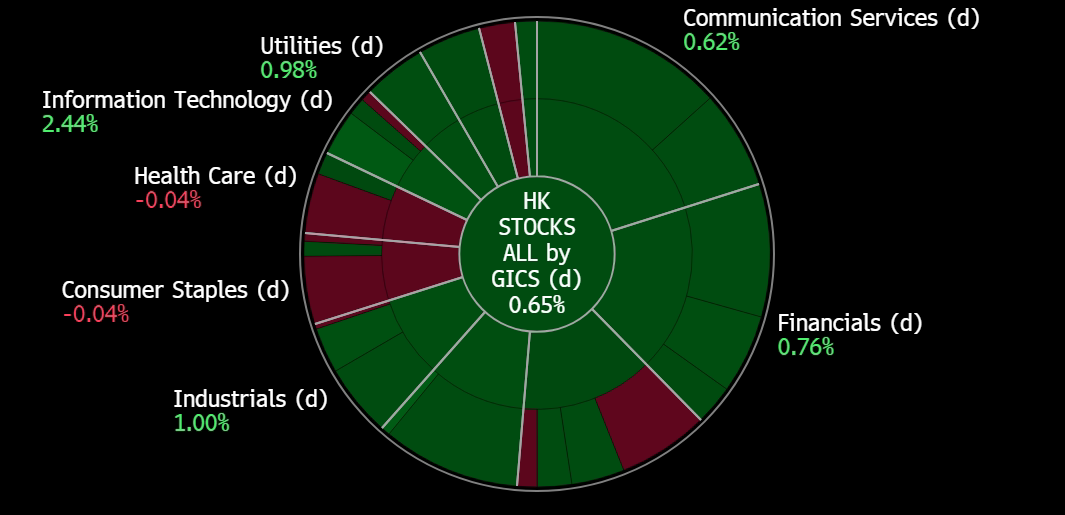

Hong Kong

UMS Holdings (UMSH SP): Expect better 3Q23 earnings

- BUY Entry 1.26 – Target – 1.36 Stop Loss –1.21

- UMS Holdings Limited provides equipment manufacturing and engineering services to Original Equipment Manufacturers (OEMs) of semiconductors and related products. The Company manufactures high precision components and complex electromechanical assembly and final testing services. UMS supports the electronic, machine tools and oil and gas industries.

- Semiconductor sector is bottoming out. The milestone development of artificial intelligence (AI) in 1H23 not only buffers the downcycle of the semiconductor sector but also kickstarts a new growth engine. The AI hype shadows the fall in demand for mobile/PC chips due to the normalisation of life and the drop in capex due to geopolitical factors. However, several market leaders projected that the sector will bottom out in 2H23 or 1H24 as both orders and capex will gradually recover. In the UMS’s 2Q23 press release, according to SEMI, global 300mm fab equipment spending for front-end facilities next year is expected to begin a growth streak to hit a US$119 billion record high in 2026 following a decline in 2023.

- Upbeat 2024 outlook from the upstream. Advanced Micro Devices’s 3Q23 results topped market estimates. Meanwhile, it predicted that the data center GPU revenue would exceed US$2bn in 2024. Samsung Electronics reported its 3Q23 as most profitable quarter in 2023, and it mentioned that smartphone and PC demand is poised to rebound amid the coming replacement cycle. AI theme will remain a key investment thesis in 2024, driving related segments to grow.

- Applied Materials 3Q23 review. Applied Materials (AMAT US) is a key customer to UMS. Its 3Q23 revenue dropped 1.4% YoY to US$6.3bn, beating estimates by US$250mn. 3Q23 Non-GAAP EPS was US$1.9, beating estimates by US$0.15. It expects 4Q23 net sales to be approximately US$6.51bn, plus or minus US$400 mn, compared to a consensus of US$5.87bn. 4Q23 Non-GAAP adjusted diluted EPS is expected to be in the range of US$1.82 to US$2.18, compared to a consensus of US$1.60. AMAT will be releasing its 4Q23 earnings on 16 November.

- 2Q23 results review. Revenue fell 14% YoY to S$74.4mn. Gross material margin decreased to 46.3% from 51.7%. PATMI plugged 42% YoY to S$11.6mn. Net margin fell to 15.4% from 23.2%. The new plant in Penang is expected to contribute at least US$30mn for FY24. The company declared an interim dividend of 1.2 SG cents. UMS will be releasing its 3Q23 earnings on 14 November.

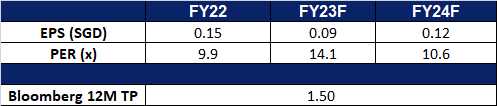

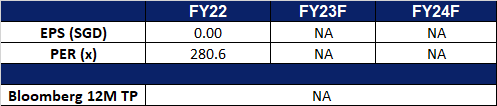

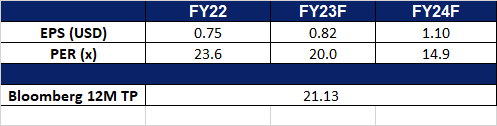

- Market Concensus.

(Source: Bloomberg)

Banyan Tree Holdings Ltd. (BTH SP): Growing expansion plans

- RE-ITERATE BUY Entry 0.385 – Target – 0.410 Stop Loss – 0.373

- Banyan Tree Holdings Limited operates as a holding company. The Company, through its subsidiaries, owns and manages hotel groups. The Company focuses on hotels, resorts, spas, galleries, golf courses, and residences, as well as provides investments, design, construction, and project management services. Banyan Tree Holdings serves customers worldwide.

- Entering Philippines. Banyan Tree is set to open its first-ever residential project in the Philippines, called Banyan Tree Residences Manila Bay in 2026. This project will offer 188 residences across three glass-enclosed towers overlooking Manila Bay, blending modern living with Philippine design traditions, including a focus on weaving in both architecture and interior design. Residents will enjoy a range of amenities, such as a 24-hour concierge, restaurants, a rooftop garden, infinity pools, a fitness center, and the first Banyan Tree Spa and Gallery in the Philippines. Additionally, owners can access the Banyan Tree Sanctuary Club, offering exclusive benefits and access to the brand’s global network of resorts and properties. Banyan Tree has further expansion plans in the Philippines, including a hotel, two golf courses, island developments, and resorts, with a focus on the thriving Southeast Asian real estate market.

- Debut Garrya in Java. The Banyan Tree Group has launched a new resort called Garrya Bianti Yogyakarta on Indonesia’s Java island, continuing the global expansion of its minimalist Garrya brand. The resort draws design inspiration from Javanese culture and the iconic Yogyakarta temple. It offers 24 villas, including a two-bedroom villa with a private plunge pool and wellness facilities, along with a spa offering Asian-rooted wellness therapies. Culinary options feature traditional Javanese dishes made from local ingredients, and guests can explore local arts and crafts. Banyan Tree Group plans to open four Garrya resorts in Vietnam and two in China by 2025.

- Visa-free travel. Thailand temporarily waives tourist visa requirements for visitors from China and Kazakhstan from 25 September 2023 to 29 February 2024, in an effort to attract more tourists and spur spending during the year-end high season to stimulate the economy, which is slowing due to weak exports. The business sector has welcomed the government’s new policy, and airlines are preparing to increase flights and add more capacity to accommodate the expected increase in tourists. The tourism industry is optimistic that the visa-free scheme will be a success and boost tourism spending in Thailand. This would also benefit businesses such as Banyan Tree, which has multiple properties in the country. The visa-free scheme would make it easier and more convenient for Chinese tourists to visit Thailand, which could lead to an increase in bookings at Banyan Tree’s properties.

- 1H23 results review. Revenue for 1H23 increased 21% to S$143.7mn, from S$118.6mn a year ago. It achieved a 68% increase in core operating profit to S$18.7mn in 1H23 from S$11.1mn in 1H22. RevPAR rose 64% in 1H23 (on a same-store basis) vs 1H22.

- Market Consensus.

(Source: Bloomberg)

Lenovo Group Ltd. (992 HK): Tap intp AI

- BUY Entry – 9.20 Target – 10.00 Stop Loss – 8.80

- Lenovo Group Limited is an investment holding company principally engaged in personal computers and related businesses. The Company’s main products include Think-branded commercial personal computers and Idea-branded consumer personal computers, as well as servers, workstations and a family of mobile Internet devices, including tablets and smart phones. The Company operates its business through four geographical segments, including China, Asia Pacific (AP), Europe, the Middle East and Africa (EMEA) and Americas (AG). The Company also provides cloud service and other related services. The Company distributes its products in domestic market and to overseas markets.

- Partnership with Nvidia. Lenovo and NVIDIA have expanded their partnership to develop new hybrid AI solutions and collaborate on engineering. This partnership aims to bring the power of generative AI to every enterprise. Working closely with NVIDIA, Lenovo will deliver fully integrated systems that bring AI-powered computing to the edge and cloud, where data is created. This will make it easier for businesses to deploy tailored generative AI applications to drive innovation and transformation across all industries.

- New product on sales. Lenovo has just placed the ThinkPad X1 Fold 16” folding laptop on sales, more than a year after announcing the product. The ThinkPad X1 Fold 16” features an impressive 16.3-inch foldable Samsung OLED display, sporting a resolution of 2024 x 2560 pixels, and when folded, the device transforms into a 12-inch display, and it can be seamlessly paired with a Bluetooth keyboard, delivering a laptop-like experience. This product is bound to attract consumers to prefer a convenient yet big tablet that provides the same experience as using a laptop.

- Tapping into the India Market. Lenovo is amongst the 100 firms that are authorised by India to import electronic devices such as laptops, tablets, and personal computers under a new system aimed at monitoring shipments. Other companies include Apple, Dell, HP, Samsung etc. These companies must register the quantity and value of imports on a portal, with an authorisation valid until September 2024. This allows Lenovo to tap into the India market, possibly adding another source of revenue from India.

- 1Q24 earnings. Revenue fell 24.0% YoY to US$12.90bn in1Q24, compared with US$17.0bn in 1Q23. Net profit was US$191mn in 1Q23, dropping 66% YoY comparing to US$556mn in 1Q23. Basic earnings per share was US 1.48 cents in 1Q24, compared to US4.39 cents in 1Q23.

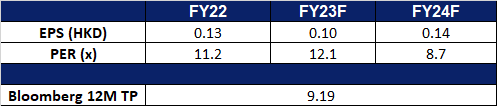

- Market Consensus.

(Source: Bloomberg)

Air China Ltd. (753 HK): Flights to increase go forward

- RE-ITERATE BUY Entry – 5.25 Target – 5.85 Stop Loss – 4.95

- Air China Limited is a China-based company principally engaged in the provision of air passenger transportation, freight transportation, postal transportation and maintenance services in Mainland China, Hong Kong, Macau and foreign regions. The Company is also engaged in domestic and international business aviation businesses, plane business, aircraft maintenance, airlines business agents, ground and air express services related to main businesses, duty free on boards, retail business on boards and aviation accident insurance sales agents business.

- Returning to Profit. Air China returned to profitability during the initial nine months of the year, driven by a substantial increase in business and leisure travel after Beijing eased stringent COVID-19 restrictions. With the increase in deployment of transportation capacity by the company, and driven by the increase in both passenger load factor and price, the loss decreased significantly with growth in profit.

- More flights between China and the US. The US Department of Transportation announced that flights between China and the US will increase to 70 a week starting on 9 November, from the current 48 a week. The average flights between the two counties averaged 340 a week in the pre-COVID period. Recently, China and the US top officials started visiting each other, signalling some improvements in China-US relations.

- Rising seasonal travel demand. With the peak travel season coming up in November, travel demand is bound to pick up as consumers make their plans to travel for the end of the year, to escape the winter cold, or to experience the winter season. This winter holiday is also the first winter holiday since China’s reopening in Jan earlier this year, and hence is likely to see a rise in travel volume over the period. Chinese airlines have also seen a rise in scheduled flights for winter-spring, scheduling 96,651 domestic cargo and passenger flights each week for the upcoming winter-spring season, an increase of 33.95% from the same period in 2019-2020, according to the Civil Aviation Administration of China (CAAC). 516 new domestic routes will also be opened from Oct 29 to March 30 next year,, providing 7,202 flights each week, according to the CAAC. In terms of international flights, 150 domestic and foreign airlines plan to arrange 16,680 flights per week, reaching 68 foreign countries.

- 3Q23 earnings. Revenue rose to RMB45.86bn, up 152.89% YoY. Net profit was RMB 4.07bn, returning to profit for the first time for the year. Basic earnings per share was RMB0.28.

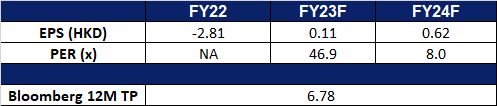

- Market Consensus.

(Source: Bloomberg)

Advanced Micro Devices Inc (AMD US): AI progression

- BUY Entry – 105.0 Target – 120.0 Stop Loss – 97.5

- Advanced Micro Devices, Inc. (AMD) produces semiconductor products and devices. The Company offers products such as microprocessors, embedded microprocessors, chipsets, graphics, video and multimedia products and supplies it to third-party foundries, as well as provides assembling, testing, and packaging services. AMD serves customers worldwide.

- Further AI developments are to be announced. AMD will be holding an Advancing AI Event on December 6, featuring its products and partnerships related to AI development. The event will be live-streamed on their website.

- Increase in AI chip sales. AMD reported strong Q3 performance with revenue growth in the server CPU and Ryzen processor segments. The company is focusing on enhancing its AI capabilities and foresees robust growth in the Data Center and Client segments, projecting Q4 revenue of around $6.1 billion. In addition, AMD is targeting the AI market with the MI300X chip to compete with Nvidia and expects $2 billion in sales from it in 2024. However, these estimates could face challenges due to recent restrictions and potentially more stringent bans enforced by the US Department of Commerce, prohibiting the sale of advanced AI chips to China. While chip manufacturers have indicated that the impact will likely be minimal, this issue remains a source of concern for certain investors.

- Acquired AI software. AMD acquired Nod.ai, an artificial intelligence startup, as part of its strategy to strengthen its software capabilities and compete with Nvidia. Nvidia has established itself as a dominant force in the AI chip market through its software and developer ecosystem. AMD aims to invest in building unified software to support its range of chips. The Nod.ai acquisition aligns with the strategy, as its technology facilitates the deployment of AI models optimised for AMD’s chips. AMD has been growing its AI group with plans for further expansion and potential future acquisitions.

- ROCm vs CUDA. AMD is emphasising its commitment to evolving its software stack, ROCm, in the competitive AI chip market, recognising that software development is a journey. The company has made ROCm a top priority and created a new organisation to consolidate its software assets. This effort includes acquiring companies like Mipsology and expanding its talent pool. AMD has also established an internal AI models group to strengthen its software expertise. It uses open-source solutions like Triton to challenge Nvidia’s CUDA and offer alternatives for developers, emphasising the importance of open-source collaboration. AMD’s ROCm stack aims to allow the community to contribute and bridge the gap in software maturity. They have MI300 and MI300X AI chips with samples currently with customers and are focused on the success of ROCm in supporting these offerings.

- 3Q23 earnings review. Revenue rose by 4.1% YoY to US$5.8bn, beating estimates by US$110mn. Non-GAAP EPS was US$0.70, beating estimates by US$0.02. Revenue from the data centre segment remained flat, whereas the client segment saw an increase, followed by a decline in both the embedded and gaming segments.

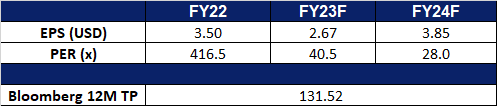

- Market consensus.

(Source: Bloomberg)

Barrick Gold Corporation (GOLD US): Safety net

- RE-ITERATE BUY Entry – 16.00 Target – 17.50 Stop Loss –15.25

- Barrick Gold Corporation engages in the exploration, mine development, production, and sale of gold and copper properties. It has ownership interests in producing gold mines that are located in Argentina, Canada, Côte d’Ivoire, the Democratic Republic of Congo, the Dominican Republic, Mali, Tanzania, and the United States.

- Escalating tensions. The ongoing conflicts in Russia-Ukraine and Israel-Hamas have introduced significant economic uncertainty in global markets. The recent escalation in the Gaza conflict, marked by intensified ground operations and violent clashes, has added to the turmoil. Israeli forces increased airstrikes, targeting tunnels and underground infrastructure, while cutting off internet and communications in Gaza, raising concerns about potential mass atrocities and disrupting humanitarian efforts. Israel’s bombardment has led to widespread displacement and critical shortages in Gaza. Worldwide demonstrations, including arrests in New York, have called for a ceasefire, and violence has escalated in the occupied West Bank. The United Nations has warned of unprecedented suffering in Gaza and urged an immediate humanitarian truce. Consequently, the ongoing conflicts have contributed to macroeconomic instability, prompting individuals to seek safer assets like Gold.

- September US CPI above expectations. In September, consumer prices in the United States increased by 0.4%, which was higher than expected. This brought the YoY inflation rate to 3.7%, exceeding forecasts. Excluding volatile food and energy prices, the core Consumer Price Index (CPI) increased by 0.3% for the month and 4.1% over the past 12 months, in line with expectations. Rising shelter costs, accounting for about a third of the CPI’s weight, played a significant role in this inflation increase, surging by 0.6% for the month and 7.2% YoY. Energy costs rose by 1.5%, with higher gasoline and fuel oil prices, and food costs increased by 0.2%. Services prices, which are important for long-term inflation trends, also saw gains. Real average hourly earnings fell by 0.2% for the month, causing worker wages to decline in real terms. With concerns about inflation and the uncertain macroeconomic environment, the Federal Reserve remains steadfast in its higher for longer decision regarding US interest rates.

- September US PPI data above expectations. In September, the producer price index (PPI) in the United States exceeded expectations by rising 0.5% against the predicted 0.3% rise. When excluding food and energy, the core PPI increased by 0.3%, in line with expectations. The inflation pressures mainly came from final demand goods, surging 0.9% for the month, while services increased by 0.3%. Gasoline and food prices were significant contributors to the rise in goods prices. This suggests that inflation remains a concern, and has implicated interest rates and policy decisions from the Federal Reserve.

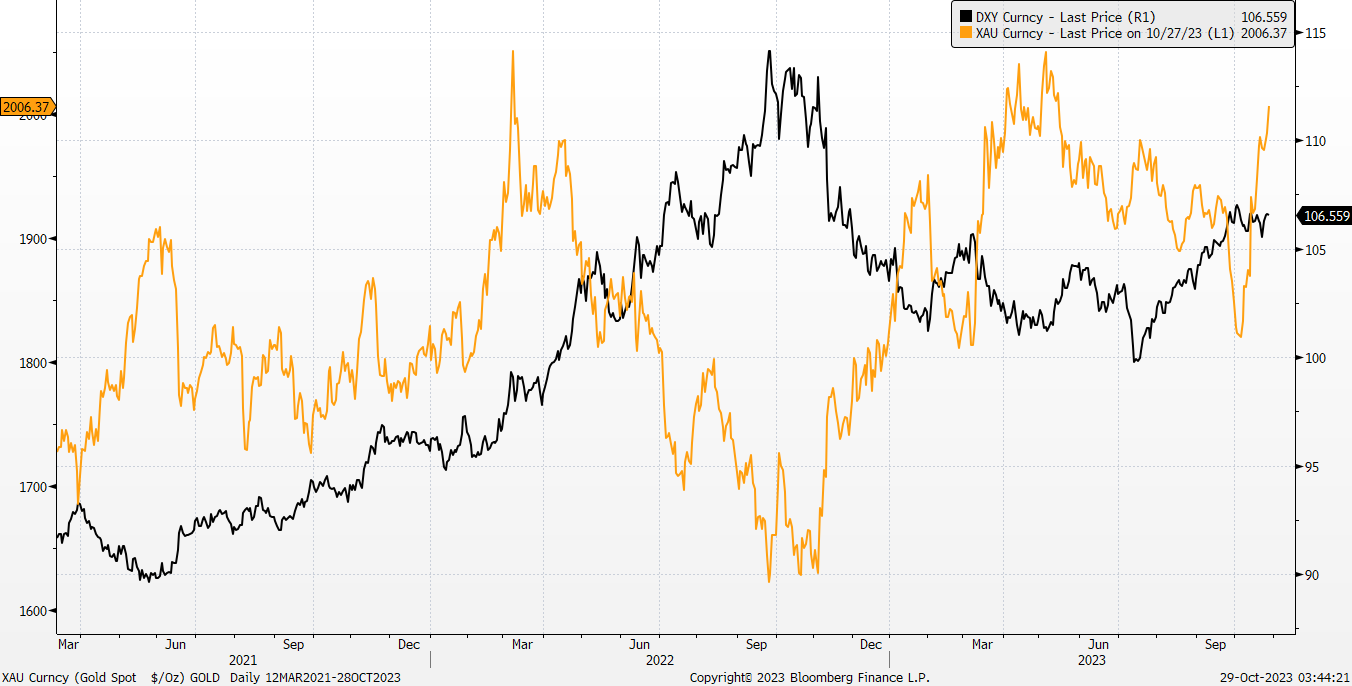

- Better outlook for gold price in 2023. Gold prices are influenced by various factors, with significant impact coming from the direction of the US dollar and global geopolitical risks. Gold tends to find support from limited inflation and low unemployment, serving as a hedge against inflation and a safe haven during uncertain economic times. The market anticipates rates staying higher for longer. The US dollar’s ascent, driven by rebounding gasoline prices and expectations of more Fed interest rate hikes, is contributing to the situation. PGold prices are also affected by persistent inflation and geopolitical tensions, with concerns in both areas influencing the market. Added caution has emerged from the ongoing war between Israel and Hamas. As a result, gold prices are likely to remain volatile, with their direction contingent upon inflation, interest rates, and geopolitical developments. Gold continues to be viewed as a reliable safe haven.

Gold Price and Dollar Index Trend

(Source: Bloomberg)

(Source: Bloomberg)

- 2Q23 earnings review. Revenue dropped by 1.0% YoY to US$2.83bn, missing estimates by US$100mn. Non-GAAP EPS was US$0.19, beating estimates by US$0.01. Gold production in Q2 was up 6% at just over 1mn ounces while copper production increased by 22% to 107mn pounds.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Cut loss on Yankuang Energy Group (1171 HK) at HK$13.4.