3 July 2023: Yangzijiang Shipbuilding (YZJSGD SP), Yankuang Energy Group Co. Ltd. (1171 HK), Whirlpool Corp (WHR US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

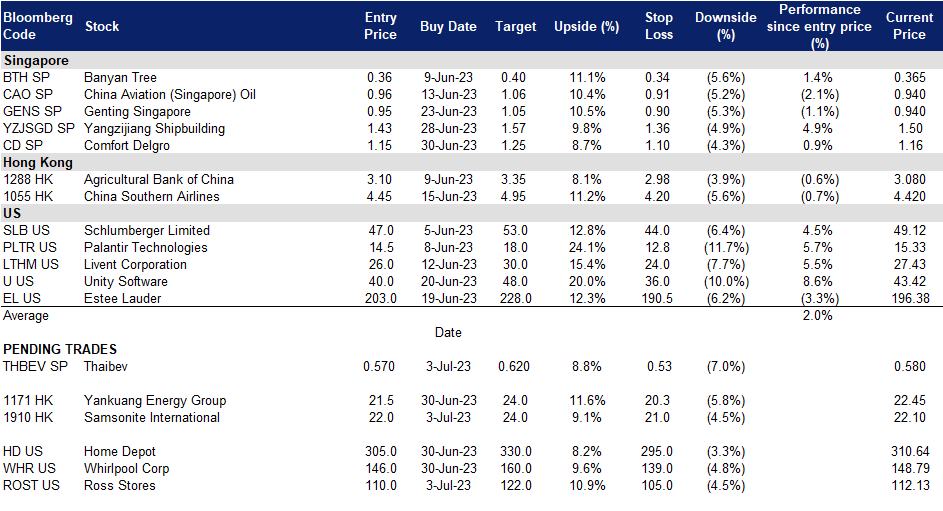

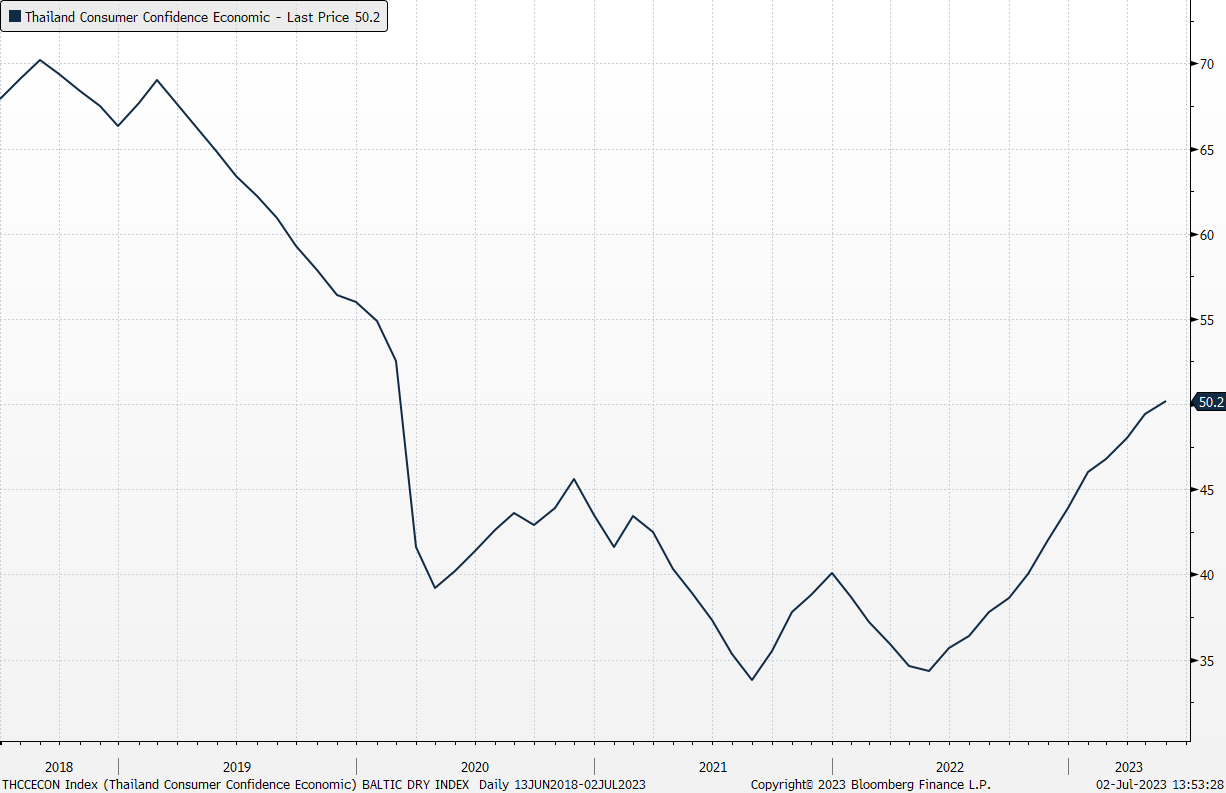

ThaiBev (THBEV SP): Recovering consumer confidence

- BUY Entry 0.57 – Target – 0.65 Stop Loss – 0.53

- Thai Beverage Public Company Limited is Thailand’s largest and leading beverage producer and distributor. Its operation is considered among the leading distillers and brewers and in Southeast Asia. ThaiBev’s leading products include a variety of well-established spirits brands, including its famous brew Chang Beer. In the non-alcoholic beverage category, key products include water, tonic soda, energy drink, ready-to-drink coffee and green tea.

- Improving consumer confidence. According to the latest consumer confidence survey, the index recovered to the highest level since the COVID outbreak, reaching 50.2 in May. The promising recovery was driven by the growth in tourism and the demand for industrial and agricultural goods.

Thailand Consumer Confidence Economic Index

(Source: Bloomberg)

- Potential liquor industry disruption. Winning the most seats in the Thailand general election in 2023, the Move Forward Party opposed the existing strict liquor law which is viewed as preserving a duopoly by suppressing microbreweries and distilleries. Boon Rawd Brewery and ThaiBev, makers of Singha and Chang respectively, hold a combined 93% of the local beer market. Though it is possible for the new government to ease the production curb, the dominance of the two giants will remain unchanged in the near term as their economy of scale can maintain stable profit margins amidst a high inflation environment.

- 2Q23 earnings review. Revenue grew mildly by 2% YoY to 67.4bn THB. Gross profit margin was 30.3%, up 0.06 ppts YoY. PATMI grew mildly by 3% YoY to 7.4bn THB. Net margin was 10.9%, up 0.01 ppts YoY.

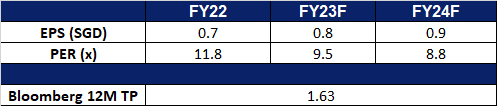

- Market consensus.

(Source: Bloomberg)

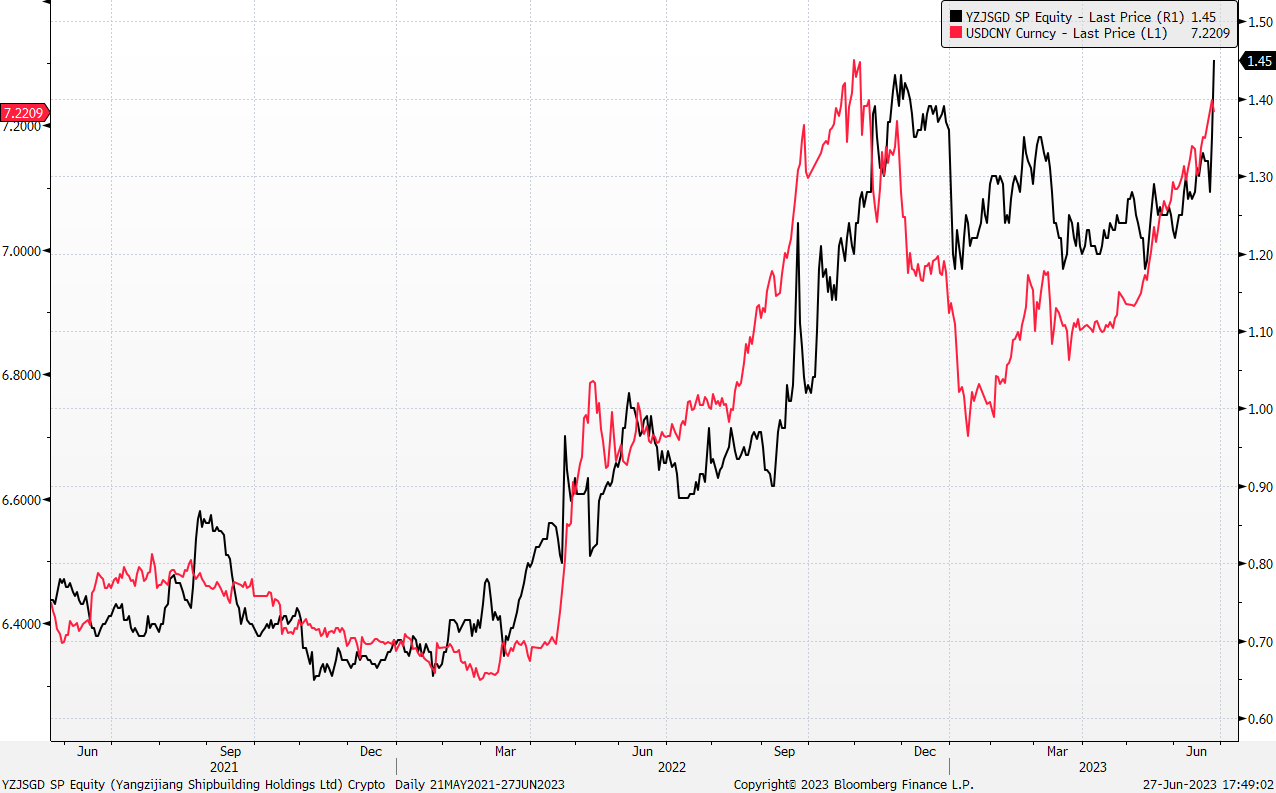

Yangzijiang Shipbuilding (YZJSGD SP): Double bonanzas-record order book and weak RMB

Yangzijiang Shipbuilding (YZJSGD SP): Double bonanzas-record order book and weak RMB

- RE-ITERATE BUY Entry 1.43 – Target – 1.57 Stop Loss – 1.36

- Yangzijiang Shipbuilding Holdings Limited builds a wide range of ships. The Company produces a wide range of commercial vessels, mini bulk carriers, multi-purpose cargo vessels, container ships, chemical tankers, offshore supply vessels, rescue and salvage vessels, and lifting vessels.

- Secures contract to build six mid-size container vessels. YZJ Shipbuilding just secured a contract with A.P. Moller-Maersk to construct six 9,000TEU methanol dual-fuel containerships in-house which are due for delivery between 2026 and 2027. They are designed to operate on green methanol and feature dual-fuel engines that can run on both fuel oil and methanol. With a capacity to carry over 9,000 containers, the new ships will replace existing vessels in Maersk’s fleet as part of their commitment to transitioning to greener options. Green methanol is reported to be able to significantly reduce nitrogen oxide (NOx) and sulphur oxide (SOx) emissions compared to conventional fuels. Moreover, considering the International Maritime Organization’s regulations that are pushing the shipping industry towards decarbonisation, it is highly likely that this contract is just the beginning of a series of future methanol dual-fuel fleet orders for YZJ Shipbuilding.

- Repeat customer. On June 25 it was announced that YZJ Shipbuilding had secured a contract from Klaveness Combination Carriers to construct three 83,300DWT third-generation CABU vessels, scheduled for delivery in 2026. The contract price for each vessel is US$56.4 million, with an estimated delivered cost of approximately US$60.5 million per vessel, including zero-emission readiness and shipyard supervision costs. These combination carriers can transport both wet and dry cargo, offering increased operational efficiency compared to single-purpose vessels. The new vessels will feature fuel-efficient solutions such as wind-assisted propulsion, reducing overall carbon dioxide (CO2) emissions by approximately 35%. This contract marks a repeat order from Klaveness Combination Carriers, highlighting the trust placed in YZJ’s delivery capabilities.

- YTD orderbook hits the full-year target. As of 26 June, YZJ Shipbuilding has secured orders for a total of 37 vessels. YTD, the company has obtained orders for 69 vessels, amounting to a value of US$5.6 billion, surpassing its target of US$3 billion for 2023. This has resulted in the highest-ever outstanding orderbook value for Yangzijiang, standing at US$14.6 billion for 180 vessels, as reported in an SGX filing. Among the newly ordered vessels, 16 are containerships, 11 are oil tankers, and 10 are bulk carriers.

- FY22 results review. Revenue for FY22 increased 24% YoY to RMB20.7bn. Net profit (ex-investment) grew 33% YoY to RMB2.6bn.

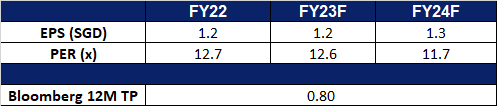

- Market consensus.

Share price and RMB price trend comparison

(Source: Bloomberg)

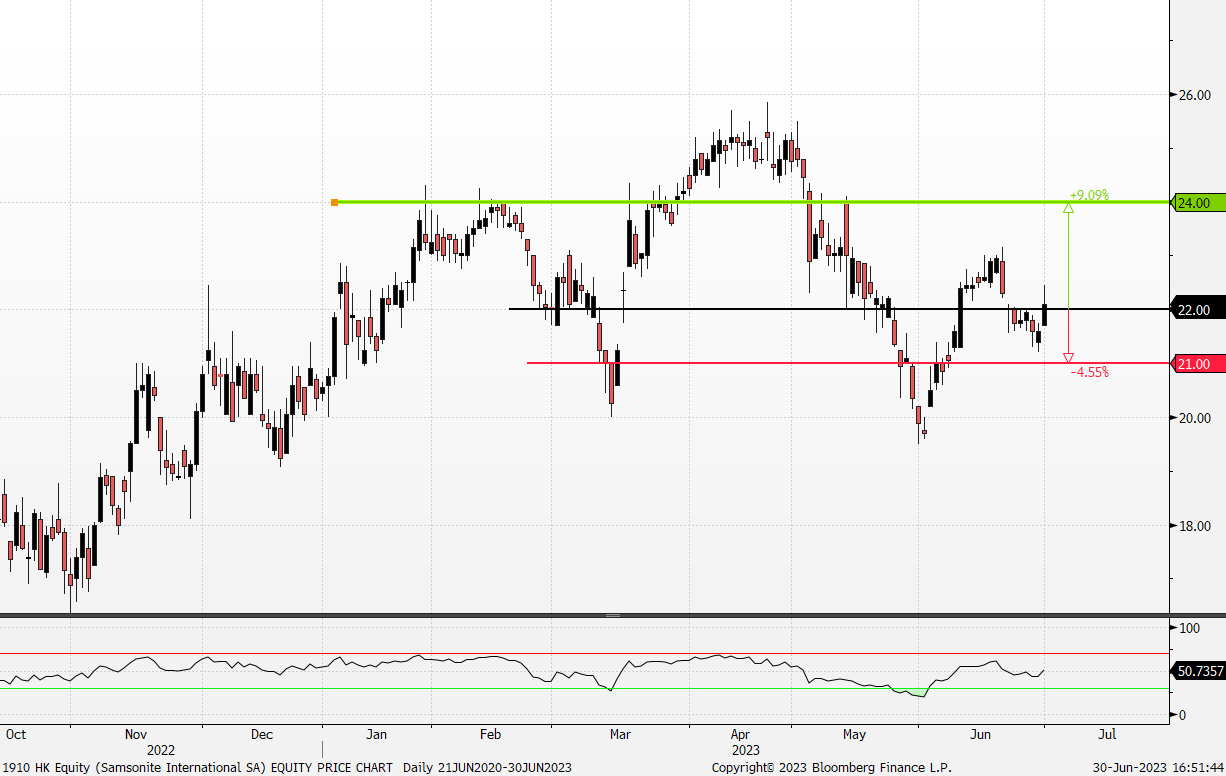

Samsonite International S.A. (1910 HK): Escaping the Holiday Heat

- BUY Entry – 22.0 Target – 24.0 Stop Loss – 21.0

- Samsonite International S.A. is a Hong Kong-based company principally engaged in the design, manufacture, sourcing and distribution of luggages, business and computer bags, outdoor and casual bags, travel accessories and slim protective cases for personal electronic devices. The Company operates its business through three segments. The Travel Bag segment is engaged in travel products with suitcases and carry-ons of three main categories, including hard-side, soft-side and hybrid luggages. The Casual Bags segment is engaged in daily use, including different types of backpacks, female and male shoulder bags and wheeled duffel bags. The Business Bags segment is engaged in business use, including rolling mobile office bags, briefcases and computer bags.

- Incoming summer holidays. According to the National Immigration Administration, China’s recent Dragon Boat Festival holiday, which ended last Saturday, demonstrated a noticeable resurgence in outbound travel. This was evidenced by the increasing number of border crossings, reaching 65% of the level seen in 2019. As the summer holidays approach, visa applications have been piling up due to the peak in Chinese travellers heading overseas. Airbnb’s summer travel report reveals a significant surge in interest among Chinese users for outbound travel during the early summer period (July 1-15). The search interest for outbound travel from Chinese users has also experienced a nearly six-fold increase, surpassing the growth observed this spring.

- Escaping the hot weather. China’s National Meteorological Center issued a renewed yellow alert for high temperatures last Friday, as heatwaves are anticipated to impact large areas of the country. The forecast predicts that temperatures in certain regions of Beijing, Tianjin, Hebei, and Henan will surpass 40 degrees Celsius. This heightened heatwave condition has led to an increased demand for tourism, as consumers seek a brief respite from the scorching weather during the upcoming holiday period.

- Campaign with New Balance. Samsonite introduced an all-new “Live United” campaign with New Balance in April 2023. This campaign seeks to address the travel and lifestyle needs of today’s consumers. This collection features four bags that come in different sizes, in 2 colours, catering to the needs of different travel purposes.

- 1Q23 results. Net sales improved to US$852.1mn (+48.5% YoY), compared to US$57.3mn in 1Q22. Net profit rose to US$73.8mn in 1Q23 (+348.4% YoY), compared t US$16.4mn for 1Q22. Basic and diluted EPS is at US 5.1 cents.

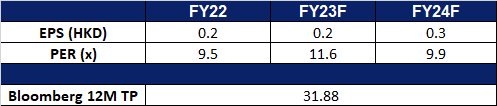

- Market Consensus.

(Source: Bloomberg)

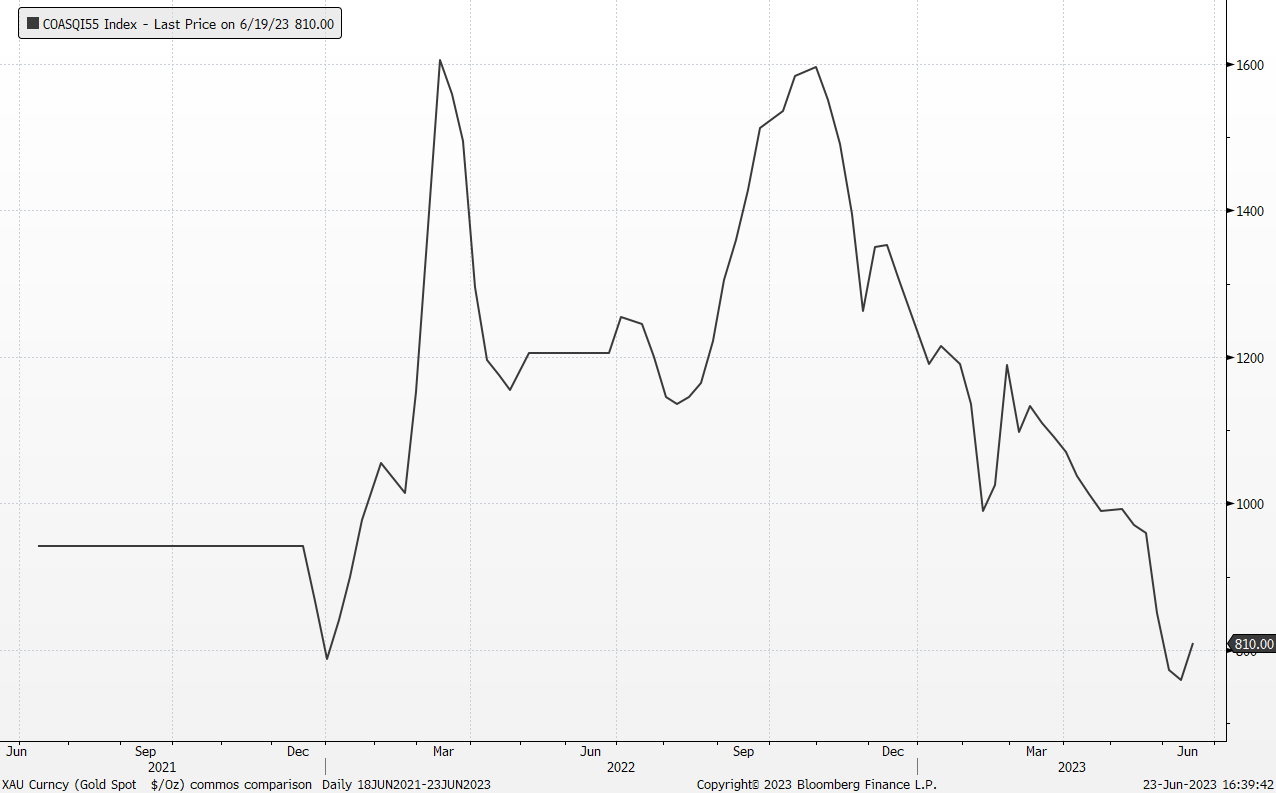

Yankuang Energy Group Co. Ltd. (1171 HK): Peak seasonal demand for coal

Yankuang Energy Group Co. Ltd. (1171 HK): Peak seasonal demand for coal

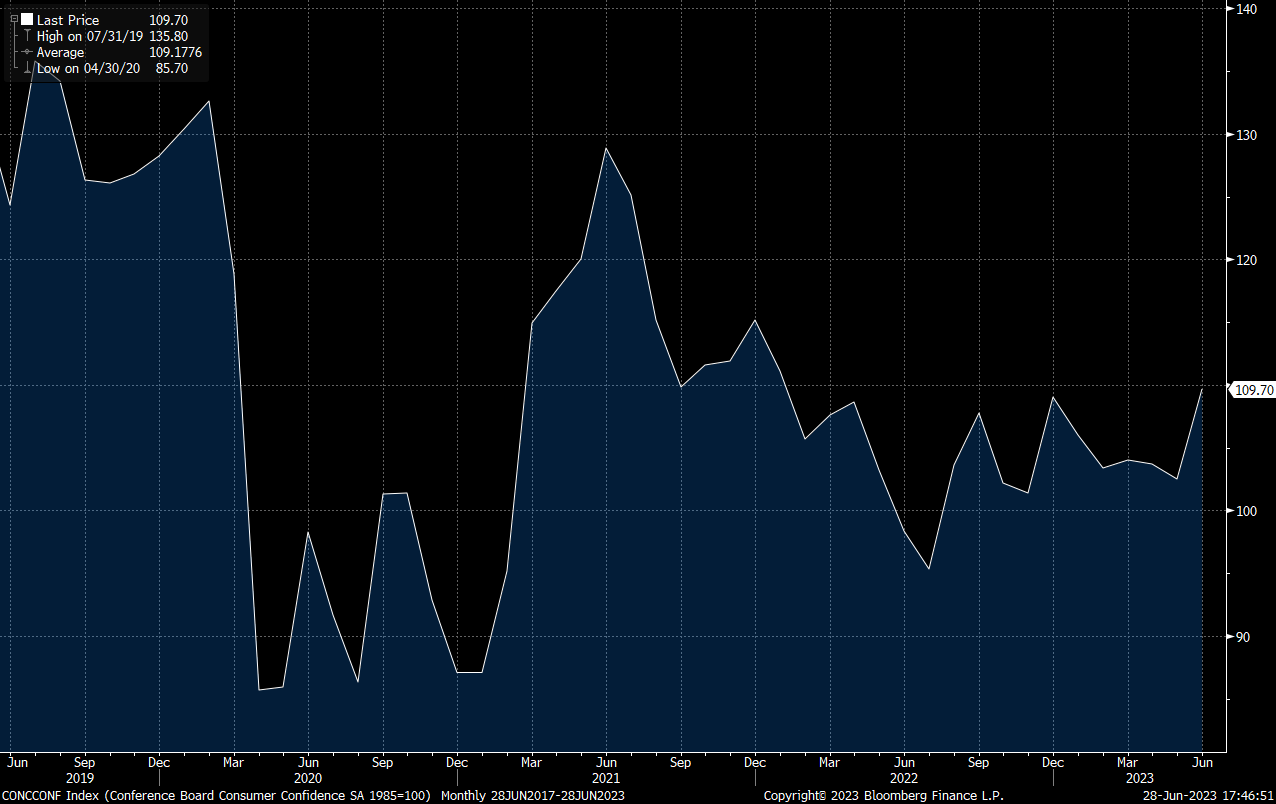

- RE-ITERATE BUY Entry – 21.50 Target – 24.00 Stop Loss – 20.25

- Yankuang Energy Group Co Ltd is a China-based international comprehensive energy company engaged in coal and coal chemical industry. The Company operates in five segments. The Coal Mining segment is engaged in underground and open-cut mining, preparation and sale of coal and potash mineral exploration. The Smart Logistics segment provides railway transportation services. The Electricity and Heating Supply segment provides electricity and related heat supply services. The Equipment Manufacturing segment is engaged in the manufacture of comprehensive coal mining and excavating equipment. The Chemical Products segment is engaged in the production and sale of chemical products. The coal products mainly include thermal coal, pulverized coal injection (PCI), and coking coal. The coal chemical products mainly include methanol, ethylene glycol, acetic acid, ethyl acetate and crude liquid wax, among others. The Company distributes products in the domestic market and to overseas markets..

- Scorching weather drives demand for coal. Recently, the China Meteorological Administration took action in response to the prediction of scorching heat and heavy rains expected to affect large areas of the country in the upcoming days. Beijing, the capital, elevated its hot weather warning to the highest level, designated as red, marking the first instance of such an alert being issued since the adoption of the new classification system in June 2015. This is expected to drive up the demand for coal as electricity consumption surge as consumers seek refuge away from the hot weather in China.

Thermal Coal Price

(Source: Bloomberg)

- Upcoming AGM. Yankuang Energy Group will be hosting its AGM on 30th June 2023, where its shareholders will be voting on the acquisition of 51% equity of Luxi Mining and 51% equity of Xinjiang Neng Hua.The company mentioned that the intended acquisition of high-quality assets and the control of mature mines in production is to realize the inflow of income into the consolidated financial statements.The successful acquisition of these assets would boost Yankuang Energy Group’s production capabilities, with Luxi Mining and Xinjiang Nenghua achieving a total coal output of 31.81mn tons in 2022, and is expected to reach a production capacity of 39.89mn tons in 2025.

- 1Q23 earnings. Operating Income rose to RMB44.4bn, a 7.82% increase YoY, compared to RMB41.2bn in 1Q22. Net Income fell to RMB5.6bn in 1Q23 compared to RMB6.7bn in 1Q22. Reported EPS of RMB1.16 fell YoY.

- High dividend yields. FY23F/24F dividend yield is 15.5%/14.5% respectively.

- Market Consensus.

(Source: Bloomberg)

Ross Stores Inc (ROST US): Strong performance shown

- BUY Entry – 110 Target – 122 Stop Loss – 105

- Ross Stores, Inc. operates two brands of off-price retail apparel and home accessories stores. Ross Stores offers name brand and designer apparel, accessories, footwear, and home fashions at discount prices. Ross Stores serves customers in the United States.

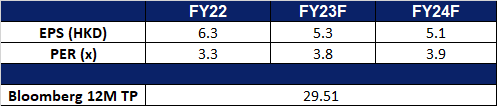

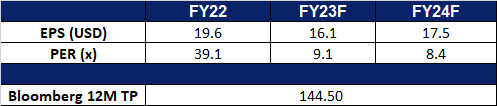

- Strong momentum. Despite concerns over inflationary pressures in the near term, Ross Stores is expected to sustain its momentum due to its strong value offerings, ongoing store-expansion efforts, and reduced freight expenses. The company has effectively tapped into the market of budget-conscious consumers seeking affordable pricing amidst challenging economic conditions. Ross Stores’ sales have risen as customers actively seek attractive bargains, while lower freight costs have positively impacted its merchandise margin. The trade-down effect, where higher-income shoppers shift to off-price retailers during uncertain times, further benefits Ross Stores. With its advantageous inventory acquisition dynamics and robust demand for bargains, the company remains well-positioned to cater to cautious consumer sentiment and continues to thrive in the current retail landscape.

- Stronger consumer sentiment. Strong consumer demand drives increased spending on discretionary items at Ross Stores, resulting in higher sales and revenue for the company. Additionally, the positive consumer sentiment leads to higher foot traffic in retail stores, including Ross Stores, as customers actively seek affordable prices and bargains. This surge in foot traffic creates more sales opportunities, while satisfied and confident customers foster customer loyalty and repeat business. Overall, the positive influence of stronger consumer sentiment is expected to drive higher revenue for the company.

US consumer sentiment vs ROST stock price comparison

(Source: Bloomberg)

- 1Q23 earnings review. Revenue rose 3.7% YoY to US$4.49bn, beating estimates by US$10mn. GAAP earning per share was US$1.09, $0.02 above expectations.

- Market consensus.

(Source: Bloomberg)

Whirlpool Corp (WHR US): Home appliance sales recover

Whirlpool Corp (WHR US): Home appliance sales recover

- RE-ITERATE BUY Entry – 146.0 Target – 160.0 Stop Loss – 139

- Whirlpool Corporation manufactures and markets major home appliances. The Company provides principal products include laundry appliances, refrigeration, room air conditioning equipment, cooking appliances, dishwashers, and mixers and other small household appliances. Whirlpool serves customers worldwide.

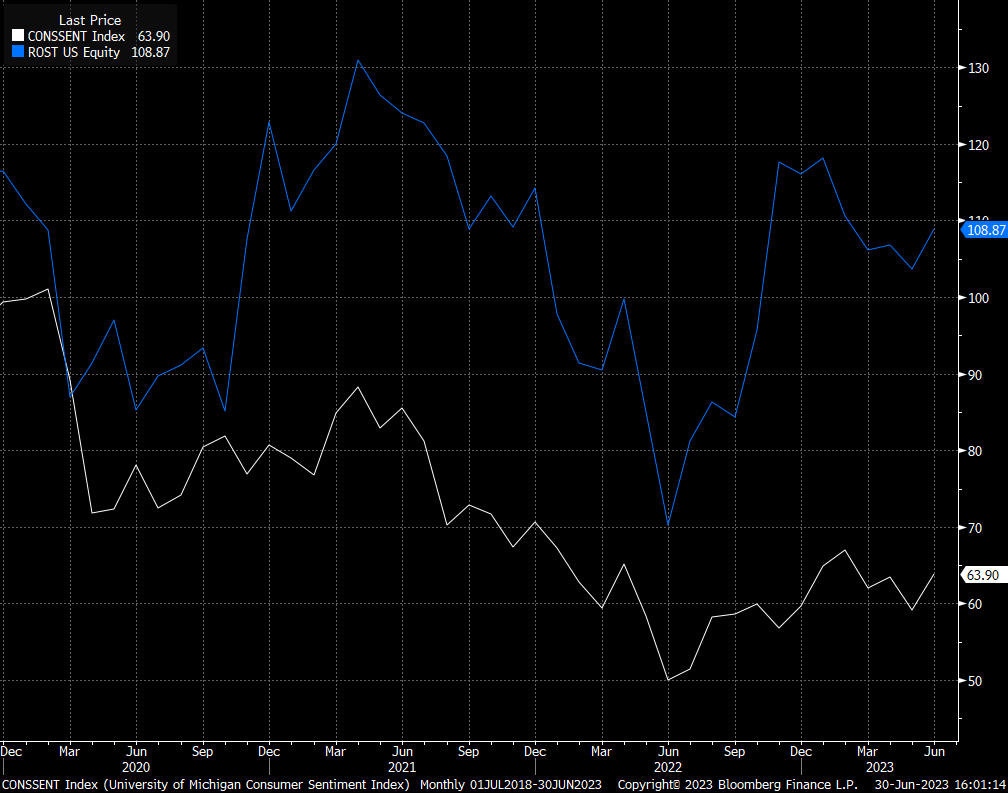

- US home sales jump as prices fall. Sales of new single-family homes in the US reached their highest level in almost 1-1/2 years in May due to a shortage of previously owned homes. The Commerce Department reported a 12.2% surge to a rate of 763,000 units, the highest since February 2022. Real construction spending on new manufacturing facilities has also doubled this year, driven by infrastructure and clean energy subsidies. Although mortgage rates rose, new home sales increased in the Northeast, South, and West. The median new house price dropped 7.6% from last year, and the supply of homes on the market slightly decreased. It is likely that signs of revival in the housing market will contribute to an increase in the purchase of household appliances. As the housing market improves and new homes are being sold at a higher rate, new homeowners typically need to furnish their homes with essential appliances such as refrigerators, stoves, washers, dryers, and more.

- Rise in consumer confidence. Consumer confidence in the United States soared to its highest level in nearly 1-1/2 years in June, surpassing expectations and marking the strongest reading since January 2022. The increase was especially prominent among consumers under 35 and those with incomes over $35,000. Strong economic indicators, such as increased consumer confidence, unexpected growth in new home sales, and robust demand for big-ticket manufactured items, reassured investors about the overall economic outlook. The positive trend in the housing market, coupled with increased consumer confidence, may encourage existing homeowners to invest in new appliances, bolstering sales of the appliance industry.

US Conference Board’s Consumer Confidence Index

(Source: Bloomberg)

- 1Q23 earnings review. Revenue fell 6.8% YoY to US$4.65bn, beating estimates by US$150mn. Non-GAAP earning per share was US$2.66, $0.49 above expectations. The company’s strong performance was bolstered by robust demand for its refrigerators and washing machines in North America, which is its largest market. It is anticipating FY23 sales to reach approximately US$19.4B.

- Market consensus.

(Source: Bloomberg)

United States

Hong Kong

Trading Dashboard Update: Add Comfort Delgro (CD SP) at S$1.15.