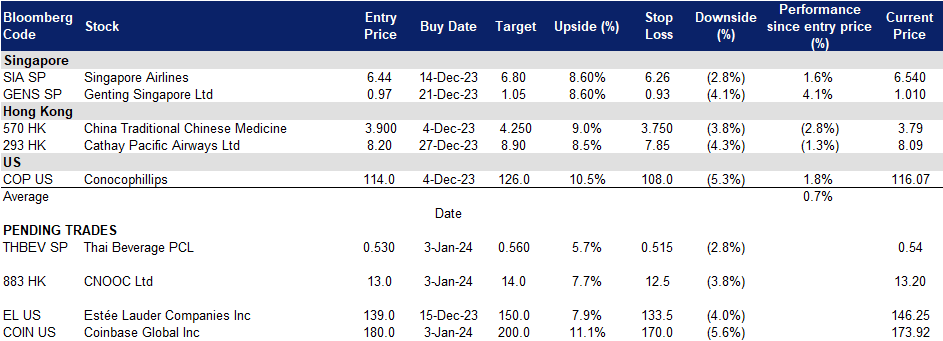

3 January 2024: Thai Beverage PCL (THBEV SP), CNOOC Ltd. (883 HK), Coinbase Global Inc (COIN US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

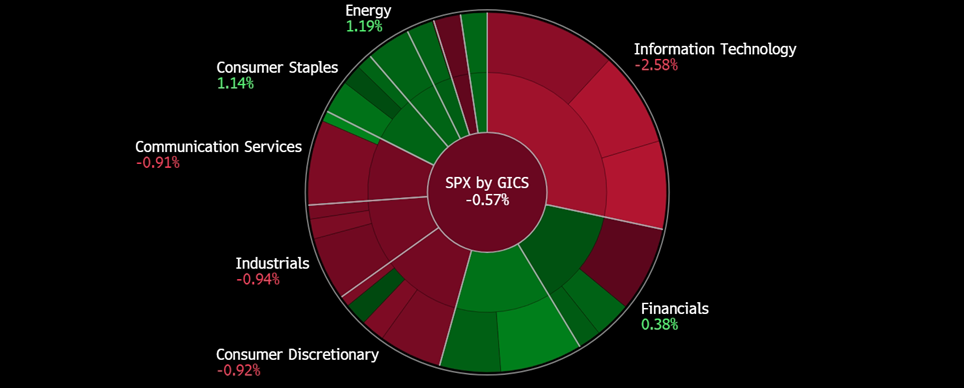

United States

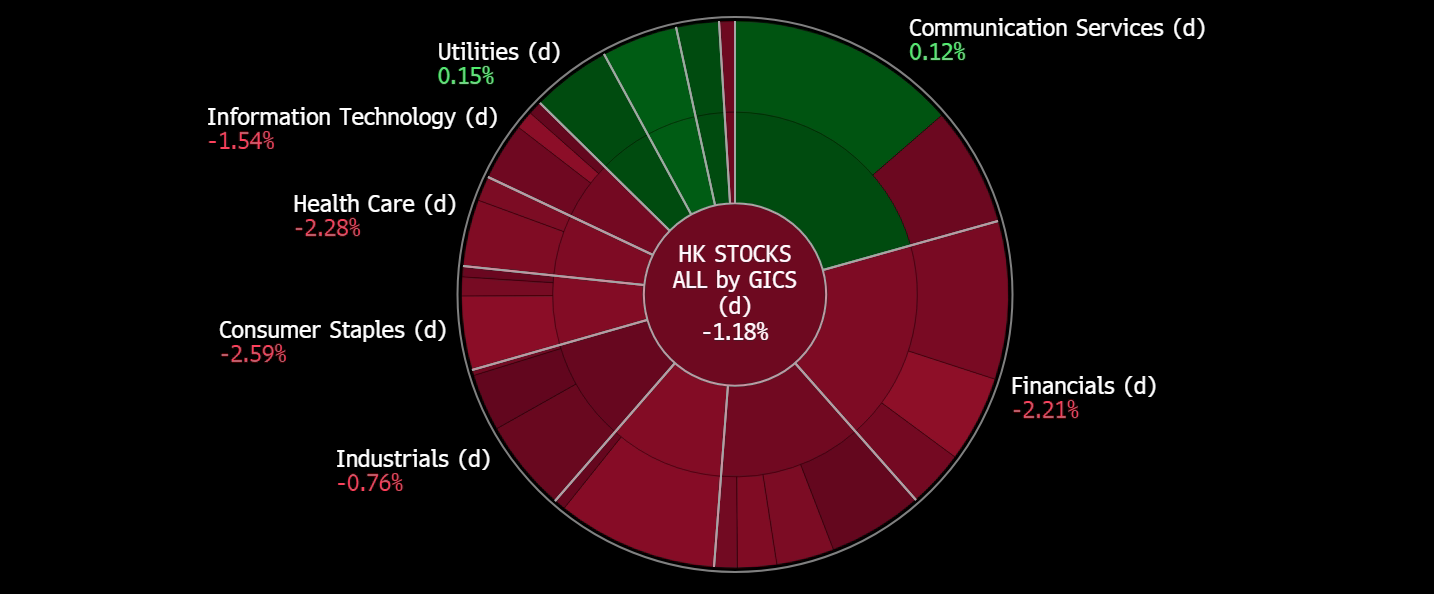

Hong Kong

Thai Beverage PCL (THBEV SP): Visa requirements waived

- Entry 0.530 – Target – 0.560 Stop Loss – 0.515

- Thai Beverage Public Company Limited is Thailand’s largest and leading beverage producer and distributor. Its operation is considered among the leading distillers and brewers and in Southeast Asia. ThaiBev’s leading products include a variety of well-established spirits brands, including its famous brew Chang Beer. In the non-alcoholic beverage category, key products include water, tonic soda, energy drink, ready-to-drink coffee and green tea.

- Permanent visa-free between China and Thailand. Thailand and China will waive visa requirement starting in March 2024. In 2023, there were 28mn tourist arrivals in Thailand, and 3.5mn of which were from China. However, the numbers were still below pre-COVID levels: 11mn Chinese tourists out of total 39mn arrivals. The revenue from tourism was THB1.2tn (US$35bn) in 2023. There is room for further recovery in its tourism in FY24.

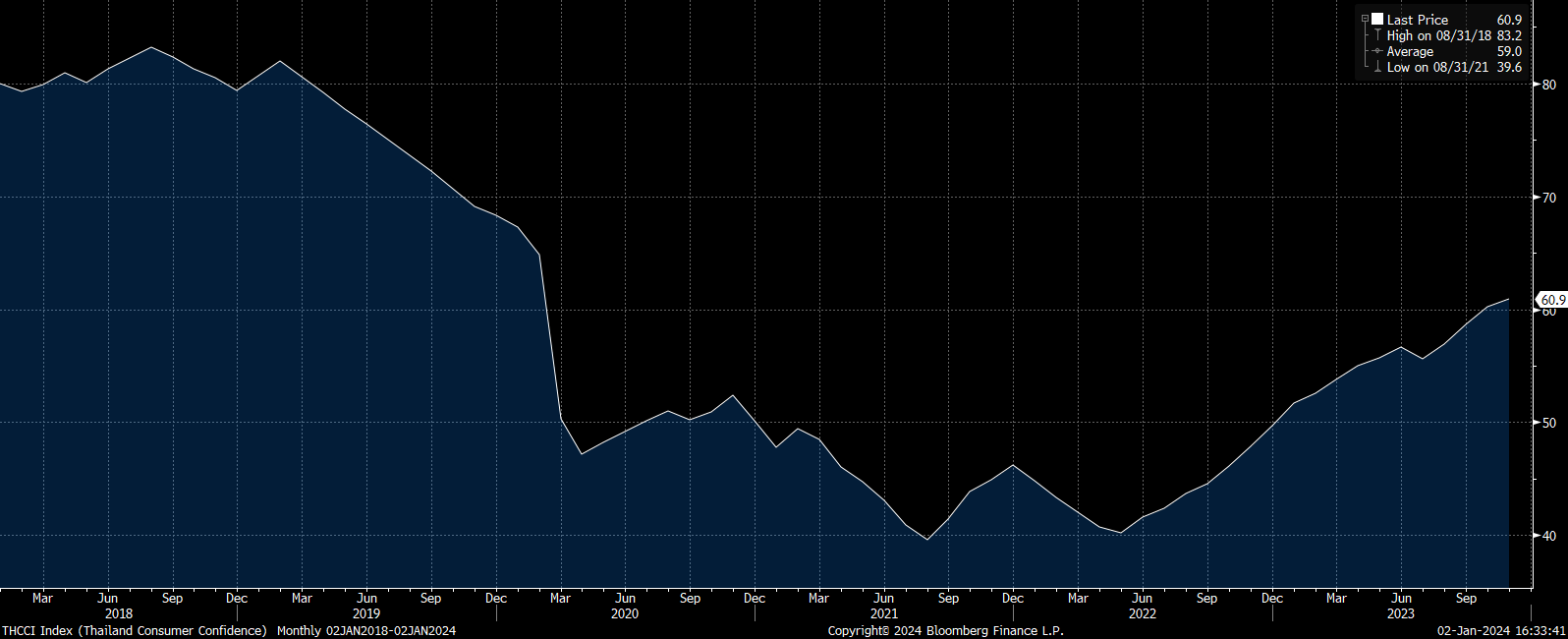

- Consumer confidence rebounding. The Thai consumer confidence index is expected to continue to improve alongside its economy, supported by government measures as well as the relaxation of tourism visa regulations. The index has been on a relatively consistent uptrend since May 2022 and currently sits at 60.9 in November.

Thailand Consumer Confidence Index

(Source: Bloomberg)

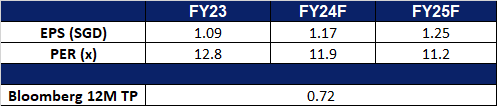

- FY23 earnings. The company revenue rose to 279.1bn baht, a 3% YoY increase compared to 272.4bn baht in FY22. The company’s net profit for the period was 27.4bn, a 9% YoY decline from its previous net profit in FY22 of 30.1bn baht. Net profit for its spirits segment rose 3% to 22.1bn baht whereas, its beer segment’s net profit fell 38% to 2.4bn baht. Basic earnings per share were 1.09 baht compared to the previous 1.2 baht in FY22. It will also pay out a final dividend of 0.45 baht per share on 28 February 2024.

- Market Consensus.

(Source: Bloomberg)

Genting Singapore Ltd (GENS SP): China-Singapore mutual visa-free in 2024

Genting Singapore Ltd (GENS SP): China-Singapore mutual visa-free in 2024

- RE-ITERATE BUY Entry 0.97 – Target – 1.05 Stop Loss – 0.93

- Genting Singapore Limited, through its subsidiaries, develops resort properties as well as operates casinos. The Company has casinos and integrated resorts in different parts of the world, including Australia, the Americas, Malaysia, the Philippines and the United Kingdom.

- 30-day mutual visa-free between Singapore and China. During the 19th Joint Council for Bilateral Cooperation, Singapore and China achieve a 30-day mutual visa-free arrangement. The implementation is expected to be in early 2024. Accordingly, Chinese visitor arrivals are estimated to further increase. Hence, Singapore Resorts World Sentosa shall see improvements in its revenue streams in 2024.

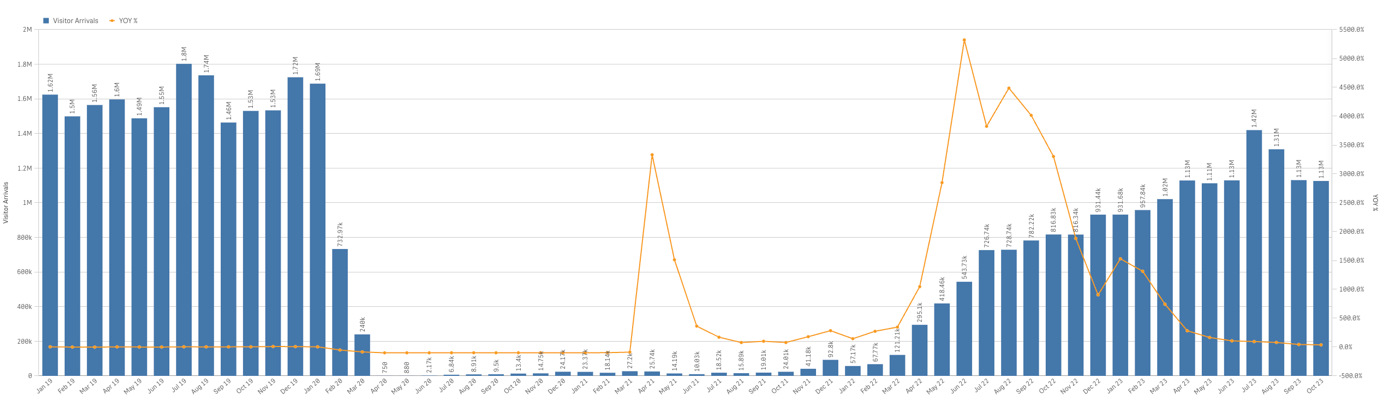

- Still has room for visitor arrivals to recover. Visitor arrivals to Singapore further improved in 2023. However, recent figures show that the number of visitors travelling to Singapore has flattened. Compared to the pre-CVOID level, tourism has not fully recovered. There is room for recovery as the average number of arrivals was above 1.5mn per month while the YTD number is around 1.1mn per month.

Singapore monthly visitor arrivals trend (2019-2023)

(Source: Singapore Tourism Analytics Network)

- Correlation between tourists and revenue. Genting Singapore reported a significant increase in net profit and revenue for 1H23. The company attributed this improved performance to an increase in foreign visitor arrivals to Singapore, despite challenges such as limited air capacity from certain regional countries and higher airfares affecting leisure travel. Resorts World Sentosa (RWS) saw a 37% growth in adjusted earnings in 2Q23, mainly due to a rebound in the non-gaming business, a strong VIP win rate, and a recovery in regional gaming activities. Gross gaming revenue also rose 3% on a hold-normalised basis, reaching $547.9mn. We anticipate continued growth in Genting’s revenue from the increase in visitor arrivals in 2H23 alongside its strong VIP gaming segment and keys added to its newly refurbished Ora Hotel.

- Project timeline. Genting Singapore previously mentioned that it aims to begin construction in FY24 after government approvals on the new Waterfront building, the Equarius Hotel extension and the Health and Wellness Centre.

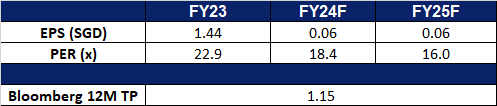

- 1H23 earnings. The company revenue rose to S$1,080.4mn, +63% YoY compared to 1H22. The company’s net profit for the period was S$276.7mn, more than 3 times the net profit in 1H22 of S$84.4mn. Basic earnings per share were S$2.29 cents compared to the previous S$0.70 cents in 1H22. It also paid out an interim dividend of S$1.5cents on 22 September 2023.

- Market Consensus.

CNOOC Ltd. (883 HK): Focusing on Supply Chain

- BUY Entry – 13.0 Target – 14.0 Stop Loss – 12.5

- CNOOC Ltd is a China-based investment holding company principally engaged in the exploration, production and sales of crude oil and natural gas. The Company operates three segments. Exploration and Production segment is engaged in conventional oil and gas business, shale oil and gas business, oil sands business and other unconventional oil and gas businesses. Trading segment is engaged in entrepot trade of crude oil in overseas areas. Corporate segment is engaged in headquarter management, assets management, research & development, and other businesses. The Company mainly operates businesses in China, Canada, the United Kingdom, Nigeria, and Brazil, among others.

- Commencement of production. CNOOC recently announced that its Mero2 Project has begun production. The project consists of 16 development wells which are planned to be commissioned, including 8 production wells and 8 injectors. The Floating Production Storage and Offloading (FPSO) used in the project also has a designed storage capacity of approximately 1.4million barrels, one of the largest FPSO in the world. This project is expected to bring an additional 180,000 barrels of crude oil per day for the company.

- Approval of license for LPG Facility. Uganda’s cabinet recently approved CNOOC to proceed with the construction of a Liquified Petroleum Gas (LPG) facility in the Kingfisher development area in Uganda. The facility will produce clean and affordable energy for the local market in the East African country, facilities the country’s transition to green energy.

- Construction of underground oil reserve. CNOOC recently started construction in Ningbo, China, on its largest commercial underground oil reserve project. The oil reserve is designed with a capacity of 3 million cubic meters, encompassing crude oil caverns, along with surface crude oil storage, transportation, and other supporting facilities. The project would be receiving a total investment of around 3 bn yuan and is scheduled to be completed by 2026. Upon completion, the oil reserve would provide a steady supply of crude oil to surrounding cities and provinces.

- 3Q23 earnings. Revenue rose by 5.48% YoY to RMB114.8bn in 3Q2023, compared to RMB108.8bn in 3Q22. Net profit fell 8.23% YoY to RMB33.4bn, compared to RMB36.4bn in 3Q22. Basic EPS fell by 7.78% YoY to RMB0.71, compared to RMB0.77 in 3Q22.

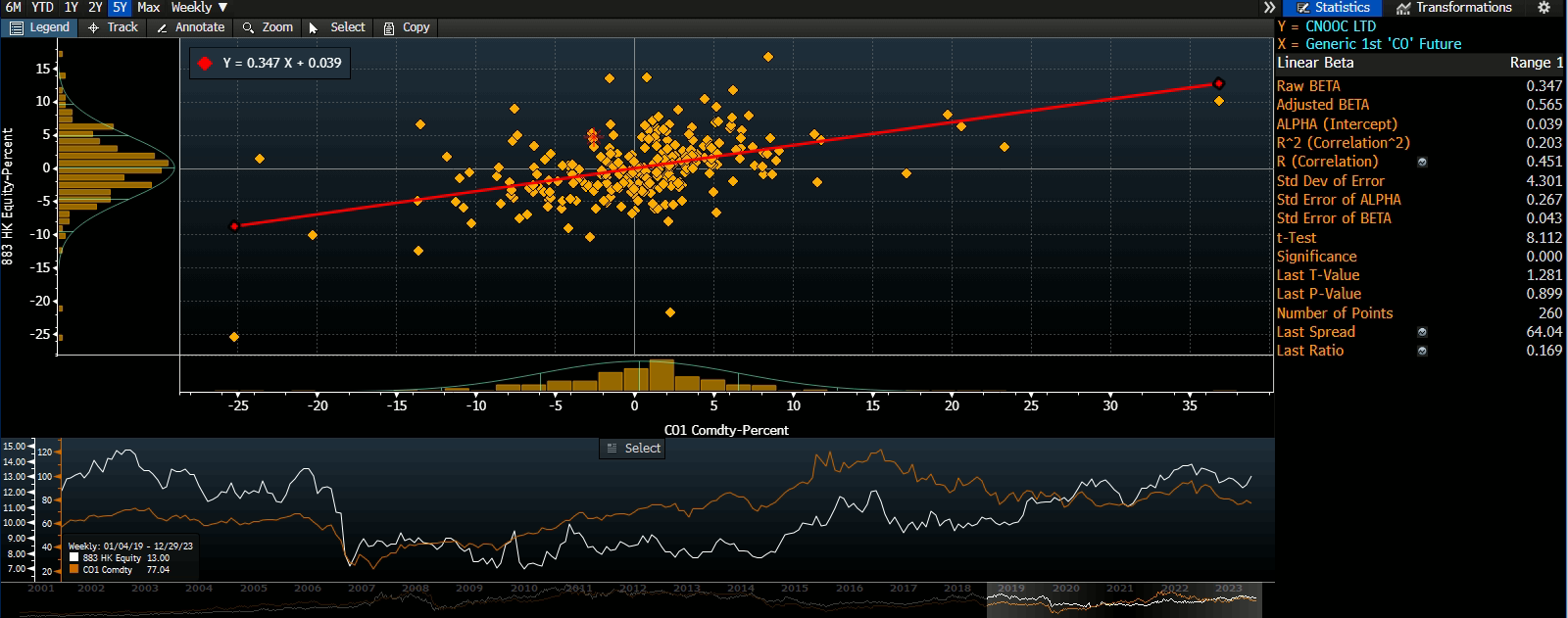

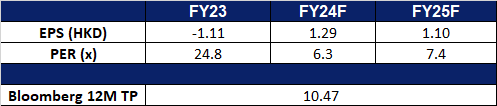

- Market consensus.

Share price and Brent crude oil price correlation

(Source: Bloomberg)

(Source: Bloomberg)

Cathay Pacific Airways Ltd. (293 HK): Capturing year-end demand

- RE-ITERATE BUY Entry – 8.20 Target – 8.90 Stop Loss – 7.85

- Cathay Pacific Airways Ltd is a company mainly engaged in the provision of international passenger and cargo air transportation. Together with its subsidiaries, the Company operates business through its four operating segments. The Cathay Pacific and Cathay Dragon segment provides full service international passenger and cargo air transportation under the Cathay Pacific and Cathay Dragon brands. The Air Hong Kong segment provides express cargo air transportation offering scheduled services within Asia. The HK Express segment provides a low-cost passenger air transportation offering scheduled services within Asia. The Airline Services segment provides supporting airline operations services include catering, cargo terminal operations, ground handling services, and commercial laundry operations.

- Partnership with Shinsegae. Cathay Pacific recently announced that from 2024 onwards, Cathay Pacific Airways users will be able to use their mileage points to shop at Shinsegae duty-free shops in South Korea. Shinsegae Duty-Free, one of Korea’s top three duty-free brands, plans to collaborate with the airline via a membership mileage partnership, to attract individual tourists to duty-free shops amid a shift from Chinese group tourists to diverse individual tourists, including those from Europe and Southeast Asia. This partnership is likely to increase customer loyalty for Cathay Pacific, as well as the number of customers for both companies.

- Expectations of a strong year-end travel demand. Cathay Pacific recently released its traffic figures for October 2023, carrying a total of 1,684,700 passengers in Oct 2023 (+320.2% YoY). The company expects year-end travelling demand to remain strong, and the company is on track to achieve its 2023 rebuild target. The company expects to operate 70% of our pre-pandemic passenger flights covering about 80 destinations, and projects that they will be back to 95% of pre-pandemic passenger numbers by the end of 2023. This highlights the strength in travel demand during the year-end holiday season.

- Increasing number of flights to capture travel demand. Cathay Pacific has gradually increased the number of flights across several destinations to capture the higher demand for travelling as the year-end holiday season arrives. Just over the last month, the airline carrier added more flights to cities like Brisbane, Sydney, as well as to Chinese Mainland.

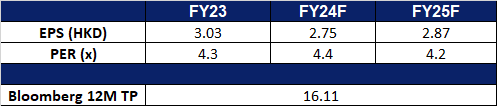

- 1H23 earnings. Revenue rose 135.0% YoY to HK$43.6bn in 1H23, compared with with HK$18.6bn in 1H22. Net profit was HK$4.3bn in 1H23, compared to net loss of HK$5.0bn in 1H22. Basic earnings per share was 61.5 HK cents in 1H23, compared to -82.3 HK cents in 1H22.

- Market consensus.

(Source: Bloomberg)

Coinbase Global Inc (COIN US): Spot Bitcoin ETF’s approval soon

- BUY Entry – 159 Target – 175 Stop Loss – 151

- Coinbase Global, Inc. provides financial solutions. The Company offers platform to buy and sell cryptocurrencies. Coinbase Global serves clients worldwide.

- Bitcoin price surge. Bitcoin has been on an uptrend since mid-October 2023 and recently surpassed US$45,000, reaching a 21-month peak, driven by optimism surrounding the potential approval of exchange-traded fund (ETF) spot bitcoin funds. It gained 154% in FY23, marking its strongest performance since FY20. Investors are focused on the US Securities and Exchange Commission’s (SEC) approval of the spot bitcoin ETFs, with expectations for SEC’s decision on the ETF approval to be released between 5 and 10 January. Despite being below its record high of US$69,000 in November 2021, the recent positive sentiment is further supported by the anticipation of regulatory developments and expectations of interest rate cuts by major central banks.

- ETF filing updates. BlackRock and Valkyrie, applicants for a spot bitcoin ETF, have disclosed their authorised participants (AP). BlackRock has partnered with J.P. Morgan and Jane Street, while Valkyrie has named Jane Street and Cantor Fitzgerald as its AP. The filings were made on the last day for updates to the SEC.

- Bitcoin halving. Bitcoin prices have recently witnessed a surge to above $45,000, after being range bound between around $41,000 to $44,000 in December 2023, marking its highest value since April 2022. The periodic Bitcoin halving which leads to a slow-down in mining output is expected to be in April 2024. In other words, the supply of Bitcoin after the halving date will be less. Based on the previous two halvings, Bitcoin experienced bull cycles for 18 months (Previous two halving dates: 9 July 2016 and 11 May 2020). Notably, the upward momentum historically initiates 6 months before the halving date, suggesting that the current Bitcoin upcycle has commenced.

Bitcoin Halving

(Source: Bloomberg)

- Rate cuts expected. Investors are anticipating potential interest rate cuts in 2024 from the Federal Reserve. The Fed’s dovish tone in December 2023, forecasting 75 basis points in rate reductions for 2024, has led to an 86% chance of rate cuts in March, according to CME FedWatch.

- 3Q23 results. Revenue rose to US$674.15mn, up 14.2% YoY, beating expectations by US$20.6mn. GAAP EPS beat estimates by US$0.52 at -US$0.01.

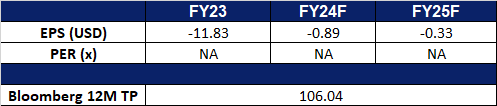

- Market consensus.

(Source: Bloomberg)

Estée Lauder Companies Inc (EL US): Bottoming out

- RE-ITERATE BUY Entry – 139.0 Target – 150.0 Stop Loss – 133.5

- The Estee Lauder Companies Inc. manufactures and markets a wide range of skin care, makeup, fragrance, and hair care products. The Company’s products are sold in countries and territories around the world.

- US retail sales increase. US retail sales rose by 0.3% MoM in November a turnaround compared to the 0.1% MoM decline seen in October. The incline can be attributed to increased consumer demand witnessed over the Black Friday, Cyber Monday weekend sales which took place in November. Furthermore, the Federal Reserve held its key interest rates steady for the third consecutive time and will be set to cut rates multiple times in the coming year. With inflation easing and future interest rate cuts, consumers will regain their confidence to spend.

- Exploring different marketing channels. Estée Lauder Companies decided to focus on its brands, Estée Lauder and The Ordinary to branch out into TikTok Shop, leveraging each brand’s distinct market position. The strategy involves livestreaming, short-form content, and affiliate links within user videos, aiming to enhance the consumer journey. While The Ordinary targets live streams as direct sales channels with viewer interaction, Estée Lauder adopts a more refined approach with professional hosts and a focus on engaging with comments. The affiliate program, involving over 200,000 sellers, enables content creators to earn commissions, emphasising TikTok Shop’s creator-led approach compared to Instagram Shop. This strategic market entry was in response to a challenging sales quarter, highlighting the company’s commitment to enhancing marketing strategies and exploring innovative approaches to tackle its decline in sales volume from the Asia travel retail and mainland China geographical segments.

- Hopping on new platforms. Kult App, a premium beauty mobile-commerce platform, has collaborated with Estée Lauder Companies to introduce six iconic brands, including Bobbi Brown, Too Faced, Smashbox, Clinique, Estée Lauder, and MAC to its platform. This partnership aims to cater to a broader audience, offering an exceptional selection of makeup and skincare products. These brands are now available for purchase on the Kult App, providing users with a personalised shopping experience through a Skin Analysis Test.

- 1Q24 results. Revenue fell 10.6% YoY, to US$3.52bn. Non-GAAP EPS beat estimates by US$0.31 at US$0.11. The company lowered its outlook to reflect the slower pace of recovery in net sales and margin as growth in overall prestige beauty in Asia travel retail and in mainland China decline alongside incremental external headwinds. In 2H24, the company expects to return to net sales growth and have progressive operating margin improvements due to improvement in the Asia travel retail business and mainland China. FY24 gross margin expansion is anticipated which will be primarily driven by strategic price increases, discount reductions and lower obsolescence charges.

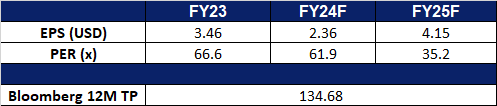

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Geo Energy Resources (GERL SP) at S$0.325, Lockheed Martin Corp (LMT US) at US$453.2, UMS Holding (UMSH SP) at S$1.33, China Oil Aviation (CAO SP) at S$0.87 and Centurion (CENT SP) at S$0.41. Add Genting Singapore Ltd (GENS SP) at S$0.97 and Cathay Pacific Airways Ltd (293 HK) at HK$8.2. Cut loss on Xiaomi Corp (1810 HK) at HK$14.5, Airbnb Inc (ABNB US) at US$139, Palantir Technologies Inc (PLTR US) at US$17.17 and Sasseur REIT (SASSR SP) at S$0.685.