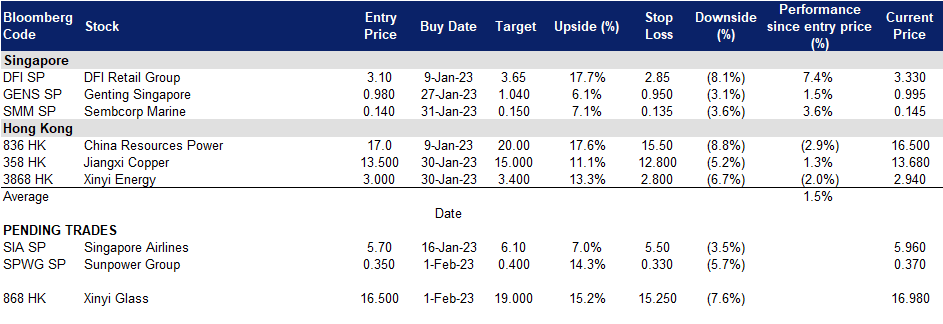

3 February 2023: Sunpower Group Ltd (SPWG SP), XINYI GLASS HOLDINGS LTD (868 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Sunpower Group Ltd (SPWG SP): Manufacturing is back to expansion territory

- RE-ITERATE Entry – 0.35 Target – 0.40 Stop Loss – 0.33

- Sunpower Group Limited is a one-stop solution provider for energy conservation, waste-to-energy and renewable energy projects which specializes in the design, R&D, and manufacture of energy conservation products in China. The Company’s main businesses include environmental equipment manufacturing, EPC integrated solutions projects, and green investments with BOT/TOT/BOO models.

- Positive signs of economic recovery in China . With China’s manufacturing PMI toppiung 50 1st time in 4 months in January, China is showing positive signs of recovery with its economic activity swinging back to growth. China’s NBS Manufacturing PMI rose to 50.1 versus 49.7 market forecasts and 47.0 prior. Sunpower Group, whose key market lies in China, would be able to ride on this recovery within China and is expected to see revenue growth.

- Increasing demand for renewables within China market. China is increasing its use of renewable energy while putting the brakes on fossil fuel capacity. Developers installed 86 gigawatts of solar power capacity last year, up 62% from 2021, data published by the National Energy Administration shows. China is also expected to achieve its 2030 target of installing renewable energy capacity ahead of schedule by about five years. Sunpower can ride on China’s shift towards a more green environment within the economy itself.

- 3Q22 operation updates. Total steam sales volume rose 15.6% YoY to 6.79 million tons in 9M22 despite the pandemic and worldwide challenges, due to strong demand for clean steam, a non-discretionary input product. YTD performance strongly differentiated Sunpower as a company that can grow despite temporary headwinds.

- Company Outlook. The company’s outlook is positive, as they are seeing a key re-opening play for the China market, with manufacturing PMI topping over 50, as well as China’s shift towards renewable energy sources instead of fossil fuels. This suggests that the company’s performance is likely to continue to improve in the near future.

- The company’s trailing 12M PER is 6.9x, compared to the 5-year average PER of 12.2x.

(Source: Bloomberg)

Sembcorp Marine Ltd (SMM SP): Further improved outlook

Sembcorp Marine Ltd (SMM SP): Further improved outlook

- RE-ITERATE Entry – 0.140 Target – 0.150 Stop Loss – 0.135

- Sembcorp Marine (SMM) provides engineering solutions to the global offshore, marine and energy industries. The Group focuses on four key capabilities, mainly, Rigs & Floaters; Repairs & Upgrades; Offshore Platforms and Specialised Shipbuilding. The group operates shipyards in Singapore, Indonesia, the UK and Brazil. Its key clients include major energy companies, drilling contractors, shipping companies and owners/operators of floating production units.

- Possible acquisition. Sembcorp Marine has issued an interim business update for the third quarter of 2022 and for the nine months ended September 30, 2022. The company announced that it has signed revised agreements to effect the proposed combination with Keppel Offshore & Marine (KOM) via a direct acquisition with simplified transaction structure and improved terms. Sembcorp Marine expects to hold an extraordinary general meeting in January 2023 with regard to the acquisition. Should the deal go through, Temasek will own around 35.5% of the new Sembcorp Marine entity, compared to 54.6% now.

- 3Q22 updates. From the start of FY2022, the Group had a total of 21 projects under execution with 12 projects scheduled for completion and delivery in FY2022. It reported that it has continued the smooth execution of projects with nine successful completions and deliveries to customers year-to-date. Despite these successes, the company expects losses in the second half of 2022 similar in range to the first half of 2022. In addition, the company reported that it has secured Year-to date new contracts in excess of S$6.71 billion, including S$0.42 billion of repairs & upgrades contracts, with the largest contract worth S$4.25 billion from Petrobras for the P-82 FPSO. Thus far, the group has a net order book of S$7.11 billion, with renewable wind energy and other cleaner and green solutions accounting for around 34% of it.

- Company Outlook. The company’s outlook is positive, as they are seeing an increase in orders due to a combination of factors such as high oil and gas prices, renewed focus on energy security due to geopolitical tensions, and a shift towards renewable energy sources. This suggests that the company’s performance is likely to continue to improve in the near future.

- Updated market consensus of the EPS in FY23/24 is -0.001/0.002 respectively, Bloomberg consensus average 12-month target price is S$0.140.

(Source: Bloomberg)

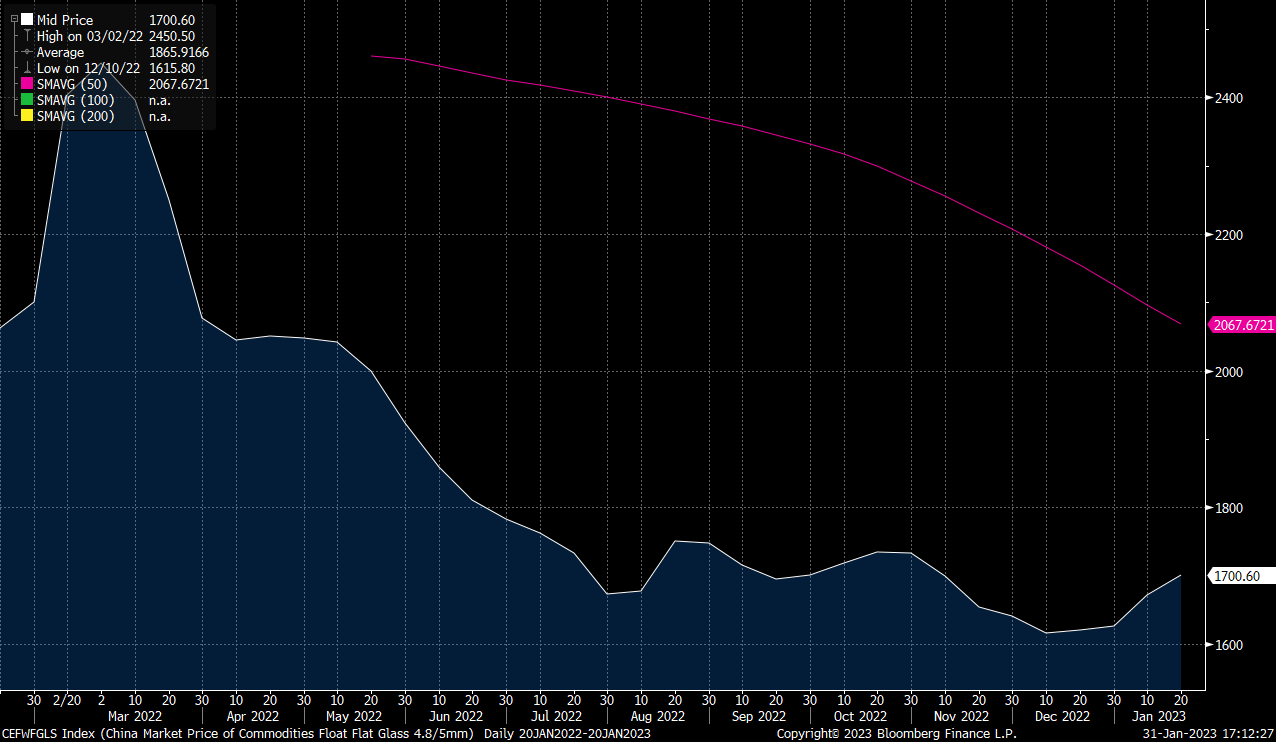

XINYI GLASS HOLDINGS LTD (868 HK): Float Glass prices bottoming out

- RE-ITERATE BUY Entry – 16.50 Target – 19.00 Stop Loss – 15.25

- Xinyi Glass Holdings Ltd is an investment holding company principally engaged in manufacture and sales of glass. The Company operates its business through three segments. The Float Glass segment is engaged in the manufacture and sales of clear glass, F-green glass and European gray glass. The Automobile Glass segment is engaged in the manufacture and sales of glass in automobiles. The Construction Glass segment is engaged in the manufacture and sales of construction glass, such as tempered glass and laminated glass, among others. The Company is also involved in the manufacture and sales of rubber and plastic products and the provision of logistics services.

- Increase in Float Glass prices. The company’s float glass segment makes up approximately 68% of its revenue, while the automobile and architectural segments making up 21% and 11% respectively. Currently, Xinyi Glass’ float glass production capacity accounts for 13% of the domestic market share, ranking first. With the gradual recovery of the Chinese economy in FY23, float glass prices expected to improve. Furthermore, driven by sufficient project reserves and the policy of guaranteed delivery of buildings domestically, the demand for float glass will gradually increase.

Float Glass price rebounding

(Source: Bloomberg)

(Source: Bloomberg)

- FY22 profit warning. FY22 profit attributable to shareholders of the company is expected to decrease 55% to 65% YoY from HK$11.56bn in 2021, to between HK$4.04bn and HK$5.2bn. The decline in annual net profit is mainly due to the decrease is its average selling price of float glass products due to lowered demand in the domestic construction market and the continuous increase in raw material and energy costs during the year.

- The updated market consensus of the EPS growth in FY23/24 is -12.3%/5.2% YoY respectively, which translates to 9.1x/8.7x forward PE. The current PER is 7.1x. FY23F/24F dividend yield is 4.8%/5.6% respectively. Bloomberg consensus average 12-month target price is HK$18.09.

(Source: Bloomberg)

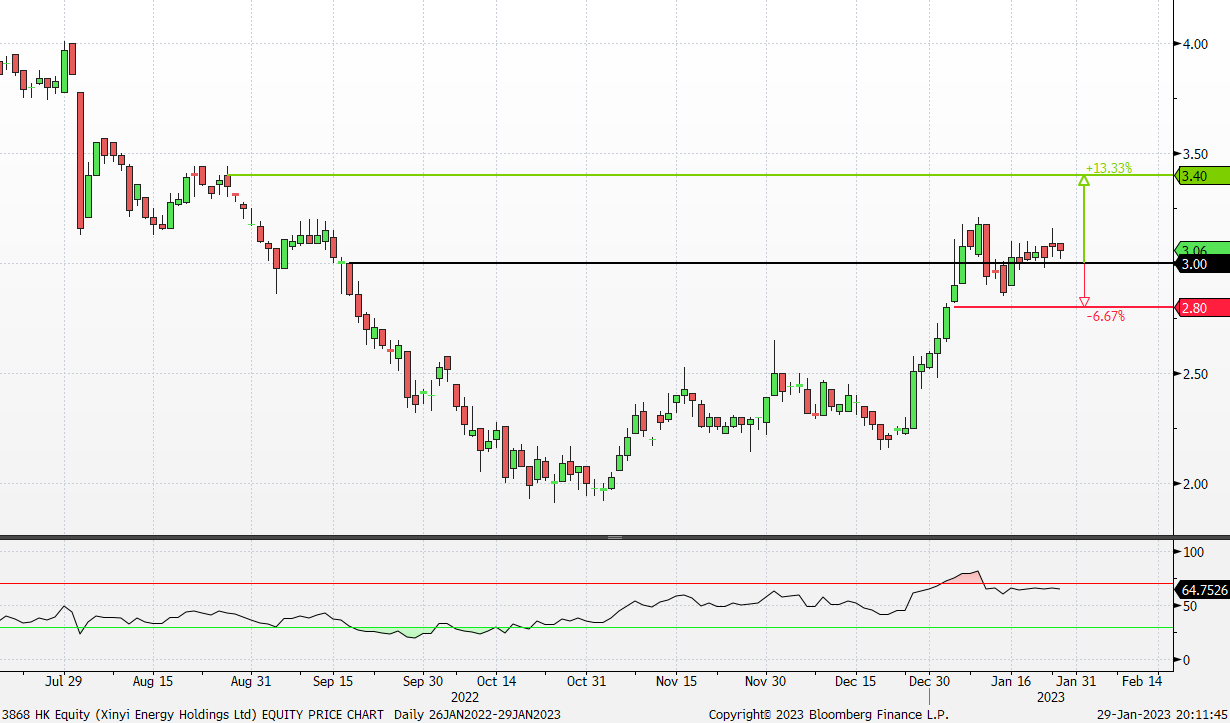

XINYI ENERGY HOLDINGS LTD (3868 HK): Solar remains popular theme in 2023

XINYI ENERGY HOLDINGS LTD (3868 HK): Solar remains popular theme in 2023

- RE-ITERATE BUY Entry – 3.00 Target – 3.40 Stop Loss – 2.80

- XINYI ENERGY HOLDINGS LIMITED is a China-based investment holding company. The Company is principally engaged in the management and operation of solar farms through its subsidiaries, and generates revenue by selling the electricity to subsidiaries of the State Grid. The Company operates Jinzhai Solar Farm, Sanshan Solar Farm, Nanping Solar Farm, Lixin Solar Farm, Binhai Solar Farm, HongAn Solar Farm and Wuwei Solar Farm, among others. These solar farms are mainly located in Anhui, Tianjin, Fujian and Hubei Provinces in China. The Company mainly conducts its businesses in domestic market

- Development in solar energy. Chinese and Swiss researchers have announced a breakthrough in the development of high-performing perovskite solar cells (PSC), which they say could lead to cheaper and cleaner energy. The team was able to stabilize the perovskite material, a key component of the cells, and improve its efficiency, making it a viable alternative to traditional silicon-based solar cells. The research is still in its early stages, but the team is optimistic about its potential impact on the renewable energy industry.

- Renewable energy appeal. With global carbon emissions increasing year by year, the development of renewable energy is attracting a lot of attention. Technologies used to manufacture various clean energy sources such as, large solar wafers, black silicon and ultra-high monocrystalline and multicrystalline silicon increase the electricity output, thereby reducing the cost needed to produce each unit of power. They are key to accelerating the proliferation of renewable energy to fight global warming and climate change.

- Global investments in renewable energy. According to a report from Bloomberg New Energy Finance, global investments in clean energy have reached parity with those in fossil fuels for the first time, approximately $1.1 trillion each. The report found that investments in clean energy totaled $401 billion in 2020, while investments in fossil fuels reached $407 billion. This marks a significant shift from previous years, when investments in fossil fuels far outpaced those in clean energy. The report attributes this change to falling costs for renewable technologies, such as wind and solar power, as well as increased government support for clean energy initiatives.

- 1H22 earnings review. 1H22 revenue rose by 13.1% YoY to HK$1.26bn. 1H22 profit attributable to shareholders of the company was flat at HK$623.1n.

- The updated market consensus of the EPS growth in FY23/24 is 14.4%/16.8% YoY respectively, which translates to 14.1x/12.1x forward PE. The current PER is 16.7x. FY23F/24F dividend yield is 6.5%/7.2% respectively. Bloomberg consensus average 12-month target price is HK$3.91.

(Source: Bloomberg)

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Technology Services | +5.45% | Facebook owner Meta sees shares up 25% after cost cuts and buyback Meta Platforms, Inc.(META US) |

| Consumer Durables | +2.85% | As Tesla ignites an EV price war, suppliers brace for Musk seeking givebacks Tesla, Inc.(TSLA US) |

| Retail Trade | +2.50% | Amazon posts solid sales but softer cloud growth Amazon.com, Inc. (AMZN US) |

Top Sector Losers

| Sector | Loss | Related News |

| Health Services | -3.12% | Health-insurance stocks drop after Medicare Advantage proposes lower rates for 2024 UnitedHealth Group, Inc.(UNH US) |

| Energy Minerals | -2.36% | Oil slumps on economic data, stronger U.S. dollar Exxon Mobil Corp.(XOM US) |

| Non-Energy Minerals | -2.10% | Iron ore price at 2-week low as traders reassess demand prospects in China BHP Group Ltd.(BHP US) |

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

E-commerce & Internet Services | +3.36% | ChatGPT Buzz Drives Buying Frenzy in China’s AI-Related Stocks Tencent Holdings Ltd (700 HK) |

Semiconductors | +3.26% | US, India target arms, AI to compete with China Semiconductor Manufacturing International Corp (981 HK) |

Biotechnology | +2.63% | U.S. investors have plowed billions into China’s AI sector, report shows WuXi Biologics Cayman Inc (2269 HK) |

Top Sector Losers

Sector | Loss | Related News |

Gamble | -1.57% | Macau casino revenues surge in Jan after COVID rules lifted Galaxy Entertainment Group Ltd (27 HK) |

Insurance | -1.51% | AIA Buys back 2.5642M Shrs for $225M AIA Group Ltd (1299 HK) |

Securities | -1.32% | CITIC Securities Co Ltd (6030 HK) |

Trading Dashboard Update: Take profit on BYD (1211 HK) at HK$255 and CMOC (3993 HK) at HK$4.80.