25 January 2024: Wealth Product Ideas

Fund inflows into the world’s third-largest economy

- A portion of international funds have been flowing out from China into Japan with investors keeping a keen eye on the Japanese Yen and the policies released by the Bank of Japan (BOJ). BOJ is expected to keep its short-term policy rate steady at -0.1% as it continues to assess Japan’s economic progression to achieving sustainable inflation. Market is anticipating BOJ’s negative rate policy to end and first-rate hike to happen during April’s policy meeting.

- Exports rose 9.8% YoY in December, the highest in FY23, above the forecast of a 9.2% YoY increase, showing a reversal from the previous decline of 0.2% in November. Shipments to the US gained at a double-digit clip and those to China rose for the first time in 13 months. For the first time since 2019, annual exports to the US topped those to China.

- Despite remaining above BOJ’s 2% target, inflation is cooling as growth in consumer prices excluding fresh food slowed to 2.3% in December, in-line with consensus. Prices of services rose 2.3% for the second month, the fastest pace in three decades excluding sales tax hike periods.

- In the 3Q23, Japan’s GDP fell by 2.9% YoY, faster than estimated. Real wages and household spending fell in October due to the prolonged inflation discouraging personal consumption. BOJ is expected to maintain its interest rates until it manages to achieve sustainable inflation of 2% and wage hikes, which would help support real disposable income and personal consumption.

- Key focus: Japan’s annual wage talk in March

|

Fund Name (Ticker) |

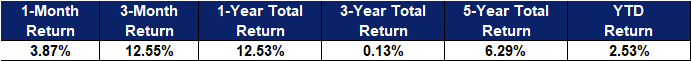

iShares JPX-Nikkei 400 ETF (JPXN) |

|

Description |

The iShares JPX-Nikkei 400 ETF (JPXN) seeks to track the investment results of a broad-based benchmark composed of Japanese equities. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 22 Jan 2024) |

10,675 |

|

Net Assets of Fund (as of 23 Jan 2024) |

US$83,788,473 |

|

12-Month Trailing Yield (as of 31 Dec 2023) |

2.57% |

|

P/E Ratio (as of 22 Jan 2024) |

15.47 |

|

P/B Ratio (as of 22 Jan 2024) |

1.61 |

|

Management Fees (Annual) |

0.48% |

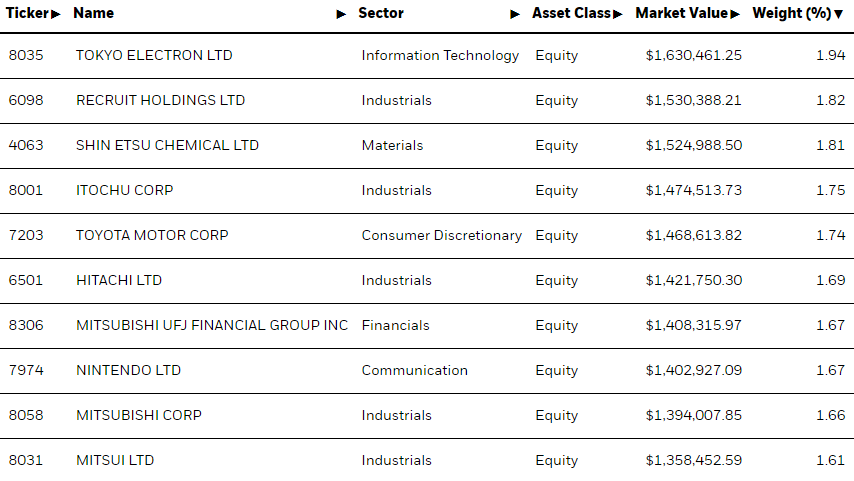

Top 10 Holdings

(as of 22 January 2024)

(Source: Bloomberg)

India 2024 Economic Growth Dominates Emerging Markets

- The global economy is expected to slow down, but India still maintains high growth, Bloomberg estimates. The real GDP growth rate in 2024 is 6%. India announced that the latest GDP growth rate in 2023Q3 was 7.6%, which was significantly better than the 6.8% expected by market analysis and India. The 7% forecast by the Reserve Bank of India (RBI) comes from the strong expansion of manufacturing and domestic construction-related industries. The National Statistic also Office (NSO) also recently estimated that India’s real GDP growth in 2023-24 is estimated at 7.3%. This puts India as the world’s fastest-growing major economy.

- In the 2024 Indian Prime Ministerial Election, Modi has a high chance of being re-elected, with policies supporting infrastructure construction and continued openness to foreign investment. India has a cabinet system, and the prime minister can be re-elected if he obtains a majority in Congress. As of December’s local elections, Modi’s alliance has won the election, winning 16 out of 29 states, accounting for 60% of the population. Policies to build additional airports, bring roads to rural areas, and electrify railways are expected to sustain domestic demand.

- Chance: Support India’s integration into the global supply chain and benefit from the relocation of industries due to the competition between China and the United States.

- Risk: Food inflation has pushed overall inflation to a record high, which may suppress private consumption and increase the central bank’s tighter stance on policy interest rates.

|

Fund Name (Ticker) |

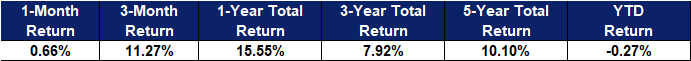

iShares MSCI India ETF (INDA) |

|

Description |

The iShares MSCI India ETF seeks to track the investment results of an index composed of Indian equities. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 22 Jan 2024) |

3,244,580 |

|

Net Assets of Fund (as of 16 Jan) |

US$7,872,765,665 |

|

12-Month Trailing Yield (as of 31 Dec 2023) |

0.16% |

|

P/E Ratio (as of 22 Jan 2024) |

29.43 |

|

P/B Ratio (as of 22 Jan 2024) |

4.14 |

|

Management Fees (Annual) |

0.65% |

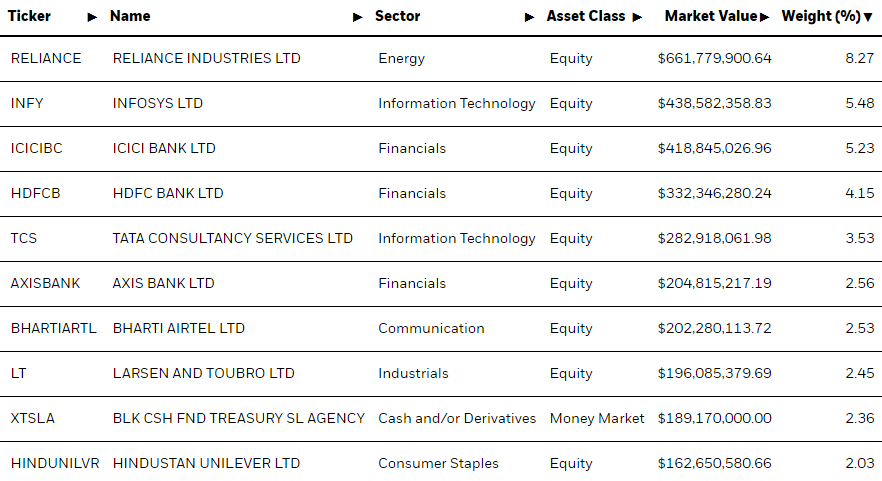

Top 10 Holdings

(as of 22 January 2024)

(Source: Bloomberg)