21 March 2024: Wealth Product Ideas

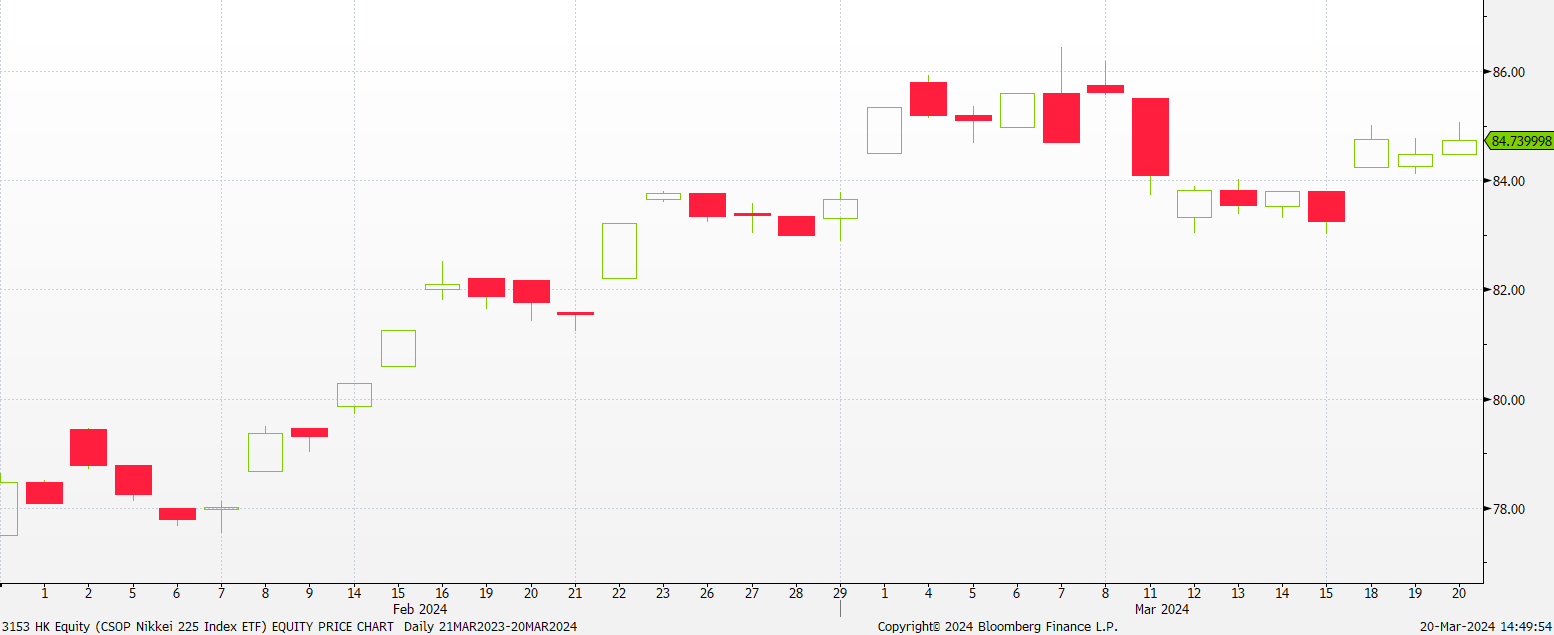

Fund Name (Ticker) | CSOP Nikkei 225 Index ETF (3153 HK) |

Description | The investment objective of the CSOP Nikkei 225 Index ETF (the “ETF”) is to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Nikkei Stock Average Index (net total return version) (the “Underlying Index”). The Manager primarily uses a full replication strategy to achieve the investment objective of the ETF. |

Asset Class | Equity |

30-Day Average Volume (as of 19 Mar) | 24,808 |

Net Assets of Fund (as of 19 Mar) | JPY 2,691,747,224.72 |

12-Month Yield | NA |

P/E Ratio (as of 19 Mar) | 27.139 |

P/B Ratio (as of 19 Mar) | 2.174 |

Management Fees (Annual) | 0.99% |

- Nikkei Stock Index all-time high. The Nikkei stock index recently closed at an all-time high and above the 40,000 mark for the first time in 34 years. The index, which consists of the top 225 leading Japanese stocks, has recently gained over 1,000 points since Feb. 22 when it topped record highs marked in 1989. This is fuelled by strong domestic and foreign investment in strong corporate earnings, low-interest rates, and better expectations for the economy emerging from deflation. The reviving fortunes of the Japanese stock market also come amid a sustained rally in US shares, fuelled by excitement surrounding advances in artificial intelligence.

- Central bank’s loose policy and a cheap yen. While the Bank of Japan recently raised its interest rates for the first time in 17 years, it has kept rates stuck around zero as a fragile economic recovery forces the central bank to go slow on further rises in borrowing costs. Looking at the long-term perspective, the Japanese Yen has been in constant depreciation, with the Japanese central bank keeping interest rates at rock-bottom levels. In contrast, the Federal Reserve and other central banks have been on a hiking cycle. Just in 2023 alone, the Yen has fallen about 11% against the USD, being one of the worst performers among major currencies. This makes other currencies or other asset classes, such as equities, much more attractive than the Japanese Yen.

Top 10 Holdings

(as of 19 March 2024)

(Source: Bloomberg)

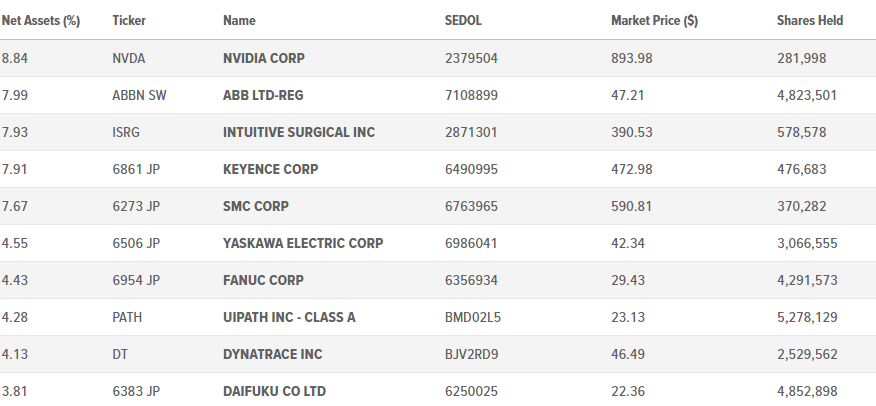

Fund Name (Ticker) | Global X Robotics & Artificial Intelligence ETF (BOTZ US) |

Description | The Global X Robotics & Artificial Intelligence ETF (BOTZ) seeks to invest in companies that potentially stand to benefit from increased adoption and utilization of robotics and artificial intelligence (AI), including those involved with industrial robotics and automation, non-industrial robots, and autonomous vehicles. |

Asset Class | Equity |

30-Day Average Volume (as of 19 Mar) | 1,317,874 |

Net Assets of Fund (as of 19 Mar) | US$2,840,000,000 |

12-Month Trailing Yield | NA |

P/E Ratio (as of 18 Mar) | 35.29 |

P/B Ratio (as of 18 Mar) | 5.09 |

Management Fees (Annual) | 0.69% |

- AI Boom. With the recent AI tech boom generated by the hype surrounding generative AI, stocks relating to AI technology have seen shocking price increases from the beginning of the year. This trend has supported the inclination of stock prices alongside strong earnings from AI companies such as NVIDIA which also provide relatively optimistic guidance with the help of AI introduction or progress.

- NVIDIA unveils Blackwell Platform. NVIDIA recently announced at its GTC 2024 the new Blackwell Platform, alongside its related products, including its latest AI chip called the B200. This new GPU Platform would succeed the company’s Hopper architecture and is likely to be the engine to power the new AI industrial revolution. The Blackwell GPUs contain 208 billion transistors and can enable AI models that scale up to 10 trillion parameters. In comparison, OpenAI’s GPT-3 is made up of 175 billion parameters. Blackwell will be incorporated in Nvidia’s GB200 Grace Blackwell Superchip, which connects two B200 Blackwell GPUs to a Grace CPU and are expected to be available later this year. With NIVIDA dominating the markets for chips used for AI applications and generative AI, the higher performance of Blackwell is poised to further drive growth for NVIDIA and the AI industry.

- Development of humanoid robots. The advancement of Generative AI has also led to a significant development of robots, which is likely to increase work efficiency across several industries and jobs that may be laborious or require precision. The recent NVIDIA GTC also saw the company announcing GR00T, which is a foundation model for humanoid robots, designed to further its work driving breakthroughs in robotics and embodied AI. The company also announced several Major Isaac Robotics Platform Update, alongside a new computer, Jetson Thor, for humanoid robots based on the NVIDIA Thor system-on-a-chip (SoC). These developments are likely to further propel robotic companies towards artificial general robotics. Companies such as Mercedes Benz have also announced recently that it has agreed to try out Austin, Texas-based Apptronik’s humanoid robots at its factories, as a chance to see how robots can be used to help human workers and ease staffing issues during the manufacturing process.

Top 10 Holdings

(as of 19 March 2024)

(Source: Bloomberg)