21 December 2023: Wealth Product Ideas

Healthcare Revival: Capturing Growth in 2024

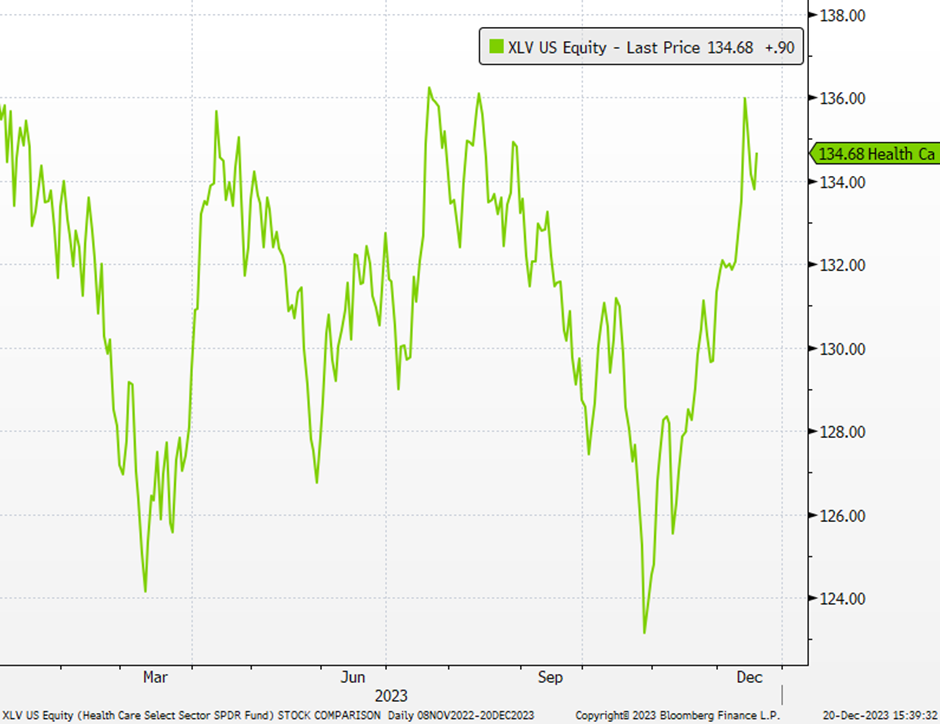

- Despite being laggards in earnings growth throughout 2023, the Healthcare Sector is poised for a dramatic turnaround in 2024. The previous year was characterized by the adverse effects of COVID and a significant patent expiration hitting many healthcare equities, which led to a marked decrease in their financial performance. However, projections indicate a resurgence in growth starting the subsequent year.

- The anticipated rebound of the global economy is expected to catalyze renewed vigor in healthcare spending. Investor enthusiasm is likely to be fueled by a confluence of factors: the positive trajectory of healthcare industry trends, groundbreaking medical breakthroughs, the demographic shift towards an older population, the ongoing threat of pandemics, and potential healthcare regulatory reforms, all of which could amplify the demand for healthcare products and services.

- Within the Health Care Select Sector SPDR Fund (XLV) portfolio, the dominant positions are held by industry stalwarts: UnitedHealth Group, Eli Lilly, and Johnson & Johnson, which collectively account for about 28% of the fund’s assets.

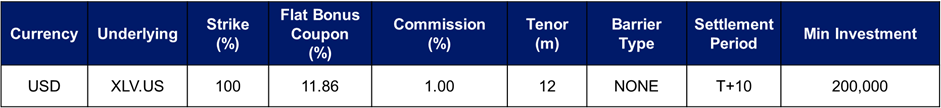

Digital Coupon Note (DCN) Key Features:

- Binary Coupon: The payout of the coupon is all-or-nothing based on the performance of the underlying asset at specific valuation dates.

- Underlying Asset: Linked to various assets (e.g., equities, indices, commodities) and the coupon payment is contingent on their performance.

- High Yield Potential: Offers the potential for higher returns compared to traditional fixed-income products due to the binary outcome of the coupon payment.

- Strike-Based Outcome: In the event the final value of the underlying asset is below the strike price at maturity, instead of cash, investors will receive the underlying stock, which represents a physical delivery of the asset.

Note: Pricing provided is indicative only. For updated pricing, please contact us directly.

Return Scenarios

Positive Performance Scenario:

- If the final value of the underlying asset is equal to or greater than the predetermined target price (Strike), the investor will receive a full return of their principal (100%) plus the agreed-upon digital coupon payment.

Negative Performance Scenario:

- Should the final value of the underlying asset fall below the target price (Strike), the investor will receive a physical delivery of the least performing underlying asset at the specified lower price level (Put Strike). This physical delivery is the default outcome unless otherwise specified.

(Source: Bloomberg)