16 November 2023: Wealth Product Ideas

6-month RCN on Singapore 10Y Government Bond

What is an RCN?

- An RCN is a structured financial product that is essentially a bond coupled with a short put option.

Background

- Rates volatility is at historic highs, presenting opportunities for yield enhancement.

- Investors with neutral/bearish rates views can earn higher returns using structured product solutions like reverse convertibles versus cash deposits. Bond investors can also use reverse convertibles for short-term bond replacement and higher yield.

Product Idea

- Underlying: SG3261987691 (SIGB 3.375% 09/01/33)

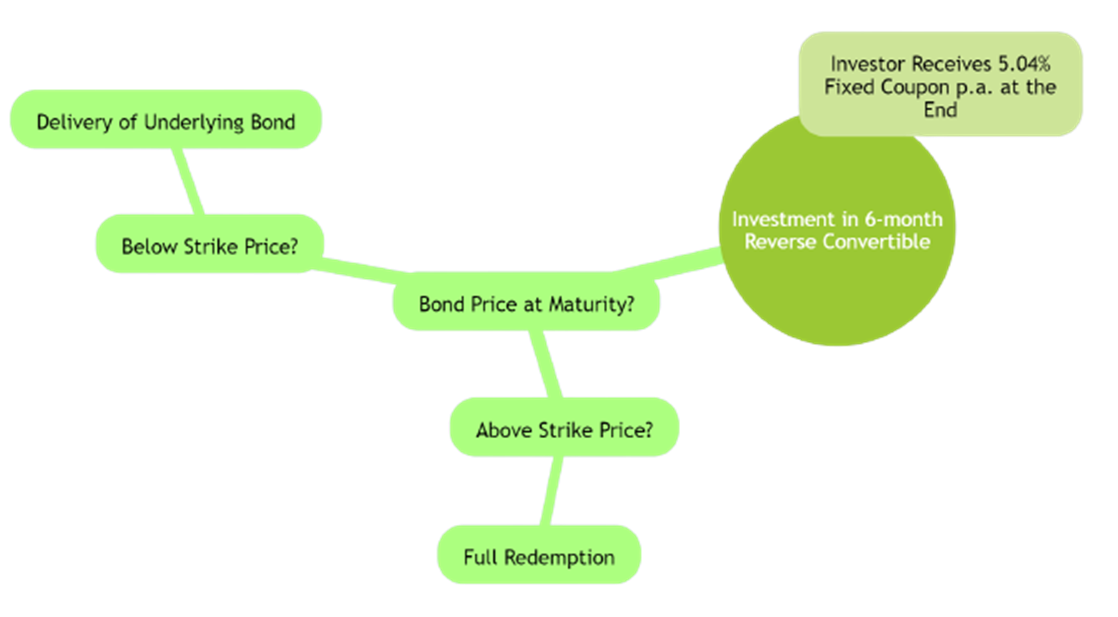

- 6-month reverse convertible on Singapore 10Y government bonds

- Offers guaranteed 5.04% p.a. coupon, paid at maturity

- At maturity, receive 100% capital or underlying bond at strike price

Key Risks

- Potential loss of capital if underlying bond price falls significantly

- Maximum return limited to coupon amount

- Credit risk of issuer

Payoff Description

- Investor gets 5.04% p.a. fixed coupon regardless of underlying performance

- If bond price remains above strike at maturity, receive full redemption

- If bond price falls below strike, receive delivery of underlying bond