14 March 2024: Wealth Product Ideas

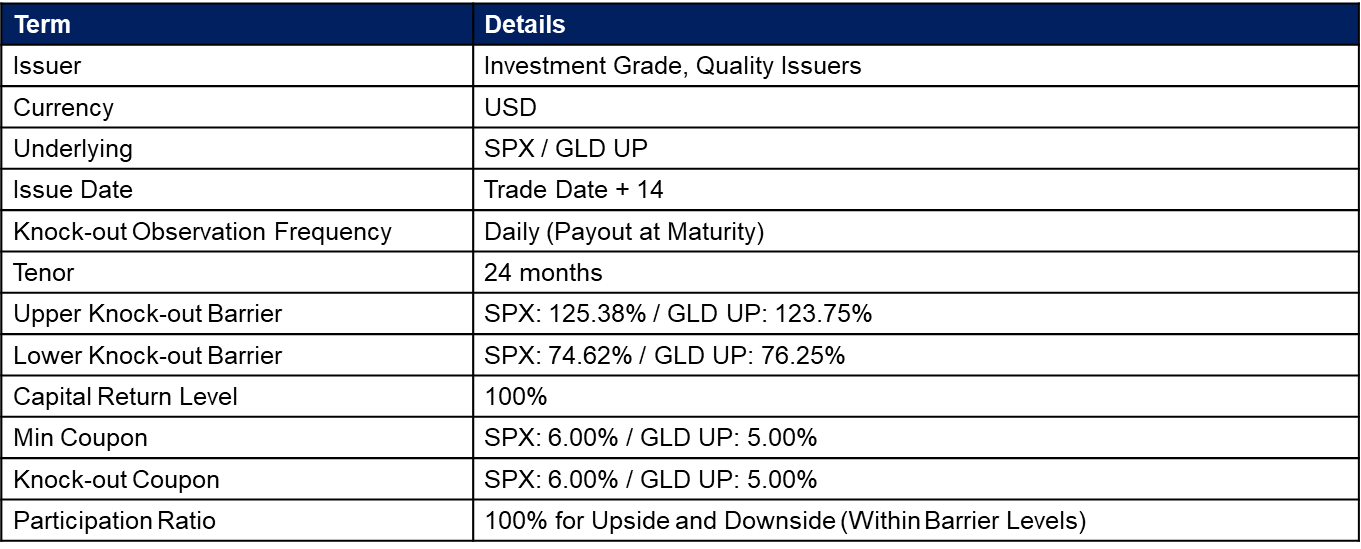

TwinWin Sharkfin Note

- Given the recent increase in market volatility, structures with a principal protection feature to safeguard capital while providing minimum coupons during periods of market declines have gained popularity. These structures offer investors the opportunity to benefit from both rising and falling markets.

- Popular underlying assets for such structures include major equity indices like the Hang Seng Index (HSI), S&P 500 (SPX), Nikkei 225 (NKY), and TAIEX (TPX), as well as equity alternatives such as the SPDR Gold Trust (GLD).

Note: Pricing provided is indicative only. For updated pricing, please contact us directly. Investing in complex structured products carries inherent risks. Ensure you fully understand the terms, conditions, and potential risks before making any investment decisions.

Payout Scenarios:

1. Knock-Out Event (Upper/Lower):

- KO is tracked daily.

- Should a barrier be breached at any point, the investor is entitled to a pre-set knock-out coupon upon maturity (5% for SPX, 6% for GLD UP).

- Initial principal protected.

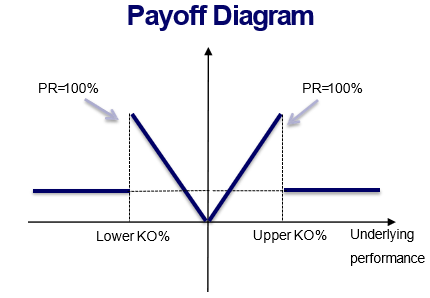

2. No Knock-Out, Underlying Up but Below Upper Barrier:

- At maturity, investor participates in upside performance up to upper barrier and receives their initial principal.

3. No Knock-Out, Underlying Down but Above Lower Barrier:

- At maturity, investor participates in downside performance down to lower barrier and receives their initial principal.

(Source: Bloomberg)

(Source: Bloomberg)