12 October 2023: Wealth Product Ideas

HSBC Indian Equity Fund

Company Profile:

- HSBC Asset Management, headquartered in London, was established in 1973. As of June 2023, it manages assets worth USD 651 billion

- Fund management team consists of Sanjiv Duggal (Lead Manager, 27 years of experience with HSBC) and Nilang Mehta (Investment Director of Asian Equities)

Investment Strategy:

- Aims to provide long-term capital growth and income through investments in Indian shares

- A minimum of 90% of the fund’s assets are allocated to shares of companies, regardless of size, that are primarily based in India

- Suitable for investors who are comfortable with the volatility and risks associated with equities in a single emerging market

- Open to retail investors as a Recognized Scheme

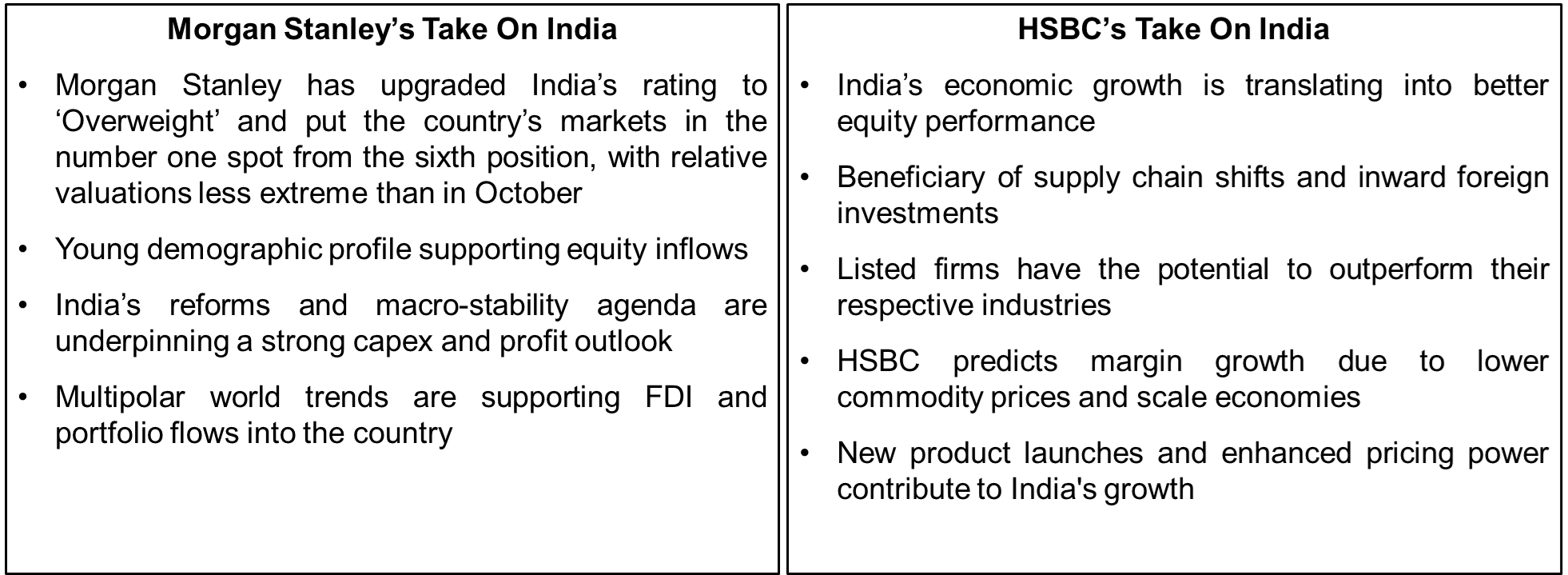

Why invest in India?

- India offers a compelling investment landscape due to factors such as effective economic growth-to-equity translation, favorable supply chain dynamics, and a youthful demographic

- Positive structural factors, including supply chain shifts, inward foreign investments, and growth in consumer markets and infrastructure, contribute to an improved outlook for India

- economic growth in India is expected to result in better equity performance compared to China (HSBC, September 2023)

Risks:

- Fund is classified as an Aggressive investment option given its concentrated exposure to Indian emerging market equities but its 3-year volatility of 15.54% is lower than the Reference Benchmark of 16.06%

- Risks include market volatility, foreign exchange exposure, liquidity constraints, emerging markets risks, single-country focus, tax treatment risks, and risks associated with the use of derivatives

Fund Performance and Advantages:

- Fund has achieved a 3-year return of 14.41% since August 2020 and a net return of 7.32% YTD as of August 31, 2023

- Strategy aims to provide long-term returns for investors seeking high-growth opportunities and exposure to the emerging Indian market

- Benefits include the opportunity to tap into a high-potential emerging market that has either surpassed or is surpassing China, particularly in sectors such as financial services, industrials, and consumer goods

HSBC GIF Indian Equity AC USD: Price Performance Over 5 years

- Remarkable steady uptrend since Q1 2020

- Strong recovery in 2020 even amidst COVID-19 – demonstrating resilience to risk and ability to generate returns even within a crisis.

Source: Refinitiv

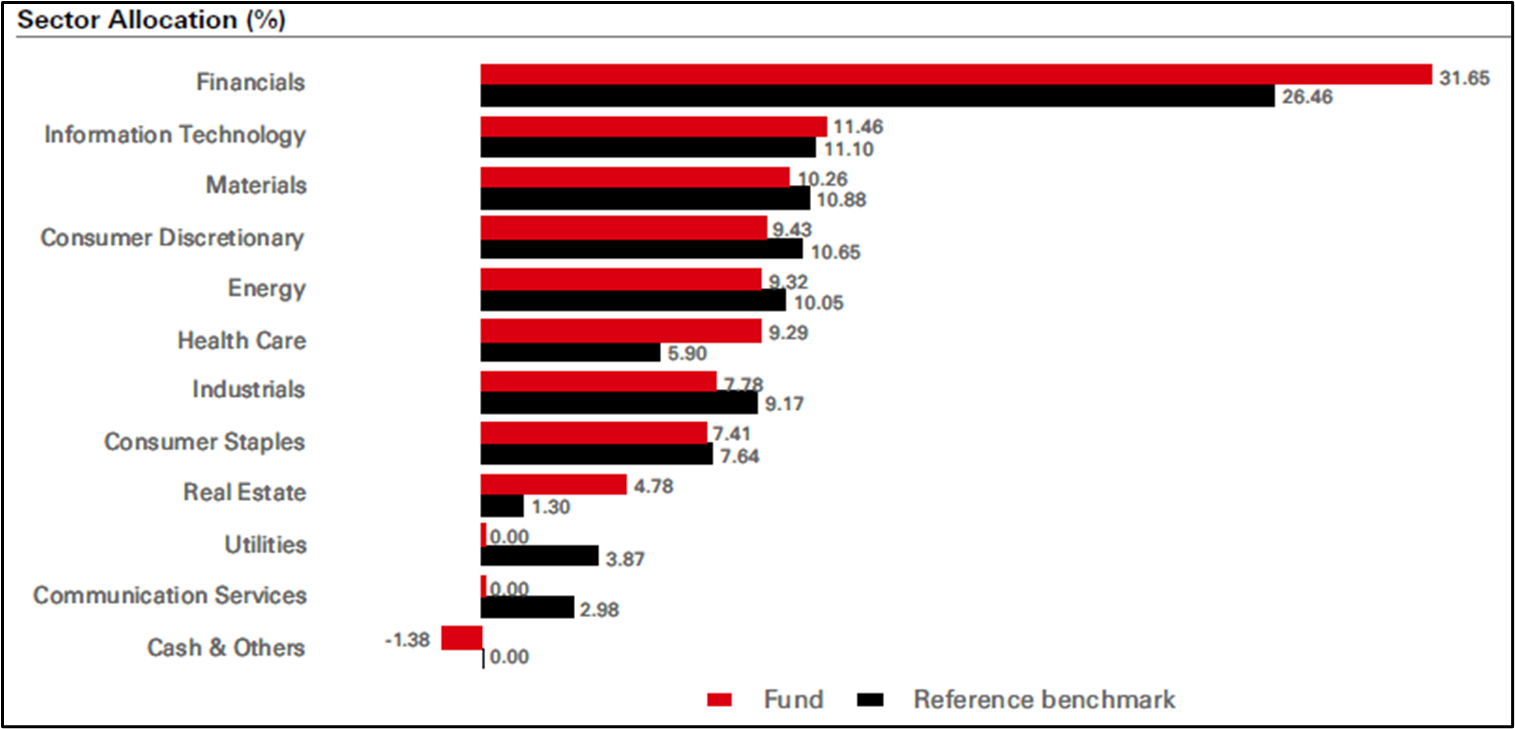

Fund’s Latest Sector Allocation as of end-Aug 2023

(Source: HSBC’s Fund Factsheet)