11 May 2023: Wealth Product Ideas

The Resilient and Profitable Luxury Goods Market

- The global luxury goods market is growing rapidly and is expected to reach USD 352.84 billion by 2027.

- This growth is being driven by rising incomes in emerging markets, a growing middle class in China, and increasing popularity of luxury goods among millennials.

- The luxury goods sector has proven to be resilient to economic downturns, with only a 9% decline during the 2008 financial crisis, although it recovered quickly.

- Luxury goods are seen as a status symbol and consumers are more likely to continue purchasing them during difficult economic times.

- The luxury goods sector is highly profitable, with margins of 20% or more due to premium pricing and limited supply.

- Investing in luxury goods companies can provide exposure to a growing market with strong profitability and resilience to economic downturns.

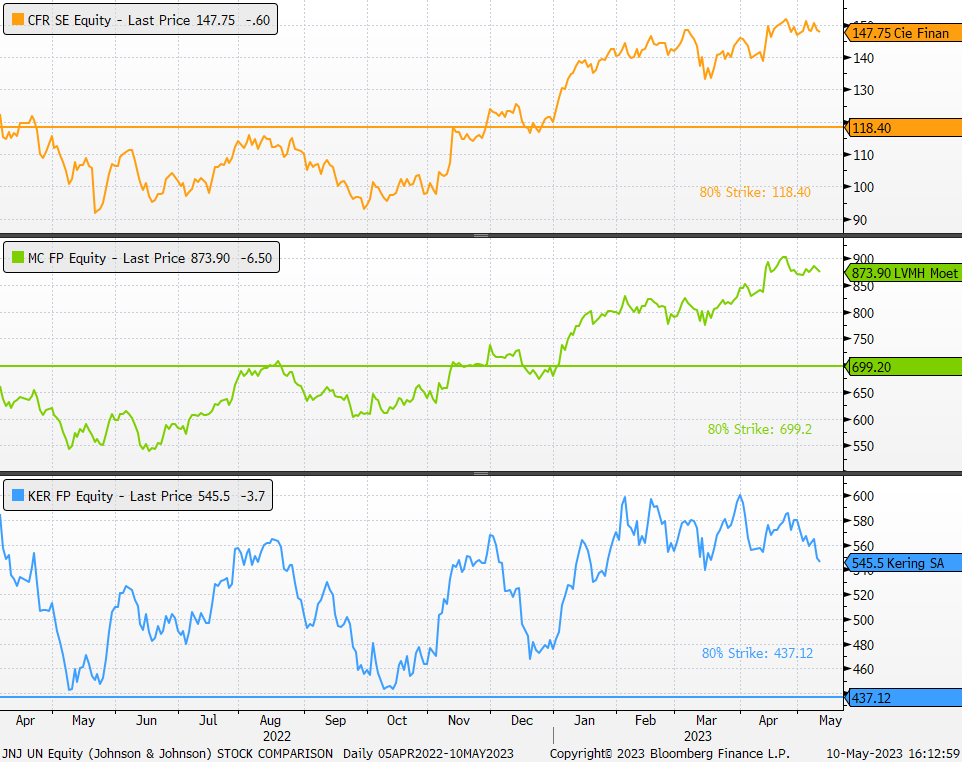

Payout Scenarios:

- KO Early Redemption: Principal + KO returns (KO event occurs only when the closing price of all underlying securities is higher than the knock-out price)

- Maturity Redemption: Investors receive corresponding interest payments every month, and if no KO event occurs, the payout will be:

- If the final price of all underlying stocks is higher than or equal to the strike price, investors will receive 100% cash return on their principal, along with the final interest.

- If the final price of one or more underlying stocks is lower than the strike price, investors will receive 100% of their principal in the form of shares of the worst-performing stock and will also receive the final interest.

(Source: Bloomberg)