Technical Analysis: 9 March 2022

United States | Singapore | Hong Kong

United States

SolarEdge Technologies Inc (SEDG US)

- Shares formed a cup and handle and are poised to break out.

- Both RSI and MACD remains constructive.

- Long – Entry 320.84, Target 368.35, Stop 299.73

Airbnb Inc (ABNB US)

- Shares formed a triple bottom level and rebounded sharply from this level yesterday.

- RSI indicates a possible reversal from its downtrend while MACD remains laggard. However, the strong support level at approximately $130-$134 provides a buying opportunity.

- Long – Entry 134.35, Target 157.66, Stop 124.74

SINGAPORE

Yangzijiang Shipbuilding SGD (YZJSGD SP)

- Shares are forming higher highs and higher lows after finding support at 1.24. As it stands, the 20d EMA level of around at 1.40 would be an ideal entry point.

- MACD remains constructive while RSI is trending lower, hence a lower positioning is recommended.

- Long – Entry 1.40, Target 1.56, Stop 1.32

Bumitama Agri (BAL SP)

- Shares have formed the cup portion of the “cup and handle” chart pattern, which is bullish.

- RSI is in overbought territory and may lead to consolidation at current levels before breaking out.

- Long – Entry 0.770, Target 0.875, Stop 0.735

HONG KONG

China Datang Corp Renewable Power Co Ltd (1798 HK)

- Shares recently rebound from the 200dMA. Yesterday, the stock closed above the 60dEMA with a jump in volume.

- Both MACD and RSI are constructive.

- Long – Entry: 3.20 Target: 3.57, Stop: 3.00

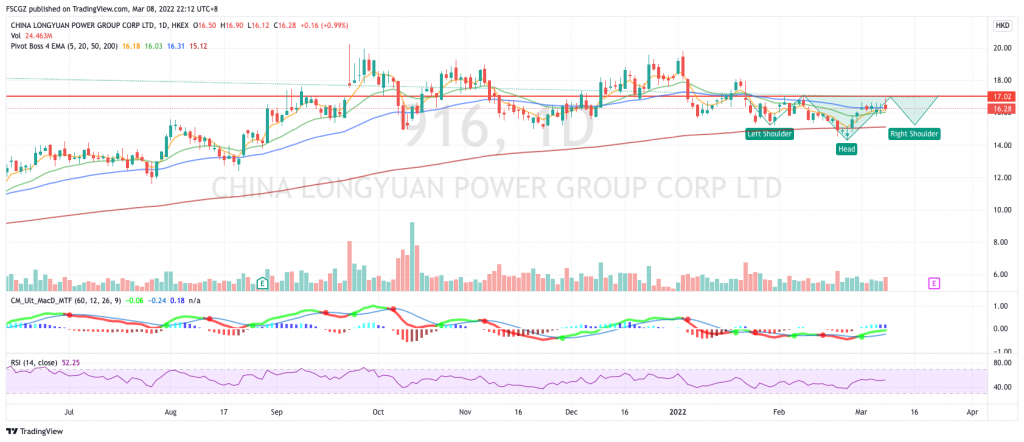

China Longyuan Power Group Corporation Limited (916 HK)

- Shares are poised to form an inverted head and shoulder pattern.

- Both MACD and RSI are constructive.

- Long – Entry: 15.25, Target: 17.00, Stop: 14.3

Related Posts: