Technical Analysis: 21 January 2022

United States | Singapore | Hong Kong

UNITED STATES

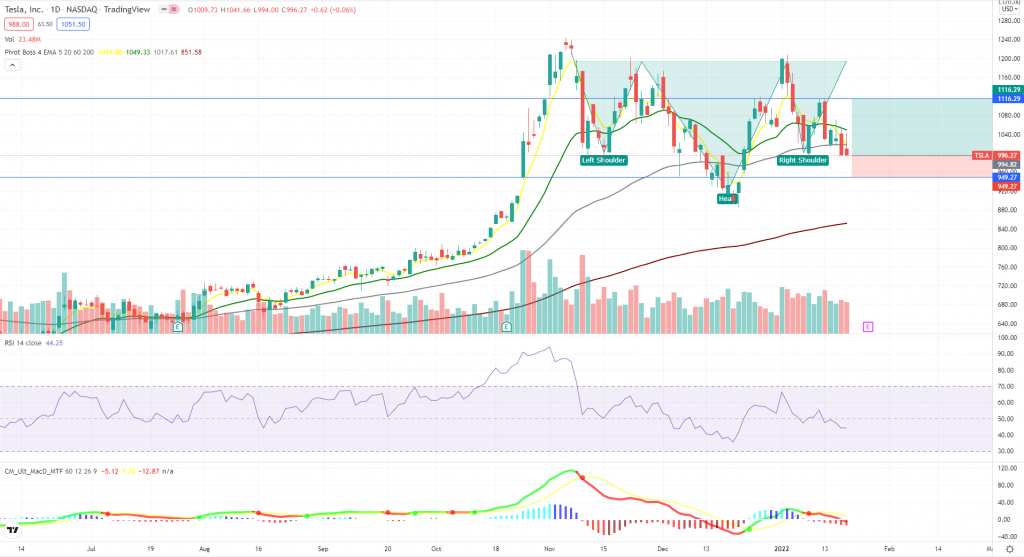

Tesla Inc (TSLA US)

- Shares formed an inverted head and shoulder pattern.

- Shares are short-term supported at the shoulder level.

- MACD and RSI are relatively flat.

- To long at the shoulder and stop loss before the gap down.

- Long – Entry 994.82, Target 1116.29, Stop 949.27

Digital World Acquisition Corp (DWAC US)

- Shares have been trading near the 5dMA and closed above the 5dMA yesterday.

- Both RSI and MACD are on an upward momentum.

- Long – Entry 77.50, Target 91.50, Stop 70.50

SINGAPORE

Sembcorp Industries (SCI SP)

- Shares are in the process of forming a cup and handle pattern, after testing last year’s highs.

- MACD is supportive of the recent positive momentum, while RSI is near overbought levels and may indicate consolidation at the current level to complete the cup and handle pattern, and eventually breaking out from the current resistance level of 2.23

- Long – Entry 2.20, Target 2.33, Stop 2.13

BROADWAY INDUSTRIAL (BWAY SP)

- Shares are likely to find buyers at the 200d EMA of 0.177, which has been a key support since April 2020.

- RSI is oversold and due for a rebound.

- Long – Entry 0.184, Target 0.215, Stop 0.175

HONG KONG

Hong Kong Exchanges and Clearing Limited (388 HK)

- Shares formed a double bottom. The stock broke out the downtrend line with a jump in volume.

- Both MACD and RSI are constructive.

- Long – Entry: 470, Target: 495, Stop: 460

Jiumaojiu International Holdings Ltd (9922 HK)

- Shares have been turning around since 2022 with rising volumes. The 60dEMA has become a support from the resistance.

- MACD and RSI are constructive.

- Long – Entry: 17.0, Target: 19.2, Stop: 15.9

Related Posts: