2 June 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

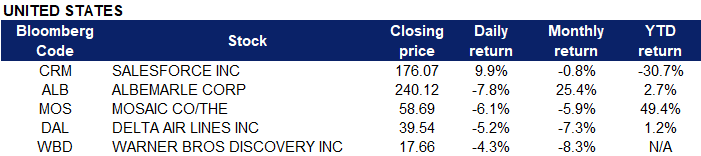

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Energy Minerals | +1.4% | Why oil prices are spiking again Exxon Mobil Corp (XOM US) |

| Industrial Services | +1.1% | Why oil prices are spiking again Schlumberger N.V. (SLB US) |

Top Sector Losers

| Sector | Loss | Related News |

| Commercial Services | -1.8% | S&P Global stock drops after suspending 2022 guidance on weak debt issuance S&P Global Inc (SPGI US) |

| Consumer Services | -1.5% | N.A Starbucks Corp (SBUX US) |

| Health Services | -1.4% | Anthem Inc. stock falls Wednesday, underperforms market Anthem Inc (ANTM US) |

- Salesforce Inc (CRM US) shares of the enterprise-software maker jumped 9.9% after the company’s stronger-than-expected quarterly earnings report. Salesforce also lifted its full-year earnings guidance, but reduced its guidance for revenue. The company said it’s slowing down in hiring and isn’t looking to make another big purchase at this point after its acquisition of Slack.

- Albemarle Corp (ALB US), Mosaic Co (MOS US). Materials companies typically linked to the economic cycle were among the biggest laggards in the S&P 500 as comments from JPMorgan CEO Jamie Dimon saying the economy is headed for a “hurricane” weighed on the market. The chemical manufacturing company Albemarle’s shares dropped 7.8%. Agriculture company Mosaic shed 6.1%.

- Delta Air Lines Inc (DAL US) shares fell 5.2% after the airline said it expects sales in the current quarter to return to pre pandemic levels. Delta Air Lines said greater travel demand from consumers who are willing to pay higher ticket fares helped offset the spike in energy prices.

- Warner Bros Discovery Inc (WBD US) shares fell 4.3% after Wells Fargo reiterated the stock at overweight. The bank said the company is a solid opportunity for “patient” investors.

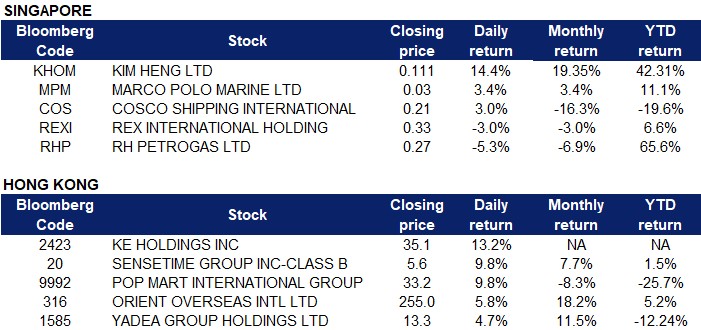

Singapore

- Kim Heng Ltd (KHOM SP) shares rose 14.4% yesterday. The Board of Directors announced on 31 May after trading hours that Credence Capital Fund II (Cayman) Limited is currently evaluating divestment options in relation to its shareholding in the Company. The evaluation and all and any discussions are still preliminary and there is no definitive transaction in relation to Credence’s shareholding in the Company.

- COSCO Shipping International Singapore Co Ltd (COS SP) and Marco Polo Marine Ltd (MPM SP) shares rose 3.0% and 3.4% respectively yesterday. There was no company-specific news, however the gain was likely due to the reopening news of Shanghai and Beijing. Major Chinese cities Beijing and Shanghai began to relax Covid controls over the weekend as the local case count dropped. In Beijing, major shopping centres, including a luxury mall that temporarily closed a month ago due to Covid, announced they would reopen as of Sunday. Ride-hailing and most public transport resumed in the main business area, while more people were allowed to return to work. Some libraries, museums and gyms could reopen at half their capacity, if no Covid cases were found in the past seven days at a community level.

- Rex International Holding Ltd (REXI SP) and RH Petrogas Ltd (RHP SP) shares lost 3.0% and 5.3% respectively yesterday. Crude oil futures were higher in mid-morning Asian trade on June 1 as investors looked past recent bearish reports of Russia being excluded from an OPEC+ production deal to refocus back on an oil market that remained severely undersupplied. The contract later gave up all its gains to end the day lower on media reports citing OPEC delegates stating Russia may be exempted from production targets under the so-called OPEC+ group, paving the way for other members to potentially raise output. The group is slated to meet on June 2 to discuss its July production targets, and most market watchers had expected it to maintain its path of gradually winding down its output cuts in 432,000 b/d monthly increments.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Automobile Retailing, Maintenance & Repair | +1.63% | Shanghai carmakers expect strong rebound as lockdown is lifted Zhongsheng Group Holdings Limited (881 HK) |

Automobiles & Components | +1.31% | China’s auto sector expects better H2 sales, as local govts move to boost consumption Yadea Group Holdings Ltd (1585 HK) |

Toys | +1.24% | KFC China’s Psyduck Toy is a Viral Hit Pop Mart International Group Ltd (9992 HK) |

Top Sector Losers

Sector | Loss | Related News |

Footwears | -2.30% | White House Pressured to Hold Firm on China Tariffs Xtep International Holdings Limited (1368 HK) |

Consumer Electronics | -1.28% | Apple to shift iPad capacity to Vietnam amid China supply chain woes Smoore International Holdings Ltd (6969 HK) |

Textile & Apparels | -1.24% | Chinese apparel brand JNBY fined 800,000 yuan for using incorrect national map Billion Industrial Holdings Ltd (2299 HK) |

- Ke Holdings Inc (2423 HK) Shares jumped 13.2% yesterday after the company released its 1Q22 results. Gross transaction value (GTV) dropped by 45.2% YoY to RMB586bn. GTV of existing home transactions declined by 44.5% YoY to RMB374.1bn. GTV of new home transactions declined by 43.9% YoY to RMB192.7bn. GTV of emerging and other services dropped by 63.6% YoY to RMB19.2bn. Net revenues fell by 39.4% YoY to RMB12.5bn. Net loss was RMB620mn. The jump in share prices was due mainly to better than expected earnings.

- SenseTime Group Inc (20 HK) Shares rose 9.8% yesterday. There was no company-specific news. Some institutes believed that the company’s digital sentinel convenient access system will see strong demand in 2Q/3Q as the company was the first batch of qualified suppliers of the digital sentinel convenient access system in Shanghai. The market scale of the system was expected to be RMB40bn.

- Pop Mart International Group Ltd (9992 HK) Shares rose 19.8% yesterday. There was no company-specific news. The stock would be included in the MSCI China index after yesterday’s market closed. Previously, Morgan Stanley lowered TP to HK$55 from HK$63 but maintained an OVERWEIGHT rating as the bank believed that the current valuation was relatively low given its 1Q22 sales growth of 65%-70%.

- Orient Overseas (International) Limited (316 HK) Shares rose 5.8% yesterday. The stock would be included in the MSCI China index after yesterday’s market closed. There was no company-specific news for both companies. Balti Dry Index went up for 4 consecutive months. With the lifting of lockdown measures in Shanghai, the pent-up demand for container shipping is expected to surge.

- Smoore International Holdings Ltd (1585 HK) Shares rose 4.71% yesterday after the company announced that the conditions precedent under the Placing Agreement have been fulfilled and completion of the placing took place on 31 May 2022. A total of 68,800,000 new shares, representing approximately 2.25% of the issued share capital of the company had been successfully placed to not less than six independent placees procured by the placing agents at a price of HK$12.58 per share. The gross proceeds from the placing amounted to approximately HK$866mn and the net proceeds amounted to approximately HK$857 million. The company intends to apply such net proceeds for expansion of its overseas business through building overseas R&D centers, manufacturing facilities, distribution networks, as well as potential mergers and acquisitions.

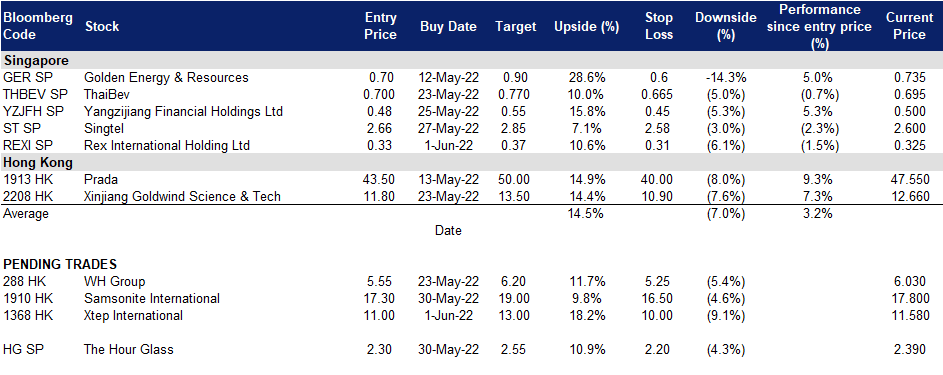

Trading Dashboard Update: Add Rex International (REXI SP) at S$0.33. Cut loss on SATS (SATS SP) at S$4.28.