Technical Analysis: 14 February 2022

United States | Singapore | Hong Kong

UNITED STATES

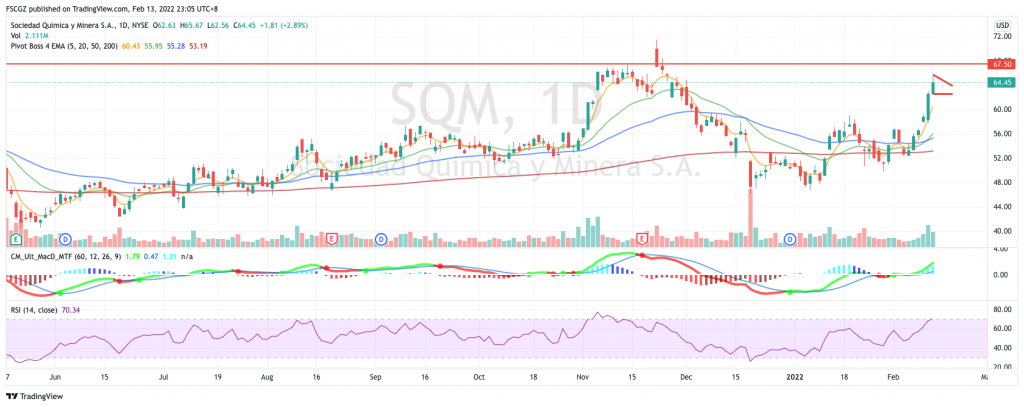

Sociedad Quimica y Minera de Chile (SQM US)

- Shares went up for 6 trading days in a row. It is about to form a bullish pattern or reach record highs without corrections.

- Both MACD and RSI are on an upward momentum.

- Long – Entry 63.5, Target 67.5, Stop 61.5

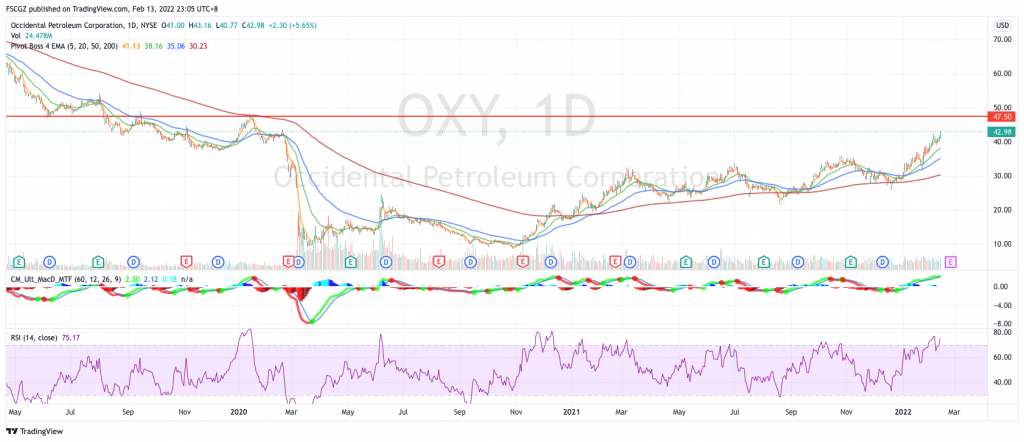

Occidental Petroleum Corporation (OXY US)

- Shares are about to reach the pre-covid highs.

- Both MACD and RSI are on an upward momentum.

- Long – Entry 41.5, Target 47.5, Stop 38.5

SINGAPORE

Singtel (ST SP)

- After finding support at 2.32 in December 2021, shares are forming higher highs and higher lows.

- MACD had a bullish crossover last week.

- Long – Entry 2.55, Target 2.73, Stop 2.46

Wilmar (WIL SP)

- Shares are forming higher highs and higher lows after bottoming at 4.00 in December 2021.

- MACD and RSI are still on an uptrend and supportive of positive momentum.

- Long – Entry 4.45, Target 5.00, Stop 4.19

HONG KONG

China Oilfield Services Limited (2883 HK)

- Shares formed a bullish flag pattern.

- MACD shows strong momentum, while RSI is at an overbought level.

- Long – Entry: 8.5 Target: 9.5, Stop: 8.0

Haidilao International Holding Ltd (6862HK)

- Shares broke out the 60dEMA with rising volume and closed at above the recent highs in January 2022.

- MACD shows an early sign of a turnaround, and RSI remains constructive.

- Long – Entry: 20, Target: 22, Stop: 21

Related Posts: