Technical Analysis: 13 April 2022

United States | Singapore | Hong Kong

United States

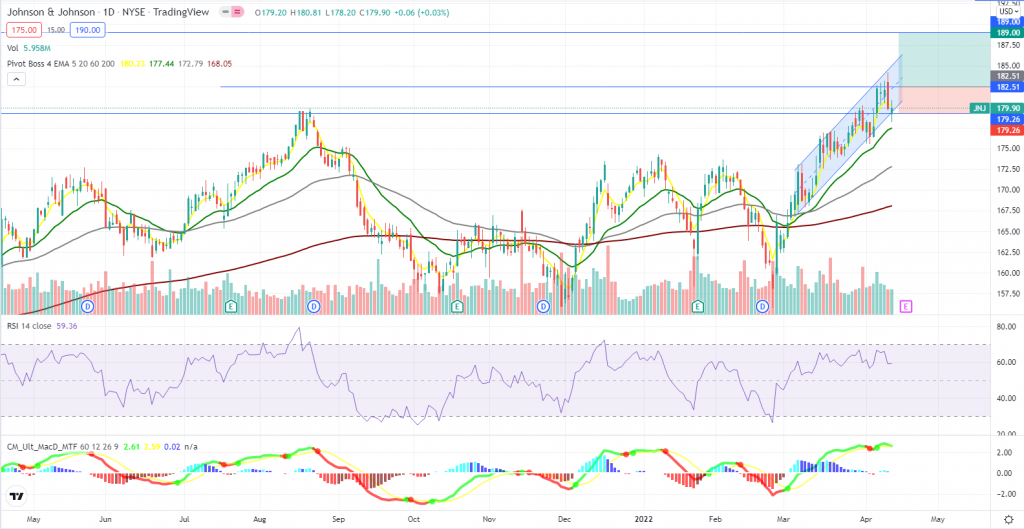

Johnson & Johnson (J&J US)

- Shares are on a healthy upward trend.

- Both RSI and MACD are constructive.

- Long – Entry 182.51, Target 189.00, Stop 179.26

Dow Inc (DOW US)

- Shares closed above the 5dMA yesterday.

- Shares closed above the previous resistance level (~US$62) and the 5dMA touched the 20dMA.

- RSI reversed from its downtrend, however MACD remains laggard.

- Long – Entry 61.95, Target 64.75, Stop 60.65

SINGAPORE

Yangzijiang Shipbuilding (BS6 SP)

- Chart is the process of forming the cup of the bullish “cup and handle” pattern.

- MACD is still supportive but uptrend may start to slow given RSI is at overbought levels

- Long – Entry 1.60, Target 1.68, Stop 1.56

Sembcorp Marine (S51 SP)

- Shares finally formed the cup of the bullish “cup and handle” chart pattern, while also closing firmly above the 200d EMA

- MACD remains bullish.

- Long – Entry 0.106, Target 0.115, Stop 0.101

HONG KONG

Hainan Meilan International Airport Co Ltd. (357 HK)

- Shares closed above the 20dEMA with a jump in volumes.

- Both MACD and RSI are about to turnaround.

- Long – Entry: 17.5 Target: 19.5, Stop: 16.5

Tsingtao Brewery Co Ltd (168 HK)

- Shares formed a bullish engulfing candlestick pattern with a jump in volumes.

- Both MACD and RSI show an early sign of turnaround.

- Long – Entry: 59.5, Target: 65.1, Stop: 56.7

Related Posts: