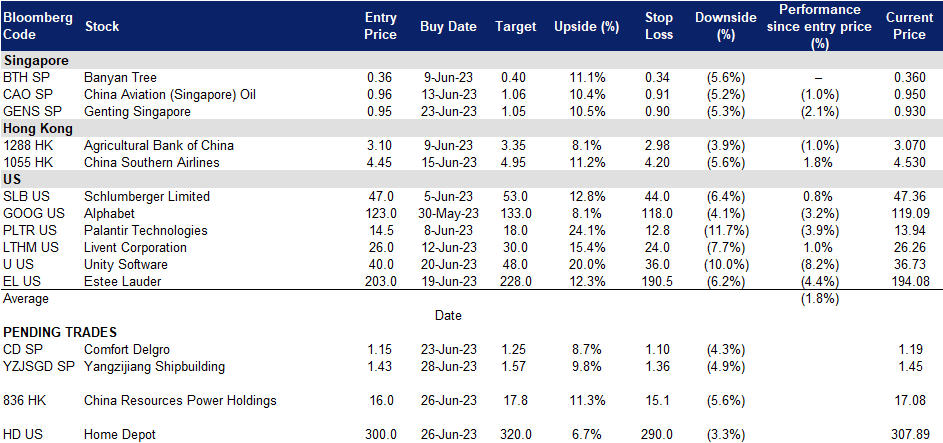

28 June 2023: Yangzijiang Shipbuilding (YZJSGD SP), China Resources Power Holdings Co. Ltd. (836 HK), Home Depot Inc (HD US)

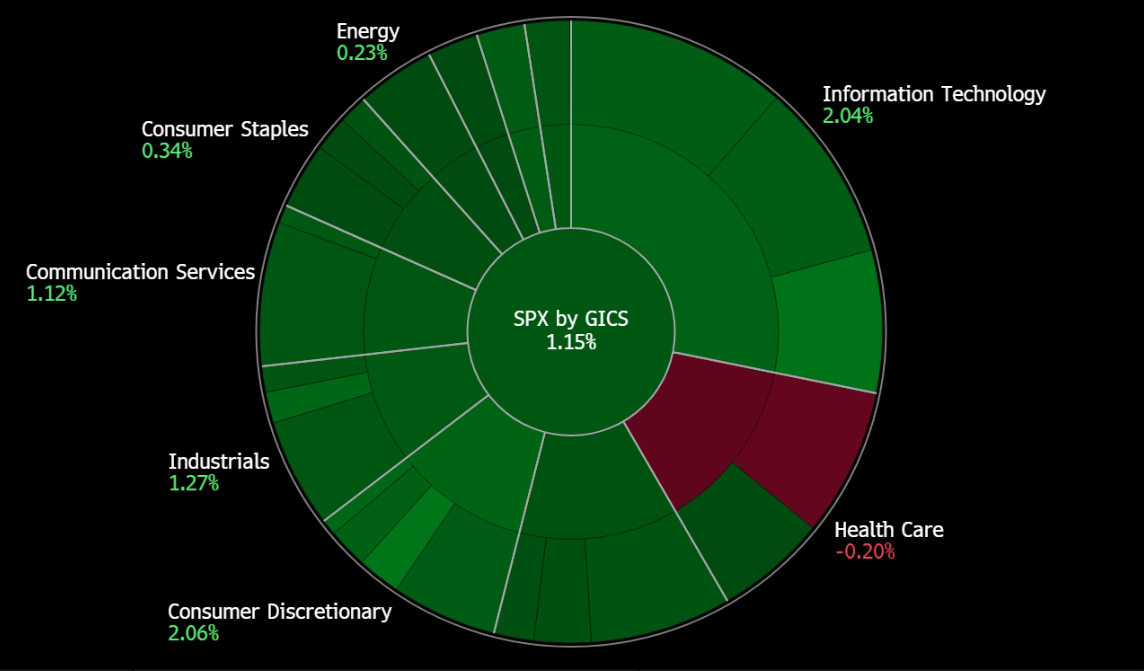

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

Yangzijiang Shipbuilding (YZJSGD SP): Double bonanzas-record order book and weak RMB

- BUY Entry 1.43 – Target – 1.57 Stop Loss – 1.36

- Yangzijiang Shipbuilding Holdings Limited builds a wide range of ships. The Company produces a wide range of commercial vessels, mini bulk carriers, multi-purpose cargo vessels, container ships, chemical tankers, offshore supply vessels, rescue and salvage vessels, and lifting vessels.

- Secures contract to build six mid-size container vessels. YZJ Shipbuilding just secured a contract with A.P. Moller-Maersk to construct six 9,000TEU methanol dual-fuel containerships in-house which are due for delivery between 2026 and 2027. They are designed to operate on green methanol and feature dual-fuel engines that can run on both fuel oil and methanol. With a capacity to carry over 9,000 containers, the new ships will replace existing vessels in Maersk’s fleet as part of their commitment to transitioning to greener options. Green methanol is reported to be able to significantly reduce nitrogen oxide (NOx) and sulphur oxide (SOx) emissions compared to conventional fuels. Moreover, considering the International Maritime Organization’s regulations that are pushing the shipping industry towards decarbonisation, it is highly likely that this contract is just the beginning of a series of future methanol dual-fuel fleet orders for YZJ Shipbuilding.

- Repeat customer. On June 25 it was announced that YZJ Shipbuilding had secured a contract from Klaveness Combination Carriers to construct three 83,300DWT third-generation CABU vessels, scheduled for delivery in 2026. The contract price for each vessel is US$56.4 million, with an estimated delivered cost of approximately US$60.5 million per vessel, including zero-emission readiness and shipyard supervision costs. These combination carriers can transport both wet and dry cargo, offering increased operational efficiency compared to single-purpose vessels. The new vessels will feature fuel-efficient solutions such as wind-assisted propulsion, reducing overall carbon dioxide (CO2) emissions by approximately 35%. This contract marks a repeat order from Klaveness Combination Carriers, highlighting the trust placed in YZJ’s delivery capabilities.

- YTD orderbook hits the full-year target. As of 26 June, YZJ Shipbuilding has secured orders for a total of 37 vessels. YTD, the company has obtained orders for 69 vessels, amounting to a value of US$5.6 billion, surpassing its target of US$3 billion for 2023. This has resulted in the highest-ever outstanding orderbook value for Yangzijiang, standing at US$14.6 billion for 180 vessels, as reported in an SGX filing. Among the newly ordered vessels, 16 are containerships, 11 are oil tankers, and 10 are bulk carriers.

- FY22 results review. Revenue for FY22 increased 24% YoY to RMB20.7bn. Net profit (ex-investment) grew 33% YoY to RMB2.6bn.

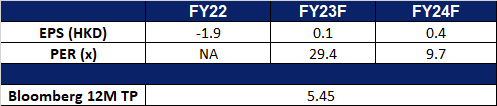

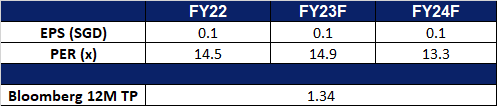

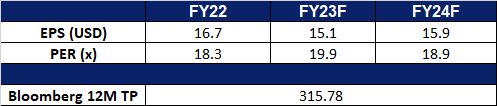

- Market consensus.

Share price and RMB price trend comparison

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

ComfortDelgro (CD SP): Peak Travel Season

- RE-ITERATE BUY Entry 1.15 – Target – 1.25 Stop Loss – 1.10

- ComfortDelGro Corporation Limited provides land transportation services. The Company offers bus, taxi, rail, car rental and leasing, automotive engineering services, inspection and testing services, driving center, insurance broking services, and outdoor advertising.

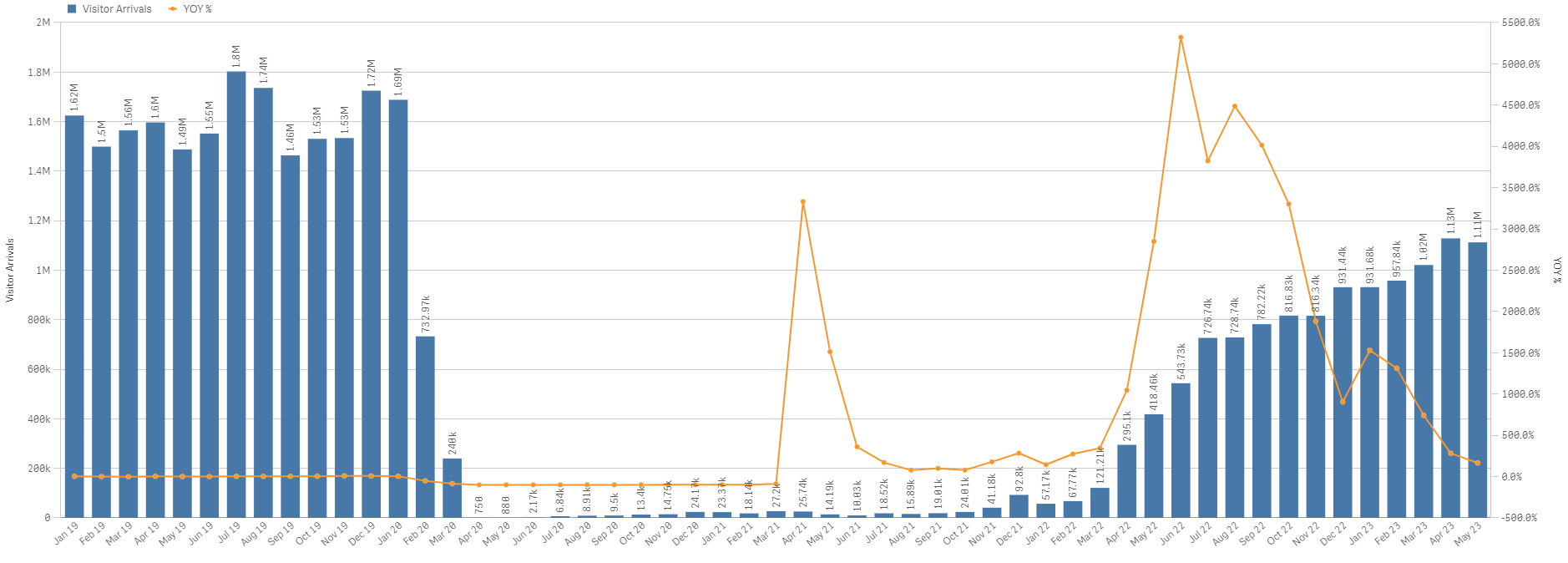

- Peak travel season drives demand for transportation. Longer waiting time were seen for taxis over peak travel season over the summer holidays. This boosted the demand for private transportation within Singapore, which was already recovering from the pandemic, as more employees return to the office. Supply of drivers has not been keeping up with the increase in demand for private transportation, as the supply of private drivers are only at around 80% of pre-pandemic levels, attributing to the long waiting time for ride-hailing passengers.

Comfort Delgro Seasonality Trend

(Source: Bloomberg)

Singapore Visitor Arrival Trend

(Source: Singapore Tourism Analytics Network)

(Source: Singapore Tourism Analytics Network)

- Platform fee to drive sales amidst higher demand. Comfort Delgro has recently made an announcement regarding their plans to implement a surcharge of 70 cents for taxi and private-hire car rides booked through their CDG Zig app starting from July 1, 2023. This platform fee has been introduced with the intention of further enhancing the quality of their point-to-point transport services. By implementing this additional fee, Comfort Delgro aims to leverage the increased demand for taxis during the peak travel period, ultimately boosting their sales.

- FY22 results review. Revenue rose by 7.94% YoY to S$3.708bn, compared to S$3.502bn in FY2021. Net profit rose by 40.7% YoY to S$173.1mn, compared to S$123.0mn in FY2021. EPS rose to 7.99 SG cents (+40.7% YoY) compared to 5.68 SG cents in FY2021.

- Market consensus.

(Source: Bloomberg)

China Resources Power Holdings Co. Ltd. (836 HK): Heat wave strikes

- RE-ITERATE BUY Entry – 16.0 Target – 17.8 Stop Loss – 15.1

- China Resources Power Holdings Company Limited is a Hong Kong-based investment holding company principally engaged in the investment, development and operation of power plants. The Company operates through three segments. Thermal Power segment is engaged in the investment, development, operation and management of coal-fired power plants and gas-fired power plants, as well as the sales of heat and electricity. Renewable Energy segment is engaged in wind power generation, hydroelectric power generation and photovoltaic power generation, as well as the sales of electricity. Coal Mining segment is engaged in the mining of coal mines, as well as the sales of coal. The Company mainly operates businesses in China.

- Higher temperatures expected. Last Friday, the China Meteorological Administration took action in response to the prediction of scorching heat and heavy rains expected to affect large areas of the country in the upcoming days. Beijing, the capital, elevated its hot weather warning to the highest level, designated as red, marking the first instance of such an alert being issued since the adoption of the new classification system in June 2015. Additionally, notable weather stations in Tianjin, as well as Hebei and Shandong provinces, experienced unprecedented high temperatures on the preceding Thursday. According to the administration’s forecast, heatwaves are anticipated to persist for a duration of 10 days in Beijing, Tianjin, other parts of North China, and select regions in Henan and Anhui provinces.

- Lower Coal Prices. The decline in global coal prices is expected to have significant benefits for the company’s coal-fired power plants and gas-fired power plants. With prices at a 2-year low around $130 per tonne, lower fuel costs for coal-fired power plants translate into improved profitability and a competitive advantage in the market. While China Resources Powers does have its own coal production plants, energy consumption during summer typically skyrockets for China, this means that the company will be required to buy coal from other suppliers to further supplement its energy production and will therefore benefit from the lower prices. Additionally, the predictability of prices enables better operational planning and mitigates risks associated with volatility. The declining prices also create opportunities for the company’s gas-fired power plants, as natural gas becomes a more cost-effective alternative. This diversification and cost advantage contribute to improved financial performance, market competitiveness, and the ability to offer competitive electricity prices to consumers. Overall, the decline in coal prices presents favourable conditions for the company’s power generation operations, enhancing profitability and sustainability.

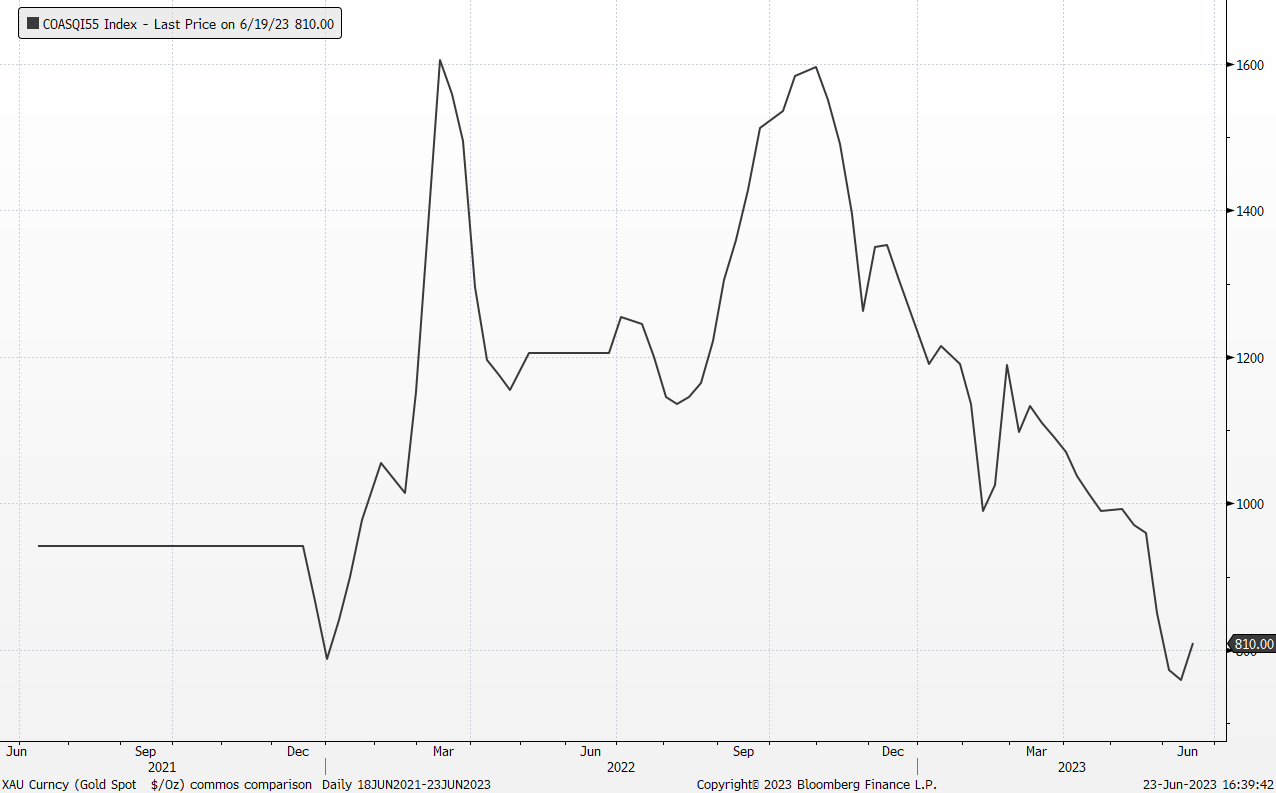

Thermal Coal Price

(Source: Bloomberg)

- Expansion of renewable projects. The city’s stock exchange has granted approval to China Resources Power (CRP) for the independent listing of its renewable energy division in Shenzhen. This decision enables CRP to generate additional funds that will be used to support the company’s ambitious growth plans in wind and solar power initiatives. Furthermore, the separate listing is expected to enhance the valuation of CRP’s assets, benefiting its shareholders.

- FY22 earnings. Revenue rose to HK$103.3bn, a 15.0% increase YoY. Net Income of HK$7.04bn was up 342% compared to FY2021.Net profit Margin rose to 6.8%, compared to 1.8% in FY2021

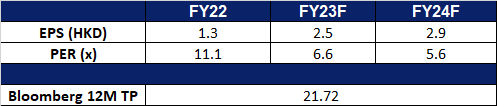

- Market Consensus.

(Source: Bloomberg)

China Southern Airlines Co. Ltd. (1055 HK): Incoming peak travelling season

China Southern Airlines Co. Ltd. (1055 HK): Incoming peak travelling season

- RE-ITERATE BUY Entry – 4.45 Target – 4.95 Stop Loss – 4.20

- China Southern Airlines Company Limited is principally engaged in the operation of civil aviation, including the provision of passenger, cargo, mail delivery and other extended transportation services. The Company operates through two business segments, including Airline Transportation segment and Other segment. Airline Transportation segment consist of passenger and cargo and mail operations. Other segment includes hotel and tour operation, ground services, cargo handling and other miscellaneous services. . The Company also provides services of general aviation and aircraft maintenance. The Company acts as an agency of domestic and foreign airlines, and other aviation and related business, such as personal accident insurance and agency business.

- More International flights. China Southern Airlines has recently unveiled a new flight route that connects Beijing and London. This development is part of the Chinese airlines’ ongoing efforts to expand their overseas routes in the wake of the pandemic. Operating seven times a week, the route departs from Beijing Daxing International Airport and arrives at London Heathrow Airport. It marks the first direct route operated by a Chinese airline between these two airports and offers a travel time of approximately 10 hours to reach London. This signifies the growing international travel demand worldwide, driven by China’s recovering economy and the gradual relaxation of post-pandemic restrictions.

- Peak travelling season. As the summer season approaches, many popular destinations in South East Asia and other parts of Asia such as Japan, anticipate a surge in tourist arrivals. Bookings in China for trips abroad have surge as China’s economy re-opens and consumers release their pent-up demand for travelling, presenting a increased in demand for international flights.

- 1Q23 earnings. The company saw a rise in Revenue to RMB34.06mn (+58.61% YoY), compared to RMB21.47mn in 1Q2022. Net Income rose 57.8% You to -RMB1.9bn. Basic EPS eased to -RMB0.1 compared to -RMB0.27 a year ago.

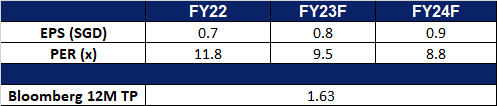

- Market Consensus.

(Source: Bloomberg)

Home Depot Inc (HD US): Improving US housing market

- RE-ITERATE BUY Entry – 300 Target – 320 Stop Loss – 290

- The Home Depot, Inc. is a home improvement retailer. The Company offers wide range of building materials, home improvement, lawn, and garden products, as well as provides DYI ideas, installation, repair, and other services. Home Depot serves customers worldwide.

- Housing shortage. The tightening supply of available homes is exacerbated by the current high-interest rate environment. Although there was a slight increase in existing home sales in May, overall market activity remained subdued. The rate-sensitive nature of the housing market has been negatively affected by the central bank’s decision to raise the benchmark lending rate as a response to inflation concerns. Furthermore, the inventory of homes for sale is significantly lower compared to pre-pandemic levels, amplifying the scarcity of housing options. This limited supply, combined with a decline in mortgage applications following the rise in interest rates, indicates that sales are likely to remain subdued in the near future. These factors indicate a housing shortage, as the demand for homes surpasses the available supply, making it challenging for potential buyers to find suitable and affordable housing options.

- US housing market is showing signs of a potential turnaround. Housing starts in May rose to a seasonally adjusted annual rate of 1.631mn units, the highest since April 2022, indicating strong demand. This marked a significant increase from April’s rate of 1.34mn units. Permits for future construction also saw a positive growth of 5.2% to the highest level since October. The National Association of Home Builders/Wells Fargo Housing Market Index in June rose above the midpoint mark of 50 for the first time since July 2022, further reflecting an improved outlook. Moreover, the average rate on the popular 30-year fixed mortgage has come down from its high above 7% in November. These figures indicate positive momentum in the housing market, which is expected to contribute to US economic growth in the second half of the year. While these trends suggest a potential recovery, it’s important to acknowledge the volatility of the housing market, with no guarantees of sustained improvement. Nevertheless, these developments could positively impact Home Depot’s sales as it operates in the home improvement sector.

- Housing shortage. In May, sales of existing homes in the United States increased slightly despite limited demand caused by a shortage of supply and high-interest rates. The housing market, which is sensitive to interest rate changes, has been impacted by the central bank’s decision to raise lending rates in order to address persistent inflation. Additionally, the availability of homes for sale is significantly lower than it was before the pandemic. Analysts have observed a decline in mortgage applications following an increase in interest rates, suggesting that sales may remain subdued in the near future. The National Association of Realtors reported a 0.2% rise in existing home sales from April, reaching a seasonally adjusted rate of 4.3 million, but compared to the previous year, sales were down by 20.4%.

- Look to improve. The shortage in the housing market has led to skyrocketing prices, further exacerbated by high mortgage rates. As a result, many homeowners may opt to improve their existing homes rather than purchase new ones. This shift in consumer behaviour can be attributed to the limited availability and increased cost of housing options. Homeowners, faced with inflated prices and limited choices, may invest in renovations, remodelling, and home improvement projects to enhance their living spaces. This trend is expected to drive increased sales of products and services offered by companies like Home Depot, as homeowners seek to upgrade their properties rather than enter the competitive and expensive housing market. With limited supply and soaring prices in the housing market, the focus on home improvements presents an alternative for homeowners to create their desired living spaces and contribute to the growth of businesses specialising in home improvement products and services.

30Y U.S. Home Mortgage Rates

(Source: Bloomberg)

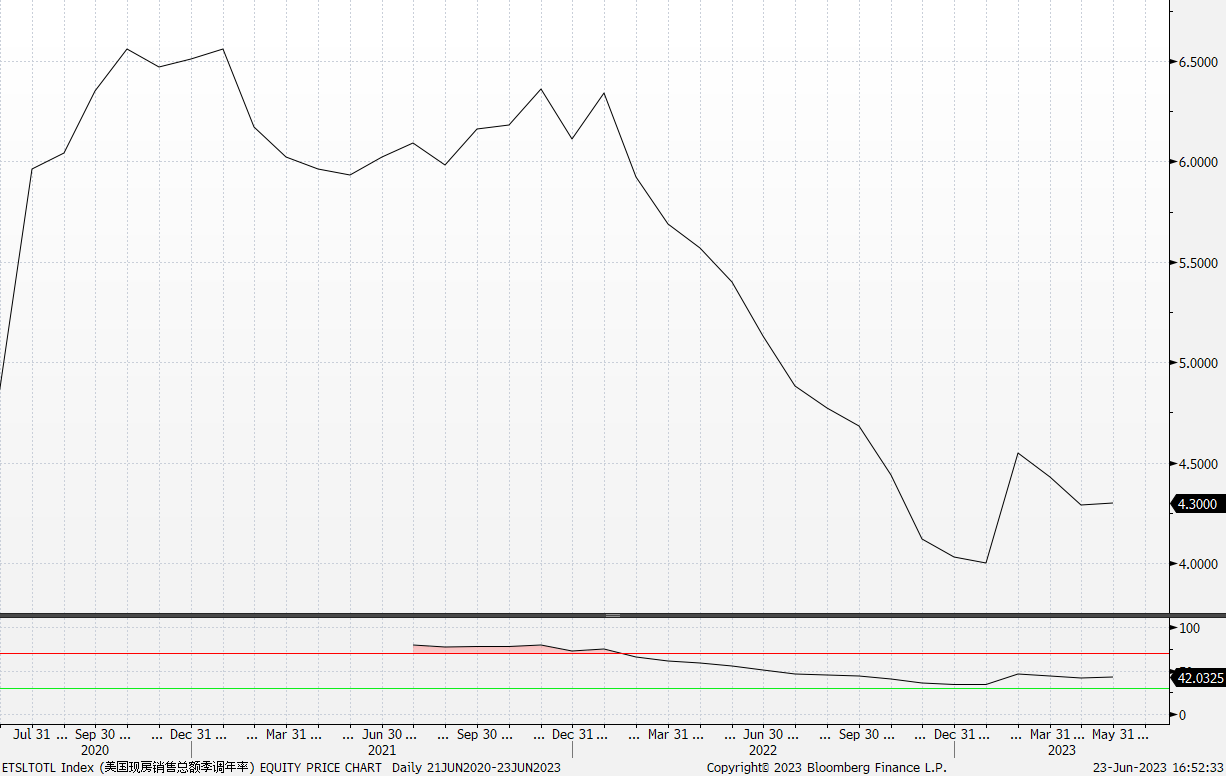

US National Association Realtors Total Existing Home Sales

(Source: Bloomberg)

(Source: Bloomberg)

- 1Q23 earnings review. Revenue fell 4.2% YoY to US$37.3bn, missing estimates by US$1.04bn. GAAP earning per share was US$3.82, $0.03 above expectations.

- Market consensus.

(Source: Bloomberg)

Livent Corporation (LTHM US): High in demand

Livent Corporation (LTHM US): High in demand

- RE-ITERATE BUY Entry – 26 Target – 30 Stop Loss – 24

- Livent Corporation produces and distributes lithium compounds. The Company offers lithium products for applications in batteries, agrochemicals, aerospace alloys, greases, pharmaceuticals, polymers, and various industrial applications. Livent serves customers worldwide.

- $9.2B loan for EV battery plants in the US. It was recently announced that the U.S. Department of Energy is set to provide a loan of up to $9.2 billion to a joint venture between Ford Motor and South Korea’s SK Innovation called BlueOval SK. The loan is the largest ever awarded by the Advanced Technology Vehicles Manufacturing (ATVM) program and will aid in the construction of three battery plants in Kentucky and Tennessee, with a combined annual production capacity of over 120-gigawatt hours. The aim of the loan is to strengthen domestic supply chains and promote their development within the United States. Additionally, the Inflation Reduction Act previously introduced a tax credit of $45 per kilowatt for battery production, which Ford estimates could result in over $7 billion in incentives for Ford and its battery partners. This support for domestic EV manufacturing is expected to drive greater demand for lithium in the future.

- Federal tax credit for electric vehicles (EV) in the US. Tesla’s Model 3 sedans, have become eligible for the full US tax credit under new criteria for battery-sourcing set by the US Treasury Department. This is part of the Biden administration’s plan to promote the adoption of electric vehicles. The updated eligibility now includes a total of 22 EV models, encompassing offerings from General Motors, Ford, Volkswagen, and other companies. As a result, this expansion of the tax credit availability to Tesla and other manufacturers is expected to have a positive impact on the demand for lithium and other materials used in EV battery production.

- Easier access to EV chargers. General Motors (GM) has announced a partnership with Tesla to gain easier access to the electric vehicle (EV) leader’s charging network and technologies. Through this deal, GM vehicles will be able to utilize Tesla’s fast chargers using an adapter and GM’s EV charging app, starting in 2023. Additionally, GM will adopt Tesla’s North American Charging Standard (NACS) instead of the current industry-standard CCS for its EVs from 2025 onwards. This collaboration is a significant win for Tesla and its charging technology, placing pressure on other automakers and the U.S. government to consider adopting Tesla’s approach. The partnership is expected to double the availability of fast chargers for GM and Ford customers, leading to increased demand for EVs and subsequently driving up the demand for lithium. Tesla’s extensive Supercharger network, which has approximately 45,000 connectors worldwide, will contribute to enhancing the public charging infrastructure, addressing a major concern for potential EV buyers and encouraging further adoption of electric vehicles.

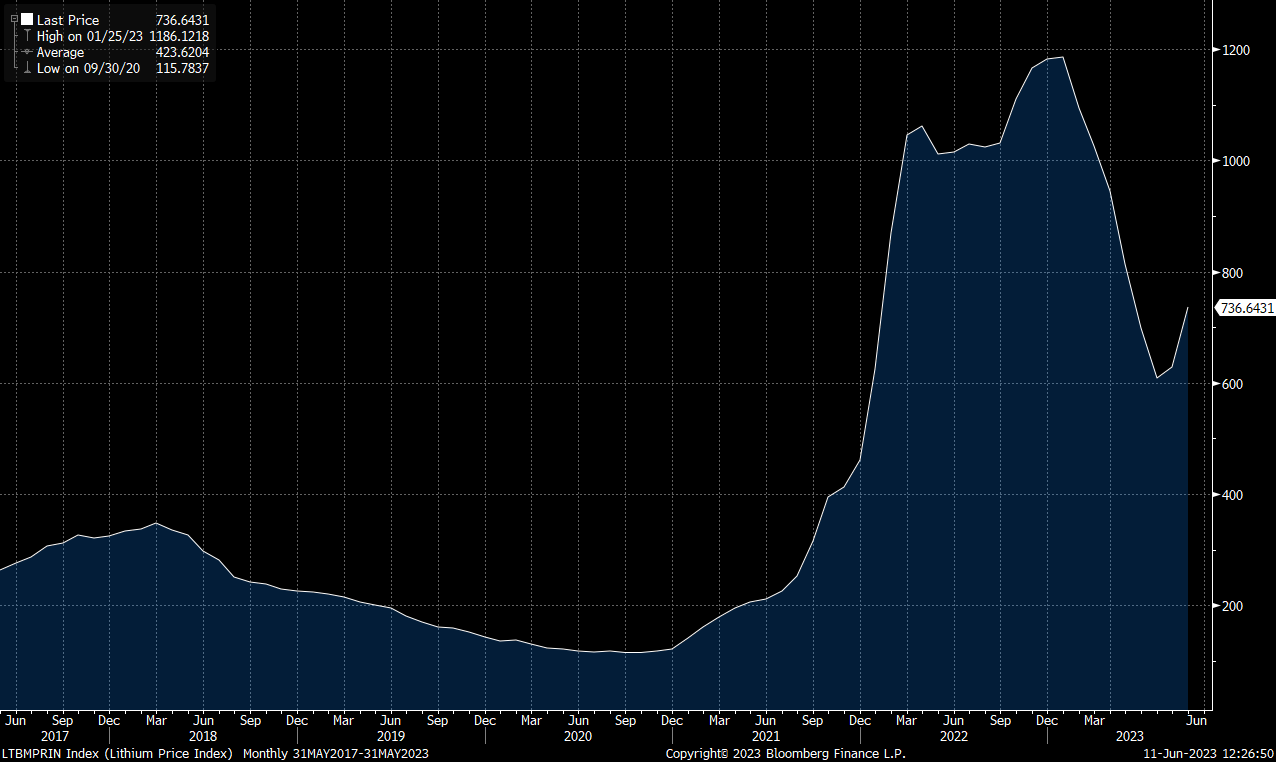

Lithium Price Index

(Source: Bloomberg)

- Increased demand for lithium batteries. As more EVs are being purchased, there is a greater demand for lithium batteries that are used to power these EVs. Tesla Inc reported a 2.4% increase in China-made EV deliveries in May compared to April, while sales rose by 142% on a yearly basis. Chinese automaker BYD Co Ltd also experienced a 14% sales growth in May for its EVs and hybrid vehicles. This surge in sales reflects the recovery in consumer spending and manufacturing activity in China, supported by favourable policies to boost vehicle consumption. The sales of new energy vehicles (NEVs) continue to rise, with significant growth seen in both NEV sales and vehicle charging equipment sales. This trend highlights the growing demand for EVs and the corresponding need for lithium batteries to power these vehicles.

- 1Q23 earnings review. Revenue rose 77% YoY to US$253.5mn, beating estimates by US$23.56mn. GAAP EPS of $0.55 beat expectations by $0.15.

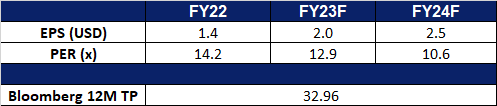

- Market consensus.

(Source: Bloomberg)

United States

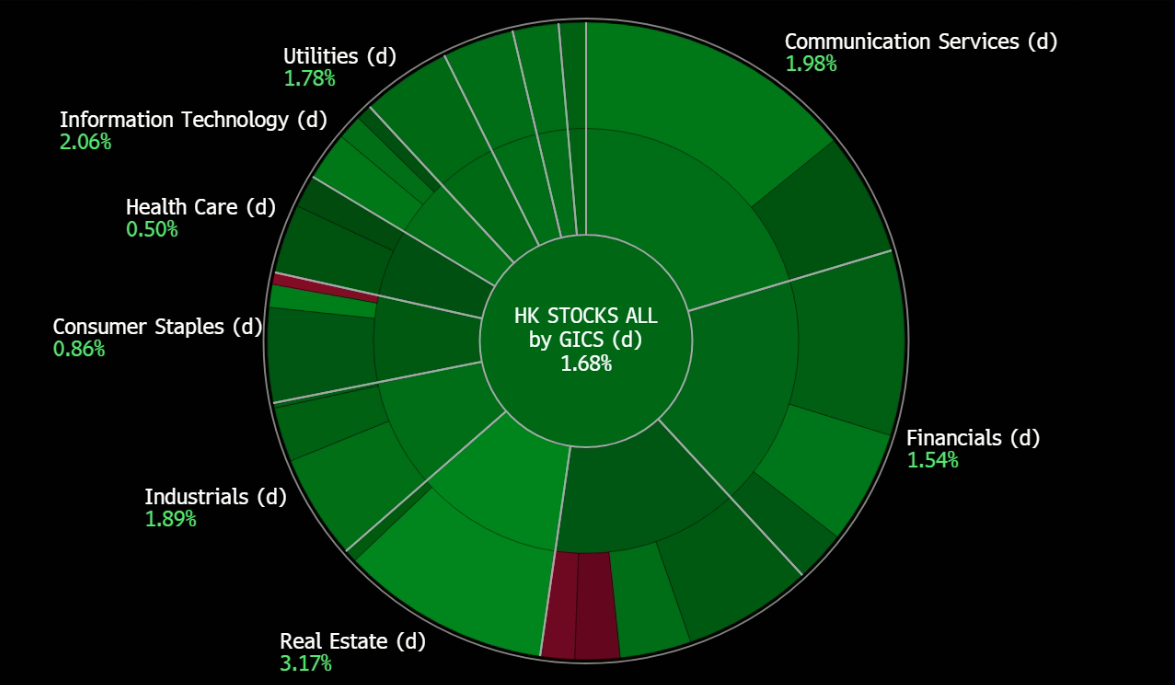

Hong Kong

Trading Dashboard Update: Take profit on Coinbase (COIN US) at US$62.0.