KGI DAILY MARKET MOVERS – 8 April 2021

IPO WATCH

TRIP.COM (TCOM US / 9961 HK) Secondary listing in Hong Kong

- TCOM is launching its Hong Kong public offering of 2.21mn shares at HK$333/share (US$42.95/share) and 29.4mn shares for the international offering.

- Offer period opens on Thursday, 8 April and closes on Tuesday, 13 April 2021. Allotment will be on Friday, 16 April and trading starts on Monday, 19 April.

- The company is a leading one-stop travel platform globally, integrating a comprehensive suite of travel products and services and differentiated travel content. It is the go-to destination for travelers in China, and increasingly for travelers around the world, to explore travel and get inspired, to make informed and cost-effective travel bookings, and to enjoy hassle-free, on-the-go support and share travel experience.

- While it reported net loss in 1Q and 2Q 2020 due to the negative impact of travel restrictions, earnings have recovered in 3Q and 4Q 2020. Looking into 2021, under the backdrop of supportive government policy towards opening inbound and outbound travel in 2H21, China Tourism Academy expects outbound travel to reach 30% of 2019 level, and 100% by 2022, assuming normal progress of Covid-19 vaccination.

- Valuations are currently attractive at 91x/24x/18x FY2021/22/23F and the company is forecasted to report earnings per share growth (EPS) of 85%/280%/33% in FY2021/22/23F, according to consensus estimates.

Financial Highlights:

| (RMB mn) | FY20 | FY19 | FY18 |

| Revenue | 18,316 | 35,666 | 30,965 |

| YoY growth | -48.6% | 15.2% | 15.6% |

| Gross profit | 14,285 | 28,294 | 24,641 |

| YoY growth | -49.5% | 14.8% | 11.4% |

| Net profit | -3,269 | 6,998 | 1,096 |

| YoY growth | N.M. | 538.5% | -49.6% |

Market share by gross merchandise volume as of 2019:

| Global market | Chinese Domestic market | ||

| Players | Market share | Players | Market share |

| Trip.com | 2.3% | Trip.com | 13.7% |

| A | 1.9% | A | 3.8% |

| B | 1.7% | B | 2.6% |

| C | 0.7% | C | 0.9% |

| D | 0.5% | D | 0.6% |

| Total | 7% | Total | 21.5% |

The key risk is that global prolonged COVD-19 lockdowns will slow down the recovery of tourism. According to market consensus, the company’s performance will normalise in FY22.

However, if quarantine measures or travel restrictions remain tight due to slow vaccination, full normalization will be delayed.

MARKET MOVERS

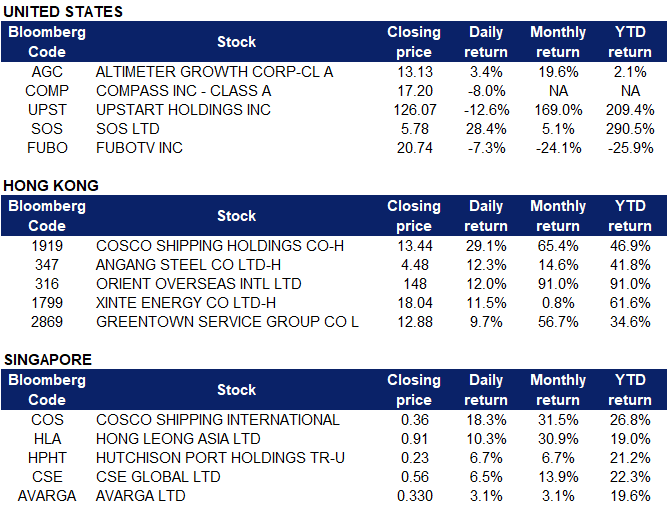

United States

- Altimeter Growth Corp 1 (AGC US) and its related tickers (AGCWW US, AGCUU US) climbed and closed above US$13 after Financial Times reported that the SPAC is in talks to merge with Grab, providing around US$1.2bn of financing to the food delivery and payment services giant.

- Compass Inc (COMP US) continued trading to new lows, closing below its IPO price of US$18 on Wednesday.

- Upstart Holdings (UPST US) fell back below US$130 after announcing a follow-on offering for 2 million shares of stock to the market.

- SOS Limited (SOS US) spiked on the back of no news, with market rumours pinning the move to a short squeeze. Short interest has risen from less than 8% to over 12% of SOS’s float since February after share prices briefly tripled amidst February’s crypto stock trading frenzy.

- FuboTV (FUBO US) closed at a 4-month low after a rating downgrade from Hold to Sell by Zacks Investment Research.

Hong Kong

- COSCO SHIPPING Holdings Co., Ltd., (1919 HK) The company released a positive profit alert for 1Q21. Net profit is expected to reach RMB15.45bn in 1Q21 compared to RMB292mn in 1Q20. As a comparison, FY20 full-year net profit was RMB9.9bn.

- Angang Steel Company Limited (347 HK) The company released a positive profit alert for 1Q21. Net profit is expected to reach RMB1.35bn in 1Q21 compared to RMB292mn in 1Q20. The FY20 full-year net profit was RMB2.0bn.

- Orient Overseas (International) Limited (316 HK) The shipping sector jumped, driven by COSCO Shipping’s exponential growth in 1Q21 net profit.

- Xinte Energy Co., Ltd. (1799 HK) The company announced the FY20 full-year results. Revenue grew by 54.9% YoY to RMB13.5bn. Net profit attributable to owners of the company grew by 72.7% YoY to RMB695.4mn. Management proposed a final dividend of RMB0.1.

- Greentown Service Group Co Ltd (2869 HK) Property management sector jumped. CLSA upgraded TP to HK$15.4 from HK$12.7 and maintained a BUY rating. Revenue CAGR from 2020 to 2025 is expected to be 38%. The target of total contracted GFA under management in FY21 is 150mn square metres. The managed GFA reached 250.5mn square meters as of FY20.

Singapore

- Cosco Shipping International (COS SP) +18% boosted by the positive spillover from the 29% surge of Cosco Shipping Holdings’ (1919 HK) shares in Hong Kong. While the HK-listed Cosco Shipping Holdings is benefiting from high freight rates and strong demand for seaborne transportation, the SG-listed entity is tilted towards logistics, with shipping making up only a small portion of its business.

- Yangzijiang (YZJSGD SP) and HPH Trust USD (HPHT SP) riding on positive sentiments in the container shipping sector as both shares gained 6-7% yesterday.

- Hong Leong Asia (HLA SP) +10%. CGS-CIMB initiated an ADD recommendation and S$1.18 target price; FY2021 net profit is forecasted to surge 54% YoY. The company operates three business segments: diesel engines, building materials and rigid plastic packaging.

- CSE Global (CSE SP) +7% after UOB Kay Hian upgraded CSE to a BUY recommendation and a higher target price of S$0.68 compared to S$0.53 previously. The company is set to benefit from rising oil prices, as well robust orders for its infrastructure and mining segments. CSE offers an above-average industry yield of 5%.

- AVARGA (AVARGA SP) +3% after it announced the incorporation of a wholly-owned subsidiary in Malaysia called UPP Paper Sdn. Bhd. In our view, this is likely a precursor to the listing of its paper manufacturing business, which the company said it was exploring last year. Its paper business is one of Malaysia’s top 5 paper mills and produces almost 10% of the country’s domestic output of brown packaging paper.