27 April 2022: Capitaland Integrated Commercial Trust (CICT SP), Anhui Conch Cement Company Limited (914 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE Trading Ideas

Capitaland Integrated Commercial Trust (CICT SP): A reopening play

- BUY Entry – 2.31 Target – 2.47 Stop Loss – 2.24

- CapitaLand Integrated Commercial Trust (CICT) is the first and largest real estate investment trust (REIT) listed on Singapore Exchange Securities Trading Limited (SGX-ST). CICT owns and invests in quality income-producing assets primarily used for commercial (including retail and/ or office) purposes, located predominantly in Singapore.

- A strong set of FY21 financials. CICT recorded gross revenue of S$1.3bn and distributable income of S$687.4mn in FY2021, an increase of 75.1% and 83% YoY respectively. DPU stood at 10.4 SG Cents in FY21, up 19.7% YoY from 8.69 SG Cents. As of 31 December 2021, CICT’s aggregate leverage was 37.2%, well below MAS’ regulatory limit of 45% to 50%. The average cost of debt was stable at 2.3% per annum.

- Reopening play. The Singapore government announced on 25 March 2022 that all vaccinated travellers can enter Singapore without quarantine from the first of April. Travellers will no longer be required to take only designated flights to enter Singapore quarantine-free, and will not have to take the antigen rapid test (ART) within 24 hours of arrival. This latest round of easing will make travelling as seamless as it was before the pandemic. Out of CICT’s Retail REIT portfolio, Clarke Quay’s occupancy was the lowest at 73.5% as of 31 December 2021. The recent easing of regulations which includes alcohol after 1030pm and the upcoming reopening of all nightlife activities, such as clubs and discos starting 19 April is expected to boost the laggard retail mall. As for CICT’s Office REIT portfolio, the occupancy rate is currently at 91.5% and further upside is driven by the relaxation to 75% of workers being able to return to office, compared to 50% previously.

- Inflationary hedge. Out of CICT’s total borrowings of S$8.6bn as of 31 December 2021, 83% are on fixed interest rates, which is able to shield the impact of upcoming interest rate hikes. In addition, because rents and property value tend to increase amidst the increase in overall prices, the REITs whose properties are able to capitalise on that can provide an inflation hedge.

- Recent acquisitions. On Friday (Mar 25), CICT and CapitaLand Open End Real Estate Fund (Coref) announced that they had entered into an agreement to acquire 79 Robinson Road with a respective 70% and 30% ownership.

- Positive consensus estimates. Currently, CICT has a consensus rating of 17 BUYS, 3 HOLDS and 0 SELL, and a 12M TP of S$2.45.

Capitaland Integrated Commercial Trust (CICT SP) (Source: Bloomberg)

Aztech Global (AZTECH SP): IoT enabler

- RE-ITERATE BUY Entry – 0.93 Target – 1.00 Stop Loss – 0.90

- Aztech provides Original Equipment Manufacturer (OEM), Original Design Manufacturer (ODM), Joint Development Manufacturing (JDM) or Contract Manufacturing Services (CMS) services to brand owners sold under the label of the respective customers. The company distributes a wide range of IoT devices and Data-communication products sold under its proprietary “Aztech” and “Kyla” brands through channel partners and e-commerce platforms. In addition, the company manufactures a wide range of LED lighting products used in residential, commercial and industrial applications.

- Missed expectations. On 18 April, Aztech posted 1Q results which missed expectations, making up only 15% of consensus full-year forecast. While the company posted a 10% YoY revenue increase to S$128mn and a 5% YoY increase in net profit to S$14mn, management said that inflationary cost pressure negated improvements in revenue and led to margin compression of between 60 to 110 bps for its net profit. Furthermore, Aztech’s Dongguan factory was closed in March due to the Covid-19 restrictions.

- Strong outlook. Aztech’s strong order book of S$677mn as at end March 2022 puts it in a favourable position when Covid-19 restrictions start to loosen up in China. The company remains a locally-listed proxy for the high-growth Internet of Things (IoT) trend.

- Positive consensus estimates and attractive valuations. There are currently 4 BUY recommendations and a 12m average TP of S$1.40, implying a 47% return from the last close price. Aztech trades at attractive valuations of 8x and 7x FY2022 and FY2023F, and offers a higher-than-average industry dividend yield of 4.4% and 5.2% in FY2022 and FY2023. Net cash of S$187mn as at end Dec-2022 makes up 25% of market cap.

Aztech Global (AZTECH SP) (Source: Bloomberg)

HONG KONG Trading Ideas

Anhui Conch Cement Company Limited (914 HK): Expecting infrastructure expansion to revive the weak economy

- BUY Entry – 38 Target – 42 Stop Loss – 36

- Anhui Conch Cement Co Ltd is a China-based company principally engaged in production and sale of cement, commodity clinker and aggregate. The Company’s main cement products included 32.5-grade cement, 42.5-grade cement and 52.5-grade cement, which are widely used in construction projects of large-scale national infrastructures such as railways, expressways, airports and hydraulic power as well as urban property, cement products and the rural markets. The Company distributes its products within the domestic market and to overseas markets.

- A new round of loosening monetary policy. On April 15th, PBOC lowered the requirement reserve ratio by 25bps but kept the one-year loan prime rate at 2.85%. There will be RMB530bn (US$83.25bn) in long term liquidities released in the banking system, buffering the slowdown in the economy due to lockdowns in main cities. Previously, China’s central government drew up lists of infrastructure projects totalled at US$2.3tn. It is evident that China will resort to government spending to boost the economy in the near term.

- China cement price holding up well. As of 25th April, China cement price index (CEMPI) grew by 9.13% YoY to 169.76. The index has been consolidating at the current level YTD. The supply and demand dynamics are relatively balanced as the production and the consumption declined due to lcokdowns of cities.

China Market Price of Commodities Ordinary Portland Cement P.C 42.5 in Bulk

- FY21 financials review. Revenue mildly dropped by 4.7% YoY to RMB168bn. Gross profit mildly dropped by 3.3% YoY to RMB48.6bn. GPM increased by 0.4ppt. Net profit dropped by 5.3% YoY to RMB32.2bn. NPM was flat at 19.2%. The company will announce the 1Q22 results on 28th April Thursday.

- The updated market consensus of the EPS growth in FY22/23 is -3.3%/2.9% YoY respectively, which translates to 5.4x/5.2x forward PE. The current PER is 5.2x. FY22F/23F dividend yield is 7%/7.2% respectively. Bloomberg consensus average 12-month target price is HK$55.02.

Anhui Conch Cement Company Limited (914 HK) (Source: Bloomberg)

Xinjiang Goldwind Science & Tech Co Ltd (2208 HK): Headwinds already priced in

- RE-ITERATE BUY Entry – 10.8 Target – 12.5 Stop Loss – 10.0

- Xinjiang Goldwind Science & Tech Co Ltd is a China-based company, principally engaged in the manufacture and distribution of wind turbine generator sets and spare parts. The company is also engaged in the provision of wind power services, as well as the investment and development of wind farms. The company distributes its products within domestic and overseas markets.

- Expecting bottom-out after the headwinds. China’s economy will hit a speed bump in 2Q22 due to a surge in Covid infection in major cities and ensuing lockdowns. Domestic supply chains are disrupted, and manufacturing activities are halted. PBOC lowered the required reserve rate a week ago. To revive the economy, China will probably resort to infrastructure expansion, and clean energy projects will be one of key propellants. According to BloombergNEF, prices for turbines in China plummeted from about US$700,000 per megawatt in early 2020 to about US$470,000 at the end of 2021. Currently, the bid for new projects averages at about US$370,000. Xinjiang Goldwind’s Chairman commented that the price of wind turbines had reached the bottom, and there was no room for further price declines.

- FY21 financials and operations review. FY21 operating revenue dropped by 10.2% YoY to RMB50.4bn. Net profit attributable to owners of the company grew by 16.7% YoY to RMB3.4bn. The decline in revenue was due mainly to the offshore wind sector experiencing rush-to-installation and the onshore wind sector entering the era of grid-parity. The company will announce its 1Q22 earnings on 26th April Tuesday.

Revenue breakdown

Operation breakdown

The updated market consensus of the EPS growth in FY22/23 is 18.9%/9.4% YoY respectively, which translates to 10.3x/9.4x forward PE. The current PER is 12.4x. Bloomberg consensus average 12-month target price is HK$16.08.

Xinjiang Goldwind Science & Tech Co Ltd (2208 HK) (Source: Bloomberg)

MARKET MOVERS

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Coal | +7.0% | Arch Resources Swings to 1Q Profit Despite Headwinds — Commodity Comment Peabody Energy Corp (BTU US) |

| Industries Specialities | +2.7% | Sherwin-Williams Co Q1 Profit Decreases, but beats estimates Sherwin-Willians Co (SHW US) |

| Environmental Services | +2.1% | Waste Management Posts Higher 1Q Profit, Revenue Waste Management Inc (WM US) |

Top Sector Losers

| Sector | Loss | Related News |

| Motor Vehicles | -9.1% | Tesla loses $126 billion in value amid Musk Twitter deal funding concern Tesla Inc (TSLA US) |

| Apparel/Footwear | -5.4% | N/A Nike Inc (NKE US) |

| Industrial Machinery | -4.9% | GE Stock Dives As General Electric Gives Tepid 2022 Outlook, Citing Ukraine, China General Electric Co (GE US) |

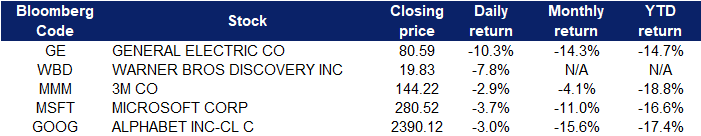

- General Electric Co (GE US) shares slid 10.3% despite the industrial company reporting top and bottom line beats for the first quarter. CEO Lawrence Culp said GE is “trending toward the low end” of its guidance due in part to inflation pressure. Additionally, pressures from supply chain issues, the war in Ukraine and the spread of Covid hurt GE’s revenue by six percentage points, Culp said.

- Warner Bros. Discovery (WBD US) shares fell 7.8% after the company warned its 2022 profit would be lower than expected. Chief financial officer Gunnar Wiedenfels cited “unexpected projects” and weaker first-quarter WarnerMedia operating profit on the company’s earnings call.

- 3M Co (MMM US) shares fell 2.9% despite the company reporting quarterly earnings and revenue that came in above consensus estimates. 3M also said it anticipates weaker mask demand and rising cost pressures.

- Microsoft Corp (MSFT US), Alphabet Inc (GOOG US). Tech stocks led the decline Tuesday as investors did not wait around for Microsoft and Alphabet first-quarter results after the bell, fearing more blow-ups like the one seen in Netflix earlier in the earnings season.

Singapore

- Dyna-Mac Holdings Ltd (DMHL SP) shares surged 24.5% yesterday. Dyna-Mac has secured two new contracts, bringing its net order book to date to S$461.1 million, and also entered into two new strategic alliances. The total value of the two new contracts is estimated at about S$90.3 million. Dyna-Mac has also informed it has entered into strategic agreements with partners Malaysia Marine and Heavy Engineering (MMHE) and MAN Energy Solutions Switzerland (MAN ES).

- Sembcorp Marine Ltd (SMM SP) shares rose 7.4% yesterday. The deadline for a transformative deal between Keppel Corp and Sembcorp Marine is just days away. Shares of both companies have surged on expectations that they will decide on combining their oil rig businesses into a separate entity by the end of April, with some expecting further gains.

- Bumitama Agri Ltd (BAL SP) and First Resources Ltd (FR SP) shares rose 5.4% and 4.2% respectively yesterday. Malaysian palm oil futures rebounded to above MRY 6,400 per tonne, on renewed supply worries after Indonesia said that if there is a domestic shortage of refined palm oil, then further export bans can be carried out. Last week, Indonesian President Joko Widodo announced a decision to ban shipments of cooking oil and its raw material starting April 28th to bring down domestic prices. The ban covers shipments of refined palm olein but not crude palm oil. Malaysia is the world’s second-largest producer of palm oil after Indonesia, and its producers have said they cannot meet the global supply gap that will be triggered by Indonesia’s ban on palm oil exports. Even before Indonesia’s ban, palm supplies were already low on drought and shortages from Russia’s invasion of major crop producer Ukraine.

- Geo Energy Resources Ltd (GERL SP) shares rose 4.7% yesterday. Newcastle coal futures, the benchmark for top consuming region Asia, moderated to $326 per ton, close to a five-week high of $331.1 reached last Thursday, supported by skyrocketing demand amid tight supplies of alternative energy products and sanctions on Russian coal.

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Medicine | +2.41% | China’s vaccine makers get stock market jolt as rivalry, price cuts undermine earnings outlook Shanghai Fosun Pharmaceutical (Group) Co., Ltd. (2196 HK) |

| Agricultural, Poultry & Fishing Production | +1.91% | Chinese officials are quick to embrace alternative protein research WH Group Ltd (288 HK) |

| Accessories & Leather Goods | +1.62% | NA Prada S.p.A. (1913 HK) |

Top Sector Losers

| Sector | Loss | Related News |

| Nonferrous Metal | -2.09% | Copper to Iron Ore Rebound as China Vows to Support Economy China Hongqiao Group Limited (1378 HK) |

| Precious Metal | -1.42% | Gold prices settle at a 2-month low as investors sidestep the metal for more attractive safe havens Zijin Mining Group Company Limited (2899 HK) |

| Insurance | -1.29% | China’s First Ever Private Pension Scheme – What You Need to Know Ping An Insurance (Group) Company of China, Ltd. (2318 HK) |

- Shanghai MicroPort MedBot Group Co Ltd (2252 HK) Shares rebounded from a consecutive four trading days’ losses. There was no company-specifc news. The jump in price could be due to short covering movements as the volumes surged.

- ZTO Express (Cayman) Inc (2057 HK) Shares rebounded from a consecutive five trading days’ losses. There was no company-specifc news. According to the Xinhua news agent, China’s logistics sector reported steady growth in the first three months of 2022. Social logistics rose 6.2% YoY in the first three months to 84 trillion yuan (12.8 trillion U.S. dollars), said the China Federation of Logistics and Purchasing in an industry report. The ratio of social logistics to GDP reached the highest level since 2020, indicating that logistics demand has provided strong support for economic growth, the federation said. Logistics for industrial products went up 6.5% YoY in the first quarter, up 2.6 percentage points from the previous quarter.

- Pop Mart International Group Ltd (9992 HK) The company announced its 1Q22 results yesterday. The unaudited overall revenue recorded positive growth of 65% -70% YoY. Retail stores recorded positive growth of 75%-80% YoY. Roboshops

- recorded positive growth of 5%-10% YoY. Pop Draw recorded positive growth of 115%-120% YoY. E-commerce platforms and other online platforms recorded positive growth of 65%-70% YoY (of which Tmall flagship store recorded positive growth of 60%-65% YoY and JD.com flagship store recorded positive growth of 105%-110% YoY). Wholesales and other channels recorded positive growth of 25%-30% YoY.

- Shanghai Fosun Pharmaceutical (Group) Co., Ltd (2196 HK) The company announced its 1Q22 results yesterday. Revenue grew by 28.87% YoY to RMB10.4bn. Net profit excluding non-recurring profits and losses attributable to company shareholders grew by 21.73% YoY to RMB801mn.

- Li Auto Inc (2015 HK) There was no company-specific news. China unveiled guidelines to further tap the country’s consumption potential, with detailed measures to tackle short-term bottlenecks and boost longer-term consumption vitality. It will tap the consumption potential in the country’s vast rural areas, promoting the sales of automobiles and home appliances in these regions. The guidelines encouraged cities to phase out auto-consumption restrictions based on their own conditions to keep the consumption of vehicles stable.

Trading Dashboard

Trading Dashboard Update: No additions and deletions of any stocks.