22 April 2024: Genting Singapore Ltd. (GENS SP), Jiangxi Copper Co. Ltd. (358 HK), General Mills, Inc. (GIS US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

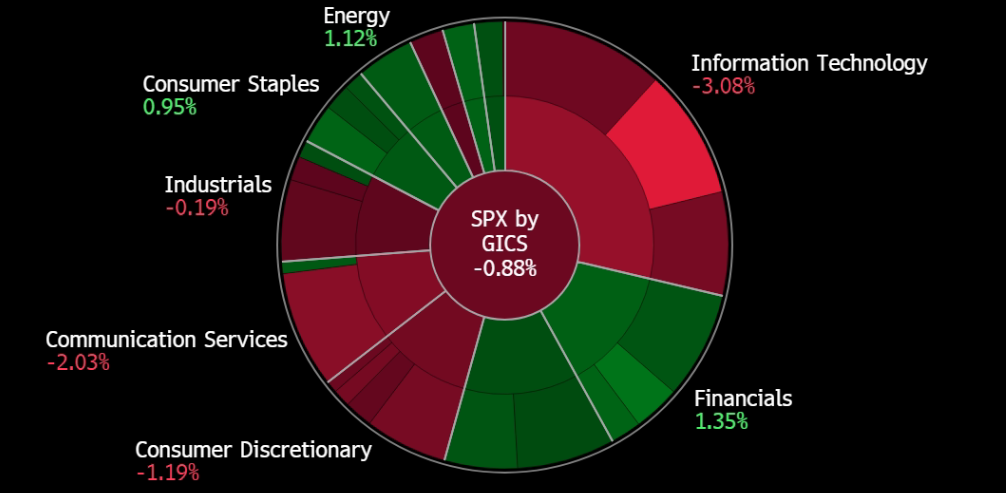

United States

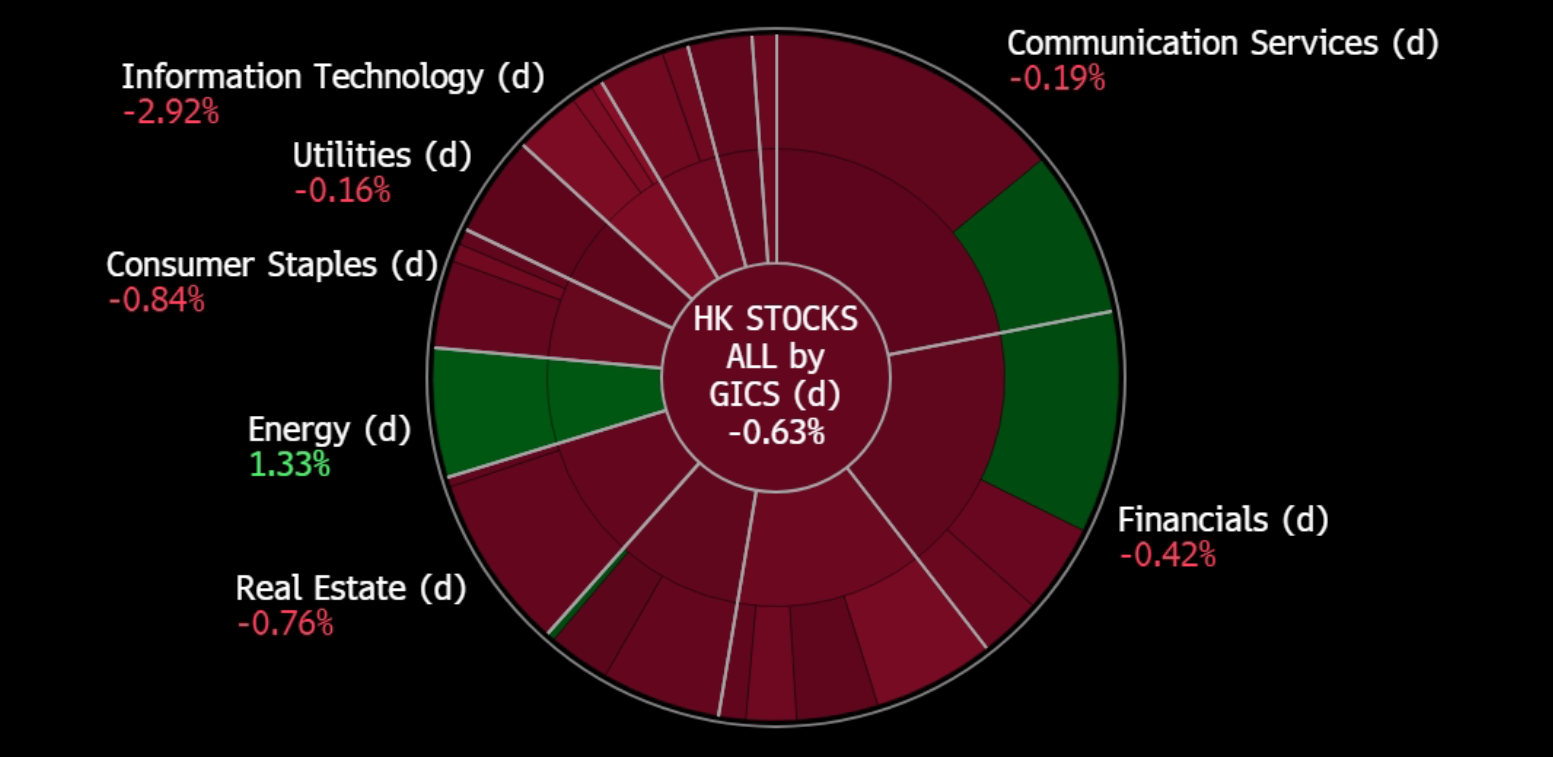

Hong Kong

Genting Singapore Ltd. (GENS SP): Expectations of strong results

- BUY Entry – 0.910 Target– 0.980 Stop Loss – 0.875

- Genting Singapore Limited, through its subsidiaries, develops resort properties as well as operates casinos. The Company has casinos and integrated resorts in different parts of the world, including Australia, the Americas, Malaysia, the Philippines and the United Kingdom.

- Expectations of good results. Marina Bay Sands (MBS) recently released good results, delivering record levels of financial and operating performance for 1Q24, with profits surging 51.5% YoY. Las Vegas Sands, the parent company of MBS, expects MBS’ new suite product and elevated service offerings to help drive additional growth for the company as airlift capacity continues to improve and travel and tourism spending in Asia continues to advance. The positive results reflect the strength of the hospitality and entertainment industry and bring about positive expectations towards Genting Singapore’s results.

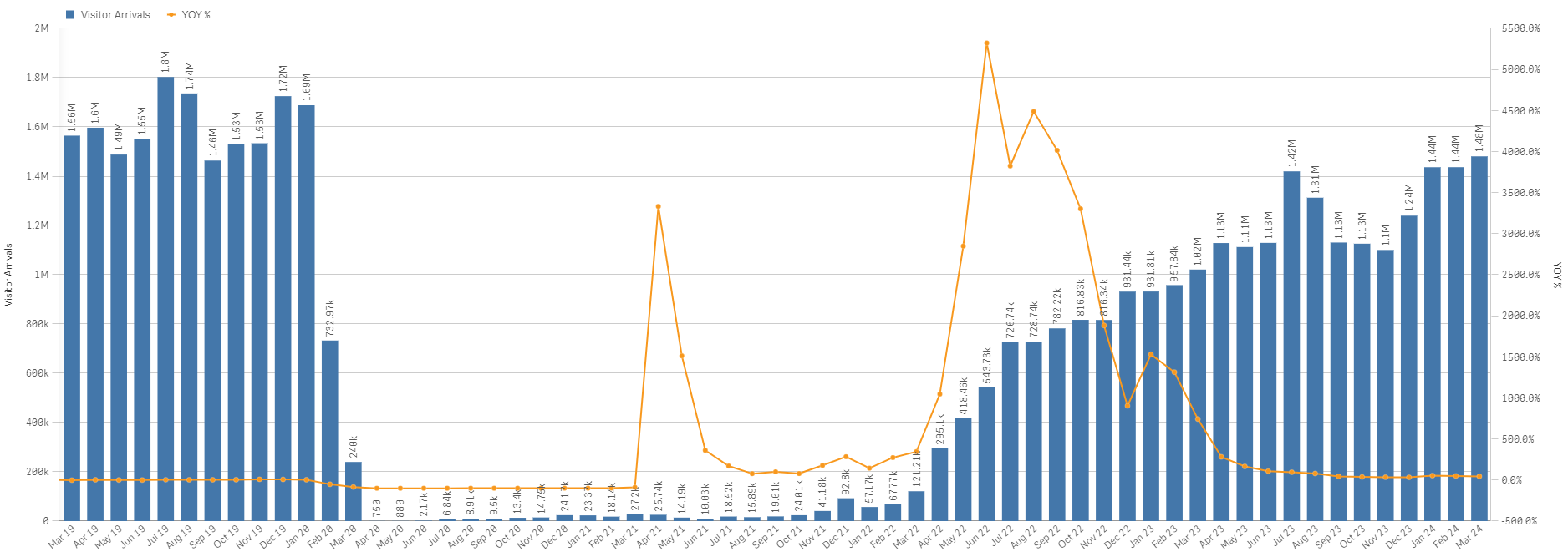

- Continued strength in International Tourist Arrivals. The Singapore Tourism Board projects continued tourism recovery in 2024, anticipating 15-16mn visitor arrivals and tourism receipts of S$26-27.5bn. Although pre-pandemic arrival numbers are not expected, tourist spending is anticipated to nearly match 2019 levels. In March, Singapore welcomed 1.48mn visitors, (+45.1% YoY), reaching a record high level since the onset of the COVID-19 pandemic. The surge is credited to improved flight connectivity, factors like the mutual visa-free travel arrangement with China, and ongoing efforts to attract diverse visitors. The sector’s resilience is underscored by 2023’s strong performance, characterized by longer stays, expanded hotel capacity, and successful event hosting. STB’s strategy focuses on enhancing visitor experiences and prolonging stays to attract higher-spending tourists, prioritizing quality over quantity. This approach aligns with Singapore’s reputation for premium experiences and top-notch connectivity. Despite potential economic challenges, an emphasis on value-added experiences could help to sustain tourist spending, even if arrival numbers do not rebound to pre-pandemic levels until 2025.

Singapore monthly visitor arrivals trend – Jan 2019 to Mar 2024

(Source: Singapore Tourism Analytics Network)

- RWS expansion on track. On 2 March, the Hard Rock Hotel Singapore at Resorts World Sentosa will close to undergo renovations for the complex’s planned expansion. The 360-room hotel will receive a complete overhaul. This aligns with Genting Singapore’s previously announced plans to invest around S$6.8bn to revamp and enlarge the resort, which includes the development of a new luxury hotel and waterfront complex with 700 hotel rooms. Other ongoing projects include the transformation of The Forum shopping area, the development of a new Minion Land attraction, and the rebranding of SEA Aquarium to the Singapore Oceanarium, all of which are expected to partially open in early 2025.

- FY23 earnings. Revenue rose to S$2.42bn in FY23, rising 40.1% YoY, compared to a revenue of S$1.73bn in FY22. The company’s net profit rose to S$611.6mn in FY23, +79.8% YoY, compared to S$340.1mn in FY22. Basic EPS rose to 5.07Scents in FY23, compared to 2.82Scents in FY22. Its gaming revenue rose 34% YoY to S$1.65bn and its non-gaming revenue jumped 58.6% YoY to S$758.2mn.

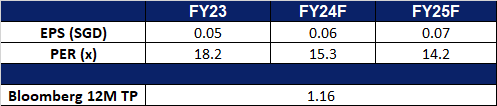

- Market Consensus.

(Source: Bloomberg)

Frencken Group Ltd. (FRKN SP): Tailwinds from the barometer of semicon

- RE-ITERATE BUY Entry – 1.60 Target– 1.90 Stop Loss – 1.45

- Frencken Group Limited (“Frencken”) is a Global Integrated Technology Solutions Company that is listed on the Main Board of the Singapore Exchange. They provide comprehensive Original Design, Original Equipment and Diversified Integrated Manufacturing solutions for world-class multinational companies in the analytical & life sciences, automotive, healthcare, industrial and semiconductor industries.

- Good 2Q24 guidance from TSMC. Taiwan Semiconductor Manufacturing Co. (TSMC) reported a 9% increase in net profit for the first quarter of 2024, surpassing market expectations amid a surge in demand for semiconductors utilized in artificial intelligence applications. TSMC also recently disclosed its fastest sales growth since 2022, indicating that the rising demand for chips driving AI development is starting to offset the effects of a slowdown in the smartphone market. Looking ahead to 2Q24, the company anticipates strong support from the robust demand for its cutting-edge 3-nanometer and 5-nanometer technologies, forecasting revenue to fall between $19.6bn and $20.4bn. Additionally, TSMC projects a more than twofold increase in revenue contribution from server AI processors this year. Despite challenges, the company maintains its expectation for revenue to grow by at least 20% this year as the broader semiconductor market rebounds. This positive trajectory is expected to extend to Frencken’s semiconductor segment, which represented approximately 40% of its Q3 revenue.

- Continued demand for AI Chips. Applied Materials, Frencken’s main customer, announced an earnings beat for FY23 and expects continued outperformance as customers ramp up next-generation chip technologies critical to AI and the Internet of Things. Their key customer, Taiwan Semiconductor Manufacturing Co., also delivered a good set of results for 1Q24 and provided a promising guidance for 2Q24, riding on a wave of global AI development. These strong demands for AI chips would translate to more revenue growth for Frencken.

- FY23 results review. FY23 revenue declined by 5.5% to $742.9mn, compared to $786.1mn in FY22. Net profit plunged 38.1% YoY to $32.0mn due to challenging business conditions for the technology sector, compared to $51.6mn in FY22. Gross profit margin contracted to 13.2% in FY23 from 15.1% in FY22, attributing it to lower revenue, inflationary cost pressures as well as increased depreciation expenses.

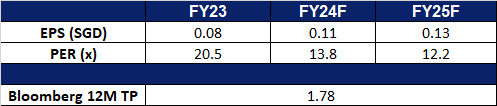

- Market Consensus

(Source: Bloomberg)

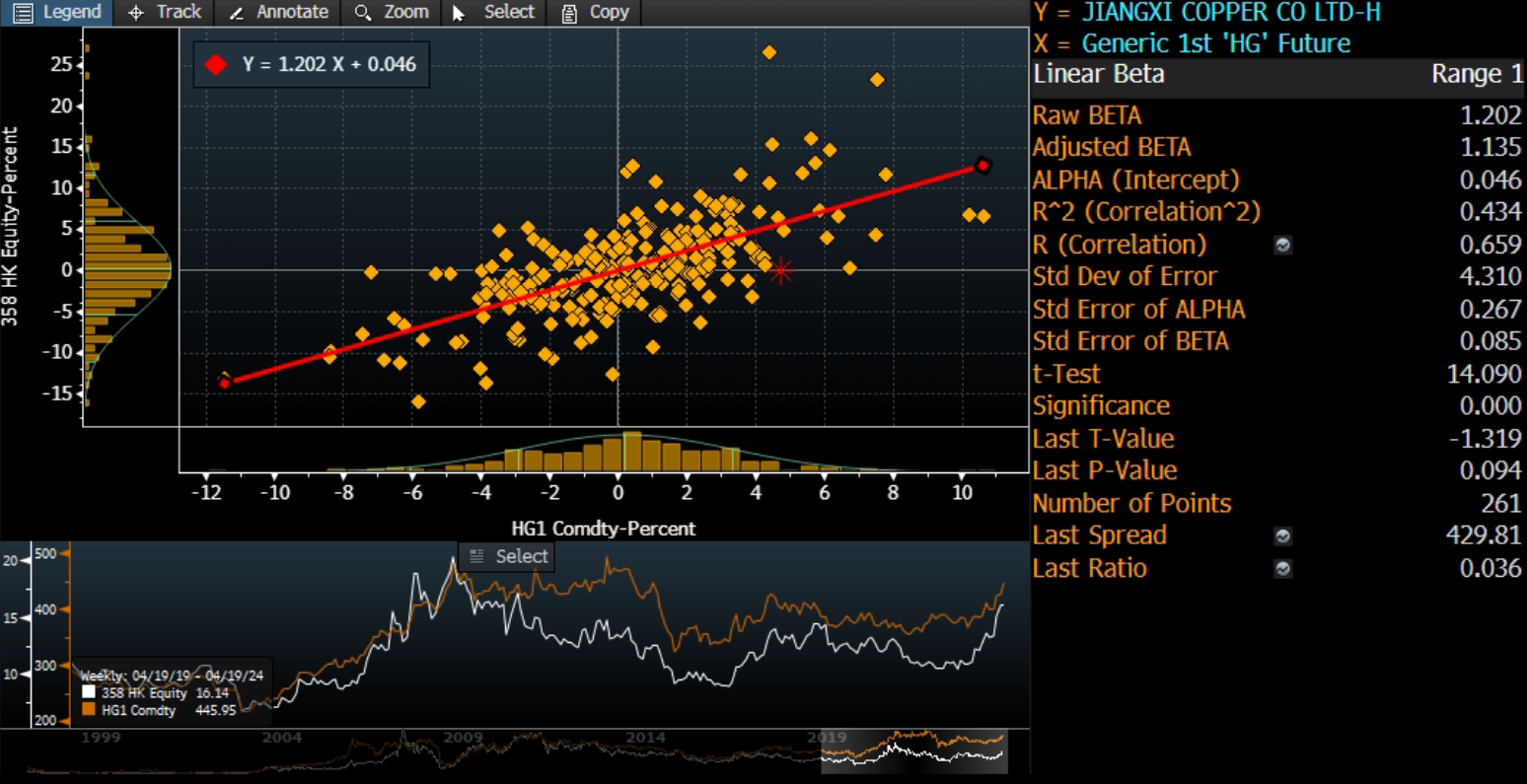

Jiangxi Copper Co. Ltd. (358 HK): Copper price surge

- BUY Entry – 16.0 Target – 17.4 Stop Loss – 15.3

- Jiangxi Copper Company Limited is a China-based company, principally engaged in the mining, smelting and processing of copper. The Company is also engaged in the extraction and processing of precious metals and dissipated metals, sulfur chemical industry business, and financial and trading businesses. The company’s products include cathode copper, gold, silver, sulfuric acid, copper rods, copper foils, selenium, tellurium, rhenium, bismuth and others. The Company mainly conducts its businesses within Mainland China and Hongkong.

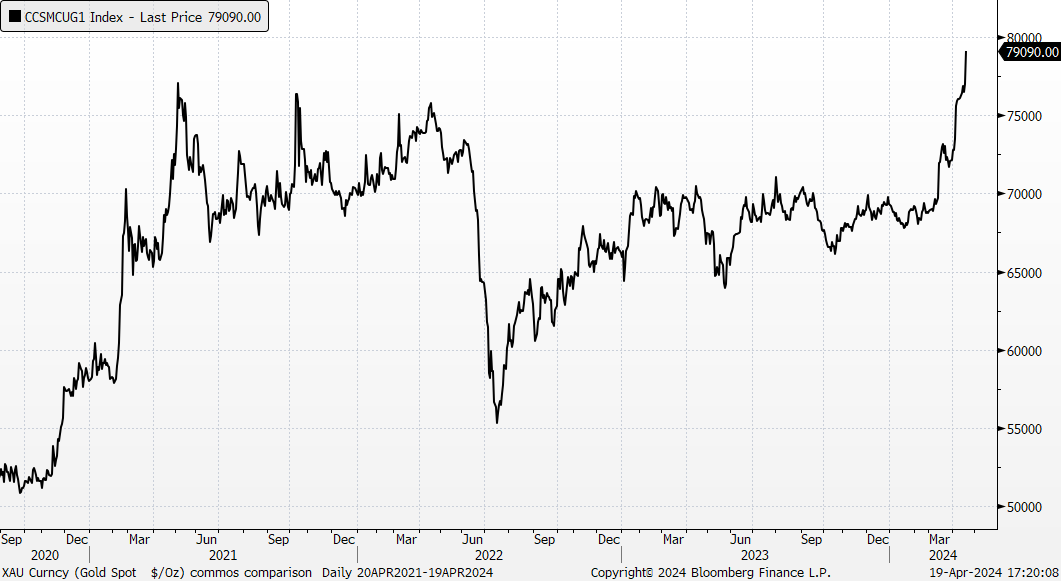

- Copper price rally. Copper futures surged to above US$4.4 per pound in April, the highest in nearly two years, as concerns of low supply were met with signs of traction in demand. Satellite data showed that copper smelters in China, the world’s top producer of refined copper decreased activity levels to act, in line with pledges that their output could fall up to 10% this year. The moves mark a response to the low supply of copper ore for Chinese smelters, magnifying the sector’s overcapacity to drive smelting fees to their lowest in years. On the demand side, improving demand from China drove imports of unwrought copper to surge by 16% to 474,000 tonnes in March, aligning with strong manufacturing PMIs for the period and suggesting that factories may be gaining some traction following prolonged pessimism. The spike in copper prices will benefit Jiangxi Copper’s revenue.

China Shanghai copper spot price (RMB/tonne)

(Source: Bloomberg)

- Increasing global demand for Copper. Despite facing global supply challenges, the demand for copper continues to thrive, driven by factors such as the energy transition and advancements in technologies like artificial intelligence (AI). This persistent demand suggests a bullish trajectory for the versatile metal, projected to endure for the next three years. As data centers evolve to support AI servers, the need for copper is anticipated to remain robust. Additionally, the global shift toward electric vehicles (EVs) adds another layer of demand for copper, as EVs require four times as much copper as traditional combustion-engine vehicles.

- FY23 earnings. Revenue rose 8.74% YoY to RMB521.9bn in FY23, compared to RMB480.0bn in FY22. Net profit attributed to company shareholders rose 8.53% to RMB6.51bn in FY23, compared to RMB6.00bn in FY22. Basic earnings per share rose to RMB1.88 in FY23, compared RMB1.73 in FY22.

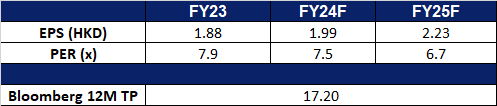

- Market consensus.

Share price and copper price (US$/lb) correlation

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

Haier Smart Home Co. Ltd. (6690 HK): Appliances trade-in program

- RE-ITERATE BUY Entry – 26.30 Target – 28.70 Stop Loss – 25.10

- Haier Smart Home Co., Ltd., formerly QINGDAO HAIER CO., LTD., is a China-based company principally engaged in the research, development, manufacture and sales of household electrical appliances. The Company’s main products include refrigerators/freezers, washing machines, air-conditioners, water heaters, kitchen appliances products, small home appliances and U-home smart home products. The Company also provides the customers with integrated smart home solutions. The Company is also involved in channel integration service business, including logistics, as well as the distribution of home appliances and other products. The Company distributes its products in domestic market and to overseas markets.

- Trade-in program for consumer products. The National Development and Reform Commission has unveiled a plan to drive large-scale equipment renewal and consumer goods trade-ins. With annual demand for equipment in crucial sectors projected to surpass 5 trillion yuan ($691 billion), the initiative aims to rejuvenate China’s equipment and consumer goods industries, as well as stimulate consumer spending appetites, bolster consumption recovery and inject new momentum into economic growth through comprehensive renewal initiatives. The central government of China will collaborate with local authorities to allocate funds to support consumers in trading in or upgrading their old home appliances for newer green, smart home appliances. This program is expected to boost demand for Haier’s products.

- Launch of new products in India. Haier India recently launched its new S800QT QLED TV in India. This new TV comes in 4 sizes and will be available for purchase at a starting price of Rs 38,990 across the offline and online channels which are available in the country. The company also recently launched a new range of super heavy-duty air conditions in India, which comes with the company’s Hexa Inverter and Supersonic cooling technologies, giving up to 20 times faster cooling experience than “conventional air conditioners. The new range of Haier Heavy-Duty air conditioners will be available at all leading stores with a starting price of Rs 49,990. These new products are expected to generate more sales for the company.

- Introduction HomeGPT. Recently at Shanghai’s Appliance & Electronics World Expo 2024, Haier introduced HomeGPT, the first large language model for smart homes. Haier’s new technologies can have conversations with users that seem almost natural and take orders. This new technology is likely to take smart home living to a new level in the future. This integration of AI with home appliances is bound to drive growth for the company in the future.

- FY23 earnings. Revenue rose by 7.3% YoY to RMB261.4bn in FY23, compared to RMB243.6bn in FY22. Net profit increased 13.6% YoY to RMB16.7bn in FY23, compared to RMB14.7bn in FY22. Basic EPS rose to RMB1.79 in FY23, compared to RMB1.58 in FY22.

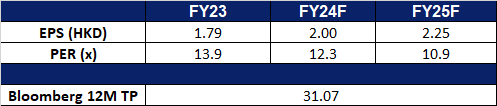

- Market Consensus.

(Source: Bloomberg)

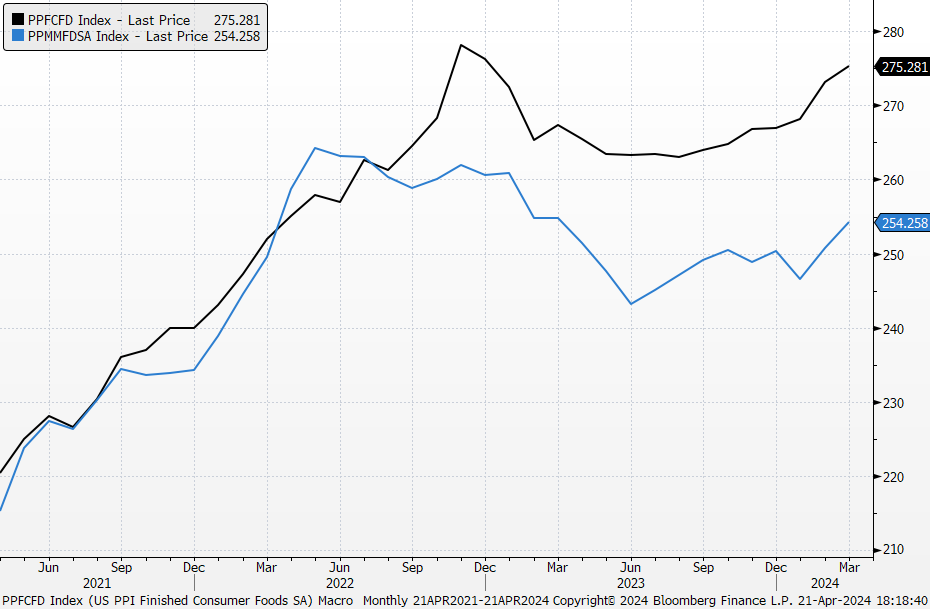

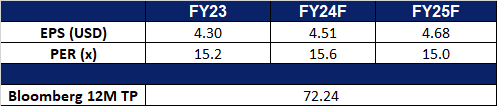

General Mills, Inc. (GIS US): Inflation rebounding

- BUY Entry – 70 Target – 77 Stop Loss – 67

- General Mills, Inc. operates as a food company. The Company manufactures and markets branded processed consumer foods sold through retail stores. General Mills serves customers worldwide.

- Inflation rebounding. US March inflation data such as CPI and PPI showed that inflation rebounded. The price performances of several key commodities have signalled that inflation is returning. Brent/copper/aluminium rises more than 20%/16%/17% YTD respectively. Regarding agricultural products, coca and coffee rally sharply while the rest remain at lows. However, soybean and wheat recently rebounded from 52-week lows. Both materials for food manufacturing and finished consumer food PPIs indicate that uptrends are resuming. Accordingly, the packaged food sector is expected to bottom out after a one-year downturn.

- Geopolitical tensions escalating. Recent Israel and Iran conflicts reinforced the risk-averse sentiment. The uncertainty of whether both countries set up new rounds of retaliation will continue to rattle the market in the short term. Consumer staples as a defensive sector saw inflows accordingly.

US PPI – Materials for food manufacturing (black) and finished consumer food (blue)

(Source: Bloomberg)

- 3Q23 earnings review. Revenue dipped by 1.0% YoY to US$5.1bn, beating estimates by US$130mn. Non-GAAP EPS was US$1.17, beating estimates by US$0.12. FY24 guidance is that the organic net sales are expected to range between down 1% and flat. Adjusted operating profit and adjusted diluted EPS are each expected to increase 4% to 5% in constant currency.

- Market consensus.

(Source: Bloomberg)

First Solar Inc (FSLR US): Next sector to benefit from the AI wave

- RE-ITERATE BUY Entry – 178 Target – 194 Stop Loss – 170

- First Solar, Inc. designs and manufactures solar modules. The Company uses a thin film semiconductor technology to manufacture electricity-producing solar modules.

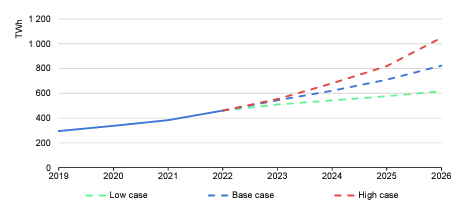

- Doubled electricity demand from data centres towards 2026. The 2024 IEA electricity report shows that global electricity demand from data centres, cryptocurrencies, and artificial intelligence (AI) is projected to nearly double by 2026, reaching between 620 and 1,050 terawatt-hours (TWh), with a base case of just over 800 TWh, up from 460 TWh in 2022. This surge in demand, driven by the expansion of digitalization, poses challenges and opportunities for various regions. In the United States, data centre electricity consumption is forecasted to rise rapidly, with Virginia’s data centre sector becoming a significant economic driver. China anticipates doubling its data centre electricity demand by 2030, while the European Union aims to bolster sustainable practices in data centres to align with decarbonization goals. In Ireland, data centres are expected to consume almost one-third of the country’s electricity by 2026. Efforts to enhance energy efficiency and regulatory measures are underway globally to mitigate the environmental impact of escalating electricity consumption in data centres. First Solar stands to benefit from the projected surge in electricity demand as solar energy can help these data centres to mitigate the environmental impact of escalating electricity consumption by providing renewable and sustainable power sources, thus contributing to the reduction of carbon emissions and promoting greener operations.

Global electricity demand from data centres, AI and cryptocurrencies

(Source: IEA electricity 2024 report)

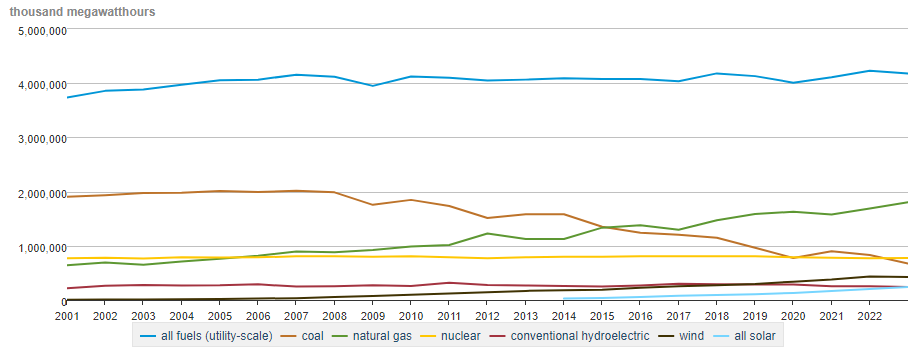

- Solar demand to grow. In the coming years, solar panel installations are predicted to substantially increase in the United States to meet the soaring electricity demand, driven particularly by data centres, electric vehicles, and heating/cooling systems. This surge comes as legacy power plants retire, and solar emerges as a cost-effective and rapid solution. Solar energy, being one of the fastest-growing energy sources in the US, is expected to expand significantly despite challenges like permitting delays and increased capital costs. In response to the growing demand, solar companies plan to boost their manufacturing capacity, buoyed by tax incentives under President Biden’s Inflation Reduction Act.

Net electricity generation in the United States

(Source: US Energy Information Administration)

- 4Q23 earnings review. Revenue was US$1.16bn, rising 16.0% YoY, missing expectations by US$160mn. GAAP earnings per share were US$3.25, beating expectations by US$0.13. The company issued FY24 guidance for revenue of US$4.4B to US$4.6B and EPS US$13 to US$14, compared to analyst consensus estimates of US$4.56B of revenue and EPS of US$13.26. FSLR also forecast full-year sales volumes of 15.6 to 16.3 GW, gross margin of US$2bn to US$2.1bn, and operating income of US$1.5bn to US$1.6bn on sales volume of 15.6 to 16.3 GW, which includes anticipated Section 45X tax credits of US$1bn to US$1.05bn and US$85mn to US$95mn of production start-up expense; year-end net cash balance is projected at US$900mn to US$1.2bn.

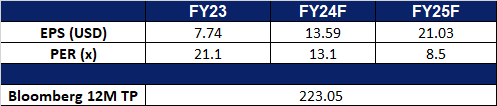

- Market consensus.

(Source: Bloomberg)

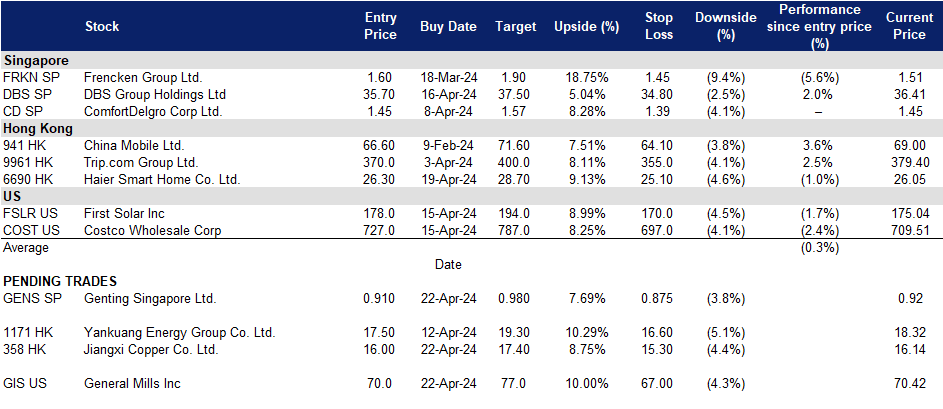

Trading Dashboard Update: Cut loss on Netflix (NFLX US) at US$567.88.