KGI DAILY TRADING IDEAS – 18 August 2021

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

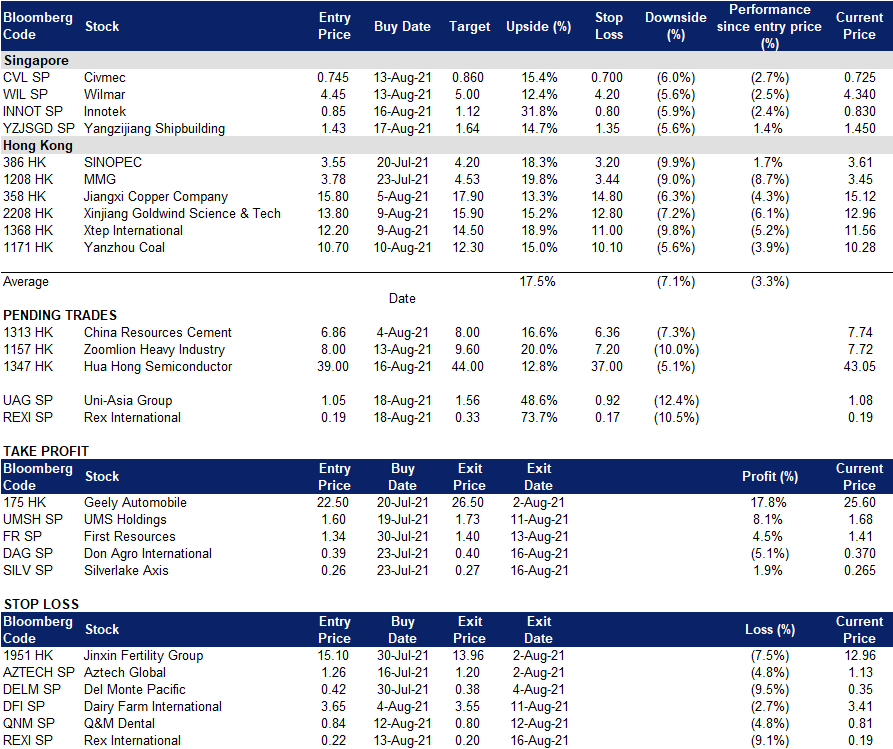

Rex International (REXI SP): Bulking its war chest

- BUY Entry – 0.19 Target – 0.33 Stop Loss – 0.17

- Rex International Holding (Rex) is a pure-play oil & gas exploration and production company (Independent). It owns and operates an oil-producing field in Oman and has a portfolio of exploration licenses in Norway. Its recent acquisition of the Norwegian Brage oil field will add another production asset to its portfolio. This is an accomplishment from its early days when it was listed on the SGX as a pure-play explorer.

- Good start; even better second half. Rex International Holding (Rex) reported its highest semi-annual revenue since listing in 2013. Rex’s 1H2021 PATMI of US$24.0mn is a significant reversal from the US$20.1mn loss in 1H2020, driven by higher production and oil prices. We expect better performance ahead as the group grows organically and through acquisitions.

- Record free cash flows. Free cash flow generated by oil and gas companies are expected to break records this year with oil currently trading above US$70 per barrel. For Rex, the windfall will continue to strengthen its already strong balance sheet and give it opportunities to diversify.

- For the year ahead, based on US$65 oil price, we forecast Rex’s net cash position to surge to US$107mn by FY2022F. This is equivalent to S$144mn or 58% of the group’s current market capitalisation (based on 19.2 Sing cents share price).

- We maintain an Outperform recommendation while raising our DCF-backed target price to S$0.33, factoring in higher production from Oman.

- Read our full company update report here.

Uni-Asia Group (UAG SP): Strong 1H2021 beat, even better year ahead

- BUY Entry – 1.05 Target –1.56 Stop Loss – 0.92

- UAG is an alternative investment company which owns and manages bulk carriers, invests in Hong Kong commercial offices and develops residential properties in Japan. The group derives around 65% of its revenues from charter income generated by its fleet of bulk carriers. The remainder of revenue is from its property projects in HK and Japan.

- UAG reported a stellar 1H2021. UAG’s bottom line reversed from a loss of US$3.9mn in 1H2020 to a US$7.0mn profit in 1H2021, driven mainly by its shipping segment. Charter income rose 46% YoY to US$20mn as average daily charter rose to about US$10,900 in 1H2021 compared to around US$7,000 in 1H2020. As a result, its shipping business reported a profit of US$9mn in 1H2021, vs a US$11mn loss in 1H2020. UAG’s balance sheet continued to strengthen, with total debt declining to US$95mn as at the end of 1H2021. Given the stronger-than-expected results and positive outlook in 2H2021 and 2022, shareholders will be rewarded with a 2.0 Sing cents interim dividend.

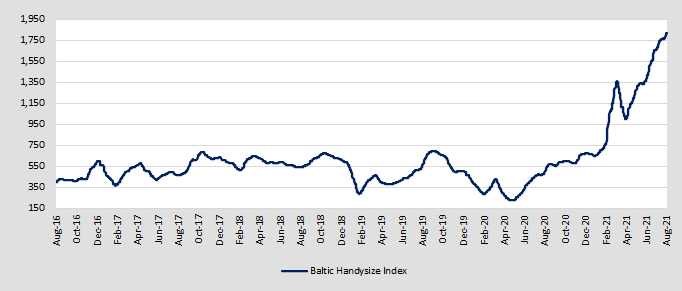

- UAG has right assets at the right time. The broad-based increase in commodity demand and the tight supply of vessels have pushed Baltic Freight rates to their highest in more than 10 years. The market for handysize, which UAG specialises in, is even more favourable as rates rise to their highest since 2008. Current charter rates are above US$25,000 per day. We expect charter rates to remain resilient at these levels, or even increase, amid historically low order book, rising scrap rates and further cuts in operating speeds. Six of UAG’s wholly owned dry bulks will renew in 2H2021, three will renew in 1H2022 and one in 2H2022.

- Maintain Outperform and raise our TP to S$1.56. Valuations are attractive amid the stronger-than-expected bulk carrier upcycle. Our TP implies a 0.7x FY2021F P/B, which is still a conservative 30% discount to international peers who are trading above 1.0x P/B.

- Read our full report here.

Baltic Dry Index Handysize Index (2016-2021 YTD)

HONG KONG

China Resources Cement Holdings Limited (1313 HK): A perfect candidate of Peter Lynch’s “Turnarounds” classification

- Reiterate BUY Entry – 7 Target – 8.0 Stop Loss – 6.5

- China Resources Cement Holdings Limited is a Hong Kong-based investment holding company principally engaged in the cement and concrete businesses. The company operates through two business segments. The cement segment is engaged in the manufacture and sales of cement and related products. The Concrete segment is engaged in the manufacture and sales of concrete and related products. The Company is also involved in the trading of fly ash, mortars and shotcrete, as well as the property holding business through its subsidiaries.

- On 2nd August, China released Caixin manufacturing July PMI which was 50.3, lower than the expectation of 51.0. However, the infrastructure sector rebounded substantially even though investors were concerned about the slowdown of the economic recovery. The counter-intuitive market reaction could be due to investors wagering on a new round of infrastructure expansion in 2H21 as consumption and exports are not expected to uphold the economic recovery.

- Infrastructure stocks have been out of flavour since February as investors were chasing technology, consumer staples & discretionary, and materials stocks in 1H21. The whole industrial sector has been dropping and breaking key support levels. At the moment, investors are trying to avoid sectors exposed to regulatory risks and are seeking safe havens. Industrial stocks are one of the candidates as their valuations are dirt cheap.

- Currently, China’s domestic average cement price has reached last August’s level where the previous uptrend started. The company’s forward PE dropped to the 10-year lows recently. Therefore, we see it as deeply undervalued right now.

- Updated market consensus of the estimated growth of net profit in FY21 and FY22 are -0.96% and 3.24% respectively, which translates to 5.7x and 5.5x forward PE. The current PE is 5.5x. The estimated respective dividend yield in FY21 and FY22 is around 8.3% to 8.5%. Bloomberg consensus average 12-month target price is HK$9.67.

Hua Hong Semiconductor Ltd (1347 HK): Pull back to the previous consolidation range

- REITERATE Buy Entry – 39 Target – 44 Stop Loss – 37

- Hua Hong Semiconductor Ltd is an investment holding company engaged in production and sales of semiconductor wafers. The company produces 200mm and 300mm-wafers. Its products are applied in general microcontroller (MCU), Type-C interface chips, image stabilization chips, touch control chips, and smart meter controller chips. The products also serve the Internet of Things (IoT), new energy vehicles, artificial intelligence and other markets.

- 1H21 results were better than market expectations. Revenue reached a record high of US$651mn, an increase of 52.0% YoY primarily due to increased wafer shipments and improved average selling price. Gross margin was 24.2%, an increase of 0.6ppts YoY, primarily driven by improved average selling price and capacity utilization, partially offset by increased depreciation expenses. Profit for the period attributable to owners of the parent was US$77.1 million, an increase of 102.3% YoY.

- 90nm eFlash, 90nm BCD, 55nm CIS, DT-SJ, and IGBT were mass produced in the 12-inch production lines, thereby better meeting the capacity needs of customers. The Company is the first Pure Play Foundry in the world to mass produce advanced FS-Trench IGBT on both 8-inch and 12-inch production lines at the same time.

- The Company’s simultaneous progress in its “8+12” production line technologies and its “IC + Discrete” technology platforms development strategy for the Embedded Non-Volatile Memory, Analog & Power Management, and Logic & RF IC device and Discrete device businesses will provide its customers with comprehensive and excellent technical support in foundry field.

- Consensus estimates per the 12-month target price at HK$54.7, implying a 26% upside potential. EPS is forecasted to grow at 70%/25.6%/16.6% for FY2021/22/23F, which would bring forward P/Es down to 43x/34x/29x FY2021/22/23F.

Market Movers

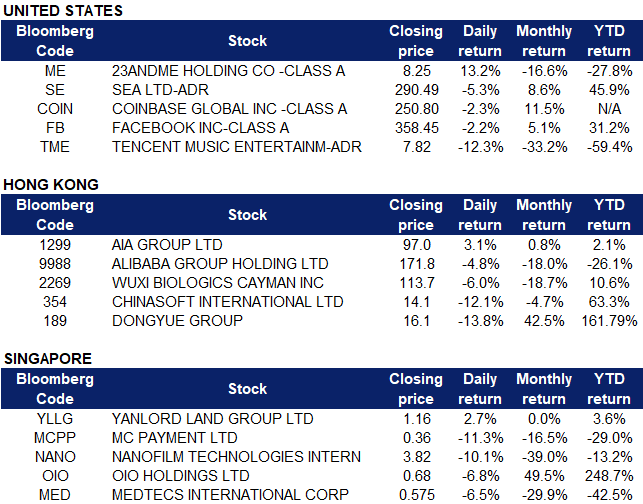

United States

- 23andMe Holding (ME US). Shares of the personal genomics and biotechnology company surged 13.17% on Tuesday. Credit Suisse analysts initiated coverage of the stock with an outperform rating and a target price of $13, saying that the company’s database would be hard to match for pharmaceutical research, offering investors a platform that “enables novel discoveries into the causes and potential treatments of a wide variety of diseases at unprecedented statistical power”. Credit Suisses expects 23andMe to leverage its unique advantages as it collaborates with GlaxoSmithKline, as Glaxo uses 23andMe’s data to validate more than 40 new potential drug candidates.

- Sea Limited (SE US) shares closed 6.112% higher at $308.27 after releasing second quarter results. Although the e-commerce giant missed analyst estimates for earnings, reporting a loss of $0.61 per share instead of $0.51 that was expected, the company beat sales expectations with revenue of $2.3 billion, up 159% YOY. Sea updated guidance, and projected 122% sales growth in e-commerce for all of 2021.

- Coinbase (COIN US) shares fell 2.35% on Tuesday. There was no company specific news. However, cryptocurrency-related stocks tend to move with prices for broader cryptocurrencies such as Bitcoin and Ethereum, which were both down on Tuesday. The cryptocurrency exchange’s stock has been down 26% since its IPO in April.

- Facebook (FB US) shares slipped 2.21% on Tuesday, along with a broader pullback in the market. There was no company specific news. The Census Bureau reported that total retail sales fell 1.1% from June to July, which could have likely been the cause of the dip, as Facebook’s advertising business performance is closely tied to overall consumer spending.

- Tencent Music (TME US) plunged 12.33% on Tuesday after reporting second quarter financial results. The online music platform saw revenue rising 15.5% YOY to $1.2 billion, largely attributed to a 40.6% increase in online music paying subscribers, which fueled 36.3% increase in revenue from music subscriptions. However, due to higher operating expenses, net profit for equity holders declined 11.9% to $128 million. Monthly active users for online mobile music dropped 4.3% to 623 million, and social entertainment MAUs dropped 13.3% to 209 million. Chinese regulators ended Tencent Music’s ability to sign exclusive music licensing deals back in July 2021, which could have slowed subscriber growth.

Singapore

- Yanlord Land Group Limited (YLLG SP). Shares rose by 2.7% yesterday, even though there was no company specific news. Yanlord announced positive 1H21 earnings results on 12 August, where 1H2021 revenue rose by 44.7% YoY to RMB13.2mn while profit increased by 54.8% to RMB1.57bn. Total rental and hotel income of the group increased by 40.9% to RMB692mn, mainly attributable to the strong recovery of domestic business travel and tourism demand for hotels and serviced apartments in the PRC. Even though China’s housing market eased in July as price gains slowed, investors could be less bearish on China’s housing-related stocks as compared to other sectors, given that government intervention has merely resulted in a slight dip in home prices, as compared to significant declines in sectors such as big tech.

- MC Payment Limited (MCPP SP). Shares continued to decline and closed at a one-month low, following the company’s announcement of its half-yearly results on 14 August. Reported net loss was mainly due to one-time RTO expense of S$30.mn, of which S$26.4mn was a non-cash expense item relating to the write-off of “goodwill” for the reverse takeover of the Company. Disregarding this, the adjusted net profit was S$0.66mn, flat from 1H20’s adjusted net profit of S$0.66mn. Read the full results here. Given stagnant profits, investors are likely liquidating their positions with a bearish outlook on the company’s results moving forward.

- Nanofilm Technologies International Limited (NANO SP) Shares continued to dip from Monday and closed at a YTD-low, after Nanofilm announced disappointing 1H21 results. 1H21’s net profit fell by 2.3% to S$18.1mn. The company also announced that its Chief Operating Officer (COO) Ricky Tan has resigned to pursue other opportunities following the group’s re-organisation. Additionally, in a news article published by The Edge yesterday, analysts from UOB Kay Hian, DBS and Jefferies downgraded Nanofilm to HOLD, with lowered target prices due to weak results and leadership uncertainty.

- OIO Holdings Limited (OIO SP). Shares dropped by 6.8% yesterday as investors are likely taking profit after the price rally following OIO’s positive 1H21 earnings results. Shares rose by 7.4% on Monday and closed at an all-time high. Even though losses widened by 68.7% YoY to S$638k, revenue surged by 142% YOY to S$1.6mn, backed by a 276% jump in blockchain business revenue. Gross profit margins also increased from 59.4% to 75.3% in 1H21. Losses were mainly attributable to promotional expenses, non-cash impairment due to the weaker crypto market in June and higher staff related costs.

- Medtecs International Corporation Limited (MED SP). Shares continued to decline from Monday and closed at a 52-week low, after Medtecs announced disappointing 1H21 results. Revenue decreased by 47.5% YoY to US$85.3mn in 1H21, while net profit decreased by 52.4% to US$18.5 mn. This was due to reduced PPE demand in 1H2021 from customers that had already stocked up in FY2020, resulting in more stable market prices and supply chain situation. Investors are likely having a gloomy outlook on the company’s results moving forwards, given that competitors are on the rise and masks are currently overstocked.

- Trading Dashboard: Add Yangzijiang (YZJSGD SP) at S$1.43.

Hong Kong

Hong Kong listed stocks dropped and the Hang Seng Tech Index fell for the fifth consecutive day amid moves by China to tighten its grip on the internet sector. China’s market regulator issued draft rules banning unfair competition among online platform operators. Regulators also issued separate rules to protect key network facilities and information systems, to be effective next month.

- AIA Group (1299 HK). Shares of AIA climbed amid the broad-based market sell-off after the company’s 1H2021 earnings beat consensus’ expectations. Profitability of new policies sold climbed to US$1.8bn in 1H2021 from US$1.4bn in 1H2022, beating the 21% of median estimate of seven analysts polled by Bloomberg. New business value in Malaysia surged 94% in the six months from a year earlier, while Thailand saw a 57% jump and Singapore a 39% increase. Consensus estimates remain positive, with an average 12m TP of HK$116 (+20% upside), based on 33 BUY calls and 3 HOLD calls.

- Alibaba Group Holding Limited (9988 HK), Chinasoft International Limited (0354 HK). Alibaba shares dropped by 4.8% yesterday and closed at a 5-year low, while Chinasoft’s shares dropped 6.0% and closed at a weekly-low. HK listed Chinese shares, especially those belonging to big tech, software and information system sector have been trending downwards and took a hit yesterday with news that China’s market regulator issued draft rules aimed at stopping unfair competition on the internet. The rules published by the State Administration for Market Regulation (SAMR) cover a wide range of areas from prohibitions on the way companies can use data to stamping out fake product reviews.

- Wuxi Biologics Cayman Inc (2269 HK). Shares dropped by 6.0% yesterday as biotech stocks fell collectively. Besides the broad-market sell-off, the top ten traded stocks of Southbound Connect included Wuxi, which was net sold amounting to HKD$530mn.

- Dongyue Group Limited (0189 HK). Shares dipped by 13.8% yesterday following a report issued by Citic Securities. Proton exchange membranes are widely used downstream, mainly in the chlor-alkali industry, fuel cells, hydrogen production from electrolysis of water, and all-vanadium flow battery energy storage systems. The proton exchange membrane market will be dominated by the automotive fuel cell market in the future, with a market size of over RMB10bn. However, the report mentioned that there is still a gap between domestic technology level and foreign countries, which may have dampened investors’ confidence in Dongyue, the leading company in the sector.

Trading Dashboard

Related Posts: