12 September 2022: Singtel Ltd (ST SP), Keppel Corp Ltd (KEP SP)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Singtel Ltd (ST SP): A new business development

- BUY Entry 2.68 – Target – 2.86 Stop Loss – 2.56

- Singtel provides an extensive range of telecommunications and digital services to consumers and businesses across Asia, Australia, Africa and the US. It serves over 753 million mobile customers in 21 countries, including Singapore, Australia (via wholly-owned subsidiary Singtel Optus) and the emerging markets of India, Indonesia, the Philippines, Thailand and Africa.

- Offloading stakes in Airtel. According to NSE block deal data, Singtel entities were believed to have sold 1.76% stakes of Bharti Airtel through block deals, aggregating to around INR7,148 crore. A bulk of these shares has been acquired by Bharti Telecom Ltd (BTL), a key promoter company of the Indian telco. Two weeks ago, Singtel announced that its affiliates have entered into an agreement to transfer approximately 3.33 % shares to BTL for an aggregate amount of approximately S$2.25bn, leaving direct shareholding of Singtel and Bharti in Airtel at around 10% and 6%, respectively.

- Singtel-Intel collaboration launched a 5G programme. Singtel and Intel jointly launched a multi-access edge compute 5G incubator that will enable enterprises to adopt 5G seamlessly, deploy applications that need low latency processing at the edge, and drive innovation. Through the incubator, enterprises can tap into Singtel and Intel’s ecosystem to deliver their 5G use cases, including ready-to-deploy applications for rapid trials and proof of concepts for research and development.

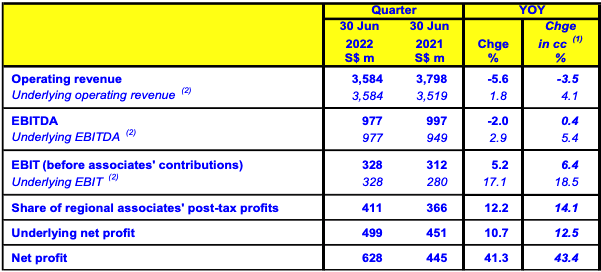

- 1Q23 (YE March) results review. The improvement of the bottom line was driven by improved operational performance and exceptional gains from Airtel and dilution of the Group’s effective shareholding in Australia Tower Network.

- Updated market consensus of the EPS growth in FY23/24 is 26.1%/17.2% YoY respectively, which translates to 18.3x/15.6x forward PE. Current PER is 23.1x. Bloomberg consensus average 12-month target price is S$3.24.

(Source: Bloomberg)

Keppel Corp Ltd (KEP SP): Back to more than 4 years high

- RE-ITERATE BUY Entry 7.2 – Target – 7.8 Stop Loss – 6.9

- Keppel Corporation is a Singaporean conglomerate headquartered in Keppel Bay Tower, HarbourFront. The company consists of several affiliated businesses that specialises in offshore & marine, property, infrastructure and asset management businesses.

- Share buyback notice. Keppel released a share buy back notice on 31 August 2022. They purchased a total of 809,000 shares for a total of S$5.85mn, paying between S$7.16 to S$7.24 per share, to be held as treasury shares.

- Develop Singapore’s first hydrogen-ready power plant. The plant will be constructed on Jurong Island, with construction to be undertaken by a consortium comprising Mitsubishi Power Asia Pacific and Jurong Engineering. The plant will be owned by Keppel Sakra Cogen (KSC), presently a wholly-owned indirect subsidiary of Keppel Infrastructure. It is intended that Keppel Asia Infrastructure Fund LP (KAIF) and Keppel Energy will hold 70% and 30% equity interests in KSC respectively. The Keppel Sakra Cogen Plant, which is expected to be completed in the first half of 2026, will be designed to operate on fuels with 30% hydrogen content with the capability of shifting to run entirely on hydrogen, although it will initially run on natural gas as its primary fuel. The advanced combined cycle gas turbine (CCGT) power plant will also be able to produce steam for use in industrial processes for the energy and chemicals customers on Jurong Island.

- 1H22 earnings review. Net profit rose 66% YOY to S$498 million in 1H2022. Keppel announced an interim dividend 15 SG cents per share. Revenue in 1H22 was S$3,356 million as compared to 1H21 S$2,888 million.

- Updated market consensus of the EPS growth in FY22/23 is -13.5%/7.0% YoY respectively, which translates to 15.3x/14.3x forward PE. Current PER is 11.6x. Bloomberg consensus average 12-month target price is S$8.69.

(Source: Bloomberg)

The Hong Kong market is closed today in observance of a public holiday, Mid-Autumn Festival. The market will reopen on 13 September, Tuesday.

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Steel | +5.61% | Vale Posts Best Week in 20 Months on Metals Rebound, Nickel Plans Vale SA (VALE US) |

| Other Metals/Minerals | +3.97% | Rio Takeover of Giant Copper Mine Opposed by Top Investor Rio Tinto PLC (RIO US) |

| Oil & Gas Production | +3.15% | There’s A Lot To Like About EOG Resources’ (NYSE:EOG) Upcoming US$1.50 Dividend EOG Resources Inc (EOG US) |

Top Sector Losers

| Sector | Loss | Related News |

| Managed Health Care | -0.24% | N/A UnitedHealth Group Inc (UNH US) |

| Property/Casualty Insurance | -0.08% | N/A Progressive Corp (PGR US) |

- Zscaler Inc (ZS US) surged 21.9% after reporting strong earnings in its most recent quarter. The company posted adjusted earnings of 25 cents per share on $318 million in revenue. Analysts surveyed by Refinitiv were expecting earnings of 20 cents per share on revenues of $305 million.

- DocuSign Inc (DOCU US) jumped 10.5% after the electronic agreement company’s quarterly numbers topped analyst expectations. DocuSign’s revenue guidance for the third quarter was also above expectations, and its full-year outlook was in line with estimates.

- Kroger Co (KR US) traded 7.4% higher after the supermarket chain surpassed earnings expectations for the previous quarter and raised its full-year guidance.

- Two of the main meme stocks outperformed on Friday as investors piled back into risk assets. Shares of GameStop Corp (GME US) rose 12.0%, while Bed Bath & Beyond Inc (BBBY US) jumped 8.4%. There was no clear catalyst for either stock’s move.

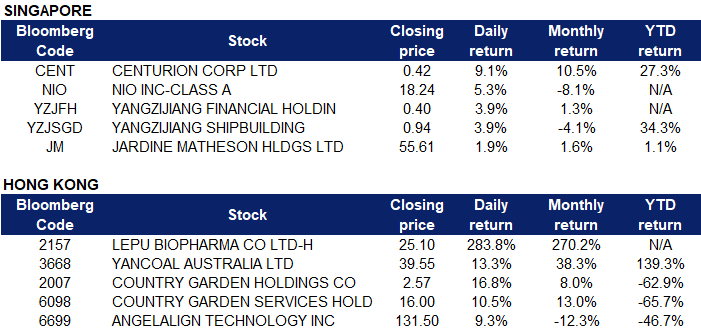

Singapore

- Centurion Corp Ltd (CENT SP) rose 9.1% on Friday. Centurion recently released its interim report for FY2022. In the first half-year ended 30 June 2022, the Group’s revenue increased by 40% to S$90.5 million, from S$64.7 million reported in the first half-year ended 30 June 2021, while profit from core business operations increased by S$8.4 million or 35% from the corresponding period a year ago, to S$32.4 million.

- NIO Inc (NIO SP) rose 5.3% on Friday. It reported increasing losses in its second-quarter earnings report this week. Although its profit margins have been on a downward trend, new models being launched could turn that around in the coming years. That longer-term outlook, along with some positive economic data out of China today, are working to boost Nio shares. Lower inflation and raw material prices should help Nio boost profit margins in the coming months. The company cited a “significant increase in battery costs” as one factor hurting margins in the second quarter.

- Yangzijiang Financial Holding Ltd (YZJFH SP) rose 3.9% on Friday. On 9 September, Yangzijiang Financial Holding purchased 4,985,500 shares in a share buy back to be held as treasury shares. The shares were purchased at a total of SGD 1,911,770.57, with price per share between SGD 0.375 to SGD 0.395.

- Yangzijiang Shipbuilding Holdings Ltd (YZJSGD SP) climbed 3.9% on Friday. It will be able to start building large LNG vessels after entering into a technical assistance and licence agreement with French naval engineering company GTT. LNG vessels are vessels used for carrying liquefied natural gas. GTT has technological expertise in containment systems with cryogenic membranes and its membranes have been widely chosen as the cargo containment and insulation system for the large LNG carriers, onshore and offshore applications. YZJ received the GTT licence after successfully completing a qualification process, including the construction of a membrane module and an audit by GTT and the ship classification societies. commencing in March 2022. It was completed in “record time”, despite delays due to the Covid-19 restrictions in China.

- Jardine Matheson Holdings Ltd (JM SP) rose 1.9% on Friday. There was no company specific news. Cycle & Carriage Bintang Bhd recently submitted an application to Bursa Malaysia Securities Bhd for the proposed withdrawal of its listing on the local bourse, following the closing of the unconditional voluntary takeover offer by Jardine Cycle & Carriage Ltd, which owned an 89.99% stake (90.66 million shares) in CCB as of Aug 25.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Alternative Energy | +1.99% | Xi Jinping calls for China to ‘push for a green, low carbon lifestyle’ amid self-sufficiency drive Xinte Energy Co Ltd (1799 HK) |

Semiconductors | +1.71% | Shanghai Fudan Microelectronics Company (1385 HK) |

Electric Equipment | +1.66% | Asia’s energy transition: a tough balancing act Dongfang Electric Corporation Limited (1072 HK) |

Top Sector Losers

Sector | Loss | Related News |

Dairy Products | -1.50% | China’s Relations with Russia in a New Age China Mengniu Dairy Company Limited (2319 HK) |

Property Management & Agency | -1.27% | Country Garden Services Holdings Co Ltd (6098 HK) |

Other Financials | -1.11% | NA Far East Horizon Ltd (3360 HK) |

- Lepu Biopharma Co Ltd (2157 HK) rose 283.8% on Friday. The company plans to conduct an IPO by applying for the allotment and issuance of no more than about 415 million A shares to achieve listing and trading on the Science and Technology Innovation Board, and plans to raise a net amount of no more than 2.5 billion yuan. In July of this year, its PD-1 antibody pterizumab was approved by the State Food and Drug Administration with conditions. The company plans to establish a commercialization team of 50 to 100 people, responsible for academic promotion, marketing and commercialization.

- Yancoal Australia Ltd (3668 HK) rose 13.3% on Friday. It issued an announcement stating that Yancoal Energy intends to issue H-share convertible bonds to increase its shareholding in Yancoal Australia. Yancoal hereby provides its shareholders and potential investors on the latest situation, it was informed by Yankuang Energy on September 8, 2022 that Yankuang Energy had decided not to proceed with the potential transaction. For the purposes of the Takeovers Code, the Offer Period ends on the date of this announcement. Previously, Fitch believed the European Union’s ban on Russian coal starting this month would boost demand for imports from other countries such as Indonesia and even Australia. Meanwhile, replacing Russian pipeline gas with shipping LNG will reduce fuel supplies in other countries, forcing them to use more coal.

- Country Garden Holdings Co Ltd (2007 HK) rose 16.8%. On September 9, Country Garden Real Estate Group Co Ltd released the prospectus for the first tranche of medium-term notes in 2022. The announcement shows that the issuance of the mid-term ticket will not exceed 1.5 billion yuan, and the issuance period is 3 years. The lead underwriter is China Securities Investment Corporation securities Co Ltd, the joint lead underwriter is Bank of China Co Ltd, provided by China Bond Credit Enhancement Investment Co Ltd. with irrevocable joint and several liability guarantees. The mid-term note is scheduled to be issued in bookkeeping from September 15 to September 16, 2022, with a fixed interest rate, and the annual coupon rate will be determined based on the results of centralised bookkeeping.

- Country Garden Services Holdings Co Ltd (6098 HK) rose 10.5% on Friday. China recently reported modest inflation data and expectations of further policy support prompted investors to look past tightened Covid-19 measures. “With the domestic recovery continuing to face pressure, the low inflationary pressure gives the PBOC (People’s Bank of China) room to stay accommodative,” said Erin Xin, an economist at HSBC in a note, referring to the country’s central bank. China-listed real estate developers surged 4.5%, while mainland developers traded in Hong Kong jumped 6.3%.

- Angelalign Technology Inc (6699 HK) increased by 9.3% yesterday. On the news, the National Medical Insurance Bureau issued a notice stating that oral implants will be collected, crowns will be auctioned, and prices of dental implant medical services will be regulated. Tooth 4500 yuan.

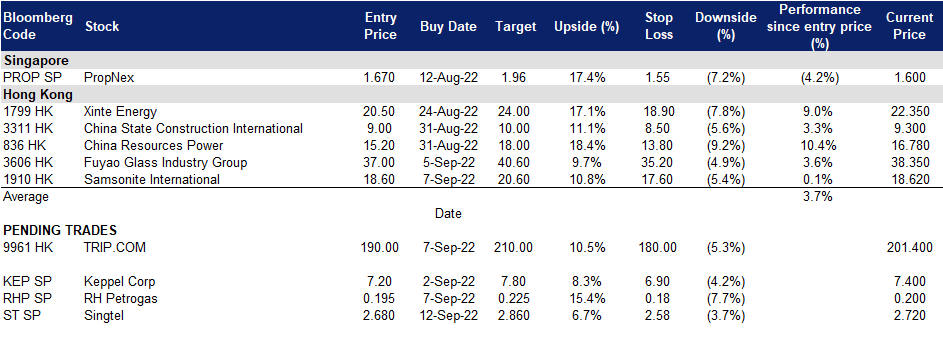

Trading Dashboard Update: No stocks additions/deletions.