KGI DAILY TRADING IDEAS – 12 July 2021

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

Jiutian Chemical (JIUC SP): Fantastic chemistry

- BUY Entry – 0.085 Target – 0.120 Stop Loss – 0.080

- Jiutian is the second largest Dimethylformamide (DMF) producer in China, with a total annual capacity of 150,000 tons of DMF and methylamine (MA). Both these chemicals are important ingredients in industries as diverse as consumer goods, petrochemicals, electronics, pharmaceuticals and fertilisers. In addition, it now produces chemicals for fast growing sectors such as batteries that are used in electric vehicles.

- China’s economy has benefited from supply disruptions in the rest of the world. We see this trend continuing this year and may surprise on the upside given the unprecedented amount of fiscal and monetary stimulus around the world.

- Robust prices. Prices of DMF, its main product, remain resilient. DMF prices rose above RMB 12,000 per tonne last week, 22% higher than our RMB 9,800 forecast for 2021.

- Outperform with fundamental TP of S$0.145. Given the buoyant DMF prices, we maintain our Outperform recommendation and TP of S$0.145 which we published in our initiation report on 17 May 2021.

- Earnings watch and catalyst. The company is likely to report its first half earnings in the second week of August.

Golden Energy & Resources (GER SP): A hidden GEM

- RE-ITERATE BUY Entry – 0.32 Target –0.43 Stop Loss – 0.26

- GER owns and operates thermal coal mines in Indonesia (through 63% owned PT Golden Energy Mines), and metallurgical coal (75% owned Stanmore Resources) and gold mining (50% owned Ravenswood Gold) in Australia. Stanmore has coal resources estimates of 1.7 billion tonnes, marketable coal reserves estimates of 130.0 million tonnes and a coal handling preparation plant capacity of up to 3.5 million tonnes per annum. PT Golden Energy Mines (GEMS) has more than 2.9 billion tonnes of energy coal resources and more than 1 billion tonnes of coal reserves. Meanwhile, Ravenswood Gold has 3.9 million ounces of gold resources and 2.6 million ounces of gold reserves, and a gold processing facility of up to 5.0 million tonnes per annum.

- Record production; long-life assets. The company has ramped up production significantly over the past 10 years. For its Indonesian operations, production increased from 1.8mt in 2010 to 33.5mn in 2020. Meanwhile, its assets in Australia are made up of high quality met coal mines and sizable gold reserves and resources. Post expansion, GER’s Ravenswood Gold is expected to be one of the largest gold producers in Queensland, Australia.

- Coal prices are near their highest in a decade, as a combination of natural gas shortfall, rebounding electricity usage and limited rainfall in China have lifted demand for thermal coal. Thermal coal prices have almost doubled from last year, and we expect prices to remain firm going into the second half of 2021. While global demand for coal peaked in 2014, the dearth of new supplies combined with the surge in electricity demand could lead to even higher prices.

- GER’s share price should be around 34-48 cents based on the previous time that coal prices were trading at these levels in 2017-2018. In fact, current coal prices are more than 30% higher than the previous cycle peak in 2018.

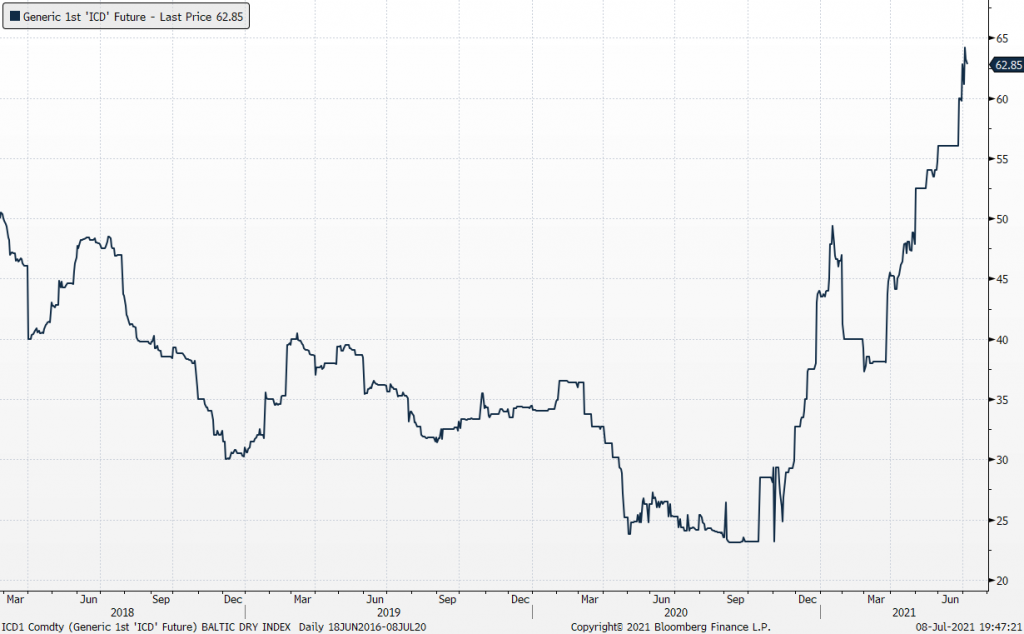

ICI 4 Indonesian Coal Index (Argus/Coalindo) Futures

HONG KONG

Fuyao Glass Industry Group Co Ltd (3606 HK): Speed Bump on the resumption of uptrend

- Buy Entry – 48 Target – 57 Stop Loss – 45

- Fuyao Glass Industry Group Co Ltd is a China-based company, principally engaged in the manufacture and distribution of float glasses and automobile glasses. The company’s products portfolio consist of automobile glasses, such as coating glasses and others, which are applied in passenger cars, buses, limousines and others, and float glasses. The company distributes its products within domestic markets and to overseas markets.

- Impacted by shortage of automobile chips, the automobile production recovery has slowed down even as demand for passenger vehicles continue to rise. Automobile glass is one of the parts in a vehicle, and hence, its sales are highly correlated to the auto production volume.

- As the automobile sector started to recover, the price performance of this counter is relatively lagging. The production issues of the auto sector will be mitigated in 2H21, which will favor the turnaround of the stock.

Key financials highlight:

| (RMB mn) | 1Q21 | 1Q10 | YoY change |

| Revenue | 5,706.0 | 4,170.5 | 36.8% |

| Gross profit | 2,316.4 | 1,436.6 | 61.2% |

| GPM (%) | 36.8 | 34.4 | 2.4 ppt |

| Net profit | 850.5 | 451.0 | 88.6% |

| NPM (%) | 14.9 | 10.8 | 4.1 ppt |

- Updated market consensus of the estimated growth of net profit in FY21 and FY22 are 51.7% and 23.8% respectively, which translates to 27.0x and 21.9x forward PE. The current PE is 41.3x. Bloomberg consensus average 12-month target price is HK$55.23.

China Petroleum & Chemical Corp (386 HK): 8% to 10% dividend yield in FY22F

- Buy Entry – 3.55 Target – 4.20 Stop Loss – 3.2

- China Petroleum & Chemical Corporation is a China-based energy and chemical company. The Company’s segments include Exploration and Development segment, Refining segment, Marketing and Distribution segment, Chemicals segment, and Corporate and Others segment. Exploration and Development segment explores and develops oil fields, as well as produces crude oil and natural gas. Refining segment processes and purifies crude oil, which is sourced from Exploration and Development segment and external suppliers. The Marketing and Distribution segment owns and operates oil depots and service stations in China. Chemical segment manufactures and sells petrochemical products, derivative petrochemical products and other chemical products to external customers.

- Oil prices are undergoing a correction at the moment due to geopolitical issues related to OPEC+. The uptrend is still intact owing to the imbalanced supply and demand dynamics. Market forecasts Brent will be higher in 4Q21 than in 3Q21 (Average: US$70/bbl vs US$67/bbl)

- The company is one of the oil majors globally and Big Three Oil in China. Benefiting from the uptrend of oil prices, the company has turned its performance around. It reported RMB0.15 EPS in 1Q21 (the best quarter since 3Q18). The improving profitability is expected to stretch to FY22.

- This is a value stock as it has high dividend yield and cheap valuation.

- Updated market consensus of the estimated growth of EPS in FY21 and FY22 are 90.25% and 0.84% respectively, which translates to 6.0x and 5.9x forward PE. The current PE is 5.3x. The respective estimated dividend yield is 9.9% and 10.1% in FY21 and FY22. Bloomberg consensus average 12-month target price is HK$5.46.

Market Movers

United States

- Wynn Resorts (WYNN US) and Occidental Petroleum Corporation (OXY US) fell around 7% for the week as reflation and reopening stock trades took a hit behind a worsening COVID-19 situation caused by the Delta variant. Meanwhile, OPEC+ members’ discussions to increase oil supply in August have stalled, which limited the crude oil rally.

- Weibo Corporation (WB US) was one of few Chinese stocks listed in the US that climbed for the week despite the increasing pressure from China, as rumours of a Weibo privatisation surfaced. Reuters cited that Weibo’s chairman is working on a deal to take the company private at over a US$20bn valuation. However, the company has announced that this was not the case, limiting its weekly gain.

- Snowflake (SNOW US) saw a strong rebound for the week as one of the few beaten growth stocks making a comeback.

- Stamps.com Inc (STMP US) shot up on Friday after announcing that it will be acquired by private equity firm Thoma Bravo for around US$330 in cash.

- Clover Health Investments (CLOV US) fell over 20% this week to return back to its pre-squeeze trading range. Meme stocks largely traded towards the downside this week as momentum begins to run out with little news.

Singapore

- Silverlake Axis Limited (SILV SP) Shares rose 16% on higher than average trading volume last Friday’s trading session, possibly driven by investors’ positive outlook on Silverlake’s digital software solutions and services business. The most recent news in July reported that Singapore saw its largest rise in digital investments among financial institutions, as banks seeked to boost their online offerings amid the Covid-19 pandemic by integration of new technology and innovation.

- KTL Global (KTLG SP) Shares gained 15% for the week on higher than average trading volume, bringing total gains to 52% over the last month. Last Friday, the company announced that its wholly owned subsidiary, Tianci Agritech, was expanding its business presence in Singapore with a wider variety of fresh produce and consumer products. The company has procured nearly 18 containers of fresh produce and consumer products to be distributed and marketed in Singapore.

- Riverstone Holdings Limited (RSTON SP) There was no company specific news on Friday. Shares rose on higher than average trading volume last Friday likely on bargain hunting opportunities and short covering. The recent surge in Covid-19 cases in countries such as America and Malaysia could benefit the company considering that it produces gloves supplies to major customers in Asia, America and Europe.

- GKE Corporation Limited (GKEC SP) Shares closed at a 5-month high. It was published on The Edge on 8 Jul that CGS-CIMB Research analysts have maintained their “add” call and raised their TP for GKE Corp to 21 Sing Cents, up from previous TP of 18.4 Sing Cents. Key factors were highlighted, such as the possibility of dividend payouts resuming which was suspended since FY2017 and the emergence of twin drivers of growth, with China operations riding on high ready-mixed-concrete (RMC) volumes and pricing while Singapore operations to benefit from robust performance in warehousing.

- Propnex Limited (PROP SP) There was no company specific news on Friday. However, shares could have risen due to the positive outlook on the real estate sector where real estate stocks collectively rose by 1%. Singapore homes prices and sales continue to remain strong, driven by transactions of buyers looking to upgrade from public housing to private homes. There were a total of 2,311 resale flats that changed hands in June, an 18% increase from May. In a new record, 19 flats were sold above S$1mn in June, bringing the total number of such flats sold to 106 in the first of 2021.

Hong Kong

- Haidilao International Holding Ltd (6862 HK) Food and beverage sector jumped after Thursday’s sharp fall. Shares were trading higher due to a technical rebound as there was no company specific news. Previously, Goldman Sachs downgraded the TP down to HK$45 from HK$56 and maintained a NEUTRAL rating.

- Yihai International Holding Ltd (1579 HK) Due to the rebound in the Food and Beverage Sector, shares jumped from Thursday’s 52-week low. Similar to Haidilao, Goldman Sachs downgraded the TP from HK$100 to HK$42, and recommended a SELL rating.

- China Molybdenum Co Ltd (3993 HK) Non-ferrous metal sector jumped on market reports of higher selling prices QoQ in 2Q21. Shares closed at a one-month high, driven by bullish market sentiment in the EV sector. The company produces cobalt which is one of the raw materials for EV batteries.

- Great Wall Motor Co Ltd (2333 HK) Shares rose as the company released outstanding production and sales data for 1H2021. In 1H21, 618,000 vehicles were sold representing a 56.5% YoY increase. 101,000 vehicles were sold in June alone, up 22.7% YoY. Meanwhile, the company announced to invest RMB100bn to develop new energy vehicles.

- Ming Yuan Cloud Group Holdings Limited (909 HK) SaaS sector jumped as Daiwa Securities reiterated a positive outlook on the sector. Daiwa reiterated a TP of HK$40 with an unchanged rating of OUTPERFORM; the cross sales of SaaS modules will improve the profitability of related businesses. Previously, the company’s management mentioned that ERP business recorded a strong recovery in 1H21, and they expected the growth to persist in 2H21.

Trading Dashboard

Related Posts: