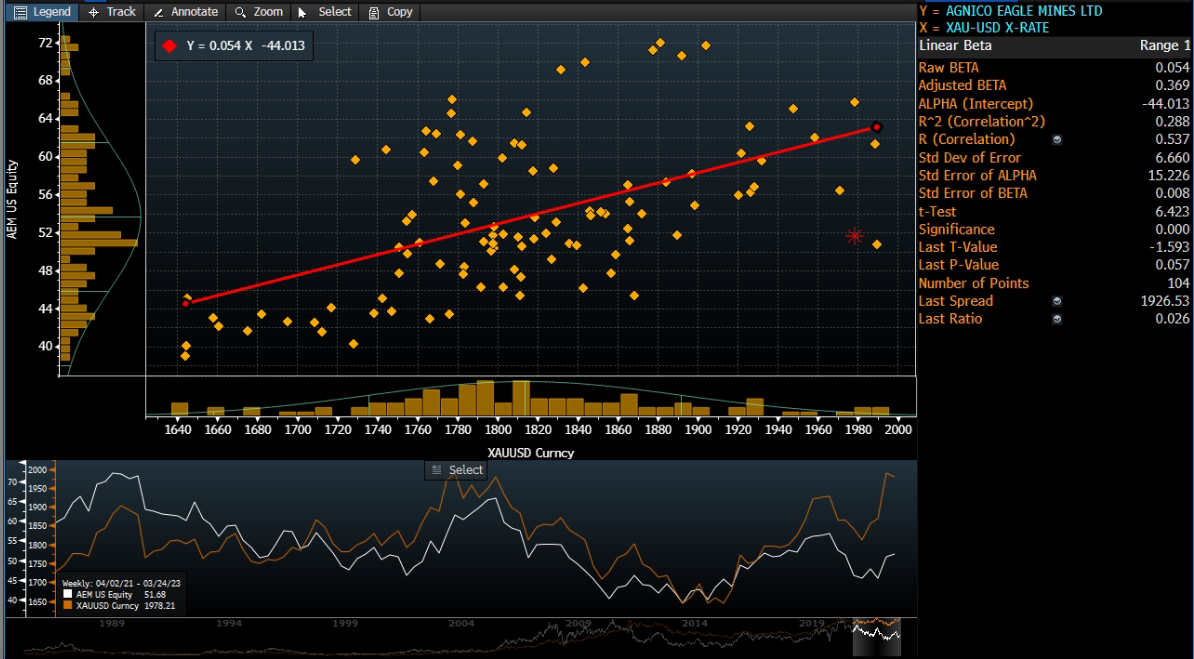

10 April 2023: Bumitama Agri Ltd (BAL SP), Prada SPA (1913 HK), Uber Technologies, Inc. (UBER US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

Bumitama Agri Ltd (BAL SP): Palm oil rebounding

- BUY Entry 0.61 – Target – 0.65 Stop Loss – 0.59

- Bumitama Agri Ltd. produces CPO and PK, with its oil palm plantations located in Indonesia. The Company’s primary business activities are cultivating and harvesting our oil palm trees, processing FFB from its oil palm plantations, its plasma plantations and third parties into CPO and PK, and selling CPO and PK in Indonesia.

- Palm oil prices. Malaysian palm oil futures were trading below the MYR 3,900 per tonne mark, easing from an almost three-week peak of around MYR 4,000 as a stronger ringgit prompted investors to unwind some long positions. Palm oil prices remained supported by prospects of lower production and shrinking inventories. Heavy rains, floods, and older trees will likely constrain Malaysia’s output growth to less than 3% in 2023. Furthermore, inventories in Malaysia probably plunged the most in over two years in March, sinking below the two million-tonne level, as exports soared and production remained sluggish. With reported increased Malaysian shipments to India, China, European Union, and Africa. Malaysia has also been benefiting from Indonesia’s move to support domestic demand by curbing exports until the end of Ramadan and the Eid celebration.

Palm oil price trend

(Source: Bloomberg)

- Stabilization of palm oil. On 1 April, the Malaysian Palm Oil Board (MPOB) signed an MOU with the China Chamber of Commerce of Import and Export of Foodstuffs, Native Produce, and Animal By-products (CFNA) in Beijing to enhance trade and cooperation in the palm oil sector between both countries. The MOU includes promoting the supply chain stability of palm oil, promoting the exploration and implementation of new technologies, and facilitating China’s participation in oil palm mechanisation in Malaysia. China is Malaysia’s second-largest trading partner for palm oil and palm products, with exports valued at RM14.86 billion in 2022. The MOU aims to increase China’s confidence in Malaysian palm oil and secure its position in the Chinese market.

- FY22 results review. Revenue rose 29% YoY to IDR15,829bn from IDR12,249bn the prior year. Despite a decline in net profit for 2H22, FY22 net profit increased by 67% YoY to IDR3,003bn from IDR1,802bn in FY21. FY22 EBITDA was IDR5,686bn a 63% increase YoY from the previous IDR3,498bn.

- Updated market consensus of the EPS growth in FY23/24 is -29.7%/-5.5% YoY respectively, which translates to 6.1x/6.4x forward PE. Current PER is 4.3x. Bloomberg consensus average 12-month target price is S$0.76.

(Source: Bloomberg)

Sembcorp Marine Ltd (SMM SP): Oil rebound

- RE-ITERATE BUY Entry 0.117 – Target – 0.130 Stop Loss – 0.111

- Sembcorp Marine Ltd offers engineering solutions for the offshore, marine, and energy industries. The Company provides rigs and floaters, repairs and upgrades, offshore platforms, and specialized shipbuilding. Sembcorp Marine serves customers worldwide.

- Oil rebound. Crude oil rebounded last two weeks with the recession fears tapered. Brent recovered from the recent low of US$70/bbl to near US$80/bbl, and WTI recovered from below US$65/bbl to above US$75/bbl. According to Reuters, crude oil production from OPEC declined by 70,000 bbls/d in March compared to February.

- New projects acquired. On March 30, Sembcorp Marine has won a multi-billion-dollar contract with GE Renewable Energy’s Grid Solutions to construct and deliver three high-voltage direct current (HVDC) electrical transmission systems for offshore wind farms in the Netherlands. The deal is worth €6 bn (S$8.68 bn), and construction is set to commence in Q3 2024 at Sembcorp Marine’s Singapore and Batam yards; marking the company’s third HVDC offshore platform project.

- Merger complete. Sembcorp Marine has completed its merger with Keppel Offshore & Marine (Keppel O&M) in a S$4.5 billion deal on 28 February 2023, with a total order book of about S$18bn. The combined group is expected to be better positioned to capture growth opportunities in the face of falling oil prices and the global transition to renewable energy. With the merger, the enlarged Sembcorp Marine will benefit from greater synergies from the broader geographical footprint, larger operational scale, and enhanced capabilities.

- FY22 results review. Revenue rose 4.6% YoY to S$1,947mn from S$1,862mn the prior year. Net loss declined by 78.0% YoY to -S$261mn from -S$1,171mn in FY21. With positive EBITDA for 2H22, the FY22 EBITDA was -S$7mn a 99% decrease YoY from the previous -S$1,028mn.

- Updated market consensus of the EPS in FY23/24 is 0.0/0.4 SG cents respectively. Bloomberg consensus average 12-month target price is S$0.14.

(Source: Bloomberg)

Prada SPA (1913 HK): Luxury never goes out of style

- BUY Entry – 54.5 Target – 58.0 Stop Loss – 52.7

- Prada SpA is an Italy-based company engaged in fashion industry. The Company is a parent of the Prada Group. The Company, along with its subsidiaries, is engaged in the design, production and distribution of leather goods, handbags, clothing, eyewear, fragrances, footwear and accessories. Prada SpA manufactures jackets, trousers, skirts, dresses, sweaters, blouses, as well as perfumes and watches, among others. The Company trades its products through several brands, such as Prada, Miu Miu, The Church and The Car Shoe. Prada SpA operates in approximately 70 countries through directly operated stores, franchise operated stores, a network of selected multi-brand stores and department stores. Prada Spa operates through a numerous subsidiaries, including Artisans Shoes Srl, Angelo Marchesi Srl, Prada Far East BV, Tannerie Megisserie Hervy SAS and Prada SA, among others.

- Strengthening Production. Prada Group recently announced that the company will recruit 400 people by the end of 2023 to strengthen its production capability and craftsmanship expertise in Italy. The strengthening of the company’s production would allow for greater agility and a reduction of time-to-market, bolstering its internal logistics process, which already includes quality checks on raw materials and finished goods.This builds on the Prada Group’s ongoing investment into its supply chain, a strategy that it first announced during its Capital Markets Day at the end of 2021.

- An enhanced marketing partnership. Prada Group announced recently that the company would be engaged in a partnership with Adobe to elevate customer experiences across all digital and physical retail properties. The partnership spans Prada Group’s range of brands, including Prada, Miu Miu, Church’s, Car Shoe, Pasticceria Marchesi, and Luna Rossa. The company will be able to combine vast amounts of existing data, create unified customer profiles, and deliver personalized experiences across any channel to its customers in real-time. Clients who have opted in will enable sales assistants to know when they visit a store and their preferences, with the goal of a richer personalized experience.

- Lyst index. Lyst, a reporting index that uses shopper data to rank popular fashion brands quarterly, has released its latest report for October to December 2022, marking its fifth year of customer insights. This unique index ranks fashion’s top brands and products by gathering shopping data from two hundred million customers globally. The determination of brand heat on the Lyst index chart goes beyond sales and views. It also includes social media mentions, activity, and engagement stats from around the world to determine which brands top the rankings. In Lyst’s latest report, Prada ranked at the top followed by Gucci and Moncler.

- FY22 earnings. Revenue in FY22 was €4.2 bn, up 21% YoY. Retail Sales rose 24% YoY to €3.7 bn.

- The updated market consensus of the EPS growth in FY23/24 is 23.6%/16.1% YoY respectively, which translates to 28.6x/24.6x forward PE. Current PER is 35.3x. Bloomberg consensus average 12-month target price is HK$62.24.

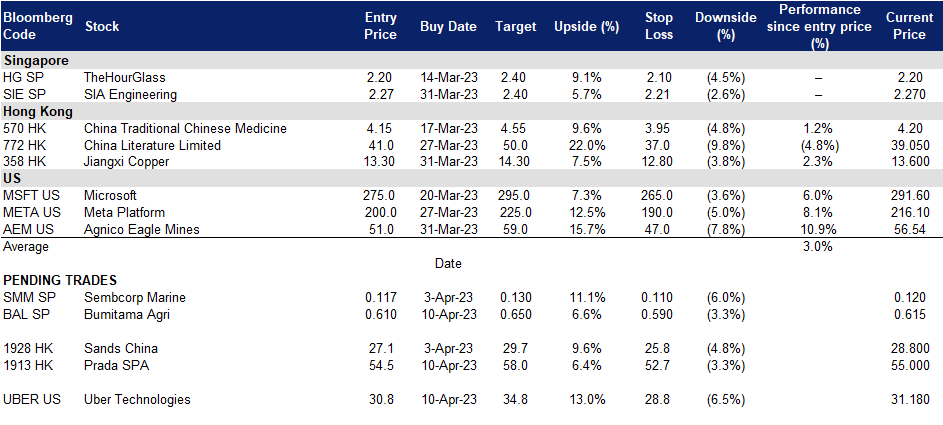

Sands China Ltd. (1928 HK): Happy Holidays

- RE-ITERATE BUY Entry – 27.1 Target – 29.7 Stop Loss – 25.8

- Sands China Ltd. is an investment holding company principally engaged in the development and operation of integrated resorts in Macao. The Company operates many places, including gaming areas, meeting space, convention and exhibition halls, retail and dining areas and entertainment venues. The Company operates its business through six segments: The Venetian Macao, Sands Cotai Central, The Plaza Macao, Sands Macao, Ferry and Other Operations and The Parisian Macao. Through its subsidiaries, the Company is also engaged in the provision of high speed ferry transportation services. The Company’s subsidiaries include Cotai Ferry Company Limited, Hotel (Macau) Limited and Development Limited.

- Macau gaming revenue jumps. Macau gaming revenue surged by 247% YoY to US$1.6bn, according to data released by the Gaming Inspection and Coordination Bureau. While March revenue rose 23% MoM, it was still 51% down from the 2019 level.

- Upcoming holidays. China is expected to see a higher level of tourism with the upcoming 5-days May Day holidays. Overall domestic travel bookings during the May Day holidays this year have increased by 150% YoY, and the number of outbound travel bookings has increased by nearly 17 times YoY.

- Increase in Tourist Arrivals. Tourist arrivals in Macau jumped 143.1% from a year earlier to 1,593,743 in February 2023, following a 103.1% increase in the previous month. This increased level of tourism is expected to drive revenue growth for Sands China over the period.

Macau’s 5 years visitor arrival

- Subsidy Program. Since September 2020, the Macao Government Tourism Office has initiated a promotion campaign for mainland travellers called “buy one, get one free” air ticket offers. In an effort to boost the tourism industry, the office has also launched a subsidy program aimed at encouraging more mainland tourists to visit Macao. Additionally, the office is considering extending a “buy an outbound ticket, get an inbound ticket free” discount offer to Hong Kong residents who use shuttle or ferry tickets between the two regions.

- The updated market consensus of the EPS growth in FY24 is 318.1% YoY respectively, which translates to 16.72x forward PE. Bloomberg consensus average 12-month target price is HK$33.91.

(Source: Bloomberg)

Uber Technologies, Inc. (UBER US): Year of turnaround

- BUY Entry – 30.8 Target – 34.8 Stop Loss –28.8

- Uber Technologies, Inc. develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and Asia excluding China and Southeast Asia. It operates through three segments: Mobility, Delivery, and Freight.

- Mobility business expansion. The company recently announced that it would make electric and common bicycles on its app in Latin America together with the Brazilian bike-sharing company Tembici. By the end of 2023, Uber expects 30,000 bicycles to run in Latin America, one-third out of which is electric.

- Ongoing restructuring. Previously, Uber was reported to consider a spin-off of its Freight logistics arm. Listing the freight business is more likely instead of selling to peers. On the other hand, the company also planned to remove 5,000 virtual brands from its Uber Eats delivery. According to the main press, these virtual brands are delivery businesses that do not have physical locations, make up more than 8% of Uber Eats’ storefront in the US and Canada, but less than 2% of bookings.

- Ready for recession. The abovementioned actions show that the company is preparing for the upcoming recession. Both bicycle-sharing development and the potential spin-off can be viewed as a way to reserve capital, and the removal of virtual brands is to optimise operating costs.

- 4Q22 earnings beat estimates. 4Q22 revenue jumped by 48.8% YoY to US$8.6bn, beating estimates by US$90mn. 4Q22 GAAP EPS was US$0.45, beating estimates by US$0.29. Gross Bookings grew by 19%YoY and 26% YoY (constant currency basis). The company guided 1Q23 Gross Bookings to grow by 20%-24% YoY on a constant currency basis.

- The updated market consensus of the EPS in FY23/24 is US$0.31/US$1.11 respectively, compared to US$4.65 losses in FY22. Bloomberg consensus average 12-month target price is US$48.56.

(Source: Bloomberg)

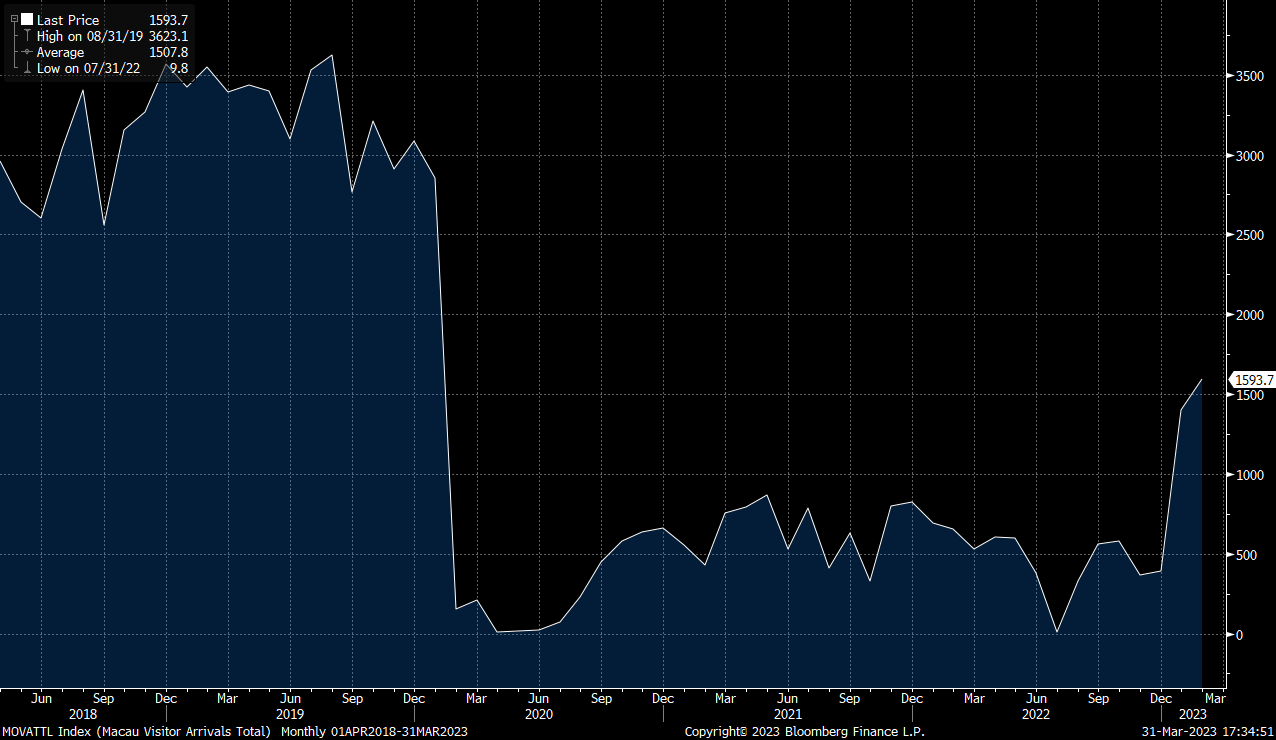

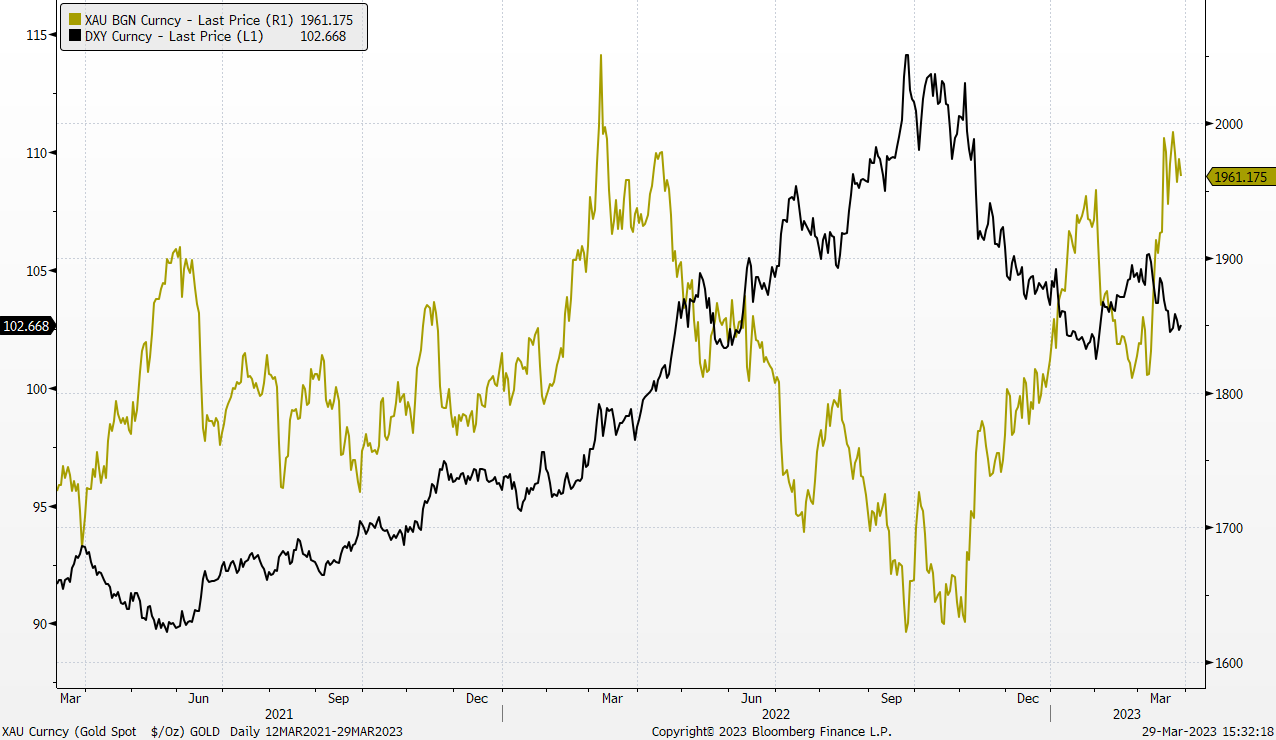

Agnico Eagle Mines Limited (AEM US): Gold back up

- RE-ITERATE BUY Entry – 51.0 Target – 59.0 Stop Loss – 47.0

- Agnico Eagle Mines Limited engages in the exploration, development, and production of mineral properties in Canada, Australia, Mexico, and Finland. The company primarily produces and sells gold deposits, as well as explores for silver, zinc, and copper deposits.

- Malfunction of the monetary system. The cent banking crisis in the US and Europe was due to liquidity concerns which led to a bank run. Though central banks reacted immediately to provide liquidity, the problem has not been resolved. Now, both the economy and markets are suffering from the backfire of decades of cheap credit. Central banks are confronting a dilemma between continual rate hikes to cool down inflation and pause/stop rate hikes from maintaining financial stability. The credibility of central banks is questioned, and investors’ confidence weakens gradually. Gold outshines on such a backdrop.

- Central banks are increasing gold reserves. According to Bloomberg, the People’s Bank of China raised its gold holdings by 30 tonnes in December 2022, and China’s central bank held a total amount of 2,010 tonnes of gold reserves as of January 2023. Russia increased its gold reserve by 1mn ounce to 74.9mn ounces as of February 2022. The Monetary Authority of Singapore’s bullion reserves rose to 6.4mn ounces at the end of January, up from 4.9mn ounces a month earlier.

The Fed recently hiked rates by 25 basis points. The market expects the Fed to stop raising interest rates and begin to cut rates in the second half of 2023.

- Better outlook for gold price in 2023. There are several factors that impact gold prices, and the key ones are the trend of the US dollar and global geopolitical risk. The broad market has expected that US dollars peaked last year as inflation has been on a downswing. Even though recent macro data such as CPI and core PCE prices showed overall prices were declining. The US job market started showing some weaknesses as the unemployment rate rose to 3.6% in February. The market expects Fed to cut rates in 2H23. On the other hand, geopolitical tensions remain high and probably escalate anytime as China-US confrontations are more frequent. Gold is the good old safe haven.

Gold Price and Dollar Index Trend

(Source: Bloomberg)

(Source: Bloomberg)

- Mixed 4Q23 results. Revenue jumped by 45% YoY to US$1.38bn, missing estimates by US$40mn. Non-GAAP EPS was US$0.4, in line with estimates. The company guided gold production for 2023 to be 3.24mn to 3.44mn ounces, with total cash costs and all-in sustaining costs forecast at US$840-US$890/oz and US$1,140-US$1,190/oz, respectively.

- The updated market consensus of the EPS growth in FY23/24 is -8.9%/18.6%, respectively, which translates to 28.8x/24.3x forward PE. Bloomberg consensus average 12-month target price is US$59.83.

Agnico Eagle Mines VS Gold price

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

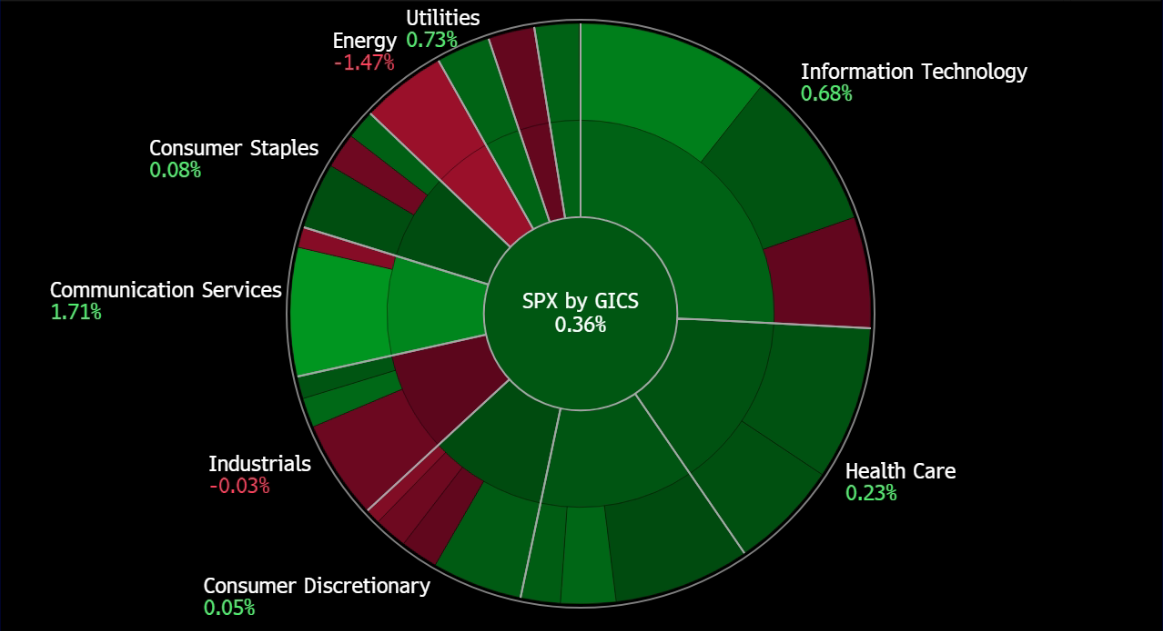

United States

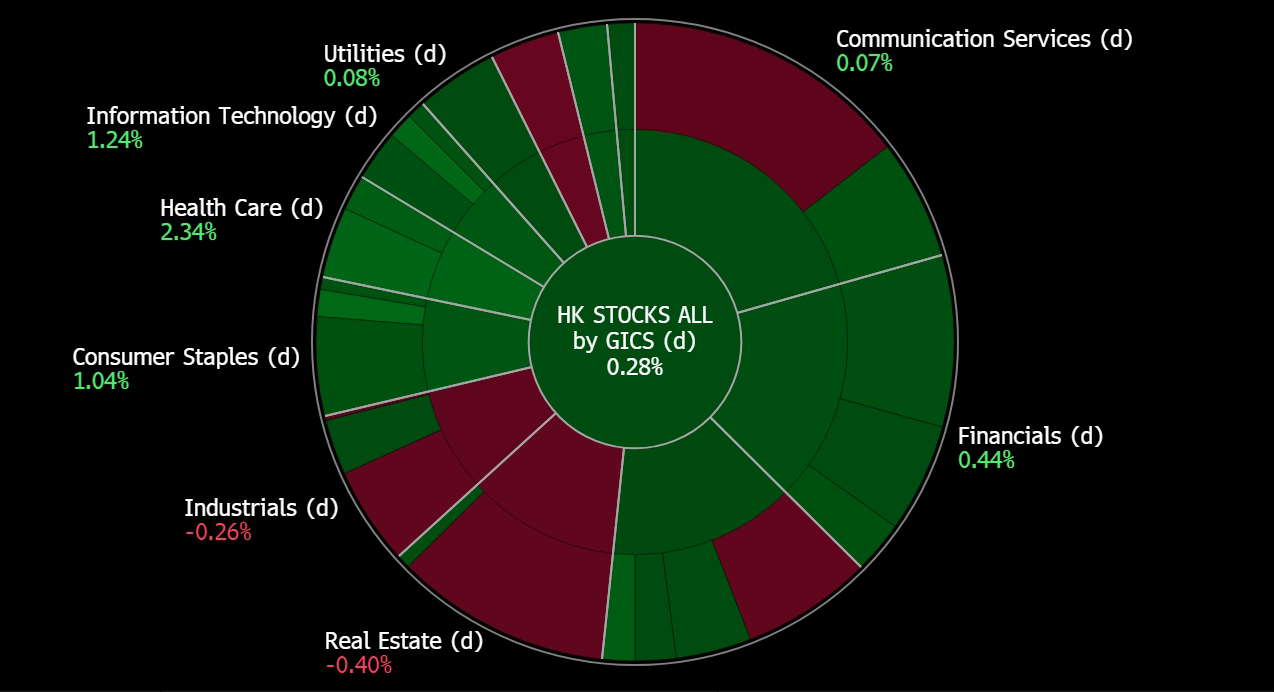

Hong Kong

Trading Dashboard Update: Take profit on Shandong Gold (1787 HK) at HK$17.0 and Northrop Grumman (NOC US) at US$470.4. Cut loss on Datadog (DDOG US) at US$65.0.