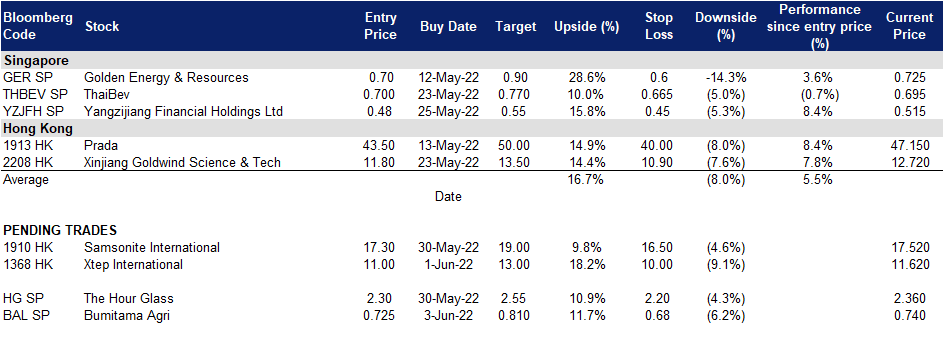

3 June 2022: Bumitama Agri Ltd (BAL SP), The Hour Glass (HG SP)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

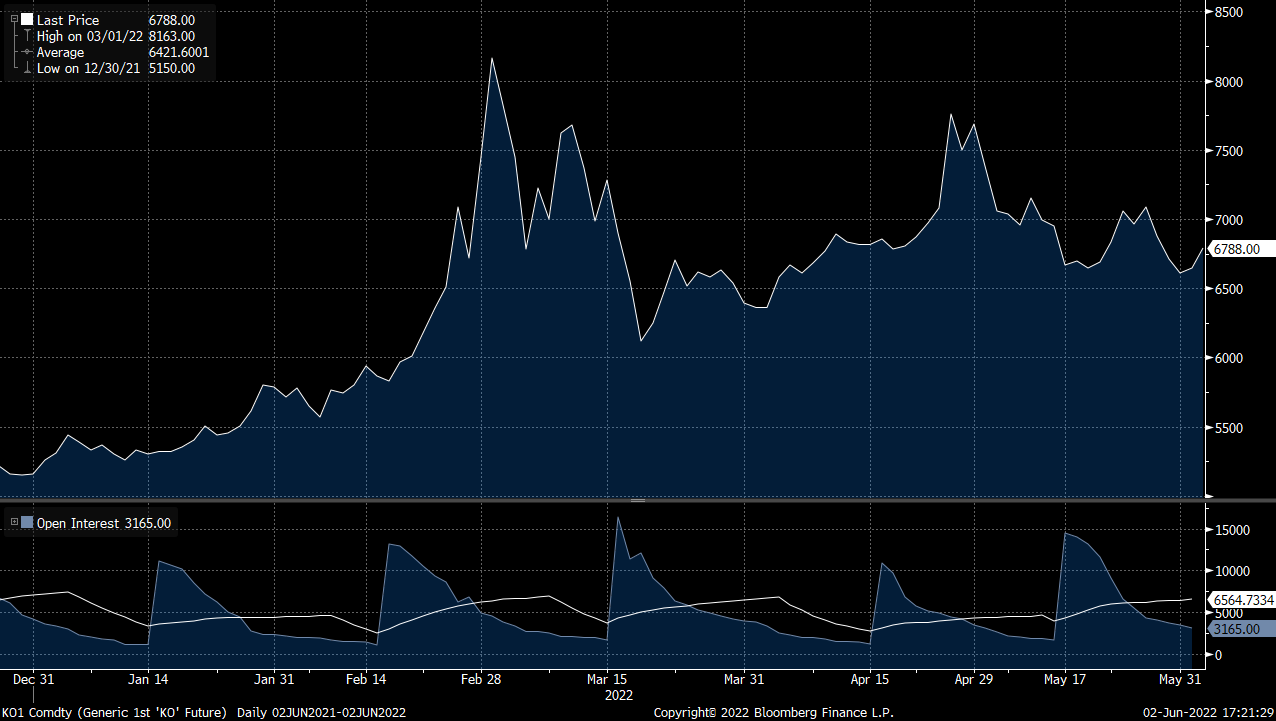

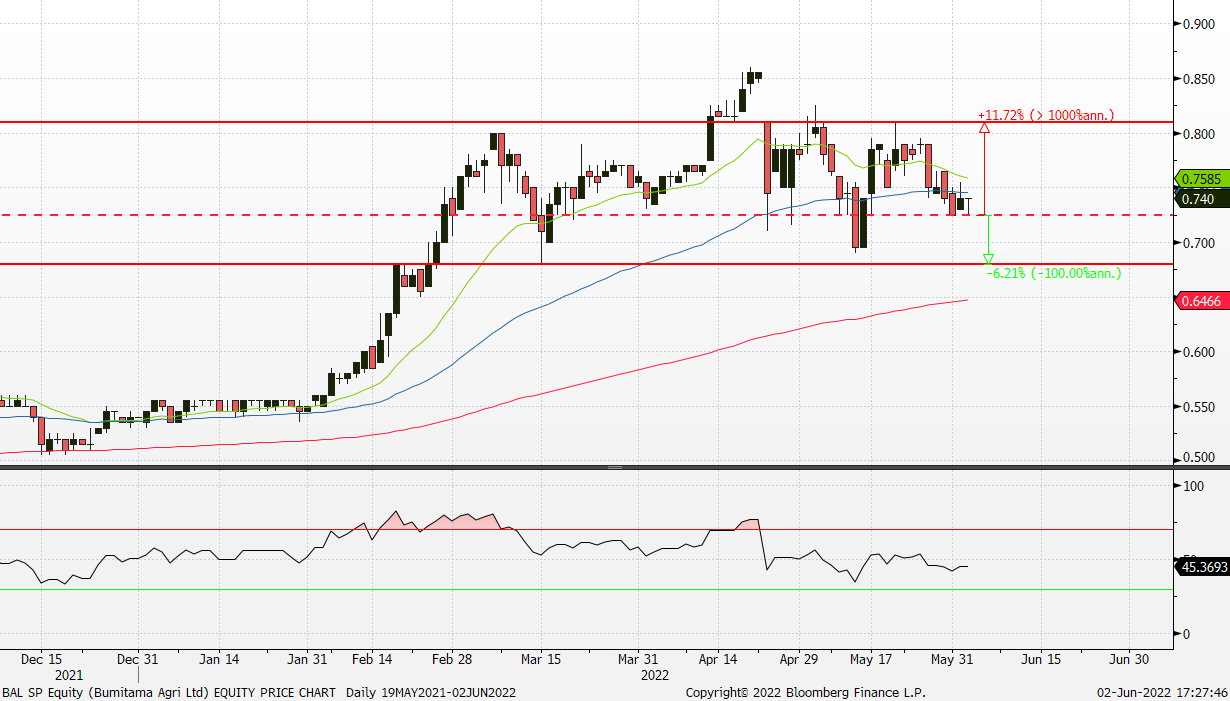

Bumitama Agri Ltd (BAL SP): Palm oil prices on another run

- BUY Entry – 0.725 Target – 0.810 Stop Loss – 0.680

- Bumitama Agri Ltd is an Indonesia-based producer of crude palm oil and palm kernel with oil palm plantations and mills located in three provinces of Indonesia, namely Central Kalimantan, West Kalimantan and Riau. Its primary business activities are cultivating and harvesting oil palm trees, processing fresh palm fruit bunches from its oil palm plantations, plasma plantations and third parties into crude palm oil and palm kernel, and selling crude palm oil and palm kernel.

- Stellar 1Q22 financials. Revenue rose 69% YoY to IDR 3,899,550 mn in 1Q22 while gross profit rose 195.9% to IDR 1,500,622mn. Gross profit margin improved significantly to 38.5% in 1Q22, compared to 22.0% in 1Q21. Overall net profit grew 423.6% to IDR 873,023mn in 1Q22, while net margins stood at 22.4%, compared to 7.2% in the previous period.

- Cloudy production outlook in Malaysia. State agency Malaysian Palm Oil Council (MPOC) on Wednesday lowered its production outlook for the world’s second largest producer and pegged prices to remain above 6,000 ringgit ($1,367.37) a tonne this year. The Malaysian Palm Oil Council forecast Malaysia’s 2022 production at 18.6 million tonnes, below previous expectations and after Indonesia has cancelled a long-awaited plan to send a batch of workers to operate in labour-starved Malaysia’s palm oil plantations. MPOC pegged Malaysia’s benchmark palm oil prices to remain between 6,500-6,800 ringgit until the end of July, and ease to 6,300-6,500 ringgit until September due to the resumption of Indonesian exports, Mohd Izham said.

- Indonesia’s export ban. Despite efforts made by Indonesia to cool palm oil prices, Indonesia has so far re-entered the export market only slowly with export volumes allowed significantly low. The government expected to allocate 1 million tonnes of palm oil exports based on domestic sales made during the export stoppage. So far, permits have been issued for 87,109 tonnes of refined, bleached and deodorised (RBD) palm oil and 90,255 tonnes of RBD olein, while the rest were issued for cooking oil, according to trade ministry data provided by Oke.

- Positive consensus estimates. Bumitama Agri currently has a positive consensus estimate of 4 BUYS, 0 HOLD and 0 SELL, with a 12M TP of S$0.97.

Generic 1st Crude Palm Oil (K01 Comdty)

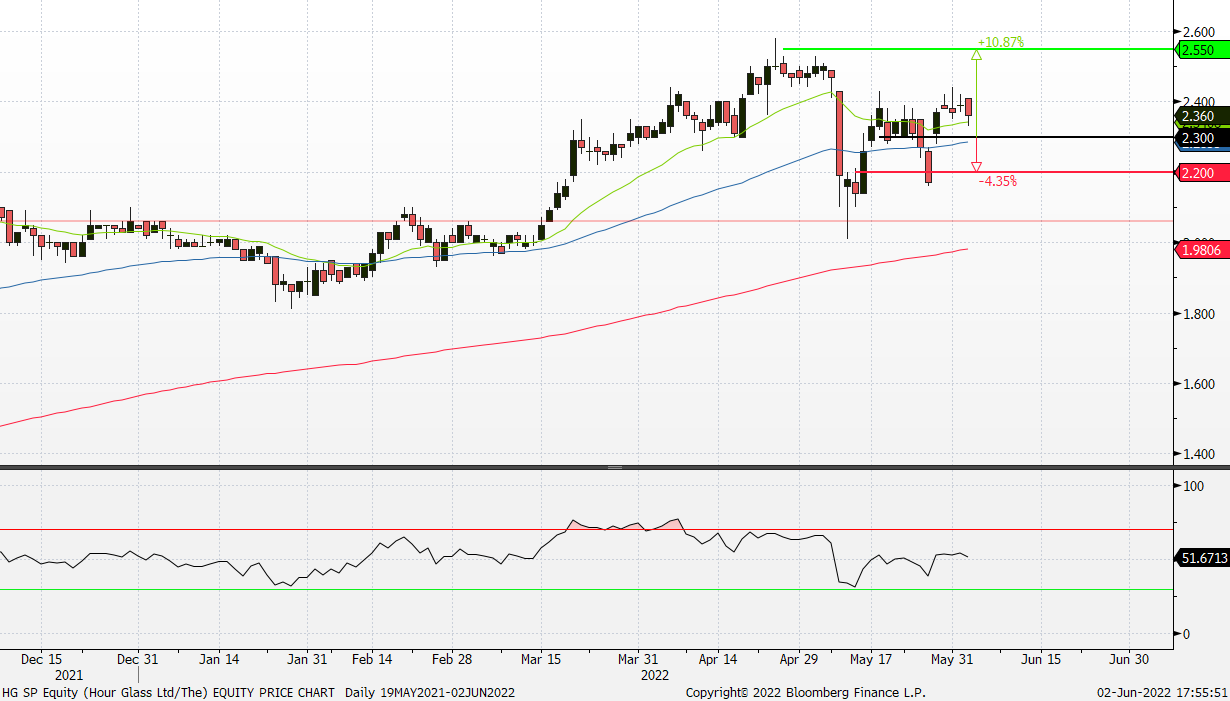

The Hour Glass (HG SP): More tourists to visit Singapore

- RE-ITERATE BUY Entry – 2.30 Target – 2.55 Stop Loss – 2.20

- The Hour Glass Limited is a specialty luxury watch retail group with multi-brand and standalone boutiques in the Asia Pacific Region. The group also owns Watches of Switzerland, a watch retail chain in Singapore that deals in mid-tier to high-end Swiss timepieces.

- Stellar 2H22 results. The company announced its 2H22 results (YE March). Revenue increased by 23.8% YoY to S$561mn. Net profit attributable to the company shareholders jumped by 75% YoY to S$92.1mn. The company proposed a final dividend of 6 SG cents for the full FY22.

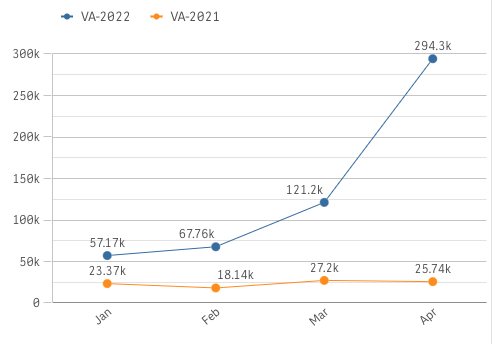

- Benefiting from the in-time reopening. Singapore has eased travelling restrictions since March. According to the Singapore Tourism Analytics Network, the number of visitor arrivals significantly improved in April, reflecting the onset of recovery of tourism. Therefore, we expect the ongoing recovery of tourism to uphold the upbeat outlook of the company.

Visitor Arrivals (VA) YoY Trends

Source: Singapore Tourism Analytics Network

- Asia’s road to recovery. Geographically, Southeast Asia and Oceania (Australia and New Zealand) contribute over 80% to the company’s total revenue. Singapore registered strong growth in consumer spending power despite the ongoing pandemic, evident from the retail sales index for watches and jewellery maintaining at pre-covid level in March 2022. Thailand and Malaysia on the other hand, are expected to catch up in 2022 with the reopening of foreign borders.

- Technical buy TP of S$2.55 and a fundamental outperform rating with a TP of S$2.32. Our TP is based on a discounted cash flow, taking into account a WACC rate of 10.5% and terminal growth rate of 2%. The last closing price was above our TP, and we will give an update accordingly. Read our previous fundamental report here.

The Hong Kong market is closed today in observance of a public holiday (Dragon Boat Festival). Trading resumes on Monday, 6 June.

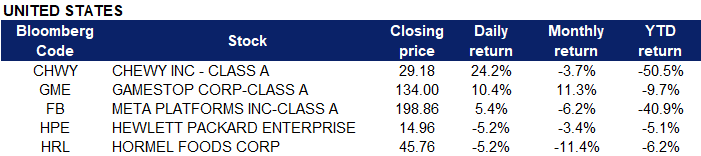

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Non-Energy Minerals | +3.6% | Copper price scales $10,000 on Chinese stimulus, lockdown reprieve Freeport-Mcmoran Inc (FCX US) |

| Technology Services | +3.4% | S&P 500, Nasdaq Finish Higher in Volatile Session Meta Platforms Inc (FB US) |

| Retail Trade | +3.2% | Costco Comparable Stores Sales Up 15.5% in May Costco Wholesale Corp (COST US) |

- Chewy (CHWY US) shares soared 24.2% after reporting an unexpected profit in the previous quarter. Chewy shared earnings of 4 cents per share on $2.43 billion in revenue. Analysts expected a loss of 14 cents per share on $2.42 billion in revenue, according to Refinitiv.

- GameStop (GME US) shares rallied 10.4% after the company posted its quarterly results. GameStop reported $1.38 billion in revenue in its fiscal first quarter, up slightly from the $1.27 billion it reported in the year-ago quarter. But it also reported a $157.9 million net loss, which is worse than the $66 million net loss in the year-ago quarter.

- Meta Platforms (FB US) shares rose 5.4% after Sheryl Sandberg announced she is leaving her role as chief operating officer. Chief growth officer Javier Olivan will take over the position this fall.

- Hewlett Packard Enterprise (HPE US) shares dropped 5.2% after missing analysts’ forecasts on the revenues and earnings for the previous quarter. The company reported a profit of 44 cents per share on revenues of $6.71 billion, compared with a Refinitiv consensus estimate of 45 cents per share on $6.78 billion in revenue.

- Hormel Foods Corp (HRL US) shares fell 5.2% after the company trimmed its fiscal 2022 earnings guidance. The food company expects earnings per share to range between $1.87 and $1.97 after previously guiding for a profit between $1.87 per share and $2.03 per share.

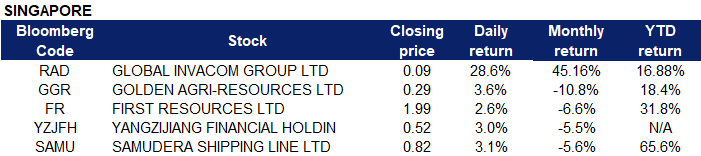

Singapore

- Global Invacom Group Ltd (RAD SP) shares rose 28.6% yesterday. The company announced recently that its wholly-owned subsidiary, OnePath Networks Limited, trading as “Global Foxcom”, has launched its new Mini-Global Navigation Satellite System (“GNSS”) repeater kit, another addition to Global Foxcom’s highly successful range of Satcom Repeater solutions. The new compact repeater is equipped with a unique set of features making it one of the most versatile and advanced GNSS repeater solutions available on the market.

- Golden-Agri Resources Ltd (GGR SP) and First Resources Ltd (FR SP) shares rose 3.6% and 2.6% respectively yesterday. Malaysian palm oil futures extended gains to above MRY 6,400 per tonne in early June, trading not far from a record high of 7268 hit on March 9th as consumption is outpacing supply. The production outlook in Malaysia continues to deteriorate amid a labour crunch while Indonesia has so far re-entered the export market only slowly with export volumes allowed significantly low. Indonesia and Malaysia account for about 85% of the world’s supply of palm oil.

- Yangzijiang Financial Holdings Ltd (YZJFH SP) shares rose 3.0% yesterday. Newly-listed Yangzijiang Financial Holdings has revised its dividend policy of paying at least 30% of its earnings for the FY2022 to FY2024. In an SGX announcement, the company, which was spun off from Yangzijiang Shipbuilding (Holdings), now plans to pay at least 40% of its earnings as dividends for the same three financial years.

- Samudera Shipping Line Ltd (SAMU SP) shares rose 3.1% yesterday. There was no company-specific news, however the gain was likely due to the reopening news of Shanghai and Beijing. Major Chinese cities Beijing and Shanghai began to relax Covid controls over the weekend as the local case count dropped. In Beijing, major shopping centres, including a luxury mall that temporarily closed a month ago due to Covid, announced they would reopen as of Sunday. Ride-hailing and most public transport resumed in the main business area, while more people were allowed to return to work. Some libraries, museums and gyms could reopen at half their capacity, if no Covid cases were found in the past seven days at a community level.

Trading Dashboard Update: Cut loss on Rex International (REXI SP) at S$0.31.