21 July 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

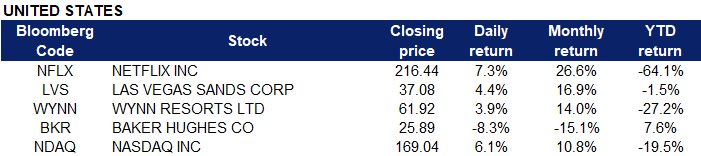

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Technology Services | +1.75% | Wall Street closes higher boosted by tech stocks gains on upbeat earnings Microsoft Corp (MSFT US) |

| Retail Trade | +1.75% | Amazon: Bargain Hunting With Prime Amazon.com Inc (AMZN US) |

| Electronic Technology | +1.70% | Why Nvidia Stock Rallied Another 3% Today NVIDIA Corp (NVDA US) |

Top Sector Losers

| Sector | Loss | Related News |

| Health Services | -2.30% | Elevance, Formerly Anthem, Tumbles Most in 2 Years on Costs Elevance Health Inc (ELV US) |

| Communications | -1.21% | AT&T Earnings Due Amid Flight To ‘Safe Yield’ Stocks AT&T Inc (T US) |

| Utilities | -1.09% | Utilities Down on Cyclical Bias — Utilities Roundup Nextera Energy Inc (NEE US) |

- Netflix Inc (NFLX US) popped 7.3% a day after Netflix posted a smaller-than-expected subscriber loss in the recent quarter. Netflix reported a beat on earnings but a miss on revenue.

- Shares of Las Vegas Sands Corp (LVS US) and Wynn Resorts Ltd (WYNN US) rose 4.4% and 3.9%, respectively. The action followed a report from Reuters that Macau will reopen casinos on Saturday as it gradually eases back on Covid restrictions.

- Baker Hughes Co (BKR US) plunged 8.3% after the oilfield services company reported disappointing second-quarter earnings. Baker Hughes reported earnings of 11 cents per share, which is half of what analysts were expecting, according to consensus estimates from Refinitiv.

- Nasdaq Inc (NDAQ US) jumped 6.1% on the back of an earnings beat on the top and bottom lines. Nasdaq reported earnings of $2.07 per share on revenue of $893 million.

Singapore

- Mermaid Maritime PCL (MMT SP) shares rose 20.5% yesterday. SUBSEA-services provider Mermaid Maritime’s subsidiaries in Thailand, the Middle East and the UK have been awarded multiple projects valued at US$265 million in total, the company said in a bourse filing on Tuesday, Jul 19. These projects are in areas such as cable-laying installation, inspection, repair and maintenance and decommissioning. Work on them has already started; they are slated for completion in late 2025, subject to certain options, said the group.

- Dyna-Mac Holdings Ltd (DMHL SP) and RH PetroGas Ltd (RHP SP) shares rose 14.3% and 4.8% respectively yesterday. Oil prices fell more than $1 a barrel on Wednesday, under pressure from global central bank efforts to limit inflation and ahead of expected builds in U.S. crude inventories as fuel demand weakens. Official weekly crude and fuel inventory data from the U.S. Energy Information Administration (EIA) is expected on Wednesday at 1530 GMT and traders are watching out for implied demand. Analysts, however, expect oil prices to continue to see support from supply tightness, even as U.S. shale oil production expands at a modest pace.

- Golden Energy & Resources Ltd (GER SP) and Geo Energy Resources Ltd (GERL SP) shares rose 4.3% and 5.1% respectively yesterday. Coal miner Yancoal Australia Ltd cut its 2022 output forecast on Wednesday, signalling a hit from floods in New South Wales and COVID-19-led labour shortages, and warned costs would balloon due to surging inflation. Torrential rain in New South Wales left mining operations in limbo amid soaring global inflation and the Russia-Ukraine crisis, while the company said it also needed to revise a longwall mining sequence at its Moolarben project in the state.

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Food Additives & Flavouring | +3.55% | EU, China to Cooperate on Tackling Food Crisis, Fertilizers Yihai International Holding Ltd (1579 HK) |

| Semiconductors | +2.97% | Senate Moves Forward With $52 Billion in Semiconductor Funding Hua Hong Semiconductor Ltd (1347 HK) |

| Other Support Services | +1.63% | NA China Education Group Holdings Ltd (839 HK) |

Top Sector Losers

| Sector | Loss | Related News |

| Infrastructure | -0.56% | In Depth: China Doubles Down on Infrastructure to Spur Growth China Railway Group Ltd (390 HK) |

| Electricity Supply | -0.55% | China Deepens Its Dependence on Coal by Speeding up Approvals China Power International Development Ltd (2380 HK) |

| Apparel | -0.49% | NA Li Ning Co. Ltd (2331 HK) |

- Zhengzhou Coal Mining Machinery Group Co Ltd (0564 HK) shares rose 15.2% yesterday. On July 20, 2022, Zhengzhou Machinery announced that it plans to jointly acquire a 43.33% stake with Henan Machinery & Equipment Co Ltd in Luoyang LYC Boeing Co Ltd through public delisting.

- SenseTime Group Inc (0020 HK) shares rose 11.0% yesterday. According to the news, the company repurchased shares for the first time after its listing. It repurchased 6.7 million shares and the price per share was 2.1 Hong Kong dollars, with a total payment of 14.07 million Hong Kong dollars.

- NagaCorp Ltd (3918 HK) shares rose 9.1% yesterday. On the evening of July 18, NagoCorp released its interim results and declared an interim dividend of HK5.66 cents per share. According to Credit Suisse ’s research report, its earnings before interest, tax, depreciation and amortisation (EBITDA) in the first half of the year was US$130 million, roughly in line with expectations. Market revenue and expenses are stable. Due to strong local demand and easing of travel restrictions, the average daily turnover of the high-end market and quarterly market has recovered to 72% and 80% of the pre-pandemic levels in FY2019, respectively.

- Techtronic Industries Co Ltd (0669 HK) shares rose 7.2% yesterday. A few days ago, Kaiyuan Securities estimated that the company’s revenue in the first half of the year was flat year-on-year, and the performance growth rate in the second half of the year is expected to outperform the industry.

- Zai Lab Ltd (9688 HK) shares rose 7.1% yesterday. Zai Lab announced that since July 18, its ordinary shares traded on the Hong Kong Stock Exchange have been included in the Shanghai-Hong Kong Stock Connect List, which will facilitate eligible investors in mainland China to invest in the company’s shares.

Trading Dashboard Update: Cut loss on Nexteer Automotive (1316 HK) at HK$5.10. Add Keppel DE REIT (KDECREIT SP) at S$1.96.

(Source: Bloomberg)