23 Nov 2021: Stocks making the biggest moves – Moderna, China Evergrande New Energy Vehicle; IPO Watch: Mooreast (MOOR SP)

Market Movers | Trading Dashboard

IPO Watch

Mooreast (MOOR SP): Debut of an offshore marine company in a niche market

- Mooreast is a total mooring solution provider.

- Its financial performance was stable during 2018-2020 but was negatively impacted by the slowdown in the offshore marine market in 1H21.

- The recovery in oil and gas E&P expenditure could benefit Mooreast in 2022.

- Ongoing growth in demand for renewable energy will be a tailwind for Mooreast in the long term.

- Read the full report here.

| IPO Price | S$0.22 |

| Shares for public offer | 800,000 |

| Shares for placement | 38,050,000 |

| Initial market cap | S$57mn |

| Trading commence | Wed, 24 Nov |

Market Movers

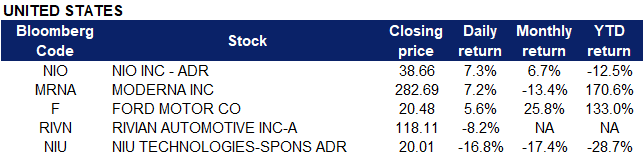

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Oil and Gas | +1.9% | OPEC+ Vows To Respond If Countries Tap Their Oil Reserves |

| Banks | +2.0% | Treasury Yields Rise After Biden Taps Powell for Second Term |

| Insurance | +1.4% |

Top Sector Losers

| Sector | Loss | Related News |

| Technology Services | -2.4% | Nasdaq dips 1% as bond yields rise, tech falters after Biden picks Powell for second Fed term |

| Semiconductors | -1.9% | |

| Precious Metals | -1.8% | Gold Price Forecast: XAU/USD bears eye $1,790 as yields cheer Fed Chair nomination |

- Moderna (MRNA US) shares added another 7.2% yesterday, likely riding on news of the Food and Drug Administration authorizing its COVID-19 booster for all adults last Friday. The German government previously announced its decision to promote the Moderna booster shot to its citizens. Additionally, Singapore’s health minister Ong Ye Kung stated publicly that a combination of the Pfizer-BioNTech vaccination with a Moderna booster jab has a “slight edge” in reducing the risk of COVID-19 infection.

- Shares of Rivian (RIVN US) declined 8.2% yesterday after Ford (F US) announced that it has halted its plans to build an electric vehicle with Rivian. Ford previously made a $500 million investment in Rivian in 2019, planning to jointly create an “all-new, next-generation battery electric vehicle” using Rivian’s development platform. Ford shares jumped 5.6%, as the news likely implied to investors that the company’s electrification strategy is strong enough to proceed on its own.

- Niu Technologies (NIU US) shares plummeted 16.8% after the company released its third quarter results. Niu reported sales of 1.2 billion yuan for the third quarter, a 37.1% YOY increase, however still missing analysts’ estimate of 1.4 billion yuan. Analysts expected earnings per share of 1.18 yuan, but the company reported EPS of only 0.57 yuan.

- Nio (NIO US) shares jumped 7.3% yesterday on rumors of its highly-anticipated flagship luxury sedan, the ET7 which is commonly touted to be a strong competitor for Tesla. The ET7 will be one of three new models the company will launch in 2022. The stock previously plunged nearly 9% last week on reports of sharp decline in deliveries for October.

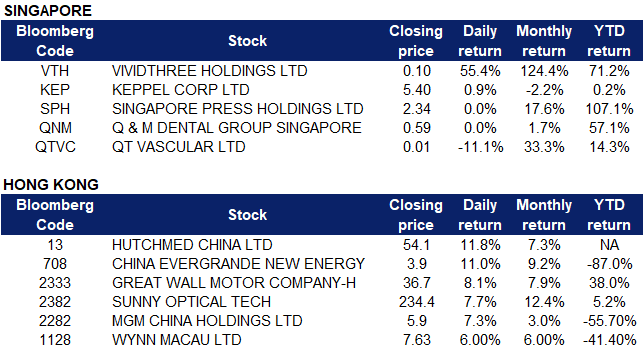

Singapore

- Vividthree Holdings (VTH SP) shares surged 55.4% after the company announced that it has raised $2.2 million through placing out 37.5 million new shares to a group of investors to fund acquisitions and fund new projects, including the market of non-fungible tokens, or NFTs. The placement price is at 5.832 cents each, a 10% discount off the stock’s last traded price on 16 November before a trading halt was called. The stock will resume trading on 22 November.

- Singapore Press Holdings (SPH SP) and Keppel Corp (KEP SP). Both stocks declined as much as 1.3% before closing flat and 0.9% higher respectively yesterday. It was announced on Sunday that Cuscaden Peak, a group backed by HPL, Ong Beng Seng and 2 Temasek-linked units CLA and Mapletree, that it has secured most of the regulatory approvals needed for its takeover bid of SPH, further cementing its advantage in a bidding contest for the company’s property assets. Additionally, SPH has said Cuscaden’s offer is superior and has called for shareholders to vote down Keppel’s proposal.

- Q&M Dental Group (QNM SP) shares declined as much as 2.5% yesterday before closing flat. It was reported that Quan Min Holdings (an investment company incorporated in Singapore, and also Q&M’s ultimate parent company) had acquired 7,584,300 of the company’s shares. The shares were acquired at an average price of 59.3 cents per share with a total consideration of S$4,497,276. The acquisitions increased the deemed interest of founder and group CEO, Ng Chin Siau in Q&M from 51.6% to 52.41%.

- QT Vascular (QTVC SP) shares plummeted another 11.1% yesterday. The company announced on Saturday that chief executive and executive director Eitan Konstantino will step down from his role on 30 November, shortly after some shareholders sent in EGM requisition notices to oust him and 3 other members from the company.

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Warehousing & Logistic Services | +2.86% | Asian shoppers unwrap Singles’ Day spoils leaving US consumers to bear brunt of supply chain woes |

| Automobile Retailing, Maintenance & Repair | +2.41% | NA |

| Precious Metals | +1.48% | Stocks slide on rate hike fears, gold prices gain |

Top Sector Losers

| Sector | Loss | Related News |

| Coal | -1.16% | Beijing, Moscow in talks to develop coal deposits in Russia |

| Dairy Products | -1.13% | New Zealand and China continue to dictate market dynamics |

| Airline Services | -0.87% | Unrest spreading in Europe as coronavirus lockdowns return |

- Hutchmed (China) Ltd (0013 HK). Shares rose 11.8% yesterday as 12 new class 1 drugs were approved for clinical use. Among them was the HMPL-653 capsule developed by Hutchmed. It is a potent and selective small molecule CSF-1R inhibitor and the drug can be used for patients with advanced malignant solid tumor and tendon sheath giant cell tumor (TGCT).

- China Evergrande New Energy Vehicle Group Ltd (0708 HK). Shares rose 11% yesterday. According to the news, the company has conducted two share placements within one month. On November 19, the company announced that it has signed a placement and subscription agreement with its placing agent worth HK$ 2.7bn. China Evergrande said that the company intends to use the proceeds collected for the company’s new energy vehicle research and development and production, laying the foundation for the smooth commissioning of Hengchi new energy vehicles.

- Great Wall Motor Co Ltd (0636 HK). Shares rose 8.1% yesterday after CICC issued a research report maintaining an OUTPERFORM rating on Great Wall Motor with a target price of HK$45. CICC expects Great Wall Motor to have about 33% upside potential, and forecasts a P/E ratio of 28x in 2022. On November 19, the SALOON brand of Great Wall Motor (GWM) made its global debut at the 19th GIAE, along with the first high-performance BEV. Meanwhile, several new models of HAVAL, GWM pickup, TANK, etc. were also unveiled. The bank believes that the SALOON brand is expected to make full use of Great Wall Motor’s expertise in the field of smart electric, and it will reshape the new ecology of the RMB 400,000 to 800,000 luxury pure electricity market.

- Sunny Optical Technology (Group) Co. Ltd (2382 HK). Shares rose 7.7% yesterday. Morgan Stanley released a research report stating that management expects smartphone lens upgrades to begin next year, as major contract manufacturers are seeking lenses with different functions (such as dual-lens OIS (Optical Image Stabilizer, etc.)) to capture high-end market share. In addition, the delay to replace mobile phones this year is expected to be alleviated next year when chips and supply chain issues are reduced. According to Morgan Stanley, Sunny Optical is the world’s top three VR and AR manufacturers and believes that the related business will grow rapidly in the next two to three years. Sunny Optical believes that it is in a favourable position in the future growth of AR due to its leading R&D capabilities in optical waveguides. However, the company also estimates that before 2024, AR business is unlikely to have a significant revenue contribution.

- MGM China Holdings Ltd (2282 HK), Wynn Macau Ltd (1128 HK). Gaming stocks rose collectively yesterday. MGM shares rose 7.3% while Wynn Macau shares rose 6% yesterday. According to the news, Macau Novel Coronavirus Infection Response Coordination Center announced that as of 11 am on November 19, Macau’s overall vaccination rate has reached 70%, and the target population’s vaccination rate is 78.8%. In addition, a research report by Motong said that the current valuation of Macau gaming stocks is equivalent to about 9x the estimated corporate value to EBITDA in 2023. It is believed that this has reflected the pessimistic situation of the renewal of gambling licenses, and further downside risks are expected to be limited.

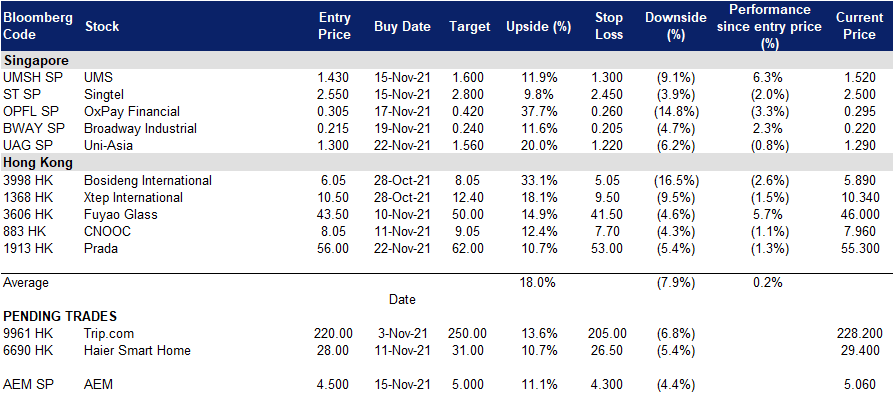

Trading Dashboard

(Click to enlarge image)

Related Posts: