4 March 2022: Mermaid Maritime (MMT SP), Ganfeng Lithium Co Ltd (1772 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

Mermaid Maritime (MMT SP): Back to the good old days

- BUY Entry – 0.084 Target – 0.100 Stop Loss – 0.075

- An indirect play on oil prices. MMT is Thailand-based but SGX-listed company that provides drilling and sub-sea engineering services for the offshore & marine industry. The company’s subsea engineering segment services clients mainly in Southeast Asia and the Middle East.

- Fuel to the fire. The commodities space is getting out of control. Brent oil surged to almost US$120 yesterday while WTI scaled US$116 as the effects of international sanctions disrupt global supply chains. Brent is now trading at the levels when oil companies were partying like there’s no tomorrow.

- OPEC keeps still. Despite the high oil prices, OPEC+ group decided on Wednesday to raise output by the widely anticipated 400,000 barrels per day. In essence, this will not have much impact on the current supply/demand dynamics. Even if the group wanted to increase production by more, only Saudi Arabia and UAE have the spare capacity to do so.

- Lagging behind. Oil and gas exploration and production (E&P) companies are among the first to rally in a commodity bull cycle. SG-listed E&P players like Rex International (REXI SP) and RH PetroGas (RHP SP) have surged by between 30% and 85% over the past month. Meanwhile, downstream companies like Sembcorp Marine (shipyard) and Mermaid Maritime (offshore support vessels and subsea services) are only starting to react to the higher oil prices. With oil prices back at where they were trading during the good all days, lagging oil companies should start to follow their upstream peers.

Brent oil prices are back to the good old days

Bumitama Agri (BAL SP): It’s getting crazy

- RE-ITERATE BUY Entry – 0.74 Target – 0.92 Stop Loss – 0.66

- A palm oil play. Bumitama Resources is a leading producer of palm oil and palm kernel in Indonesia. The group has a total planted area of 187,917 hectares and operates 14 CPO mills with a combined processing capacity of 6mn tonnes of fresh fruits bunches annually.

- To the moon. Palm oil, the most consumed edible oil, surged to new all-time highs, topping RM8,000 a tonne, as sanctions against Russia increased worries over global shortages of essential commodities. Alternatives such as soybean oil also rose by 5% yesterday to the highest on record since 1959. The surge in palm oil and soybean oil comes amid disruption of sunflower oil, which is the world’s third most traded vegetable oil. Ukraine is the world’s largest producer and exporter of sunflower oil with a market share of 47% of global exports.

- Earnings upside. Bumitama reported an 81% YoY surge in its 2H2021 net profit to S$117.5mn on the back of higher palm oil prices, despite sales volume dropping by 7% YoY. It was able to achieve a 40% YoY increase in average selling prices of crude palm oil. Earnings in 2022 is forecasted to reach the highest level since its IPO in 2012, as per Bloomberg consensus forecast.

- Positive analysts rating. There are 4 BUY ratings and an average 12m TP of S$0.87, implying a 14.5% return from the last close price. However, shares could surprise on the upside given that Bumitama’s 7.5x FY2022F P/E is the cheapest among the locally-listed palm oil companies.

Palm oil prices

HONG KONG

Ganfeng Lithium Co Ltd (1772 HK): High oil prices accelerate the end of petroleum vehicle era

- BUY Entry – 120 Target – 140 Stop Loss – 110

- GANFENG LITHIUM CO., LTD. is a China-based company principally engaged in the research, development, production and sales of deeply processed lithium products. The Company’s main products include lithium compounds, lithium metal and lithium batteries. The Company’s products are mainly used in electrical vehicles, chemicals and pharmaceuticals. The Company distributes its products in the domestic market and to overseas markets.

- Lithium carbonate reached another record high. Lithium carbonate prices in China rose to RMB483,500/tonne as of 4th March due to high global demand and tight supplies. Prices have jumped more than 87% YTD. China is expected to double the EV sales in 2022 to more than 5mn units. Meanwhile, battery producers rush to secure long-term supply contracts with lithium mining companies. The recent sanction on Russia pushed oil prices back to more than US$100/bbl. The outlook for oil is still very bullish. Accordingly, the demand for petroleum vehicles will be further suppressed. On the contrary, the demand for EVs, especially in Europe and the US will be further propelled. As a result, lithium, the main raw material for batteries, is expected to see stronger demands.

- Positive FY21 earnings alert. The company announced the FY21 earnings alert. Net profit attributable to shareholders of the company jumped by between 368.45% and 436.76% YoY to between RMB4.8bn to RMB5.5bn. Net profit after deduction of non-recurring gains and losses jumped by between 621% and 795.04% YoY to between RMB2.9bn and RMB3.6bn.

- Resumption of uptrend. Share price has corrected by 41% from the peak of HK$185 in August 2021 to the low of HK$109 in December 2021. Driven by the positive earnings guidance, shares have been trading upward since February.

- Updated market consensus of the EPS growth in FY22/23 is 67.8%/7.0% YoY respectively, which translates to 20.6x/19.3x forward PE. Current PER is 44.4x. Bloomberg consensus average 12-month target price is HK$203.37.

AviChina Industry & Technology Co Ltd (2357 HK): Arms race has begun

- RE-ITERATE BUY Entry – 4.80 Target – 5.50 Stop Loss – 4.55

- AviChina Industry & Technology Company Limited is principally engaged in the research, development, manufacture and sale of civil aviation products. The Company operates its business through two segments. The Aviation Entire Aircraft segment is engaged in the manufacture, assembly, sales and servicing of helicopters, trainers and other aircraft. The Aviation Parts and Components segment is engaged in the manufacture and sale of aviation parts and components.

- Invasion marks the start of accelerating expansion of worldwide defence spending. The Russia-Ukraine conflict continued to escalate even though the peace talks ended on Monday night. Previously, Russia had raised nuclear threats by putting its nuclear forces on high alert on Sunday. Subsequently, Germany announced to commit EUR100bn (US$112.7bn) of the 2022 budget for the armed forces. Meanwhile, the EU agreed to give EUR500mn in arms to aid Ukraine. The ripple effect is expected to extend the arms race globally as the Middle East, South, Southeast and Northeast Asia have huge geographical disputes and ideological conflicts. China has been increasing its defence spending consistently. China’s 2021 defence budget was RMB1.35tn, up 6.8% YoY. The world order which was built after WWII is being undermined, China is likely to budget more for 2022 defence expenditure to counter potential external unrest.

- Preliminary FY21 earnings. Total operating revenue grew by 25.2% YoY to RMB12.9bn. Gross profits jumped by 34.9% YoY to RMB2.3bn. Net profits attributable to the shareholders excluding non-recurring gains and losses jumped by 38.4% YoY to RMB1.9bn.

- The updated market consensus of the EPS growth in FY22/23 is 16.3%/13.5% YoY respectively, which translates to 11.1x/9.8x forward PE. The current PER is 13.4x. Bloomberg consensus average 12-month target price is HK$7.55.

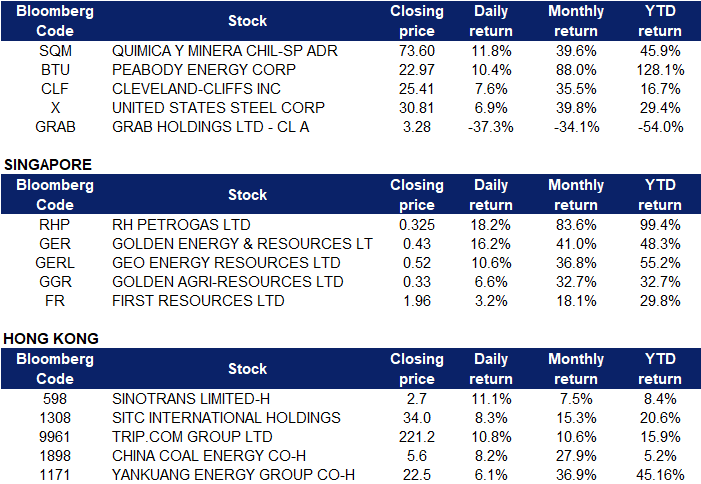

MARKET MOVERS

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Coal | +5.9% | China’s Russian coal purchases stall as buyers struggle to secure financing Peabody Energy (BTU US) |

| Food Retail | +3.5% | Wheat Prices Surge Amid Russia’s Invasion Of Ukraine—Here’s What That Means For U.S. Food Costs Kroger Company (KR US) |

| Chemicals (Agricultural) | +24% | Russia’s war with Ukraine risks putting fresh pressure on rising fertiliser prices CF Industries (CF US) |

Top Sector Losers

| Sector | Loss | Related News |

| Motor Vehicles | -4.2% | Ukraine War Plunges Auto Makers Into New Supply-Chain Crisis Tesla (TSLA US) |

| Casinos / Gaming | -3.2% | Is the China Reopening Trade for Real? Las Vegas Sands (LVS US) |

| Internet Retail | -3.1% | Current Sea Limited Sell-Off a Buying Opportunity: Barclays SEA (SE US) |

- Sociedad Química y Minera de Chile S.A. (SQM US) shares popped 12% after it reported better than expected 4Q earnings and revenues, topping its target to sell around 100,000 metric tons of lithium in 2021. SQM’s net profit surged almost 5x to US$322mn, beating analyst estimates of US$266mn. The company said that lithium demand grew around 55% in 2021 compared to the prior year, driven by new demand for electric vehicles.

- Peabody Energy (BTU US) shares surged 10% in overnight trading after newcastle thermal coal futures contracts reached a fresh all-time high of US$425 per metric ton vs the US$75 that it traded at over the past decade. The coal miners also announced earlier this week that it will make its first foray into renewable energy through a JV and develop over 3.3GW of solar energy in five years on their former mining sites.

- US steel makers Cleveland-Cliffs (CLF US) and United States Steel Corp (X US) shares rose by 7-8% over concerns of supply chain disruption that has caused steel prices to jump over the past week.

- Grab (GRAB US) shares crashed 37% after it reported a US$1.1bn net loss for its 4Q period, almost double that of the US$576mn loss in the prior year period. Revenue plunged 44% YoY to US$122mn, with declines in mobility and delivery revenue but an improvement in financial services revenue.

Singapore

- RH Petrogas Ltd (RHP SP) shares surged 18.2% yesterday. WTI crude futures extended their rally to briefly top $116 per barrel on Thursday, the highest since September 2008, on fears of further supply disruptions from Russian sanctions over its invasion of Ukraine. The US took aim on Wednesday at Russia’s oil refining sector with new export curbs and targeted Belarus with sweeping new export restrictions, but has so far stopped short of targeting Russia’s oil and gas exports amid concerns over energy prices. The OPEC+ alliance that includes Russia also stuck to a planned output increase of 400,000 barrels a day in April despite the market turmoil brought by the war in Ukraine.

- Golden Energy & Resources Ltd (GER SP) and Geo Energy Resources Ltd (GERL SP) shares surged 16.2% and 10.6% respectively yesterday. Newcastle coal futures broke another record high at $400 per tonne and are now up more than 100% since the beginning of 2022, as mounting sanctions on Russia for invading Ukraine led to an international energy crunch and exacerbated concerns over the commodities supply. Asian customers have also been scrambling to find alternative supplies to replace Russian coal. Aside from Ukraine headlines, investors were already bullish on coal since early 2022 amid supply disruptions in top exporting countries such as Indonesia and Australia.

- Golden Agri-Resources Ltd (GGR SP) and First Resources (FR SP) shares rose 5.2% and 2.0% respectively yesterday. Malaysian palm oil futures briefly hit a fresh all-time high of MYR 7,108 a ton before moderating to around MYR 6,660 in early March, as traders digested tight market conditions and the Ukraine crisis. The ongoing war in Ukraine has added to upside risks in the palm oil market, as sunflower oil exports from the Black Sea region were disrupted, boosting further demand for the alternative palm oil.

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Airline Services | 4.74% | Chinese airlines face no direct impact from Western bans on Russian flights Air China Ltd (753 HK) |

| Travel & Tourism | 3.97% | China Reopening Stocks Jump on Report of Covid Policy Easing Trip.com Group Ltd (9961 HK) |

| Marine & Harbour Services | 2.40% | Asian Aframax freight for shipping Far East Russia ESPO crude nearly double SITC International Holdings Co Ltd (1308 HK) |

Top Sector Losers

| Sector | Loss | Related News |

| Automobiles & Components | -1.77% | Chinese Auto Makers Dive as New Sales Data Shows Continued Sector Weakness Great Wall Motor Company Limited (2333 HK) |

| Software | -1.54% | Global Rate Bets Evaporate as Traders Ditch Half-Point Fed Move Kingsoft Corporation Limited(3888 HK) |

| Biotechnology | -1.22% | NA Zai Lab Ltd (9688 HK) |

- Sinotrans Ltd (598 HK), SITC International Holdings Co Ltd (1308 HK). Shipping sector shares rose collectively yesterday. Yamato released a research report saying that the situation in Russia and Ukraine will exacerbate the disruption of the global logistics supply chain. Freight rates of dry bulk carriers may increase, and the companies covered by the bank will only be affected to a limited extent. It is expected that geopolitical factors will further put pressure on logistics supply and push up freight rates. The bank reiterates a “buy” rating on SITC International and Pacific Ocean Shipping.

- Trip.com Group Ltd (9961 HK) shares rose 10.8% yesterday. China, the last major country to stick with a zero-tolerance approach to Covid-19, is now actively exploring ways to loosen controls. Chinese public health experts have recently started to discuss some of the efforts publicly, part of an effort to prepare Chinese people to live with a virus the country has spent two years trying mightily to eradicate. Covid-19 controls likely won’t be eased before next spring, according to two of the people, but experimental opening measures could arrive in select cities as early as this summer.

- China Coal Energy Co Ltd (1898 HK), Yankuang Energy Group Co Ltd (1171 HK). Coal sector shares rose collectively yesterday. Newcastle coal futures broke another record high at $400 per tonne and are now up more than 100% since the beginning of 2022, as mounting sanctions on Russia for invading Ukraine led to an international energy crunch and exacerbated concerns over the commodities supply. Asian customers have also been scrambling to find alternative supplies to replace Russian coal. Aside from Ukraine headlines, investors were already bullish on coal since early 2022 amid supply disruptions in top exporting countries such as Indonesia and Australia.

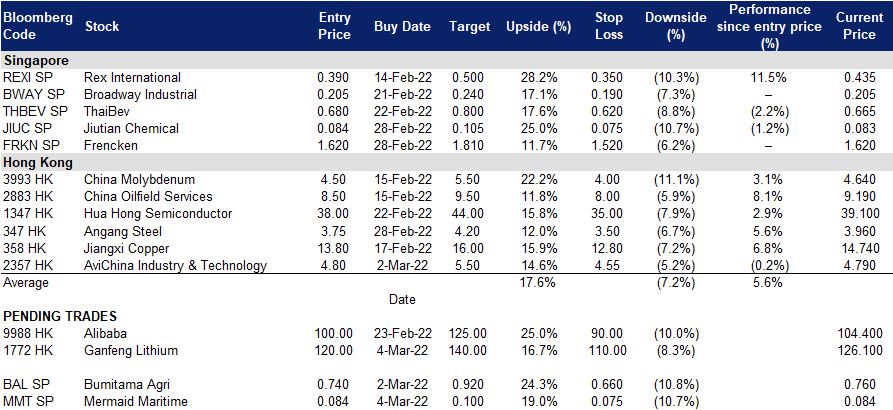

Trading Dashboard

Trading Dashboard Update: Add AviChina Industry & Technology (2357 HK) at HK$4.80. Take profit on ST Engineering (STE SP) at S$3.93.

(Click to enlarge image)