23 February 2022: Rex International Holdings Ltd (REXI SP), Alibaba Group Holding Ltd (9988 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

Rex International Holdings Ltd (REXI SP): Brent at US$100

- BUY Entry – 0.39 Target – 0.50 Stop Loss – 0.35

- Rex International Holding Limited operates as an independent oil exploration and production company. It operates through Oil and Gas, and Non-Oil and Gas segments. The company offers Rex Virtual Drilling, a liquid hydrocarbon indicator, which uses seismic data to search for oil. The company is involved in the oil and gas exploration and production activities with a focus in Oman and Norway.

- Geopolitical risks are a boost to oil prices. Brent rose 2% on Tuesday, closing in on US$100 per barrel, after Russia ordered troops into regions of Ukraine. European natural gas led gains in commodities, surging as much as 13%, while European coal prices rose 4%. The US and UK say they plan to announce new sanctions as soon as Tuesday. However, this may further complicate matters given that Russia is the largest provider of gas in Europe, and about a third of which usually travels through pipelines across Ukraine.

- Tightening an even together market. Even without the prospect of war, oil supply challenges among exporting countries still threaten to increase the tightness in oil markets and may continue to push prices higher, according to the International Energy Agency.

- Earnings watch. Rex is due to report its full year results on Friday, 25 February 2022. This set of earnings will be closely watched as it will include contributions from the Brage Field in Norway that Rex acquired in 2021.

First Resources (FR SP): Palm oil prices at all-time highs, again

- BUY Entry – 1.74 Target – 1.90 Stop Loss – 1.66

- Established in 1992 and listed on the SGX since 2007, First Resources is one of the leading palm oil producers in the region, managing over 200,000 hectares of oil palm plantations across the Riau, East Kalimantan and West Kalimantan provinces of Indonesia. The group’s core business activities include cultivating oil palms, harvesting, and milling them into crude palm oil (CPO) and palm kernel (PK). In addition, the group through its refinery, fractionation, biodiesel and kernel crushing plants, processes its CPO and PK production into higher value palm-based products such as biodiesel, refined, bleached and deodorised (RBD) olein and RBD stearin, palm kernel oil and palm kernel expeller.

- Palm oil prices are at all-time highs, again. Malaysian palm oil futures jumped to new all-time highs on Tuesday, extending gains for the fourth session, as concerns over the tensions in Ukraine spilled over into the broader commodity market. On a fundamental level, palm oil supply-demand dynamics remains favourable going into 2022. In addition to supply constraints in Indonesia and Malaysia, the two largest producers, palm oil prices have been buoyed by higher prices of alternatives such as soybean due to yield losses in drought-hit South America.

- 4Q2021 earnings is the key catalyst. Given stronger palm oil prices and the absence of hedging on the company’s part, we think 4Q results may surprise on the upside. The company is scheduled to report its full year results on 25 February 2022.

- Room to outperform consensus view. Sell side analysts have become more cautious recently after the 15% YTD rally in its share price.There are still 6 BUYS and 3 HOLDS as of 22 Feb 2022, but a shade lower than the 7 BUYS in the same period last year. However, against the cautious consensus backdrop, we think the company has more room to outperform when it reports its full year results.

PALM OIL FUTURES (KO1)

HONG KONG

Alibaba Group Holding Ltd (9988 HK): Upcoming 4Q21 result is the watershed event

- BUY Entry – 100 Target – 125 Stop Loss – 90

- Alibaba Group Holding Ltd is a holding company that provides the technology infrastructure and marketing reach to help merchants, brands and other businesses to leverage the power of new technology to engage with users and customers to operate. The Company operates four business segments. The Core Commerce segment provides China retail, China wholesale, International retail, International wholesale, Cainiao logistics services and local consumer services through Taobao Marketplace and Tmall. The Cloud Computing segment provides complete suite of cloud services, including database, storage, network virtualization services, big data analytics and others. The Digital Media and Entertainment segment provides consumer services beyond the core business operations. The Innovation Initiatives and Others segment is to innovate and deliver new services and products.

- Headwinds or noises. The recent negative news for the e-commerce giant was a fresh round of checks on state-owned companies and banks regarding the financial exposure to Ant Group. As Alibaba owns about one third of Ant, the shares were sold down again owing to the concerns of another new round of crackdown which could result in some headwinds.

- Technology re-rating amidst the rate hike cycle. The worst start of 2022 for the US market was driven by the Federal Reserve’s more aggressive than expected rate hike and balance sheet reduction. Technology companies’ shares have been hammered and under selling pressure. However, Chinese technology peers have already re-rated due to policy and geopolitical risks. Comparatively, Chinese companies are less impacted from the sell-off given that downside is limited. YTD, China has recorded more ETF fund inflows than the US.

- Growth is the anchor for valuation. Investors have been averaging down into BABA’s shares since its downturn in 2021 given cheap valuations. We use PEG as a simple valuation metric. Based on Bloomberg estimates, BABA EPS is expected to drop by 20.64% YoY in FY22 and rebound by 13.0% YoY in FY23. Its FY23F PER is at 12.35x. The PEG is about 0.95x, which is lower than the US big tech giants’ averages of between 1.0x and 2.0x.

- The company will be announcing the 4Q21 earnings on 24th February Thursday. Updated market consensus of the EPS growth in FY22/23 are -21.4%/12.8% YoY respectively, which translates to 14.1x/12.5x forward PE. Current PER is 14.1x. Bloomberg consensus average 12-month target price is HK$192.88.

Ping An Insurance (Group) Company of China, Ltd. (2318 HK): Turnaround

- RE-ITERATE BUY Entry – 64 Target – 72 Stop Loss – 60

- Ping An Insurance (Group) Company of China, Ltd. is a personal financial services provider. The Company provides insurance, banking, investment, and Internet finance products and services. The Company operates its businesses through four segments. The Insurance segment provides life insurance and property insurance, including term, whole-life, endowment, annuity, automobile and health insurance. The Banking segment is engaged in loan and intermediary businesses with corporate customers and retail business. The Assets management segment is engaged in security, trust and other assets management businesses, including investment, brokerage, trading and asset management services. The Internet Financing segment is engaged in the provision of Internet finance products and services.

- Nightmare is gone. 2021 is the third worst year for the China insurance giant, following the 2008 global financial crisis and 2011 European debt crisis. The main reason for the sharp sell-off is due to the large investment exposure to the property sector which is overleveraged and hammered by regulations. However, authorities have started to ease the tightening measures on the property sector by the end of 2021. Entering 2022, China has adopted a counter-cycle monetary policy by further lowering key rates, which is totally opposite to the western countries’ rate hike cycle. With the property sector, especially the market leaders’ survival, Ping An’s investment will recover gradually.

- Ping An was experiencing the HSBC moment. Investors should focus on the core business fundamentals of Ping An. Similar to HSBC whose shares were hammered during the China-US trade tensions, Ping An’s shares once plunged to below book value, which has never happened since its listing. Negative sentiment pushed prices down to oversold levels.

- January gross insurance premium of the big five listed companies showed mixed signals. Total gross premium amounted to RMB572bn, up 1.86% YoY in January 2022. Total casualty and property insurance premium income recovered evidently, of which Ping An’s grew by 8.2% YoY to RMB32.8bn. However, total life insurance premium income continued its decline, of which Ping An’s dropped by 0.6% YoY to RMB98.6bn.

- Updated market consensus of the estimated net profit growth in FY22/23 is 24.9%/12.4% respectively, which translates to 6.5x/5.8x forward PE. The current PE is 7.6x. The FY22/23 dividend yield is expected to be 4.7%/5.1% respectively. Bloomberg consensus average 12-month target price is HK$79.56.

MARKET MOVERS

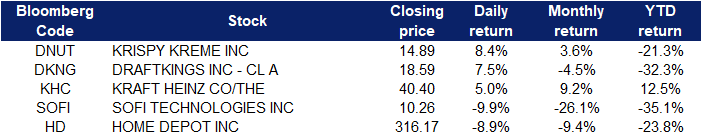

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Marine Shipping | +2.1% | Dry bulk market rises amid Russia-Ukraine tensions Star Bulk Carriers (SBLK US) |

| Diversified Food | +0.9% | Pushed by high meat prices, food inflation rate hits 7% The Kraft Heinz (KHC US) |

| Food / Meat / Dairy | +0.4% | Corporate pricing is boosting inflation Tyson Foods (TSN US) |

Top Sector Losers

| Sector | Loss | Related News |

| Home Improvement Chains | -7.3% | Home Depot’s margin warning casts shadow on solid quarter Home Depot (HD US) |

| Motor Vehicles | -3.7% | Electric Vehicles Gain Ground but still Face Price, Range, Charging Constraints Tesla (TSLA US) |

| Oil & Gas Production | -2.1% | The World Cannot Afford To Replace Russian Oil Occidental Petroleum (OXY US) |

- Krispy Kreme Inc (DNUT US) shares gained 8.4% yesterday, after the company reported its first quarterly profit since its July initial public offering, but its earnings fell short of Wall Street’s expectations. Net sales rose 13.8% to $371 million, beating expectations of $364 million. Organic revenue climbed 13.9% compared with the year-ago period and 15.9% on a two-year basis. CEO Mike Tattersfield said in an interview that Krispy Kreme, like the broader restaurant industry, is seeing labour and commodity inflation, although it’s able to hedge against higher ingredient costs. The cost of sugar, wheat and oil make up about 12% of the company’s sales, and he said that the company has pricing power, too.

- Draftkings Inc (DKNG US) shares gained 7.5% yesterday despite a downgrade by Wells Fargo to equal weight from overweight. The firm cut its price target on DraftKings to $19 per share from $41 per share, noting its concern about the company’s path to profitability given its expense increases. Investors may have been buying the dip after the shares plunged 21.6% on Friday on a higher than expected adjusted EBITDA loss for 2022. However, DraftKings raised its revenue guidance for 2022 from a range of $1.7 billion to $1.9 billion to a range of $1.85 billion to $2 billion. The company said the projection reflects the launch of mobile sports betting in New York and Louisiana at the start of the year.

- Kraft Heinz Co (KHC US) shares rose 5% yesterday after the company increased its long-term growth targets and reiterated its adjusted EBITDA guidance for 2022 of between $5.8 billion and $6 billion.

- SoFi Technologies Inc (SOFI US) shares plunged 9.9% yesterday after the company announced it will buy Technisys, a maker of banking software, for about $1.1 billion in stock. SoFi said the deal will help it generate up to $800 million in additional revenue through 2025.

- Home Depot Inc (HD US) shares plunged 8.9% yesterday with the broader market sell-off, despite the company reporting a quarterly beat on profit, revenue and comparable store sales for the most recent quarter. Home Depot on Tuesday said sales grew 11% in the fiscal fourth quarter, as it topped Wall Street’s expectations and said it sees sales growth ahead for 2022. While demand has eased from the height of the coronavirus pandemic, Home Depot is being challenged by inflation and supply chain bottlenecks. The company topped Wall Street’s expectations and said it anticipates earnings per share will grow at a low single-digit pace while sales trends will be “slightly positive” in the coming fiscal year.

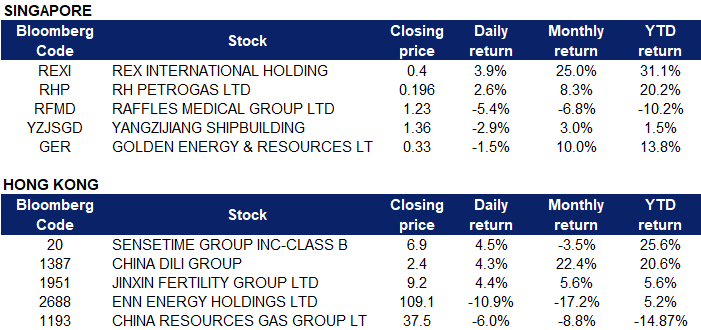

Singapore

- Rex International Holding Ltd (REXI SP) and RH Petrogas Ltd (RHP SP) shares rose 3.9% and 2.6% respectively yesterday. WTI crude futures surged more than 4% to around $96 per barrel yesterday, a level not seen since September of 2014, while Brent crude futures rose about 2% to above $97 per barrel yesterday, scaling fresh 7-year highs. The move came after Russian president Vladimir Putin recognized the independence of two breakaway regions in eastern Ukraine and later ordered forces into the area. US president Joe Biden responded by ordering sanctions on the two separatist regions, with the European Union vowing to take additional measures. Meanwhile, investors continued to monitor efforts to revive the 2015 Iran nuclear agreement after a senior European Union official said Friday a deal was “very very close.” Analysts suggested that a potential deal could add more than 1 million barrels a day of Iranian crude to the market.

- Raffles Medical Group (RFMD SP) shares extended their losses and fell 5.4% yesterday. The company recently announced its results and reported that net profit for 2H2021 fell 8% YoY to S$44.7mn. The lower profit was attributed to higher tax expenses. However, on a full-year basis, net profit rose 28% YoY to S$84.2mn. The healthcare provider expects to remain profitable in FY2022 as demand for tests will remain for some time and as regional patients return. OCBC Investment Research maintained a “buy” rating on the stock with a fair value of S$1.65.

- Yangzijiang Shipbuilding Holdings Ltd (YZJSGD SP) shares declined 2.9% yesterday after the company announced that its Independent Director, Mr Teo Yi-Dar was asked for assistance in an investigation. As mentioned in the TEE International Announcement, it was disclosed that all the Independent Directors and the Non-Executive Director and one Management personnel, namely the managing director of the Group’s Engineering and Construction Business, were asked to assist with the Investigation and were accordingly interviewed by CAD on 17 February 2022 and 18 February 2022. Mr Teo is currently a Non-Executive Non-Independent Director of TEE International.

- Golden Energy & Resources Ltd (GER SP) shares extended their losses and declined 1.5% yesterday, after plunging 9.5% the day before, despite record numbers for both the top-line and bottom-line. The miner announced that it does not plan to give a dividend, reasoning, instead, that resources should be channelled to fund new acquisitions. Golden Energy and Resources reported earnings of US$171 million for 2H21 ended Dec 2021, up 113.2% YoY. Revenue in the same period was US$1.07 billion, up 32.3% YoY, thanks to higher coal prices amid a pandemic-induced supply shortage. For the whole of FY2021, earnings surged 629% YoY to US$251.3 mn – an all-time high. Revenue was up 61% to US$1.87 bn, also a record.

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Petroleum & Gases Equipment & Services | 0.08% | Oil prices surge as Russia-Ukraine crisis escalates China Oilfield Services Limited (2883 HK) |

Top Sector Losers

| Sector | Loss | Related News |

| Alternative Energy | -3.19% | Asia stock markets sink, oil hits 7-year high as Russia-Ukraine crisis escalates CGN New Energy Holdings Co Ltd (1811 HK) |

| Travel & Tourism | -3.14% | NA Tongcheng Travel Holdings Ltd (780 HK) |

| Biotechnology | -2.88% | Covid-19 booster jabs given at lower dosage in trial – and it may help global supply |

- China Dili Group (1387 HK) and SenseTime Group Inc (20 HK) shares extended their rally and rose 4.3% and 4.5% respectively yesterday. Hang Seng Index announced the quarterly inspection results for the fourth quarter of 2021 on Friday. It was announced that China Dili and Sensetime will be included in the Hang Seng Composite Index. In addition, Sensetime will also be included in the Hang Seng Technology Index. CICC also released a research report recently, giving SenseTime an “outperform industry” rating for the first time, with a target price of HK$7.3.

- Jinxin Fertility Group Ltd (1951 HK) shares extended their rally and rose 4.4% yesterday. The Beijing Municipal Medical Insurance Bureau, together with the Municipal Health Commission and the Municipal Human Resources and Social Security Bureau, recently issued the “Notice on Regulating the Adjustment of Some Medical Service Price Items”. In order to implement active fertility support measures, several birth inducing drugs were included in the scope of medical insurance Category A reimbursement.

- ENN Energy Holdings Ltd (2688 HK) and China Resources Gas Group Ltd (1193 HK) shares plunged 10.9% and 6% respectively yesterday after Russian Energy Minister, Shulijinov said that there are resources for the supply of natural gas from the Far East to China. In addition, Morgan Stanley released a report on the gas industry, expecting that the difficult outlook will continue in the first half of this year. Among the gas stocks, Kunlun Energy and China Resources Gas are believed to benefit from the continued rise in oil prices, and maintain the “overweight” rating of the two stocks. However, the bank expects overall industry valuations to fall back to 12 to 13 times earnings, mainly as EPS growth slows to the low teens.

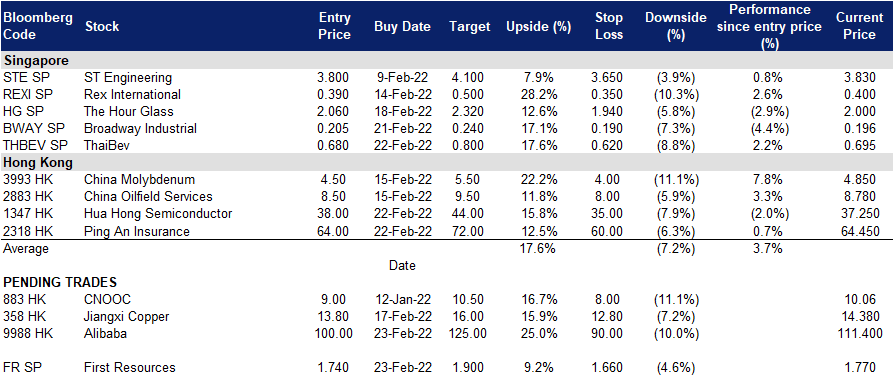

Trading Dashboard

Trading Dashboard Update: Add Hua Hong Semiconductor (1347 HK) at HK38. Add Ping An Insurance (2318 HK) at HK$64. Add ThaiBev (THBEV SP) at S$0.68. Cut loss on Grand Venture Tech (GVTL SP) at S$1.04.

(Click to enlarge image)