8 March 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

Market Movers

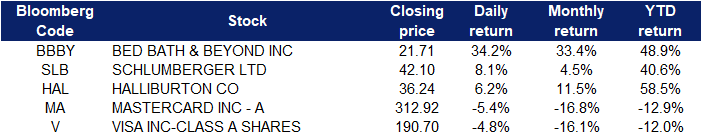

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Oilfield Services / Equipment | +7.1% | Schlumberger, Halliburton post multiyear highs as U.S. crude touches $130/bbl Schlumberger (SLB US) |

| Precious Metals | +6.6% | XAU/USD remains in the hands of the bulls with a strong finish near $2,000 Barrick Gold (GOLD US) |

| Integrated Oil | +1.1% | Saudi Arabia raises April crude prices to Asia to all-time highs Exxon Mobil (XOM US) |

Top Sector Losers

| Sector | Loss | Related News |

| Airlines | -11% | Airline stocks slump as jet fuel surge overshadows travel rebound Delta Air Lines (DAL US) |

| Restaurants | -6% | McDonald’s, quiet on the Ukraine war, has more exposure to Russia than other U.S. fast-food chains McDonald’s (MCD US) |

| Semiconductors | -4.9% | N/A Nvidia (NVDA US) |

- Bed Bath & Beyond Inc (BBBY US) shares surged 34.2% yesterday after GameStop chairman, Ryan Cohen revealed he had a nearly 10% stake in the retailer, through his investment company RC Ventures. Cohen, who also co-founded online pet retailer Chewy, wrote in a letter to Bed Bath’s board that he believes the retailer is struggling to reverse market share losses and to navigate supply chain woes. He said the company should explore selling itself to private equity and spinning off its Buybuy Baby chain.

- Schlumberger NV (SLB US) and Halliburton Company (HAL US) shares rose 8.1% and 6.2% respectively yesterday. WTI crude futures and Brent crude futures jumped to their highest levels since 2008 early on Monday, amid the risk of Western ban on Russian oil imports, exacerbated by delays in the Iran nuclear talks and the potential return of Iranian crude exports. US secretary of state Antony Blinken said Sunday the US and its allies are considering banning Russian oil and natural gas imports, in an effort to ramp up sanctions against Russia for its invasion of Ukraine.

- Visa Inc (V US) and Mastercard Inc (MA US) shares declined 4.8% and 5.4% respectively yesterday after announcing that they have blocked financial institutions from their networks in response to sanctions targeting Russia after its invasion of Ukraine. On Monday, Mastercard said it had “blocked multiple financial institutions” from its payment network, without naming companies or individuals. “We will continue to work with regulators in the days ahead to abide fully by our compliance obligations as they evolve,” the company added. Rival Visa has also blocked those on the sanctions list, saying Tuesday that it was “taking prompt action to ensure compliance with applicable sanctions, and are prepared to comply with additional sanctions that may be implemented.”

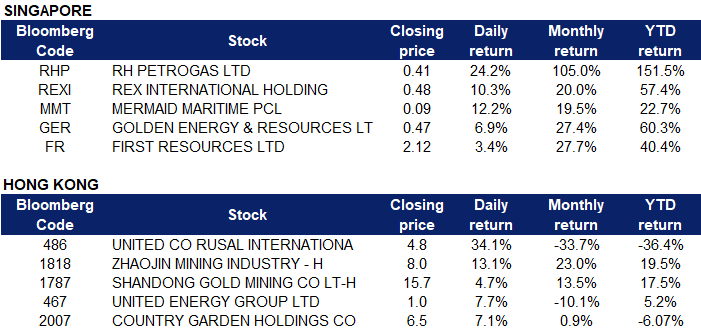

Singapore

- RH Petrogas Ltd (RHP SP), Rex International Holding Ltd (REXI SP), Mermaid Maritime (MMT SP). Oil sector related shares surged yesterday. WTI crude futures and Brent crude futures jumped to their highest levels since 2008 early on Monday, amid the risk of Western ban on Russian oil imports, exacerbated by delays in the Iran nuclear talks and the potential return of Iranian crude exports. US secretary of state Antony Blinken said Sunday the US and its allies are considering banning Russian oil and natural gas imports, in an effort to ramp up sanctions against Russia for its invasion of Ukraine. Meanwhile, talks to revive the Iran nuclear deal were mired in uncertainty on Sunday following Russia’s demand for written US guarantees that sanctions on Russia would not hurt its trade with Iran, seen by analysts as a way for Moscow to bypass Western sanctions.

- Golden Energy & Resources Ltd (GER SP) shares extended their rally and gained 6.9% yesterday. Newcastle coal futures topped a new record high of $430 per tonne amid the conflict in Ukraine. Recent sanctions on Russia, such as restricting access to European ports, triggered a rush in Asia and Europe to find alternative suppliers, such as Australia. The war has created a global energy crunch and exacerbated concerns over coal supplies in a market already tight in balance after outages. The contract has surged more than 100% since the beginning of 2022, with earlier bullish sentiment already fueled by supply disruptions in top exporting countries such as Indonesia and Australia.

- First Resources (FR SP) shares extended their gains and rose 3.4% yesterday. Malaysian palm oil futures rebounded to around MYR 6,600 a tonne, approaching their all-time high of MYR 7,108 amid tight market conditions and the Ukraine crisis. The ongoing war in Ukraine has added to upside risks in the palm oil market, as sunflower oil exports from the Black Sea region are halted, boosting further demand for alternative palm oil. On the supply side, the Malaysian Palm Oil Board estimated the country’s production in February fell 1.79% from the previous month, while exports for Feb. 1-25 rose over 25.1% to 1,095,753 tonnes from 876,056 tonnes shipped during the same period of January.

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Precious Metal | +1.71% | Palladium scales record high, gold hits US$2,000 on Russia-Ukraine war Zhaojin Mining Industry Company Limited (1818 HK) |

| Nonferrous Metal | +1.46% | Rusal Stock Soared 13%, LME Aluminium Broke through $4,020/mt. RUSAL (486 HK) |

| Petroleum & Gases Equipment & Services | +0.57% | Oil Shoots Near $130 as Chance of Russian Ban Spurs Crisis Fears |

Top Sector Losers

| Sector | Loss | Related News |

| Airline Services | -7.57% | Expect to pay more to fly amid skyrocketing fuel prices, analyst warns Boc Aviation Ltd (2588 HK) |

| Biotechnology | -4.07% | J&J targets Chinese biotech deals as western pharma groups look east Cansino Biologics Inc (6185 HK) |

| Environmental Energy Material | -3.81% | Clean energy: US faces big challenges as it takes on China’s supply-chain dominance Xinyi Solar Holdings Limited (968 HK) |

- United Co Rusal International (486 HK) shares soared 34.1% yesterday. According to media reports, Rusal’s parent company En+ confirmed that it is exploring the separation of Rusal’s international business. The current European and American sanctions do not involve Rusal, after reports that the Biden administration is currently delaying direct sanctions on Rusal, because it could disrupt the already short supply of global aluminum. Aluminum prices have continued to rise recently, and today’s intraday LME aluminum rose to 4.2%, rising above $4,020 per ton, setting a new record high.

- Zhaojin Mining Industry Co Ltd (1818 HK) and Shandong Gold Mining Co Ltd (1787 HK) shares rose 13.1% and 4.7% respectively yesterday. Gold extended its rally to an 18-month high within striking distance of $2,000 an ounce on Monday, as geopolitical and economic uncertainties lifted demand for the safe-haven metal. Headlines about the ongoing conflict between Russia and Ukraine continued to weigh on sentiment, as fighting intensified over the weekend and president Vladimir Putin vowed to press ahead with his invasion unless Kyiv surrendered. Investors positioned out of equities into safer assets, while oil and other commodities extended their rallies on further supply disruptions.

- United Energy Group Ltd (467 HK) shares rose 7.7% yesterday. WTI crude futures jumped to their highest levels since 2008 early on Monday, amid the risk of Western ban on Russian oil imports, exacerbated by delays in the Iran nuclear talks and the potential return of Iranian crude exports. Meanwhile, US natural gas futures traded close to $5 per million British thermal units on Monday after hitting an over three-month high of $5.11 earlier in the session, supported by strong overseas demand and following a rise in prices of other energy commodities. Natural gas prices in Europe skyrocketed to fresh record highs after US Secretary of State Antony Blinken said the West was discussing an embargo on Russian oil and gas, as its invasion of Ukraine continued.

- Country Garden Holdings Co Ltd (2007 HK) shares extended their rally and gained 7.1% yesterday. On March 3, Country Garden and China Merchants Bank signed a “Strategic Cooperation Agreement on Real Estate M&A Financing”. According to the cooperation agreement, China Merchants Bank will grant Country Garden a M&A financing quota of RMB 15 billion, which is dedicated to Country Garden ‘s real estate M&A business, including but not limited to M&A loans, M&A funds and asset securities

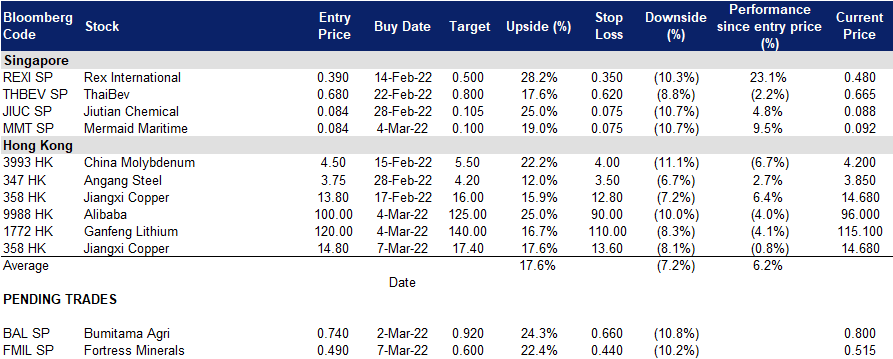

Trading Dashboard

Trading Dashboard Update: Add Jiangxi Copper (358 HK) at HK$13.80. Cut loss on Frencken (FRKN SP) at S$1.52 and AviChina Industry & Technology (2357 HK) at HK$4.55.

(Click to enlarge image)

Related Posts: