14 September 2023: Wealth Product Ideas

Fund Name (Ticker) | Global X NASDAQ 100 Covered Call ETF (QYLD US) |

Description | The Global X Nasdaq 100 Covered Call ETF (QYLD) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Cboe Nasdaq-100 BuyWrite V2 Index. |

Asset Class | Equity |

30-Day Average Volume (as of 12 September) | 4,197,925 |

Net Assets of Fund (as of 12 September) | US$8,103,591,800 |

12-Month Trailing Yield (as of 12 September) | 12.24% |

P/E Ratio (as of 11 September) | 27.10 |

P/B Ratio (as of 11 September) | 6.21 |

Management Fees | 0.60% |

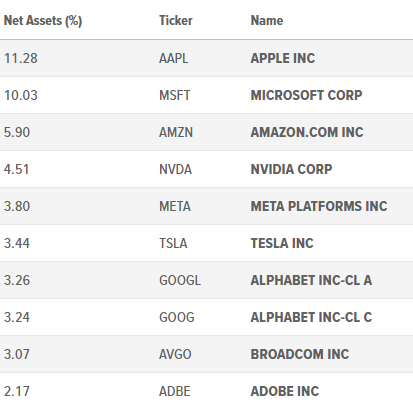

Top 10 Holdings

(as of 12 September 2023)

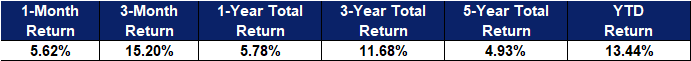

- YTD total dividends received after withholding tax: US$0.9639

- YTD total returns after withholding tax for QYLD: 16.41%

- YTD total return for QQQ (tracks the Nasdaq-100 index): 40.95%

- Benefits of a covered call. QYLD is a covered call ETF that tracks the Nasdaq-100 index. It is a good option for investors who are looking for a high-yielding, low-volatility ETF that generates income through covered calls. It generates income by selling call options on the underlying stocks and option premiums are paid out to shareholders monthly. It has a high yield, currently around 12.24%. However, foreign investors should be aware of a 30% US withholding tax rate on dividends, which means that the net dividend yield they can earn will be lower. This means that an investor from a foreign country would only earn a net dividend yield of 8.568% from QYLD. However, it is important to remember that covered calls limit the upside potential of an investment, so investors should be aware of this risk before investing. Compared to ETFs that track the same index without paying dividends, QYLD gives investors monthly dividends which can help to reduce downside risks by providing a steady stream of income.

- Interest rate to remain unchanged for the time being. The Federal Reserve is expected to keep interest rates unchanged in September, but some economists believe the central bank could raise rates one more time before the end of the year. The Fed is facing a difficult balancing act between raising rates to cool inflation and not raising rates so much that it triggers a recession. The latest economic data suggests that the labour market is still strong and inflation is not yet coming down significantly. If inflation continues to rise, the Fed may need to raise rates more aggressively. However, the Fed’s rate decision is likely to be influenced by the key inflation data being released and will remain cautious through a gradual approach to tightening monetary policy.

(Source: Bloomberg)

Fund Name (Ticker) | Kraneshares China Internet And Covered Call Strategy ETF (KLIP US) |

Description | The KraneShares China Internet & Covered Call Strategy ETF (ticker: KLIP) seeks to provide current income by following a “covered call” or “buy-write” strategy. KLIP buys shares of the KraneShares CSI China Internet ETF (ticker: KWEB) and “writes” or “sells” corresponding call options on KWEB. Both KLIP and KWEB are benchmarked to the CSI Overseas China Internet Index, which tracks the performance of the investable universe of publicly traded Chinabased companies in the Internet sector. KLIP can provide investors with attractive current yield, while retaining capped participation in the potential price gains of KWEB. |

Asset Class | Equity |

30-Day Average Volume (as of 13 Sep) | 179,738 |

Net Assets of Fund (as of 11 Sep) | US$77,879,682 |

YTD Trailing Yield | 40.19% |

P/E Ratio (as of 13 Sep) | 32.791 |

P/B Ratio (as of 13 Sep) | 2.159 |

Management Fees (Annual) | 0.95% |

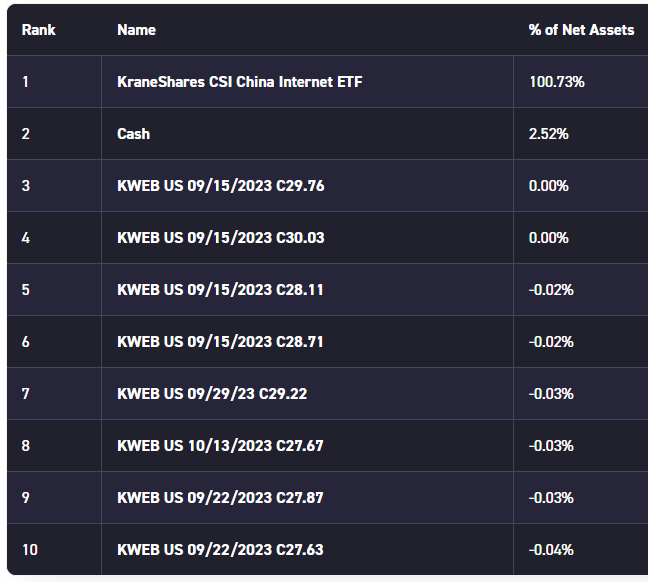

Top 10 Holdings

(as of 11 September 2023)

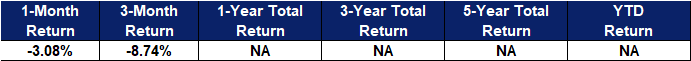

- YTD total dividends received after withholding tax: US$5.05

- YTD total returns after withholding tax for KLIP: -6.8%

- YTD total return for KWEB (tracks the CSI Overseas China Internet Index): -18.7%

- Expectations towards a rebound in Chinese internet stocks. The recent sell-off in Chinese stocks created an opportunity for investors to buy these stocks at a discount. KLIP offers exposure to a number of high-quality Chinese internet stocks, and these stocks could rebound in the future. The Chinese government has also set in place several measures as well as cutting the loan prime rate to drive organic consumption within the country. With expectations that the Chinese government would be releasing more stimulus to revive the economy and boost the consumption level in China, this is expected to drive up the price of Chinese internet stocks and hence KLIP.

- Monthly Premium from Covered Calls. The KLIP ETF sells covered calls as part of its asset, which are options contracts that give the buyer the right to buy the underlying stock at a certain price on or before a certain date. The premiums from these call sales help offset the losses from the underlying stock declines, which has helped limit the losses in KLIP. KLIP ETF currently distributes monthly dividends with an annualized DVD yield of 40.19%. However, foreign investors should be aware of the 30% US withholding tax on dividends, which means that the net dividend yield they can earn will be lower. This would mean an investor from a foreign country would only earn a net dividend yield of 28.13% from KLIP. Covered Calls also serve as a strategy to reduce risks for investors, which could potentially drive the demand for KLIP, given the uncertainty in the China economy.

(Source: Bloomberg)