25 April 2024: Wealth Product Ideas

Compelling Reasons to Invest in Gold

Why Invest in Gold:

- Provides diversification – historically had low correlation to many financial assets

- Acts as a hedge against market downturns, volatility, and systemic risk

- Delivered positive long-term returns – 7.64% compound annual growth rate since 1971

- Highly liquid global market with estimated average daily turnover of around $163 billion

Gold Outlook:

- Diverse sources of demand:

- Jewelry accounts for 51% of annual demand and is a cyclical driver

- Industrial demand makes up 8% and is a cyclical driver

- Investment demand is 28% and is a counter-cyclical driver that tends to increase during uncertainty

- Central bank purchases are 13% and are a non-cyclical source

- The mix of cyclical and counter-cyclical demand drivers offers persistent diversification benefits and a hedge during downturns

- Factors like economic uncertainty, inflation, and geopolitical risks could support ongoing investment demand for gold as a safe-haven asset

SPDR Gold Shares (GLD/GSD):

- The SPDR Gold Trust is an investment vehicle that holds physical gold bullion and issues shares that track the price of gold.

- The trust aims for the value of the shares to reflect the performance of the gold price, less the trust’s operating expenses.

- Shares are traded on the Singapore Exchange (SGX) in both US dollars (GLD) and Singapore dollars (GSD).

Key Benefits for Investors

- Accessibility: Offers a convenient way to gain exposure to the gold market.

- Backed by Physical Gold: Each share represents ownership in physically-held gold bullion.

- Transparency: Holdings are fully allocated and regularly audited.

- Cost-Effective: Has one of the lowest expense ratios for a US-listed, physically-backed gold ETF.

- Liquid and Flexible: Shares can be easily traded on the exchange.

Strong Performance Track Record

- Fund has delivered strong returns, with NAV up 11.85% over the past year and 8.67% annualized since inception.

- Performance has closely tracked the LBMA Gold Price PM, demonstrating the fund’s ability to provide exposure to the gold spot price.

Trusted by Investors Worldwide

- SPDR Gold Shares was launched in 2004 by the World Gold Council.

- One of the largest and most liquid physically-backed gold ETFs globally.

Relationship Between GLD NAV, Share Price, and Gold Spot Price:

- NAV of GLD is calculated based on the total ounces of gold owned by the Trust valued at the LBMA Gold Price PM, plus any cash held less accrued expenses.

- GLD share price on the exchange reflects supply and demand, influenced by the underlying gold spot price and its impact on the NAV. However, the efficient price discovery and tight bid-ask spreads of this heavily traded ETF help minimize deviations between the share price and NAV.

- Additionally, the creation and redemption of 100,000-share “Baskets” in exchange for physical gold provides an arbitrage mechanism. If the share price significantly diverges from the NAV, authorized participants can profit by creating or redeeming shares, bringing the price back in line.

|

Fund Name (Ticker) |

SPDR Gold Shares (GLD SP) |

|

Description |

SPDR Gold Shares is an investment fund incorporated in the USA. The investment objective of the Trust is for the Shares to reflect the performance of the price of gold bullion, less the Trust’s expenses. The Trust holds gold and is expected from time to time to issue Baskets in exchange for deposits of gold and to distribute gold in connection with redemptions of Baskets. |

|

Asset Class |

Commodity |

|

30-Day Average Volume (as of 24 Apr) |

16,318 |

|

Net Assets of Fund (as of 23 Apr) |

US$62,391,692,956.04 |

|

12-Month Yield (as of 28 Mar) |

12.28% |

|

P/E Ratio (as of 28 Mar) |

NA |

|

P/B Ratio (as of 28 Mar) |

NA |

|

Management Fees (Annual) |

0.40% |

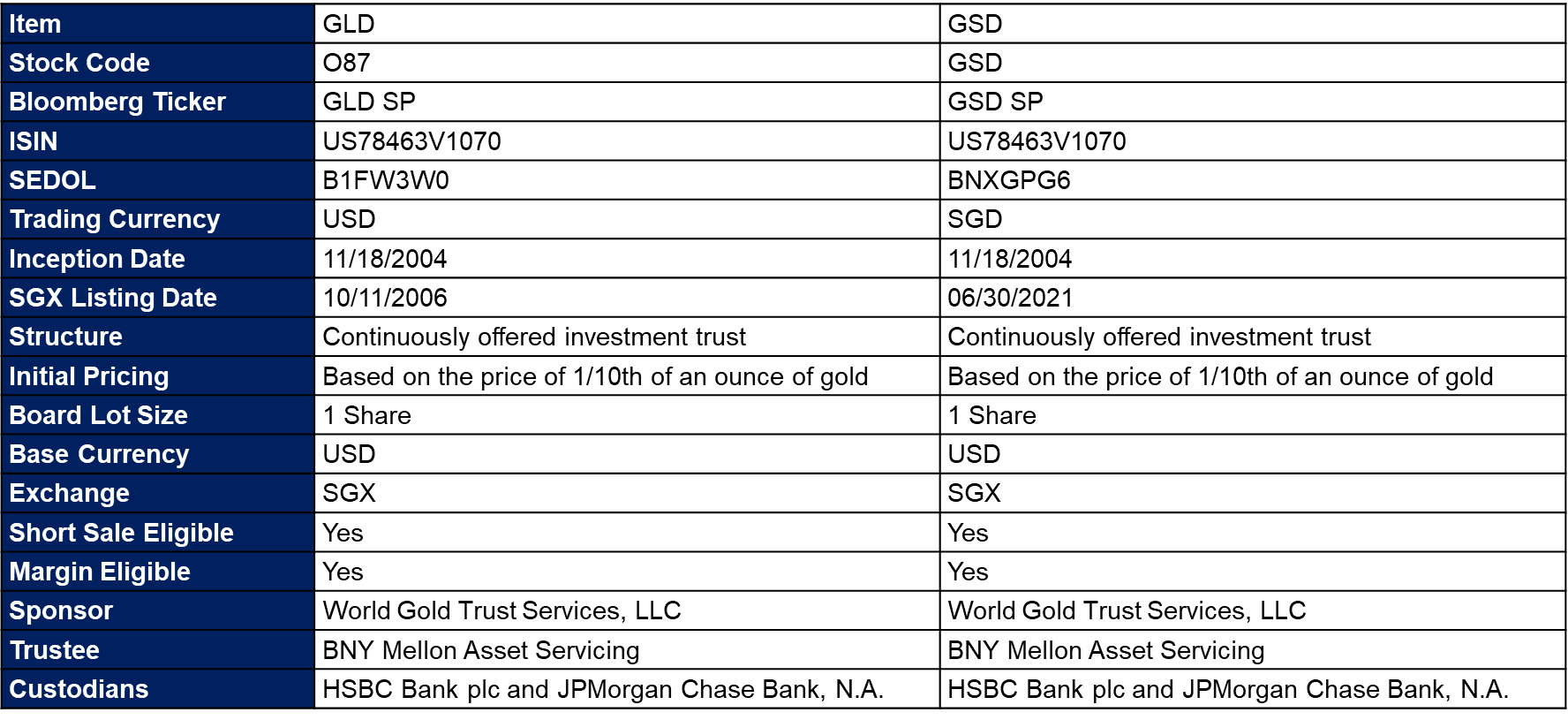

Key Fund Details: (GLD and GSD)

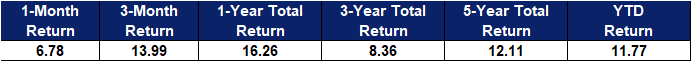

Performance Snapshot (as of 24th April)

(Source: SSGA)

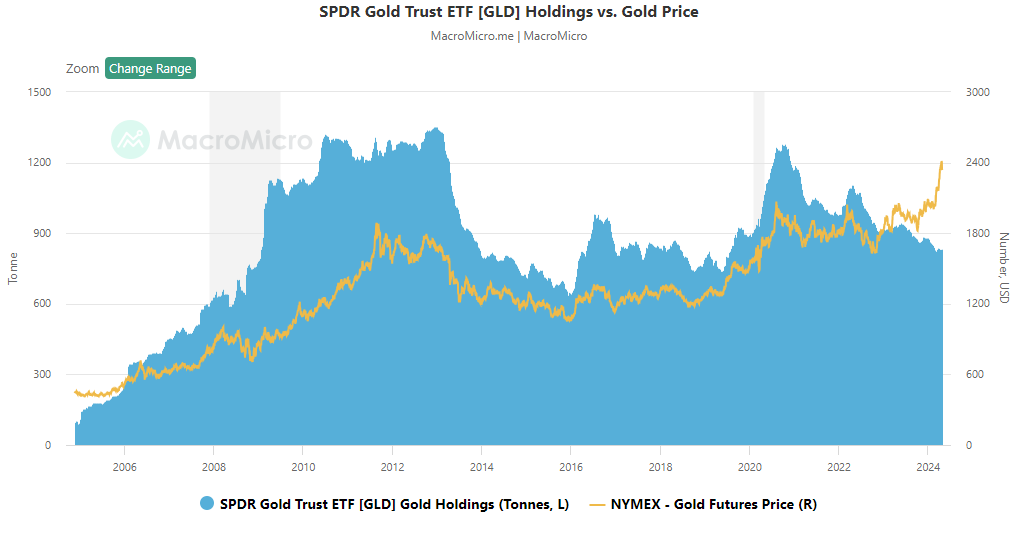

GLD Holdings vs. Gold Price Trend (as of 24th April)

(Source: MacroMicro)

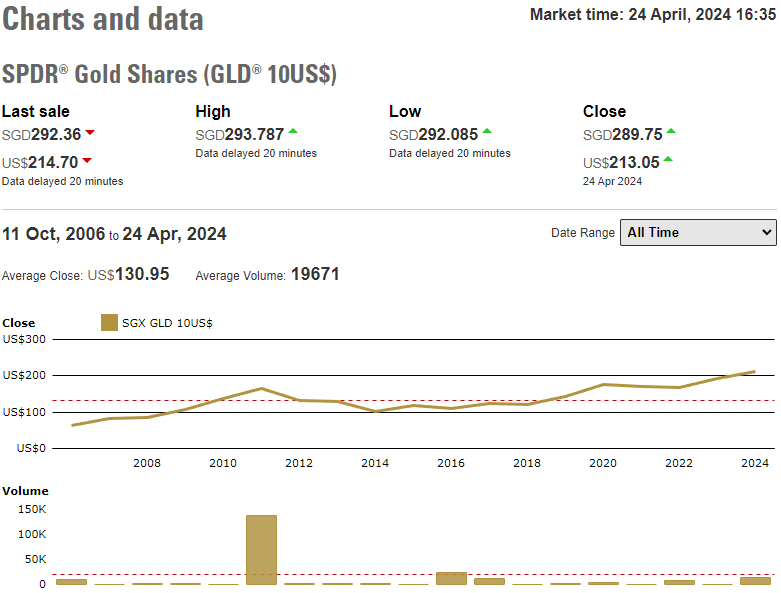

(Source: Bloomberg)