2024 Market Predictions – KGI Opinions

Ready to peek into the future?

Think you know next year’s key trends? Have you taken part in KGI Securities Singapore’s ‘2024 Market Predictions Quiz’? You have just 3 more days to take the quiz through this link before Dec 31st and stand a chance to win a prize at the end of 2024!

2024 Market Prediction Quiz:

Theme: Global Markets, Economies & Industries

Due date: 31/12/2023

Where to submit your answers: 2024 Market Prediction Quiz

Furthermore, check out KGI’s In-house Analysis for our research team’s take on what’s next for these trends. You won’t be disappointed!!

KGI’s In-house Analysis

1. 2024 US General Election: Who will be the next president?

- Biden

- Trump

- Nikki Haley

- Others

Analysis:

According to a consensus survey by McLaughlin & Associates in December, the survey shows that Donald Trump is likely to win the 2024 U.S. Presidential Election, holding a vote of 36%, with Joe Biden following closely behind with a vote of 34%.

While Trump faces challenges in being disqualified from the election to Colorado’s ruling, he is still the most popular candidate amongst Republicans and has the most potential to win Joe Biden from the Democrats.

2. What will China’s GDP growth be in 2024?

- Above 5.0%

- 4.5%-5.0%

- 4.0%-4.5%

- 3.5%-4.0%

- Below 3.5%

Analysis:

Leaders agreed at the annual economic meeting to a modest budget deficit of 3%, lower than the revised 2023 target of 3.8%. This signals prioritizing fiscal discipline over aggressive stimulus in the coming year.

Despite a planned lower deficit, government advisors and the IMF predict GDP growth will hover between 4.5% and 5.5%, with many favouring a 5% target similar to 2023. This reflects concerns about weakness in the property sector and global demand.

The property market downturn and subdued consumer spending continue to cast a shadow over China’s outlook, prompting calls for additional supportive policies to boost demand. Leaders are expected to unveil further measures during their meetings to discuss 2024 growth targets. Considering these factors, we project China’s 2024 GDP growth in the range of 4.5% to 5.0%, slightly below the anticipated 5.4% for 2023.

3. The current Fed Fund rate is 5.5%. How many basis points (bps) will the Fed cut in 2024?

- Less than 100 bps

- 100 bps

- 100 bps-150 bps

- More than 150 bps

Analysis:

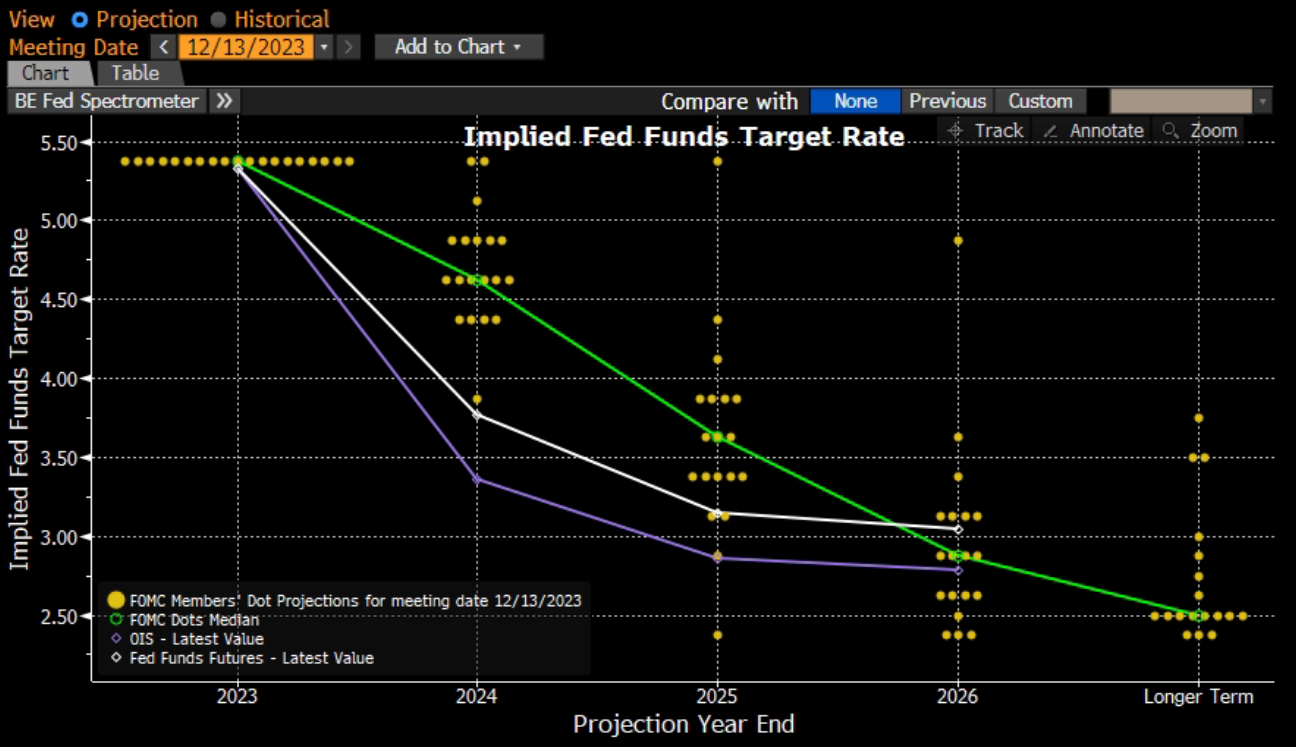

Based on FOMC Dot Projections, the Median implied Fed Fund Target Rate is 4.625% by the end of 2024. Several Fed Officials have also highlighted the need for rate cuts in 2024 to prevent an overtightening, with the majority of the officials expecting three rate cuts totalling 75bps in 2024, as the inflation rate falls faster than they had expected.

The annual United States Inflation rate in the U.S. slowed to 3.1% in November 2023, which is also the lowest reading in 5 months. This shows that inflation has already been cooling down and is relatively closer to the Fed’s target of 2%, compared with an inflation rate of 6.4% at the start of 2023. With inflation falling faster than expected, we expect more than 3 rate cuts to come in 2024 totalling 100 bps-150 bps.

(Source: Bloomberg)

4. Which of the following equity market index will perform best in 2024?

- S&P 500 (US)

- Stoxx 50 (Europe)

- Nikkei 225 (Japan)

- HSI (Hong Kong)

- Nifty 50 (India)

Indexes P/E Ratio & 10Y P/E Ratio

P/E Ratio | 10 Years P/E ratio | |

S&P 500 (US) | 22.87 | 30.55 |

Stoxx 50 (Europe) | 12.98 | 22.33 |

Nikkei 225 (Japan) | 27.37 | 28.78 |

HSI (Hong Kong) | 9.23 | 10.48 |

Nifty 50 (India) | 24.63 | 35.66 |

*Figures are as of 26 Dec 2023

Comparing the P/E ratio across the different indexes, the Nifty 50 index, with a current P/E ratio of 24.63, present the highest upside compared against its 10Y P/E ratio of 35.66. This is followed by Stoxx 50, with its current P/E ratio of 12.98, compared to its 10Y P/E of 22.33.

Based on historical track record, Nifty 50 (India) has also been the best-performing index with a rate of return of 84.53% and a CAGR of 13.70%. The market forecasted that India’s economy will grow at a rate of 6.30% in 2024, highest amongst the five different regions.

5. Which range will WTI Crude oil end at in 2024?

- Above US$90

- US$80-US$90

- US$70-US$80

- US$60-US$70

- Below US$60

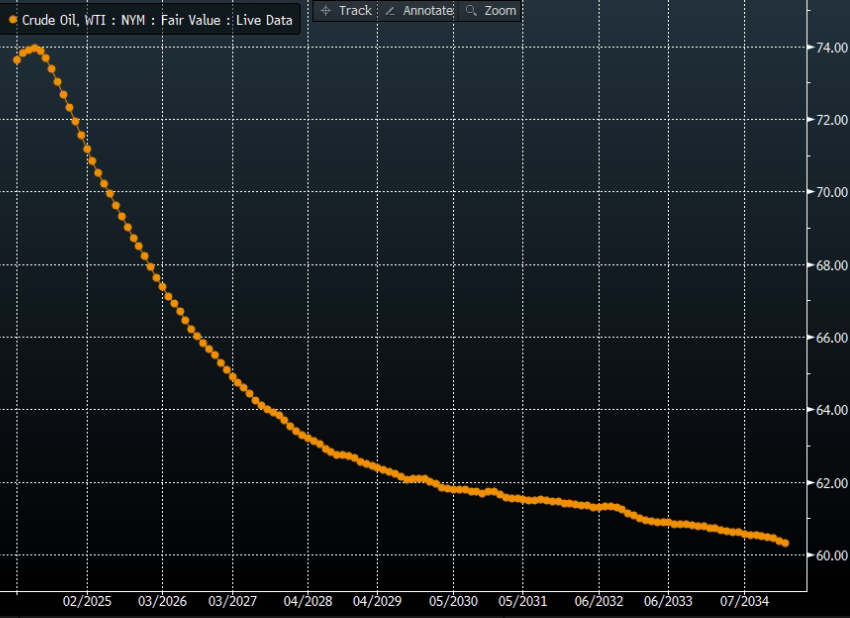

Crude oil is likely to see moderate growth in demand in 2024, as expectations toward rate cuts fuels demand for oil. While supply for crude oil remains tight, with members of OPEC+ has also agreed to voluntary output cuts in 1Q2024. However, the United States have also announced that they will continue to increase oil production going into 2024, with the most recent U.S. oil supply growth reaching the 20mb/d mark.

WTI Crude Oil Futures

(Source: Bloomberg)

The WTI Crude Oil futures also shows a backwardation curve, indicating that oil prices is likely to fall in the future, but still remains in the range of US$70 – US$80 at the end of 2024.

6. As of December 2023, gold price (US$/oz) once reached an all-time high of US$2,144.6. Which range will gold highest price reach in 2024?

- Above US$2,300

- US$2,200-US$2,300

- US$2,100-US$2,200

- US$2,000-US$2,100

- Below US$2,000

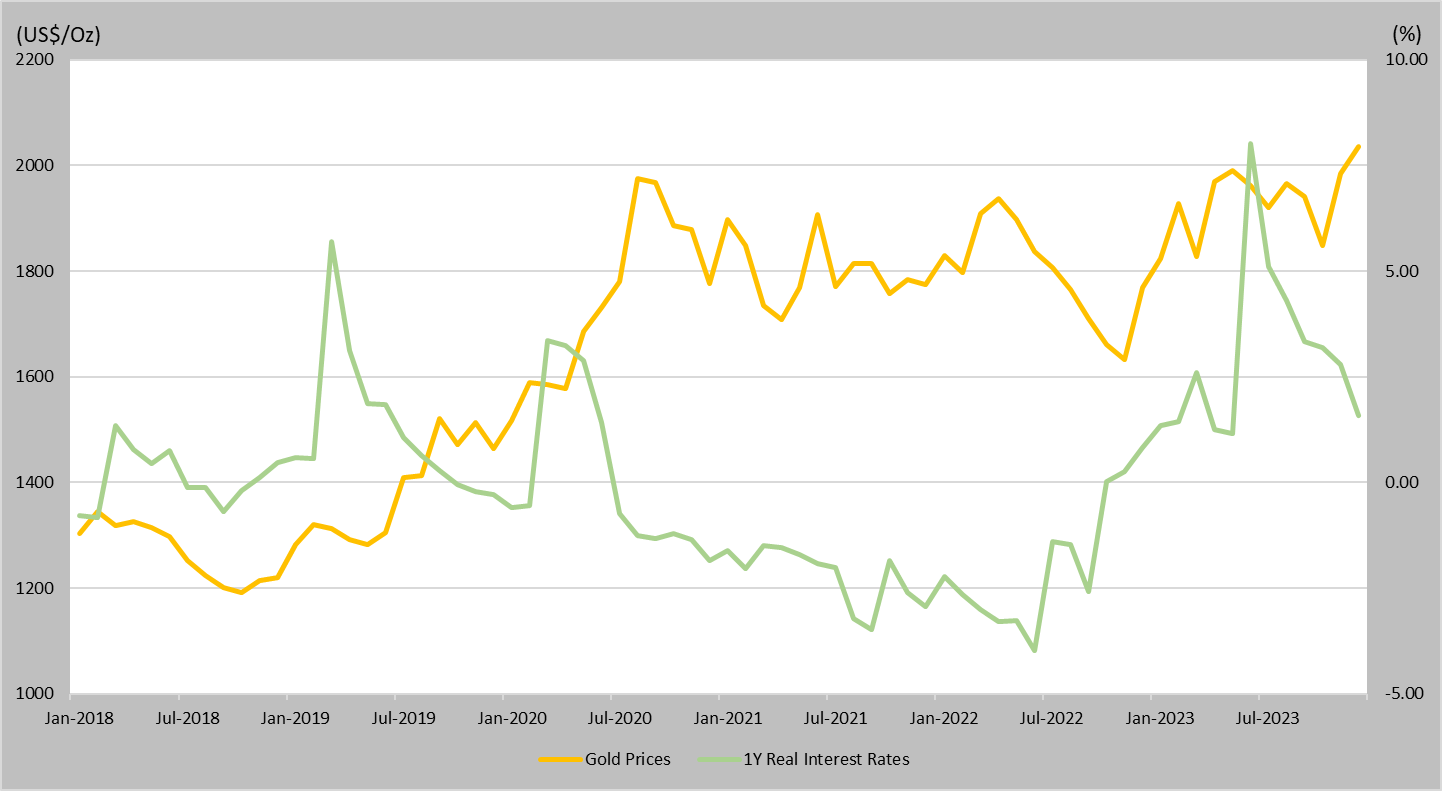

Gold is generally observed to have an inverse relationships with real interest rates. Real interest rates is expected to fall going into 2024, as the Federal Reserve is expected to cut interest rates from early 2024. Each historical rate cut cycles has results in a surge in gold prices, with the previous rate cuts in 1Q2020 resulting in a surge in gold prices from US$1600 to close to US$2000.

With lower interest rates, capital will flow from other financial instruments into gold, as investments such as bonds and treasury yields become less attractive. We expect gold to climb around 10%, similarly compared with 2023, from its current level of US$2,025 to around US$2,200. Furthermore, amidst more and more ongoing economic uncertainties, as well as geo-political uncertainties, Gold is likely to continue to stand out as a safer form of asset.

Gold Prices vs 1-Year Real Interest Rates

(Source: Federal Reserve, Bloomberg, KGI Research)

7. As of December 2023, the price of Bitcoin reached a 52-week high of US$45,000. Which range will Bitcoin price end at in 2024?

- Above US$70,000

- US$60,000-US$70,000

- US$50,000-US$60,000

- US$40,000-US$50,000

- Below US$40,000

With speculations that the SEC is likely to approve Bitcoin ETFs to be traded on the market, this is likely to garner investors to invest in the risky asset, putting an upwards pressure on Bitcoin prices.

Furthermore, the next Bitcoin halving, which occurs every four years, is set to happen on 25th April 2024. This marks another drop in the rate of new Bitcoins as it approaches its finite supply. Upward momentum is likely to begin six months before the halving date, which was shown in the recent rally of Bitcoin Prices.

With these catalysts in place, we expect Bitcoin to test its highs around US$60,000 to US$70,000 by the end of 2024.

8. In 2023, USD/JPY once reached above 151.9. Which range will USD/JPY end at in 2024?

- Above 150

- 140-150

- 130-140

- 120-130

- 110-120

- Below 110

The U.S. Federal Reserve is set to cut rates going into 2024, while the Bank of Japan is set to increase interest rates in 2024, away from its rates at negative levels. The BOJ said the target level of the 10-year JGB yield will be held at 0%, conducting yield curve control with the upper bound of 1.0% for these yields as a reference and will control the yields mainly through large-scale JGB purchases and nimble market operations. While the U.S. interest rates is still higher than BOJ’s interest rates, this concurrent movement is likely to make the Japanese Yen slightly more attractive to investors, selling their dollars and buying yen, pushing the USD/JPY exchange rate down. This concurrently interest rates action by U.S. and Japan is likely to push the USD/JPY back to its resistance level around 130.

9. According to the Urban Redevelopment Authority, the residential property index reached an all-time high of 196 in September 2023. What range will the index end at in 2024?

- Above 200

- 190-200

- 180-190

- 170-180

- Below 170

With a high interest rate environment (current SORA is around 3.70%), as well as the upwards pressure on property prices over the past few months, property price hikes may be losing momentum going into 2024.

Furthermore, the URA recently announced the largest housing supply on the Confirmed List in a single GLS programme since 2H2013. these sites will be able to yield about 8,910 private residential homes, 107,750 sqm gross floor area (GFA) of commercial space, and 530 hotel rooms. On the other hand, demand growth is likely to face headwinds as buyers feel the impact of the enhanced ABSD cooling measures that were introduced earlier in 2023.

However, with interest rates cut expected to arrive in 2024, this might also make it more attractive for buyers to buy a private property, possibly in 2H2024 as where interest rates and housing prices are expected to be lower.

10. As of December 2023, the CAT E COE price was S$133,338, and the record high was S$158,004. How high will CAT E COE prices hit again by the end of 2024? Singapore COE Price

- Above S$200,000

- S$180,000 – S$200,000

- S$170,000 – S$180,000

- S$160,000 – S$170,000

- S$150,000 – S$160,000

- S$130,000 – S$150,000

- Below S$130,000

The Singapore government also recently brought forward more COEs into the market for the quarter from Nov 2023 to Jan 2024, with the overall quota at 12,774, going up by 13% QoQ, This has brought the price of COE slightly down, after reaching a peak at S$158,000 in October 2023. Demand for cars in Singapore is likely to remains strong, despite the increase in quotas of COEs. COE prices can be expected to reach above S$170,000 in 2024, following a historical 5Y CAGR of 33.2%.

With COE prices rocketing in the recent years, the government is also likely to implement several measures to contain the demand for COE in the near term. Our choice of COE prices reaching S$160,000 – S$170,000 reflects the strong demand and limited supply for COEs, and also take into account possible measures that may be imposed by the government to lower COE prices.

Terms and Conditions:

Participants who manage to successfully predict all 10 events will be given a prize at the end of 2024. Kindly provide us with your name and email address via the survey link so that we can contact you regarding the prize details should you be the winner. Personal contact information will remain confidential. KGI Securities (Singapore) Pte. Ltd. All rights reserved.