1 September 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Biotechnology | +0.29% | Why Moderna Stock Slumped on Wednesday Moderna Inc (MRNA US) |

| Cable/Satellite TV | +0.29% | Comcast: High Upside Potential Through Attractive Valuation Comcast Corp (CMCSA US) |

| Investment Trusts/Mutual Funds | +0.26% | N/A Texas Pacific Land Corp (TPL US) |

Top Sector Losers

| Sector | Loss | Related News |

| Computer Processing Hardware | -2.70% | HP Reduces Profit Forecast as PC Sales Continue to Slide HP Inc (HPQ US) |

| Chemicals: Agricultural | -2.18% | Mosaic provides July sales update Mosaic Co (MOS US) |

| Multi-Line Insurance | -1.63% | Warren Buffett Cuts Stake in China’s BYD, Spurring Bets More May Come Berkshire Hathaway Inc (BRK.A US) |

- Snap Inc (SNAP US) rose 8.7% after it announced a restructuring plan that includes a 20% cut in its staff and a new chief operating officer. The changes come after Snap reported disappointing second-quarter earnings and said it would not provide guidance for its current quarter.

- Bed Bath & Beyond Inc (BBBY US) tumbled 21.3% after it outlined a strategic plan that only confirmed investor fears that the company will struggle to turn around its business. Bed Bath also filed to sell an undisclosed amount of stock in the future.

- PVH Corp (PVH US) declined 10.5% after the owner of Tommy Hilfiger and Calvin Klein apparel brands cut its full-year outlook. At the same time, PVH said it’s reducing its global office workforce by 10%.

- Chewy Inc (CHWY US) slid 8.2% after it issued weak current-quarter revenue guidance. Chewy reported a profit beat in its most recent quarter, but its revenue fell short of expectations. The company expects rising inflation will dent spending on pet products purchases.

- Express Inc (EXPR US) plunged 20.8% after the company reported quarterly revenue of $464.4 million, compared to StreetAccount estimates of $479.6 million. The apparel retailer, which also cut its full-year guidance, cited challenging macroeconomic conditions.

Singapore

- Dyna-Mac Holdings Ltd (DMHL SP), RH PetroGas Ltd (RHP SP) and Rex International Holding Ltd (REXI SP) fell 6.2%, 4.4% and 1.8% respectively yesterday. Oil prices continued to slide on Wednesday on investor worries about the ailing state of the global economy, the prospect of key central bank interest rate hikes, and increased restrictions to curb COVID-19 in China. Brent crude futures for October, due to expire on Wednesday, climbed 89 cents, or 0.9 per cent, to $100.20 a barrel, trimming Tuesday’s $5.78 loss. The more active November contract was up 88 cents, or 0.9 per cent, at $98.72 a barrel.

- First Resources Ltd (FR SP) fell 2.6% yesterday. Malaysian palm oil futures retreated on Tuesday to clock their fourth straight monthly decline, weighed down by growing expectations of an improvement in production. Bursa Malaysia will be closed on Wednesday for a public holiday. Palm output in the world’s second-largest producer is expected to rise as plantations enter the peak production months, but exports are likely to slow due to competitive pricing in larger rival Indonesia. Top producer Indonesia extended an export levy waiver until Oct. 31 to maintain price stability, but raised its crude palm oil reference price for the Sept. 1-15 period.

- Geo Energy Resources Ltd (GERL SP) loss 3.8% yesterday. Indonesia is the world’s largest exporter of thermal coal and the discount between its benchmark price and that for Australian Newcastle coal has widened to almost 82%. Indonesian coal hasn’t seen much change in valuation at all, despite a scramble for coal that stretches from major Asian buyers such as India, Japan and China, all the way to energy-starved Europe. In the absence of strong competition from other buyers for Indonesian coal, the price has remained largely stable, and has decoupled from other grades being used to replace cargoes from Russia, such as those from Newcastle and South Africa’s Richards Bay.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

E-Commerce & Internet Services | -1.52% | Xi’s Tech Crackdown Fuels Another Crisis: Out-of-Work Youth Meituan (3690 HK) |

Software | +1.04% | China’s ‘Great Firewall’ pushes top Taiwan AI startups toward Japan SenseTime Group Inc (20 HK) |

Footwears | +1.03% | Fujian highlights key role of private economy Xtep International Holdings Limited (1368 HK) |

Top Sector Losers

Sector | Loss | Related News |

Coal | -2.80% | China coal shares soar as investors bet economics trump emissions Yancoal Australia Ltd (3668 HK) |

Alternative Energy | -1.86% | Rain eases China’s record heatwave but fresh energy crisis looms CGN New Energy Holdings Co Ltd (1811 HK) |

Automobile Retailing, Maintenance & Repair | -1.66% | Chinese Automobile Stocks Slump After Warren Buffett Trims BYD Stake Zhongsheng Group Holdings Ltd (881 HK) |

- Hopson Development Holdings Ltd (0754 HK) rose 7.1% yesterday. It recently released its 2022 interim results, with a turnover of HK$13.17 billion, down 18.1% year-on-year; profit attributable to equity holders was HK$6.39 billion, up 13.46% year-on-year; Basic and diluted earnings were HK$2.446, and it was planned to distribute bonus shares “10 get 1 free”. During the period, the overall decrease in core profit was mainly due to the impact of the Group’s investment business performance during the period.

- China Tourism Group Duty Free Corp Ltd (1880 HK) rose 7.1% yesterday, it released its results for the six months ended June 30, 2022. The group achieved operating income of RMB 27.651 billion, a year-on-year decrease of 22.17%; attributable to shareholders of listed companies The net profit was 3.938 billion yuan, a year-on-year decrease of 26.49%; the basic earnings per share was 2.0168 yuan. During the reporting period, the domestic epidemic spread widely and frequently occurred in many places, passenger flow dropped sharply, and the store and logistics operations were interrupted. The company’s operations from March to May were greatly impacted. In the face of challenges, the company had taken a series of measures such as optimising commodity supply, improving supply chain efficiency, strengthening marketing and promotion, and improving customer service to minimise the impact of the epidemic on the company’s operations. Since late May, as the domestic epidemic has eased, in June, the company’s sales increased significantly month-on-month, and the month’s revenue increased by 13% year-on-year.

- SenseTime Group Inc (0020 HK) gained 6.9% yesterday. GF Securities released a research report saying that the smart business and smart city businesses of SenseTime have been greatly affected by the epidemic, mainly due to the delay in the implementation of intelligent transformation projects that require on-site construction due to the epidemic containment and control measures. The company’s smart life and smart car businesses have grown rapidly. The revenue of the smart life business increased by 97.6% year-on-year, and the revenue of the smart car business increased by 71.1% year-on-year. The visual AI sensors and smart cabins developed by the company were mass-produced and delivered in the first half of the year, driving the rapid growth of these two businesses.

- Haidilao International Holding Ltd (6862 HK) rose 6.5% yesterday. The group announced its interim results , recording a loss attributable to shareholders of 266 million yuan (RMB, the same below), a year-on-year profit turnaround, but lower than the previous profit warning loss of up to 297 million yuan, with a loss of 0.05 yuan per share. During the period, revenue was 16.764 billion yuan, a year-on-year decrease of 16.57%. Revenue from food delivery business was RMB 476 million, an increase of 37.6% year-on-year, mainly due to the establishment of community operation centres to encourage restaurants to generate revenue in different ways, and more restaurants providing food delivery services, which increased the penetration rate of food delivery business.

- Poly Property Services Co Ltd (6049 HK) shares rose 6.5% yesterday after Goldman Sachs released a research report saying that it maintained the “buy” rating of Poly Property and raised its 2022-25 profit forecast by 3%, reflecting the average development of 2G and the slow expansion of community value-added services revenue, and higher gross profit margin, the target price rose 4% from HK$64.3 to HK$66.7.

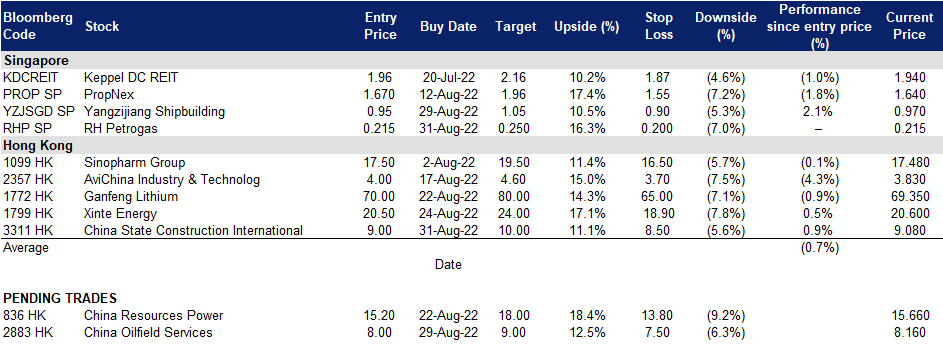

Trading Dashboard Update: Add RH Petrogas (RHP SP) at S$0.215 and China State Construction International (3311 HK) at HK$9.00.