Singapore: Market Movers – 2 November 2021

Technical Analysis | Market Movers | Trading Dashboard

Technical Analysis Of The Day

ThaiBev (THBEV SP)

- Shares recently formed a double bottom at 0.64 and now nicely trades above the 50d Simple MA.

- After forming a death cross on 25 July at 0.705, which is a negative signal, shares fell 8% over the next 3 weeks. However, it is now starting to form a golden cross where the 50d Simple MA moves above the 200d Simple MA, thus implying a positive signal.

Recommendation:

- Investors who remain bullish can start to accumulate at 0.72, with a target to 0.80.

- Long – Entry: 0.72, Target: 0.80, Stop: 0.685

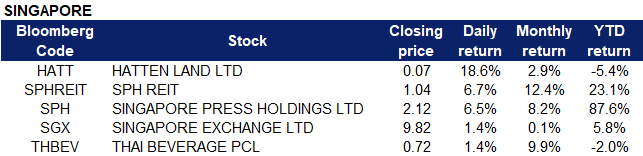

Market Movers

Stocks Making The Biggest Moves in Singapore:

- ThaiBev (THBEV SP) shares rose 1.4% on Monday. There was no company specific news. DBS Research previously said in a report on 28 October that it expects 1 to 2 interest rate hikes in 2022, and that banks will not be the only beneficiaries from rising interest rates. The brokerage also named a few stocks that can benefit from a rising rates environment and recovery trajectory, ThaiBev was one of the stocks mentioned. DBS added that the company may also benefit from improved alcoholic beverage sales in the months to come as Thailand and Vietnam prepare for re-opening.

- SGX (SGX SP). The Singapore Exchange announced yesterday that it will be investing about US$200 million as a limited partner in a private equity fund managed by 7RIDGE. The fund will be acquiring Trading Technologies, a provider of professional trading software for futures and options. SGX previously acquired MaxxTrader, an FX-trading platform for US$125 million in July 2021.

- Singapore Press Holdings (SPH SP) and SPH Reit (SPHREIT SP) jumped 6.5% and 6.7% respectively on Monday, after SPH received a rival offer from a consortium consisting of Hotel Properties and its managing director Ong Beng Seng, 2 Temasek-linked entities, CLA Real Estate and Mapletree Investments. SPH and SPH Reit both called for a trading halt on Friday morning before the consortium Cuscaden Peak announced that it had submitted a proposed acquisition for all the shares of SPH. The offer price consists cash of S$0.668 per share, 0.596 Keppel Reit unit (valued at S$0.715) and 0.782 SPH Reit unit (valued at S$0.716) per share, higher than the privatisation offer by Keppel Corp in August of $2.099 per share.

- Shares of Hatten Land (HATT SP) surged 18.6% on Monday, after it was announced that its subsidiary Hatten Technology had entered into a joint venture agreement with local fintech company Hydra X to jointly develop and operate cryptocurrency exchanges which will focus on the listing and trading of newly-minted bitcoins. Under the joint venture agreement, Hatten Land will hold 60% equity stake, while the remaining 40% will be held by Hydra X, and revenue generated will provide custody services for cryptocurrencies and tokens that are being traded. Hatten Land previously called for a trading halt on Thursday afternoon, and trading resumed yesterday.

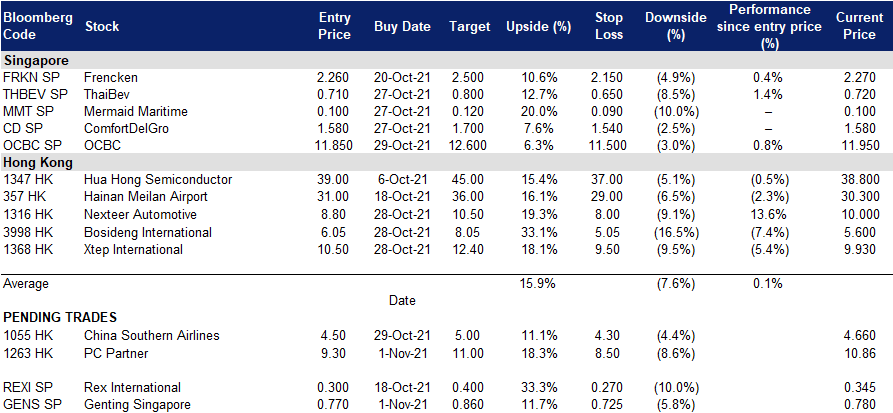

Trading Dashboard

(Click on image to enlarge)

Related Posts: