KGI Daily Trading Ideas – 5 February 2021

IPO Performance Review

Kuaishou (1024 HK) – Shares nearly triple in IPO debut

Shares of Kuaishou traded to a high of HK$345 in morning trading today, making it one of the world’s best performing trading debut.

ON24 (ONTF US) – Priced to the high, up 42% on first day

- Refer to our IPO write up here.

- ONTF priced its IPO at the top end of US$50/share, opened trading at US$77, shot up to US$81.90 before ending the day at US$70.82, for a first-day return of 41.6%. The stock traded downwards on Thursday and closed at US$67.25.

- Market cap at this price is around US$3.8bn and around 24.4x Price/Sales. Given that Qualtrics (XM US) is making new highs and has exceeded 35x Price/Sales, we expect continued upward momentum for ONTF, as a complementary CRM software with a similar customer base.

US Trading Ideas

Proshares Ultra VIX Short-term Futures ETF (UVXY US): The hedge for a volatile month

- BUY Entry – 10.3 Target – 12 Stop Loss – 9

- UVXY is an ETF that provides leveraged exposure to the S&P 500 VIX Short-Term Futures Index, which profits from increased expected volatility of the S&P 500 while being negatively correlated to S&P 500’s returns.

- Despite fairly strong earnings results from major companies, the S&P500 has largely failed to break the psychological resistance of 3900 in February, having formed a double top on 21st and 26th January.

- The dollar strength and rising US interest rates could cause volatility in risk-assets in the short-term. The spread between the 5 and 30 year Treasury yield has steepened to over 145bp recently, the highest since February 2016.

Xpel Inc (XPEL US): Trading off the bullish doji

- BUY Entry – 52.3 Target – 59.4 Stop Loss – 49.2

- XPEL provides automotive aftermarket services, specialising in paint protection films, window tints, and ceramic coating services. XPEL also does home and office window films.

- XPEL grew revenues and profit 22% and 30% respectively in 9M20 with record high margins despite COVID-19. Revenue growth has accelerated and the market has bidded up the stock, with price gain of over 200% in a year.

- On the technical basis, a bullish doji has formed on 29th January, with a large green candle on 2nd February closing above the prior red candle on 25th January. We expect price consolidation in the US$52-54 range before XPEL climbs to its all-time high again.

HK Trading Ideas

Yidu Tech Inc (2158): More rational valuation after the hype

BUY Entry – 48 Target – 56 Stop Loss – 45

- Yidu Tech Inc. operates a medical data intelligence platform. The Company provides healthcare solutions built on big data and artificial intelligence (AI) technologies. Yidu Tech offers its services in China.

- Yidu Tech is the only pure Software-as-a-Service (SaaS) company in China’s healthcare industry.

- The total amount of informatization investment in China’s healthcare industry was RMB145.6bnin 2019 and is expected to grow to RMB356.7bn in 2024 at a CAGR of 19.6%.The size of the healthcare big data solutions market was RMB10.5bn in 2019 and is expected to grow to RMB57.7bn in 2024 at a CAGR of 40.5%.

- The respective YoY growth of revenue in FY19 and FY20 are 349% and 447%. Gross profit margin improved by 20.7ppt YoY to 26.3% in FY20. However, net loss increased by 61.2% YoY to RMB1.5bn in FY20. The total number of active customers grew by 67% YoY to 159 in FY20.

- Previously, we recommended buying at HK$52, which was equivalent to 80x price-to-sales-ratio (PSR) based on FY20 sales. The average PSR of the SaaS peers is about 60x to 70x. Because the entry level for the application of SaaS in healthcare is higher than other industries, we believe Yidu Tech should be trading at a premium. Given the recent increasing volatility of the technology sector, we lower our entry price to buffer in wider price fluctuations.

Ping An Healthcare and Technology Co Ltd (1833 HK): A good doctor heals pains and makes gains

- RE-ITERATE BUY Entry – 96 Target – 135 Stop Loss – 80

- Ping An Healthcare and Technology Company Limited provides health care software solutions. The Company offers a mobile platform for online consultation, hospital referral and appointment, health management, and wellness interaction services, as well as connects consumers and patients with health care resources. Ping An Healthcare and Technology serves customers in China.

- In FY20, revenue grew by 35.5% YoY to RMB6.87bn; gross profit grew by 59.2% YoY to RMB1.86bn. Gross profit margin improved by 4.1ppt to 27.2%. The adjusted net loss dropped by 25.8% YoY to RMB516mn. Excluding financial impact due to strategic investments, net loss further dropped by 65.6% YoY to RMB236mn.

- Benefiting from the increasing recognition of online diagnosing and medical services, registered users grew by 18.3% YoY to 373mn in 2020. Average daily consultations grew by 23.9% YoY to 903,000. Average conversion rate of paying users increased by 0.9 ppt to 4.9%. Specifically, paying healthcare users accounted for 35.1%, with daily prescriptions sold rising by 88% YoY.

- The current valuation is relatively cheap as the 12-month forward price-to-sales ratio (PSR) is 11.8x, compared to the average of 16x during the COVID period (From February 2020 until now). With further improvement of its sales channels and services, we expect the company to turn profitable in three years.

SG Trading Ideas

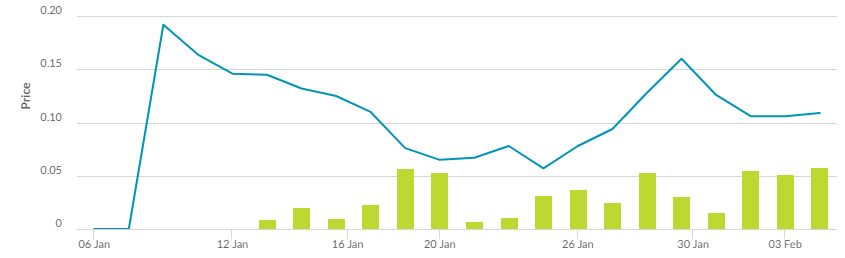

HSI 27400MBePW210330 (EEKW) – Who let the bears out

- BUY Entry – 0.090 Target – 0.150 Stop Loss – 0.080

- This product is a structured warrant listed on the SGX and only used for taking a short-term (1-2 months) directional view of the underlying security. An investor will need to be Specified Investment Products (SIP) qualified to trade structured warrants.

- The HSI 27400MBePW210330 is equivalent to buying a PUT option on the HSI, with an exercise price of 27,400 expiring on 30 March 2021.

- The Hang Seng Index (HSI) has risen for four consecutive months since October 2020. From a historical perspective, this pattern of back to back gains are usually followed by a larger-than-average correction in the month of February (examples include Feb 2013 and 2018).

- As we expect dollar strength in February due to rising US interest rates, this could also cause funds to flow out of the HK market ahead of the Chinese New Year period next week.

Nanofilm Technologies (NANO SP): Protection for your best friends

- BUY Entry – 5.0 Target – 5.50 Stop Loss – 4.70

- NANO provides advanced coating solutions to products such as smartphones, smartwatches, computers and automotive.

- We identify two key catalysts for the stock over the coming weeks. The first includes its upcoming earnings release likely in the third or fourth week of February, where management expects seasonality effect for a stronger 2H compared to 1H.

- The second catalyst is the completion of its new plant in China over the next 1-2 months. This new plant could potentially add another 200 coating machines to its existing line up of 122 machines.

- NANO has done well since its debut on SGX on 30 October 2020, gaining 102% since its listing date. We expect the company to do well given the strong tailwinds in the sectors that its customers operate in. It is expected to grow earnings per share (EPS) at 18-43% per annum in FY2021 and FY2022, according to consensus estimates.

Market Movers – What’s Hot

United States

- Short squeeze stocks have cooled down substantially, with Gamestop (GME US) -42% closing at US$53.50 and AMC Entertainment (AMC US) -21% closing at US$7.09.

- Agora Inc (API US) -2.9% closing at US$88.17, peaking at US$94 for the day. Agora is up 56% since Elon Musk used Clubhouse at the beginning of the week, an audio-focused social media app that is powered by Agora.

- Tiger Brokers (TIGR US) +15.3% closing at US$27.05 and is up 67% for the week, as the company gains greater investment interest as the “Robinhood of China”.

- Earnings watch: Digital Turbine (APPS US) +19.8%, Peloton (PTON US) -8.2% after-hours, Pinterest (PINS) +9.8% after-hours, Snapchat (SNAP US) -7.6% after-hours, Activision (ATVI) +8.4% after-hours.

Hong Kong

- China Evergrande New Energy Vehicle Group Ltd (708) +10.83%, closing at a new high of HK52.5. The company released photo and video footage of its first batch of cars undergoing a winter test. The road test is in Inner Mongolia, including a performance evaluation of the vehicle’s body, battery, electric motor and electric-control system.

- BYD Electronic (International) Co Ltd (285 HK) -8.86%, closing at HK$53.5. Hong Kong technology sector was sold down, likely ahead of the Chinese New Year long holiday, as investors began to sell into strength. Meanwhile, foreign investors continued to reduce their positions.

- COSCO SHIPPING Holdings (1919 HK) -10.16%, closing at HK$7.16. Freight rates continued to drop. Baltic Dry Index fell by 3.8% to 1,327 (the ninth consecutive fall), reaching a low since 21th December 2020. The Chinese government imposed restrictions on container carriers to cap freight rates. Company management has also indicated that they do not have plans to raise freight rates and surcharges.

Singapore

- iFAST (IFAST SP) +5.9% to S$6.50, remaining one of the most hotly traded and best performing stock in Singapore over the past year (537% gains over one year). The company announced on 30 Jan that Hong Kong’s Mandatory Provident Fund Schemes Authority (MPFA) had awarded PCCW Solutions Limited the contract to standardise Hong Kong’s pension system. iFAST is part of the group led by Richard Li’s PCCW bidding for the project.

- Straits Trading (STRTR SP) +18.9% to S$2.77 after DBS initiated coverage with a buy recommendation and S$3.50 target price, citing its cheap 0.6x price to net asset value and the significant value to be unlocked upon the potential listing of ARA Asset Management (ARA) in 2021 or 2022.

- Singapore Medical Group (SMG SP) +12.2% to S$0.415 on a possible transaction involving the company’s shares. SMG currently trades at 14x FY2021 earnings, a discount to recent offers for other healthcare service providers that were done at 26-31x earnings.

- Innotek (INNOT SP) +10.6% to S$0.73 on above-average trading volumes ahead of its full-year results to be released in the last week of February. We currently have an Outperform Rating with a TP of S$0.73 and will give an update after the earnings announcement.

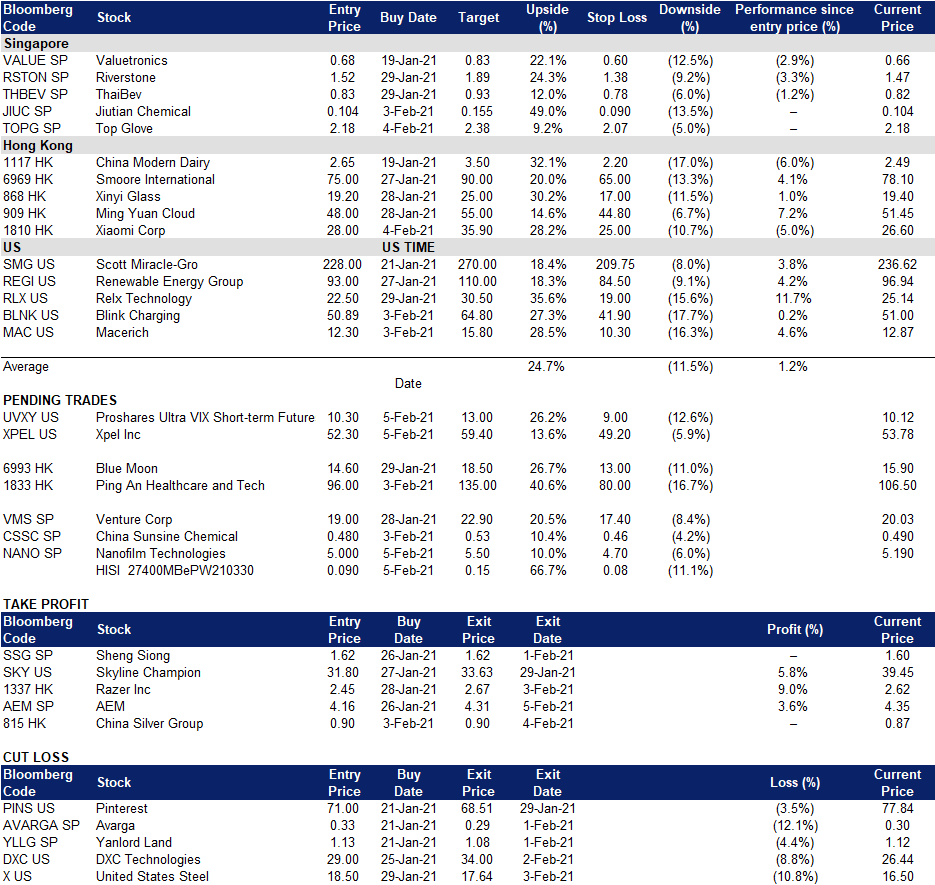

Trading Dashboard