KGI DAILY TRADING IDEAS – 28 July 2021

IPO Watch: Robinhood Markets | Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

IPO WATCH

Robinhood Markets Inc (HOOD US): Could HOOD’s IPO signal the market peak

- Key dates: Robinhood is expected to start trading on Thursday, 29th July 2021.

- Pioneer of commission-free trading. Robinhood is amongst the pioneers that offer commission-free trading. Its mission is to make trading available for everyone, especially retail investors and beginners given the app’s streamlined and easy-to-use interface.

- Fast growing user base. Robinhood sports an increasing user base compared to other brokerage apps (e.g. Webull, Coinbase, E-trade). It had a whopping total of 18 million downloads as of January 2021, with a record high of 3 million downloads in January 2021 itself.

- IPO for the masses. Robinhood is reserving 20%-35% of shares to be sold in an initial public offering for its customers, enabling retail investors to participate in IPOs.

- And enough for insti investors. Notable bookrunners and investors include Goldman Sachs, JP Morgan and Salesforce Ventures.

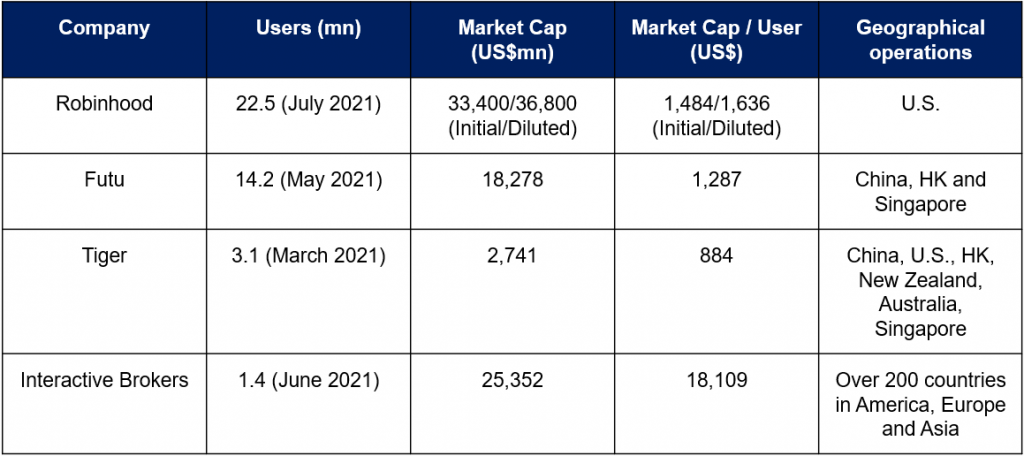

- Comparative peers among the commission free online brokers (Market Cap/User): Futu Holdings US$1,287, Tiger Brokers US$884, Interactive Brokers US$18,109 VS Robinhood US$1,484/US$1,636 (Initial/Diluted Market Cap).

- Priced for perfection. Robinhood’s Price/TTM Sales ratio at ~24-27x, which is fairly priced when compared to Futu Holdings who sports a PS ratio of 26.3x. Both are relatively expensive when compared to traditional brokers, such as Interactive Brokers Group with a PS ratio of 3.2x

- Overall recommendation: We expect huge trading volumes on IPO day as Robinhood is a big name in the market that has drawn a significant amount of controversy and hype. Possible upside/downside swing due to negative sentiments. We would consider to long Futu Holdings over Robinhood.

- Risks: Increasing number of competitors, hence customer retention might be challenging; Previously encountered crypto trading outage on platform, credibility might be underpinned should similar technology errors occur again; client support might not be strong due to short-squeeze incident in January 2021.

Comparison table between commission free online brokers

SINGAPORE

The Hour Glass (HG SP): The real TickTock

- BUY Entry – 1.44 Target – 1.60 Stop Loss – 1.40

- The Hour Glass is one of the world’s leading specialist watch retailers with an established presence of over 45 boutiques in twelve key cities in the Asia Pacific region. Fostering a global appreciation of watches, the group aims to remain the primary port of call for all watch enthusiasts and collectors alike.

- Rolex or AP? The group is the official retailer for a carefully curated selection of luxury brands including Rolex, Patek Philippe, Audemars Piguet, Hublot, A. Lange & Söhne, Breguet, Cartier, Jaeger-LeCoultre, IWC, F.P. Journe, MB&F, Omega, TAG Heuer, Tudor and the likes.

- Outperformance. HG’s shares have delivered a YTD return of 81%, outperforming both local and overseas markets. This has really been driven by strong earnings growth amid the pandemic last year. Net profit rose to an all-time high of S$83mn in FY2021 (YE March) as wealthy clients splurged on big ticket items.

- The company thinks its share price is cheap. The company has been aggressively buying back shares since 16 June 2021. Over the past month or so, the company has bought back S$10mn worth of shares from the open market.

- Life is short. The pandemic has reshaped the luxury market, with many clients and shoppers using cash they have saved from not going on holidays and socialising. Going by the long waiting list for certain Louis Vuitton handbags, we think luxury spending on items such as an AP will likely continue.

The Hour Glass has bought back S$10mn of shares in the past month or so

Del Monte Pacific (DELM SP): Hungry for more

- BUY Entry – 0.42 Target – 0.50 Stop Loss – 0.38

- Del Monte Pacific Limited produces and markets packaged vegetable and fruit, beverage and culinary products. The company has the exclusive right to use the Del Monte brand for packaged products in the USA, South America, Philippines, the Indian subcontinent and Myanmar, and the S&W brand for both packaged and fresh products globally except Australia and New Zealand. In FY2021 (April YE), Del Monte Pacific generated 69% (US$1.5bn) of sales from North America and 29% (US$0.6bn) from the Asia Pacific.

- Listing of subsidiary in the Philippines. Del Monte Philippines, a 87%-owned subsidiary of Del Monte Pacific, announced last week that it had received approval for its IPO on the Philippine Stock Exchange. The IPO is expected to raise as much as 44bn pesos (US$874mn), making it the second largest Philippines IPO in 2021, after Instant noodle and biscuit maker Monde Nissin that raised 56bn pesos in June. Shares of Del Monte Philippines will make its debut on 23 August. Del Monte Philippines enjoys strong market leadership in the Philippines being #1 for packaged pineapple (89% market share), canned mixed fruit (77%), tomato sauce (87%) and spaghetti sauce (39%).

- Turnaround and ready to fly. In 4Q FY2021 (Feb-Apr 2021), Del Monte Pacific improved gross margins to 26.8% from 17.8% on better sales mix and lower costs, while net profit turned from a US$12.4mn loss in 4QFY2020 to a net profit of US$14.5mn in 4Q FY2021. For the full-year FY2021, it reported a net profit of US$63mn, a significant turnaround from the US$81mn loss in the prior year. Balance sheet strengthened further from a gearing of 2.4x in the prior year to 2.0x as at the end of the most recent quarter, while also clinching credit upgrades from Moody’s and Standard & Poor.

- Positive outlook. The company expects higher net profit in FY2022 compared to the previous year, driven by more product availability to meet the growing demand for health and wellness products. The listing of its Philippines subsidiary should also provide a potential re-rating catalyst for the stock which has underperformed the broader market over the past four years.

HONG KONG

Hua Hong Semiconductor Ltd (1347 HK): Trading range between HK$38 and $44 is intact

- Buy Entry – 38 Target – 44 Stop Loss – 36

- Hua Hong Semiconductor Ltd is an investment holding company engaged in production and sales of semiconductor wafers. The company produces 200mm and 300mm-wafers. Its products are applied in general microcontroller (MCU), Type-C interface chips, image stabilization chips, touch control chips, and smart meter controller chips. The products also serve the Internet of Things (IoT), new energy vehicles, artificial intelligence and other markets.

- Recently, Malaysia reinstated the national lockdown due to deteriorating COVID-19 pandemic conditions. Integrated device manufacturers such as Intel, Infineon, and NXP Semiconductors have factories for package and packaging testing processing in Malaysia. Those plants were forced to shut. Some orders may be allocated to Hua Hong.

- The PHLX Semiconductor Sector ETF (SOXX US) has bottomed out since mid-May, implying that the market has factored in the headwinds and started to look forward to improvements in 2H21. The positive sentiment is expected to eventually make its way to Hong Kong related counters.

- The current market selloff is due to regulatory risks. The Chinese government is tightening regulations on the technology sector except the semiconductor sector. For investors who prefer growth stocks, semiconductor companies are a must-have.

- Consensus estimates peg the 12-month target price at HK$48.74, implying a 26% upside potential. EPS is forecasted to grow at 51.5%/23.4%/19.3% for FY2021/22/23F, which would bring forward P/Es down to 46x/37x/31x FY2021/22/23F.

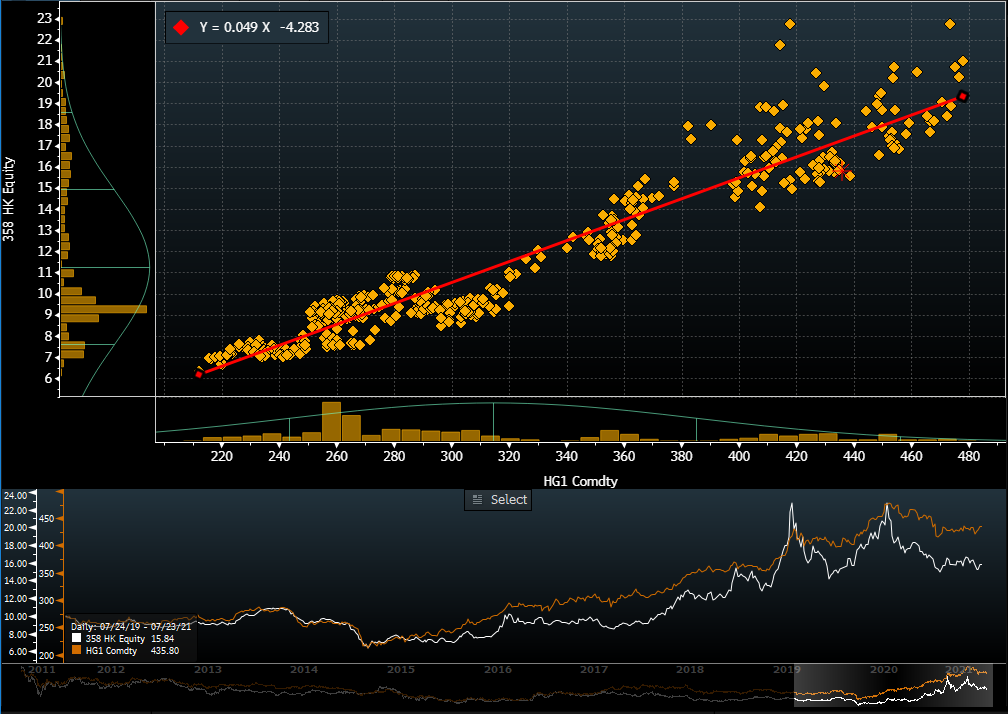

Jiangxi Copper Company Limited (358 HK): Rest is over, the new run is starting

- Reiterate BUY Entry – 15.1 Target – 17.9 Stop Loss – 14

- Jiangxi Copper Company Limited is a China-based company, principally engaged in the mining, smelting and processing of copper. The company is also engaged in the extraction and processing of precious metals and dissipated metals, sulfur chemical industry business, and financial and trading businesses. The company’s products include cathode copper, gold, silver, sulfuric acid, copper rods, copper foils, selenium, tellurium, rhenium, bismuth and others. The Company mainly conducts its businesses within Mainland China and Hongkong.

- According to the Shanghai Futures Exchange, the copper inventory had been dropping substantially, from about 100,000 tonnes on 28th June to slightly above 50,000 tonnes on 23th July. A new wave of demand for copper kick-started in July.

- COMEX copper futures closed at a one-month high of US$4.45/pound, breaking out the consolidating channel. The stock has relatively high copper beta (regression against copper futures). The market estimates of copper price average at US$9,138/tonne (US$4.14/pound) by 4Q21. Based on the regression model and the average estimates, the implied stock price is HK$16.

- Updated market consensus of the EPS growths in FY21 and FY22 are 75.6% YoY and 8% YoY respectively, which translates to 9.5x and 8.8x forward PE. Current PER is 15.1x. Bloomberg consensus average 12-month target price is HK$19.68.

Market Movers

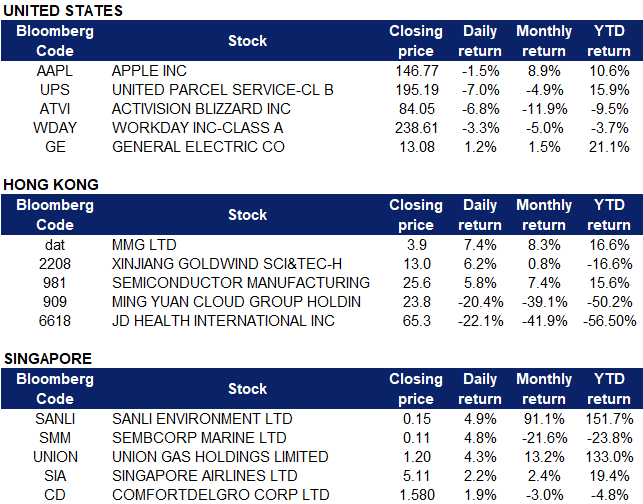

United States

- Apple (AAPL US) reported earnings per share of $1.30, $81.41 billion revenue and $39.57 billion in iPhone sales that beat Wall Street analysts’ estimates. Despite this, Apple shares fell 1.49% on Tuesday after executives warned that supply constraints related to “silicon” would affect the company’s September quarter iPhone and iPad sales

- United Parcel Service (UPS US) shares tumbled 7% on Tuesday, closing at $195.19. The company released stellar second quarter earnings which, however, failed to impress investors. Revenue was up 14% at $23.4 billion, earnings per share was up 50% to $3.05, and the company generated free cash flow worth $6.8 billion, more than the company’s highest annual FCF ever. UPS reported a 2.9% decline in their average daily domestic volumes, which could have been a result of stay-at-home restrictions and global lockdowns being lifted, hence losing demand for e-commerce and package delivery services. Competitor Fedex (FDX US) stocks also declined 5% in tandem.

- Activision Blizzard (ATVI US) shares plunged 6.76% on Tuesday, after allegations of a hostile work environment emerged. The video game maker of titles such as Call of Duty and Overwatch, was sued by the California Department of Fair Employment and Housing over a reported “pervasive frat boy culture”, leading to charges of unequal pay and harassment. The company responded to the allegations, calling it “factually incorrect, old and out of context” which further angered employees who are now planning to stage a walkout.

- Workday (WDAY US) shares fell as much as 7% intraday on Tuesday before closing at $230.66, the most in 8 months, on news that Amazon stopped using its human resources software. The software company confirmed the news, saying that this decision was made 18 months ago because of Amazon’s “unique set of needs”.

- General Electric (GE US) shares rose 1.24% after the company announced $18.3 billion in second-quarter revenue, a 9% annual increase, which surpassed analyst estimates. The American multinational conglomerate has seen its stock rising by 88% over the past year.

Singapore

- Sanli Environment Limited (SANLI SP) shares rose by 4.9% yesterday as the company announced a positive earnings report on 26 July. The group achieved a net profit after tax of S$528k for the financial year ended 31 March 2021, a 25.1% increase from S$422k for the previous financial period. With contract wins from the Public Utilities Board (PUB) worth S$72.67mn for the construction, commissioning and subsequent maintenance of new disinfection systems at Johor River Waterworks announced on 15 July 2021, the group’s orderbook stands at S$329.8mn and is expected to be completed by early 2026.

- Sembcorp Marine Limited (SMM SP). Shares rose by 4.8% yesterday, rebounding from near its all-time low of S$0.103. An article in The Straits Times yesterday made the case for minority shareholders with the means to take up the rights issue opportunity to not only subscribe for the rights shares, but also apply for excess shares to further average down their investment cost. Sembcorp Marine is due to report its 1H2021 results this Thursday, 29 July.

- Union Gas Holdings Limited (UNION SP). Shares rose by 4.3% yesterday ahead of the company’s 1H 2021 results that will be released on 13 August. Trading of the company’s shares was transferred from the Catalist board to the Mainboard of the SGX-ST on 19 July 2021. The company, which sells Retail LPG, Natural Gas and Diesel, reported its strongest year in 2020, driven by a strong top line and higher gross and net profit margins. The company is also collaborating with Surbana Jurong to study and evaluate the potential redevelopment of its existing fuel station into Singapore’s first multi-fuels and energy facility.

- Singapore Airlines Limited (SIA SP). Shares rose by 2.2% yesterday after Singapore announced that it aims to start quarantine-free travel by September of this year. SIA’s board also announced a circular addressing a few substantial and relevant questions from shareholders prior to the company’s AGM to be held on 29 July. Questions include SIA’s strategic plans going forward and how profitability can be regained. The Board responded that at the end of FY20/21 (31 March 2021), the group passenger capacity had reached 23% of pre-Covid-19 levels and by June 2021, it had risen to 28%. In addition, cargo demand fundamentals remain strong and overall airfreight demand is expected to be healthy in the coming months. Read here for more details on the circular.

- Comfortdelgro Corporation Limited (CD SP). Shares rose by 1.9% after the company announced that it will be releasing its 1H21 financial results on 13 August. Most recent news was published by the Business Times on 21 July that Comfortdelgro is expanding bus services operations in Queensland, where its wholly-owned subsidiary, CDC South East Queensland, will acquire the business assets of Young’s Bus Service, the largest bus operator in the Rockhampton region, for A$17.5mn.

Hong Kong

- MMG Limited (1208 HK) shares jumped even though the overall market was sold off. The company released its 2Q21 production report. Cathode copper output dropped by 31% YoY to 12,632 tonnes. Copper (contained in metal in concentrate) output grew by 37% YoY to 80,241 tonnes. Zinc (contained in metal in concentrate) output dropped by 8% YoY to 58,137 tonnes. Lead (contained in metal in concentrate) output dropped by 23% YoY to 11,141 tonnes. The average copper price rose by 81% YoY to US$4.4/lb. The average zinc price grew by 48% YoY to US$1.32/lb. The average lead price grew by 28% YoY to US$0.97/lb.

- Xinjiang Goldwind Science & Tech Co Ltd (2208 HK). There was no company specific news. Investors were in panic mode on high growth stocks. The inflows of funds could be due to some hedging movements as the company is a leader in wind power.

- Semiconductor Manufacturing International Corporation (981 HK). Both A-shares and H-shares jumped as investors were buying sectors with government policy support. CICC analysts maintained a positive view on the semiconductor sector outlook.

- Ming Yuan Cloud Group Holdings Ltd (909 HK). Shares closed at its lowest since IPO in September 2020. The IPO price was HK$16.5. The plunge was due to the technology sector selloff which has lasted for three consecutive days.

- JD Health International Inc (6618 HK). Shares closed at a low since IPO in December 2020. The IPO price is HK$70.58. The plunge was due to the technology sector selloff which lasted for three consecutive days.

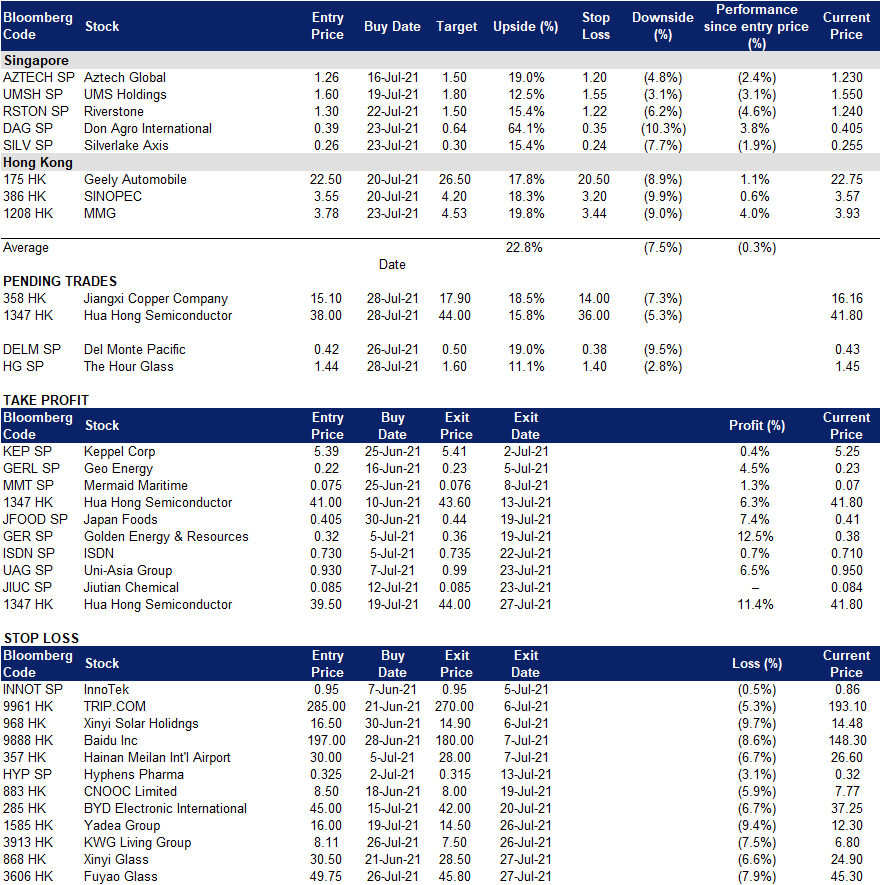

- Trading Dashboard: Huahong Semiconductor (1347 HK) took profit at HK$44. Xinyi Glass (868 HK) was cut at HK$28.5. Fuyao Glass (3606 HK) was cut at HK$45.8.

Trading Dashboard

Related Posts: