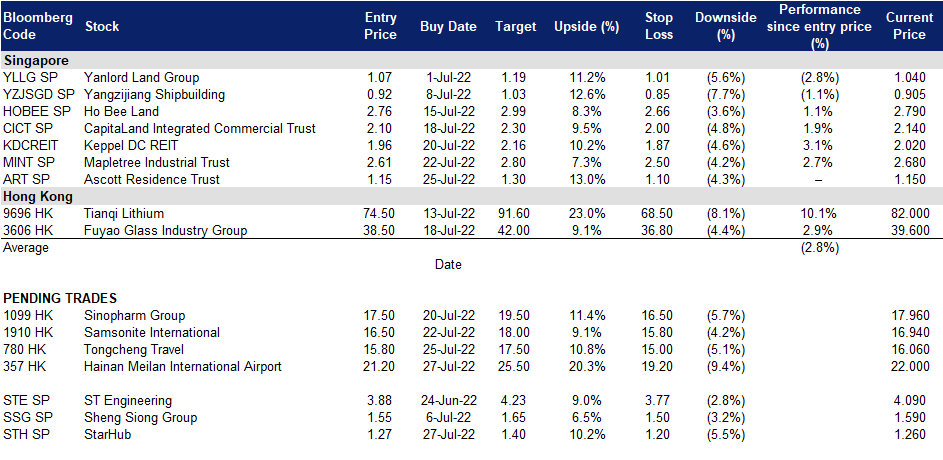

27 July 2022: StarHub (STH SP), Hainan Meilan International Airport Co Ltd (357 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

StarHub (STH SP): Aztech IoT segment implies latent demand for 5G connectivity

- BUY Entry 1.27 – Target – 1.40 Stop Loss – 1.20

- StarHub is a Singapore company that delivers communications, entertainment and digital services. With its fibre and wireless infrastructure and global partnerships, it brings to people, homes and enterprises mobile and fixed services, a broad suite of content, and a diverse range of communication solutions. It develops and delivers to corporate and government clients solutions incorporating artificial intelligence, cybersecurity, data analytics, Internet of Things and robotics.

- Read through from Aztech’s strong IoT segment. IoT play, Aztech recently announced fairly strong results, aided by its IoT segment. 1H22 revenue and earnings came in at 47%/50% of street expectations with a 46%/45.7% YoY jump to S$364.6m/S$42.8m respectively. Notably, management remained sanguine about global demand for IoT related devices and smart lighting solutions with revenue from IoT and Datacom Products swelling 52.5% YoY to S$354.9m. The strong IoT device sales imply increasing demand for 5G connectivity, and could underpin 5G plan signups by local telcos such as StarHub, thereby improving ARPU. Notably, StarHub has been seeing steadily improving postpaid ARPU (1Q22: S$29 vs 1Q21: S$27) for mobile uses, coupled with sustained 5G market lead with >300,000 5G subscribers as at end 4Q21.

- Recent Premier League Rights deal could lift STH’s entertainment segment. STH announced in February 2022 that it had secured the right to present EPL for the next six years and was rolling out open, agile, and flexible access to customers. Based on the media reports, STH’s S$19.90/month subscription price for EPL (vs Singtel Cast’s S$49.90/month previously) has been well received. This could ultimately bolster STH’s entertainment segment, which contributed about 11.3% to 1Q22 revenue.

- Downcast forecasts could provide scope for upside surprises. The Street currently has 4/11/2 BUY/HOLD/SELL ratings and an average TP of S$1.34. Based on consensus estimates, FY22F gross revenue should pick up by 10.9% YoY to S$2.27bn although EBITDA could see a 12.7% YoY decline. In line with this, the street is expecting FY22F DPU to decline to 5.4¢ (FY21: 6.4¢). Nonetheless, at current prices, STH would trade at a still fairly attractive 4.3%/4.8% FY22F/23F yield. STH is due to announce 1H22 results on 4 August after trading closes.

Ascott Residence Trust (ART SP): Tourism recovery still in play; results on 29 July

- RE-ITERATE BUY Entry 1.15 – Target – 1.30 Stop Loss – 1.10

- Ascott Residence Trust (ART) is the largest hospitality trust in Asia Pacific with an asset value of S$7.7bn as at 31 December 2021. ART’s international portfolio comprises 95 properties with more than 17,000 units in 44 cities across 15 countries in Asia Pacific, Europe and the United States of America as at 31 March 2022. ART’s properties are mostly operated under the Ascott The Residence, Somerset, Quest and Citadines brands. They are mainly located in key gateway cities such as Barcelona, Berlin, Brussels, Hanoi, Ho Chi Minh City, Jakarta, Kuala Lumpur, London, Manila, Melbourne, Munich, New York, Paris, Perth, Seoul, Singapore, Sydney and Tokyo. ART is managed by Ascott Residence Trust Management Limited (as manager of Ascott Reit) and Ascott Business Trust Management Pte. Ltd. (as trustee-manager of Ascott BT), both of which are wholly-owned subsidiaries of Singapore-listed CapitaLand Investment Limited (CLI SP).

- UNWTO/IATA sees growing occupancy rates across Asia, Europe, and the Americas. According to the UNWTO Tourism Recovery Tracker, key ART markets such as Asia Pacific, Europe, and the Americas have seen recovering occupancy rates vis-a-vis pre-pandemic levels in 2019. In the Asia Pacific region, June occupancy levels have grown to 56% vs Jan’s 43%. Meanwhile, other key markets in Europe and Americas have seen stronger and more robust occupancy rates likely due to the summer vacations. Europe’s Jun occupancy rates were 75% (Jan: 34%) of 2019 levels, while the Americas’ stood at 69% (Jan: 47%). Notwithstanding the occupancy rates, we note that the same tracker observes the Asia Pacific region further picking up the slack with hotel bookings currently at -19% (Jan: -78%) vs 2019 levels, while Europe and the Americas are substantially higher, albeit still stronger booking rates of -59% (Jan: -82%) and -59% (Jan: -72%), respectively.

- Green shoots of recovery already seen in 1Q22. ART reported strengthening portfolio RevPAU of S$67 (+22% YoY) or about 50% of 1Q19 levels, with increases in both average daily rates and occupancy. Additionally, management shared that forward bookings had indicated sustained robust demand from leisure and corporate travel segments combined with growth in the MICE industry. Leisure demand was particularly boosted by revenge travelling into key markets such as Australia, Japan, Singapore, UK, and the US.

- Trading below pre-pandemic valuations even as recovery likely picked up. The Street currently has 6/3/1 BUY/HOLD/SELL ratings and an average TP of S$1.23. Based on consensus estimates, FY22F gross revenue and NPI should surge 32.5%/55.8% YoY, while FY22F DPU growth should jump 20.6% YoY higher to S$0.052 apiece. While ART’s valuations have improved significantly since the pandemic struck, it is still significantly lower than the levels it was trading at prior. As the tourism recovery takes hold, we believe that there is upside risk that ART could outperform the Street’s forecasts and revert to its pre-pandemic valuations. At current prices, ART would trade at a still fairly attractive 4.5%/5.4% FY22F/23F yield

Hainan Meilan International Airport Co Ltd (357 HK): More upbeat tailwinds in this summer

- Buy Entry – 21.2 Target – 25.5 Stop Loss – 19.2

- Hainan Meilan International Airport Company Limited, formerly Regal International Airport Group Company Limited, is a Hong Kong-based investment holding company principally engaged in aviation and related businesses. The Company operates through aeronautical businesses and non-aeronautical businesses. Its aeronautical businesses include the provision of terminal facilities, ground handling services and passenger services. Its non-aeronautical businesses include the leasing of commercial and retail spaces at Meilan Airport, airport-related businesses franchising, advertising spaces leasing, car parking businesses, cargo handling and the sales of consumable goods.

- The second China International Consumer Products Expo opened. The Expo runs from 25th to 30th July in Haikou, the capital city of Hainan province. It will host 2,800 local and international brands, and more than 100 events will be held on the sidelines of the expo. The provincial government announced to release RMB100mn worth of consumer voucher, 60%/30%/10% of which is allocated to the consumption of offshore duty-free goods/food & beverage and retail goods/home appliance.

- Duty-Free Shopping Festival kick started. On 28th June, The first Hainan International Offshore Duty-Free Shopping Festival was launched in Sanya. The international tourism island sets to hold more than 50 promotional events during the half-year festival period to boost the recovery of duty-free shopping.

- The updated market consensus of the EPS growth in FY22/23 is -73.4%/207.5% YoY, respectively, translating to 44.0×/14.3x forward PE. The current PER is 11.7x. Bloomberg consensus average 12-month target price is HK$25.43.

(Source: Bloomberg)

Tongcheng Travel Holdings Limited (780 HK): Summer holiday to revive the domestic tourism

- Buy Entry – 15.8 Target – 17.5 Stop Loss – 15.0

- Tongcheng Travel Holdings Ltd, formerly Tongcheng-Elong Holdings Ltd, is a China-based holding company mainly providing online tourism products and services. The Company is mainly engaged in transportation ticketing services, accommodation reservation services and other services. The transportation ticketing services mainly include air ticket and train ticket booking, sales of tourism insurance and other transportation related services. The accommodation reservation services mainly provide accommodation booking services. Other services mainly include attraction ticketing, ancillary value-added user services and advertising services.

- The worst could be over. China Tourism Academy released a report stating that domestic tourism had a downturn in 1H22 due to the covid outbreaks and the ensuing lockdowns. In 1H22, travelers made 1.46bn domestic visits, down 22.2% YoY. Revenue dropped by 28.2% YoY to US$173bn. However, the tourism market started to recover in June as the number of travellers recovered to 60% of last year’s level. It is expected to rebound further in July.

- Resumption of inter-provincial group tours. At the beginning of June, more than ten Chinese localities moved to restart inter-provincial group tours, after the Ministry of Culture and Tourism (MCT) announced more targeted anti-epidemic measures in an effort to boost tourism.

- 1Q22 financials and operations review. Revenue grew by 6.5% YoY to RMB1.72bn. Adjusted net profit dropped by 18% YoY to RMB298.9mn. Average MAUs grew by 4.5% YoY to 234.2mn. Average MPUs grew by 16.1% YoY to 27.3mn.

- The updated market consensus of the EPS growth in FY22/23 is 17.8%/72.0% YoY, respectively, translating to 36.2×/21.1x forward PE. The current PER is 47.5x. Bloomberg consensus average 12-month target price is HK$17.68.

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Precious Metals | +2.14% | XAG/USD clings to gains near mid-$18.00s, not out of the woods yet Wheaton Precious Metals Corp(WPM US) |

| Agricultural Commodities/Milling | +1.76% | Archer-Daniels-Midland posts higher Q2 Adjusted Earnings, Revenue; Shares Rise Archer-Daniels-Midland(ADM US) |

| Industrial Conglomerates | +1.40% | 3M cuts 2022 outlook, to spin off healthcare business 3M Co. (MMM US) |

Top Sector Losers

| Sector | Loss | Related News |

| Food Retail | -6.43% | Walmart (WMT) profit warning underlines shift in consumer spending after Covid Walmart Inc(WMT US) |

| Apparel/Footwear | -4.26% | Adidas cuts 2022 outlook on slower China recovery, potential for a global slowdown Nike (NKE US) |

| Motor Vehicles | -2.80% | General Motors falls short of Wall Street expectations as supply chain challenges dent profit General Motors (GM US) |

- Amazon (AMZN US), Target (TGT US) fell 5.2% and 3.3% after a forecast cut from industry bellwether Walmart Inc (WMT US) stoked fers of a broader slowdown in spending as high inflation raises costs for end-consumers. Walmart’s downbeat forecast marked the latest sign about an economy that is on the precipice of a recession. Its outlook showed that consumers were dealing with higher food and essential prices by lowering spending on discretionary categories such as apparel. The biggest private US employer said its annual profit could decline up to 13% as it cut prices of clothing and general merchandise to attract consumers.

- Shopify (SHOP US) slumped 14.1% after it announced that it would be laying off 1,000 workers, or around 10% of its global workforce. This came after it acknowledged that management had misjudged how long the pandemic-driven e-commerce boom would last amidst a broader pullback in online spending. The cuts would affect all of its divisions, though most will occur in recruiting, supporting and sales.

- Coinbase (COIN US) dived 21.1% on a report that it is facing SEC’s probe into whether the platform is offering unregistered securities. This SEC probe came before and was separate from COIN’s alleged insider trading scheme that led to the fraud charge of an ex-Coinbase product manager last week. The additional probe claims that 9 out of the 25 tokens allegedly traded in the scheme were securities.

- 3M (MMM US) jumped 4.9% after it reported better-than-expected earnings although it cut sales and earnings growth forecasts. Separately, it announced that it will spin off its healthcare business that would focus on wound and oral care, healthcare IT, and biopharma filtration. 3M healthcare products recorded more than US$8bn in sales in 2021. The transaction is expected to be completed by the end of next year, and 3M will maintain a 19.9% stake in the new company.

- Coca-Cola Co (KO US) gained 1.6% after it reported quarterly earnings that topped expectations as the beverage giant’s sales at restaurants, theatres and other venues recovered from the pandemic. KO reported adjusted EPS of US$0.70 (est: US$0.67) on adjusted revenue of US$11.3bn (est: US$10.56bn). It now expects organic revenue growth of 12% to 13% for the full year, up from its previous guidance of 7% to 8%. But it noted that commodity price inflation is expected to be steeper than previously forecast, and stuck by its outlook for comparable earnings per share to grow 5% to 6% from a year ago.

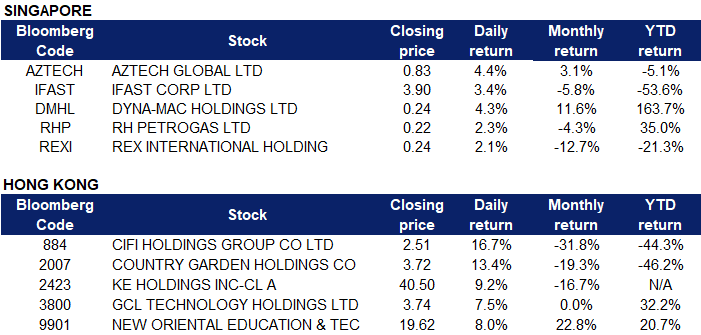

Singapore

- Aztech Global Ltd (AZTECH SP) shares rose 4.4% yesterday. Aztech Global reported a 79 per cent surge in net profit to S$29 million in the second quarter of financial year 2022, thanks to “strong production volume and shipment” of Internet of Things and data communication devices, according to the company’s interim financial statement on Monday. This has brought the net profit to S$42.8 million for the 6 months ended Jun 30, a 45.7 per cent jump compared to the same period last year, despite ongoing challenges posed by the Covid-19 pandemic and supply chain disruptions.

- iFAST Corp Ltd (IFAST SP) shares rose 3.4% yesterday. It posted a share buy-back notice on Monday. As at the date of the passed share buyback resolution, the issued share capital (excluding treasury shares) consists of 292,907,513 ordinary shares. The 106,900 shares bought back under the Share Buyback Mandate are held as treasury shares, and the total number of shares held in treasury as at to-date is 279,700.

- Dyna-Mac Holdings Ltd (DMHL SP), RH PetroGas Ltd (RHP SP) and Rex International Holding Ltd (REXI SP) shares rose 4.3%, 2.3% and 2.1% respectively yesterday. Oil prices rose on Tuesday for a second day on increasing concerns about tightening European supply after Russia, a key oil and natural gas supplier to the region, cut gas supply through a major pipeline. Russia tightened its gas squeeze on Europe on Monday as Gazprom said supplies through the Nord Stream 1 pipeline to Germany would drop to just 20% of capacity. Still, falling demand because of recent high crude and fuel prices and the expectation of an increase in interest rates in the United States have put pressure on prices. Market sentiments are swaying between the concerns about the supply-side instability and the expectations for weaker fuel demand under the downward pressure of global economy, said analysts from Haitong Futures.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Property Management & Agency | +2.11% | China’s property crisis burns middle class stuck with huge loans Ke Holdings Inc (2423 HK) |

Construction Materials | +1.99% | China eyes improved national highway system with reasonable ‘advance development’: officials China National Building Material Co Ltd (3323 HK) |

Petroleum & Gases | +1.52% | Oil rises $2 as dollar eases, market wary of Fed CNOOC Limited (883 HK) |

Top Sector Losers

Sector | Loss | Related News |

Dairy Products | -1.25% | NA China Mengniu Dairy Company Limited (2319 HK) |

Semiconductors | -0.99% | Semiconductor Bill Leaves U.S. at Disadvantage against China Hua Hong Semiconductor Ltd (1347 HK) |

Machinery & Equipment | -0.30% | NA L.K. Technology Holdings Limited (558 HK) |

- CIFI Holdings (Group) Co Ltd (0884 HK) and Country Garden Holdings Co Ltd (2007 HK) shares rose 16.7% and 13.4% respectively yesterday. According to the news quoted by the Financial Associated Press, Rongyin and HSBC Research recently released a research report stating that China has approved the establishment of a real estate fund to provide financial support amounting to 300 billion yuan for 12 real estate developers facing financial difficulties. In addition, the authorities are also considering the issuance of special bonds for shantytown reform.

- KE Holdings Inc (2423 HK) shares rose 9.2% yesterday. CITIC Securities released a follow-up review report saying that with the recovery and rebound of the real estate market, KE revenue is expected to show significant growth. The bad debts and rate stability issues of the new housing business, which the market is more worried about, can be completely eliminated in the third quarter of 2022. In addition, as a company with a dual main listing in Hong Kong, it is expected that it is only a matter of time before it obtains the status of Hong Kong Stock Connect, and the company’s Hong Kong stock trading liquidity is expected to continue to improve.

- GCL Technology Holdings Ltd (3800 HK) shares rose 7.5% yesterday. GCL Technology announced that it was informed by Chairman Zhu Gongshan that on last Friday, 22 July, the Zhu Family Trust, of which he and his son, Zhu Yufeng were the beneficiaries, purchased 10 million shares in the open market for a total of 35.48 million yuan through a subsidiary.

- New Oriental Education & Technology Group Inc (9901 HK) shares rose 8.0% yesterday. CICC issued a report stating that the operation adjustment of New Oriental is expected to have been completed, and the current development direction is clear. The existing business and new business have long-term profit prospects, and will provide stable operation and liquidity. The bank pointed out that the current market value of New Oriental is lower than its cash on hand, which fails to reflect the value of its existing or new businesses. Therefore, it has upgraded its rating to “outperform the industry”.

Trading Dashboard Update: No stock additions/deletions.