KGI DAILY TRADING IDEAS – 26 July 2021

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

Del Monte Pacific (DELM SP): Hungry for more

- BUY Entry – 0.42 Target – 0.50 Stop Loss – 0.38

- Del Monte Pacific Limited produces and markets packaged vegetable and fruit, beverage and culinary products. The company has the exclusive right to use the Del Monte brand for packaged products in the USA, South America, Philippines, the Indian subcontinent and Myanmar, and the S&W brand for both packaged and fresh products globally except Australia and New Zealand. In FY2021 (April YE), Del Monte Pacific generated 69% (US$1.5bn) of sales from North America and 29% (US$0.6bn) from the Asia Pacific.

- Listing of subsidiary in the Philippines. Del Monte Philippines, a 87%-owned subsidiary of Del Monte Pacific, announced last week that it had received approval for its IPO on the Philippine Stock Exchange. The IPO is expected to raise as much as 44bn pesos (US$874mn), making it the second largest Philippines IPO in 2021, after Instant noodle and biscuit maker Monde Nissin that raised 56bn pesos in June. Shares of Del Monte Philippines will make its debut on 23 August. Del Monte Philippines enjoys strong market leadership in the Philippines being #1 for packaged pineapple (89% market share), canned mixed fruit (77%), tomato sauce (87%) and spaghetti sauce (39%).

- Turnaround and ready to fly. In 4Q FY2021 (Feb-Apr 2021), Del Monte Pacific improved gross margins to 26.8% from 17.8% on better sales mix and lower costs, while net profit turned from a US$12.4mn loss in 4QFY2020 to a net profit of US$14.5mn in 4Q FY2021. For the full-year FY2021, it reported a net profit of US$63mn, a significant turnaround from the US$81mn loss in the prior year. Balance sheet strengthened further from a gearing of 2.4x in the prior year to 2.0x as at the end of the most recent quarter, while also clinching credit upgrades from Moody’s and Standard & Poor.

- Positive outlook. The company expects higher net profit in FY2022 compared to the previous year, driven by more product availability to meet the growing demand for health and wellness products. The listing of its Philippines subsidiary should also provide a potential re-rating catalyst for the stock which has underperformed the broader market over the past four years.

Don Agro International (DAG SP): Your source of bread and butter

- RE-ITERATE BUY Entry – 0.39 Target – 0.64 Stop Loss – 0.35

- Don Agro International (Don Agro) is one of the largest agricultural companies in Russia’s Rostov region. It has a stable track record of profitability over the last five years, with net income reaching a record in 2020.

- A bowl full of opportunities. Favourably located and well managed, Don Agro is in a sweet spot. Wheat demand, which is the key driver of the group, is forecasted to grow by almost 18% from 2019 to 2029, according to estimates by the US Department of Agriculture’s Foreign Agricultural Service (USDA FAS). Furthermore, wheat, as a staple food source, provides a resilient revenue stream for the group despite changing economic trends.

- Initiate with Outperform and TP of S$0.64. We initiate with Outperform and a TP of S$0.64 based on discounted cash flow, taking into account a WACC of 11.0% and terminal growth rate of 3.0%. Don Agro’s current valuations are attractive as it trades at only 6.0x FY2021F EPS. With a good track record and healthy outlook, Don Agro is well-positioned to ride on long-term global trends. Read our full report here.

Don Agro reported a record net profit of S$8.7mn in 2020, representing a 66% YoY increase and more than double its 2016-2017 net profit.

| S$’000 | 2016 | 2017 | 2018 | 2019 | 2020 |

| Revenue | 30,979 | 23,193 | 24,375 | 35,431 | 30,996 |

| Gross Profit | 5,913 | 6,747 | 9,062 | 8,589 | 14,626 |

| Net Profit | 4,203 | 4,096 | 6,388 | 5,223 | 8,696 |

HONG KONG

Jiangxi Copper Company Limited (358 HK): Rest is over, the new run is starting

- BUY Entry – 15.5 Target – 17.9 Stop Loss 14.5

- Jiangxi Copper Company Limited is a China-based company, principally engaged in the mining, smelting and processing of copper. The company is also engaged in the extraction and processing of precious metals and dissipated metals, sulfur chemical industry business, and financial and trading businesses. The company’s products include cathode copper, gold, silver, sulfuric acid, copper rods, copper foils, selenium, tellurium, rhenium, bismuth and others. The Company mainly conducts its businesses within Mainland China and Hongkong.

- According to the Shanghai Futures Exchange, the copper inventory had been dropping substantially, from about 100,000 tonnes on 28th June to slightly above 50,000 tonnes on 23th July. A new wave of demand for copper kick-started in July.

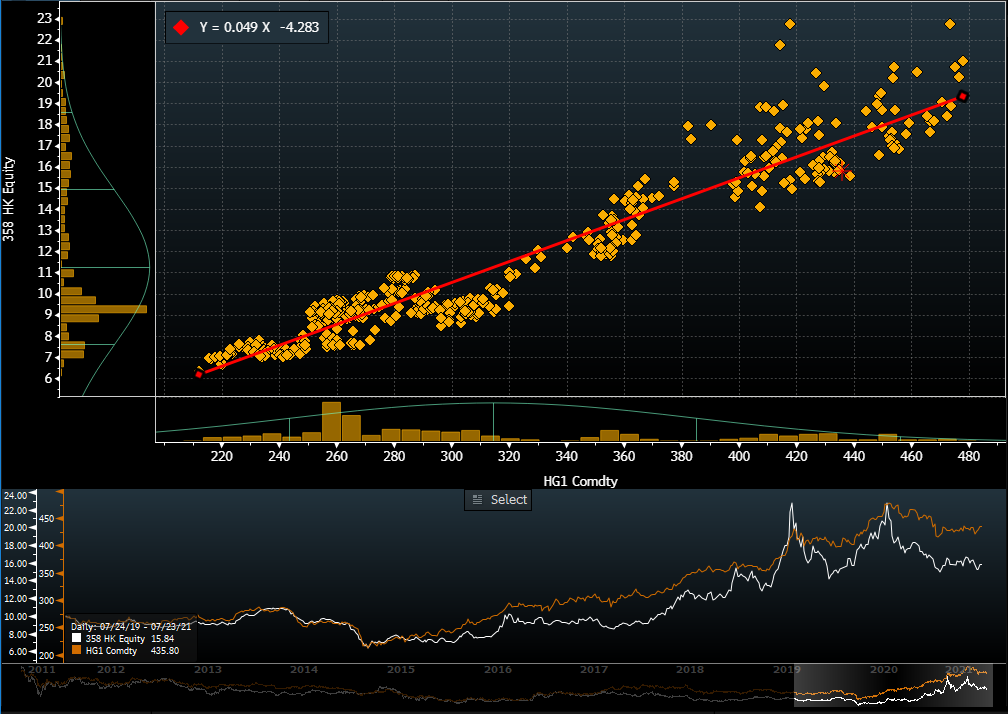

- COMEX copper futures closed at a one-month high of US$4.45/pound, breaking out the consolidating channel. The stock has relatively high copper beta (regression against copper futures). The market estimates of copper price average at US$9,138/tonne (US$4.14/pound) by 4Q21. Based on the regression model and the average estimates, the implied stock price is HK$16.

- Updated market consensus of the EPS growths in FY21 and FY22 are 75.6% YoY and 8% YoY respectively, which translates to 9.5x and 8.8x forward PE. Current PER is 15.1x. Bloomberg consensus average 12-month target price is HK$19.68.

KWG Living Group Holdings Ltd (3913 HK): Fundamentals intact but just a weak sentiment

- Reiterate Buy Entry – 8.15 Target – 10 Stop Loss – 7.50

- KWG Living Group Holdings Ltd is a holding company engaged in provision of property management services. The company operates two segments. The Residential Property Management Services segment provides pre-sale management services, property management services, community value-added services and public space value-added services. The Commercial Property Management and Operational Services segment provides pre-sale management services, commercial property management services, commercial operation services and other value-added services.

- Counter-inflation remains the main investment theme for investors this year, and property management services are viewed as an indirect hedge against rate hikes. The sector has positive investment attributes such as low capex, net cash positions, and stable dividend payout. All these are in line with the value sectors that investors are currently looking out for.

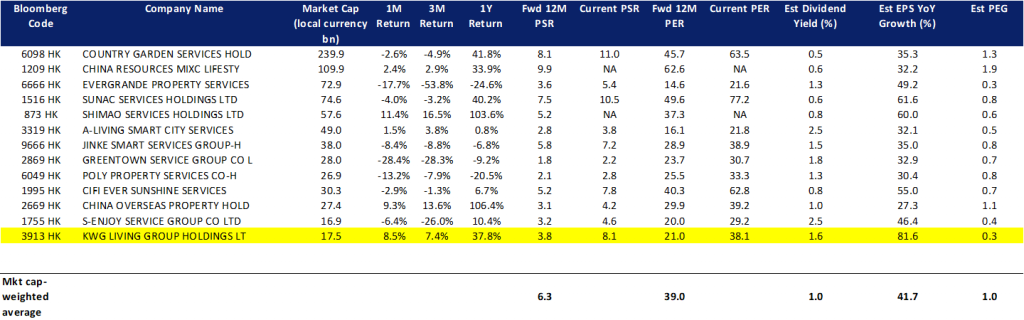

- The company has a relatively attractive valuation compared to peers in the property management sector. Its forward 12M PEG is the lowest among its peers, and the estimated dividend yield is decent compared to peers.

- Market consensus of net profit growth in FY21 and FY22 are 61.1% YoY and 43.7% YoY, which implies forward PERs of 21.0x and 13.0x. Current PER is 38.1x. Bloomberg consensus average 12-month target price is HK$12.48.

Market Movers

United States

- Moderna (MRNA US) shares jumped 7.8% to a record closing high of $348 after the European Medicines Agency’s (EMA) Committee for Medicinal Products for Human Use (CHMP) adopted a positive opinion, recommending the approval of Moderna’s Spikevax for use in adolescents aged 12 to 17 years old.

- U.S.-listed Chinese education stocks took a beating on Friday after reports of a government crackdown on the sector. TAL Education (TAL US) shares tumbled 70.8%; the lowest closing price since October 2015, while New Oriental Education and Technology (EDU US) shares dropped by 54.2%. Bloomberg reported that the People’s Republic of China is considering asking tutoring companies to turn nonprofit, potentially preventing China’s currently for-profit companies from raising capital in the financial markets.

- Facebook (FB US) shares rose 5.3% on Friday. The stock’s growth was likely driven by better-than-expected results from social media peer Snap (SNAP US). The stock also received an upgraded 12-month target price by Credit Suisse from $400 to $480.

- Virgin Galactic (SPCE US). The space tourism pioneer’s stock closed on Friday down another 4%. There was no company specific news. However, it was revealed that the Federal Aviation Administration has given notice that simply flying to the edge of space as a passenger on a space tourism vessel does not qualify the passenger call themselves an “astronaut”. In addition to this complication to Virgin Galactic’s marketing efforts, Rep. Earl Blumenaeur of Oregon is planning to introduce legislation that will specifically tax sales of space tourism tickets – a higher ticket price would almost certainly lower demand for the service.

- Earnings Watch – July 26: Tesla, Lockheed Martin; July 27: Apple, Alphabet, Microsoft; July 28: Boeing, Facebook, Pfizer

Singapore

- AnAn International Limited (ADI SP). Shares surged by 13.3% after it was announced on 22 July that its subsidiary, Dyneff SAS has made a binding offer on 26 April for the proposed acquisition of a 100% stake in AUBAC, a company incorporated in France, whose business is in the distribution of refined petroleum products. AUBAC is a distributor of refined petroleum products including diesel, gasoline and heating oil.

- Net Pacific Financial Holdings Limited (NPAC SP). Shares rose by 8.8% on higher-than-average trading volume on Friday. The company announced on 22 July that it is currently in negotiation with the remaining existing three borrowers in Australia in relation to the settlement of their loans.

- Global Invacom Group Limited (RAD SP). Shares rose by 8.5% and closed at its highest since August 2020 on higher-than-average trading volumes. There was no company specific news. However, investors could have a positive outlook on the company given that it is one of the world’s leading fully-integrated satellite communications solutions providers. On 22 July, Globe Newswire published that the SATCOM market size was USD 23.44bn in 2020 and is projected to grow from USD 25.33bn in 2021 to USD 46.50bn in 2028 at a CAGR of 9.07% in the forecast period. Global Invacom’s share price has gained more than 25% over the past month.

- Del Monte Pacific Limited (DELM SP). Shares rose by 3.5% on Friday, even though there was no company specific news. The most recent news was on 21 July where the Securities and Exchange Commission’s (SEC) and Philippine Stock Exchange, Inc’s (PSE) approved the listing of Del Monte Philippines, Inc. (DMPI), Del Monte Pacific Limited’s subsidiary on the Philippines Stock Exchange. The IPO will raise as much as 44 bbn pesos from the maiden share sale, including the over-allotment option. That makes it the country’s second-largest IPO this year. In addition, it was published in the news last Friday that export revenue increased for Del Monte Philippines, further fueling investors’ confidence in the stock.

- Yangzijiang Shipbuilding Group Limited (YZJ SP). Shares rose by 2.9% on Friday, boosted by positive news on the company over the past week. On 21 July, Yangzijiang announced that it had acquired the remaining 20% stake in Jiangsu Yangzi Xinfu Shipbuilding for US$136.9mn. Consensus remains positive on the stock with 7 BUYS / 1 HOLD / 1 SELL, and a 12m TP of S$1.65 (+17% potential upside). Yangzijiang currently trades at 9x and 8x FY2021 and FY2022 PE respectively, while offering a 3.5-4.0% dividend yield over the next two years.

- Trading Dashboard: Add Don Agro International (DAG SP) at S$0.39 and Siverlake Axis (SILV SP) at S$0.26. Remove Uni-Asia Group (UAG SP) at S$0.99 and Jiutian Chemical (JIUC SP) at S$0.085.

Hong Kong

- Metallurgical Corp of China Ltd (1618 HK). Both A-shares and H-shares closed at a 52-week high. Guotai Junan Securities had previously released a report, stating that investors have likely neglected its diversification strategy and hence, its share price has not factored in the contribution from the photovoltaic, wind, and waste power businesses. Total value of new contracts signed in 1H21 grew by 32% YoY to RMB615.1bn.

- Linklogis Inc (9959 HK). Shares recovered from a 52-week low after the company announced to utilize the share repurchase mandate and, subject to market conditions, repurchase shares in the open market and to use up to US$100 million in funds for the repurchase of shares. Total number of shares to be repurchased will not exceed 10% of the total shares issued. Citic Capital increased its holdings with another 5mn shares purchased on 22th July.

- Kuaishou Technology (1024 HK). Shares closed at a 52-week low as the Cyberspace Administration of China ordered social media platforms to remove offending accounts and pay an unspecified amount in fines.

- HengTen Networks Group Ltd (136 HK) Shares closed at a 52-week low. The Cyberspace Administration of China ordered social media platforms to remove offending accounts and pay an unspecified amount in fines. Investors are now concerned that the ongoing tech clampdown which started with Alibaba and Tencent may start to spread next to the video platforms.

- New Oriental Education & Technology Group Inc (9901 HK) Shares plunged to a 52-week low and recorded the biggest drop in a single trading day. China is considering asking companies that offer tutoring on the school curriculum to go non-profit. In rules currently being mulled, the platforms will likely no longer be allowed to raise capital or go public. Listed firms will also probably no longer be allowed to invest in or acquire education firms teaching school subjects while foreign capital will also be barred from the sector.

- Trading Dashboard: MMG Limited (1208 HK) was added at HK$3.78.

Trading Dashboard

Related Posts: