26 April 2023: TheHourGlass (HG SP), Yankuang Energy Group Co Ltd (1171 HK), Microsoft Corporation (MSFT US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

TheHourGlass (HG SP): The clock is ticking

- RE-ITERATE BUY Entry 2.20 – Target – 2.40 Stop Loss – 2.10

- The Hour Glass Limited retails and wholesales watches, jewelry and related products through its subsidiaries. The Company also manufactures watches and invests in properties. Having established itself in Singapore as a premier watch boutique, the Group expanded worldwide. The Group holds exclusive agency and distribution rights to Gerald Genta, Breguet, Daniel Roth, Bertolucci, Burberrys, Christian Dior, Revue Thommen, Hublot and Montega.

- Revival of Daniel Roth. Daniel Roth, a Swiss watch brand owned by LVMH, is set to make a comeback as an independent company, with its first new model scheduled to be released in 2023. However, those interested in purchasing the brand’s watches will have to go through The Hour Glass, as they hold exclusive distribution rights.

- Post-Covid boom. Last year, there were about 6.3 million visitors arriving in Singapore, a YoY increase of 1,810.5%. China lifted its overseas travelling restrictions in early January 2023, and Singapore is expected to see a spike in Chinese tourist influx this year. In January 2023, there were 931,500 visitors (up 1,529.3% YoY) in Singapore. According to a recent market survey from travel agents in China, Southeast Asian countries are among the top cross-border travelling preferences after a three-year lockdown.

- Luxury spending. Despite the challenging economic climate characterized by surging inflation, rising interest rates, and the looming possibility of recession, the demand for luxury goods has remained steady. This demand is largely driven by affluent individuals who have benefited from the recent wealth accumulation and the savings accrued during the Covid lockdown periods. Additionally, the return of Chinese shoppers – the primary source of profits for luxury companies before the pandemic – is expected to bolster the industry, with Chinese consumers saving one-third of their income and depositing 17.8 trillion yuan (US$2.6 trillion) into banks last year.

- Retail sales. Singapore’s retail industry, and other service sectors, are expected to reap the rewards of the ongoing revival of leisure and business air travel, as well as China’s decision to reopen its borders. Data from Singapore Tourism Board shows approximately 49% of tourists receipts from Mainland China in 2019 (pre-pandemic) were from shopping. According to the department of statistics Singapore, retail sales on watches and jewellery increased by 13.1% YoY in December 2022 and 10.8% MoM. In 1H23, it expects retail trade to improve by 8% and operating revenue to increase by 2% in the first quarter.

- 1H23 results review. Revenue rose 18% YoY for the six months ended Sept 30 to S$555.5mn from S$472.4mn. Net profit jumped 35% YoY from S$62.6mn to S$84.6mn, despite higher operating costs.

- Market consensus.

(Source: Bloomberg)

SIA Engineering Co Ltd (SIE SP): Continuous service

- RE-ITERATE BUY Entry 2.27 – Target – 2.40 Stop Loss – 2.21

- SIA Engineering Co Ltd provides airframe and component overhaul services, line maintenance and technical ground handling services. The Company also manufactures aircraft cabin equipment, refurbishes aircraft galleys, repairs and overhauls hydromechanical aircraft equipment.

- S$1.14bn agreement. SIA Engineering announced on March 29th its new service agreement with Singapore Airlines, which replaces the previous agreement signed in April 2019. The new agreement, effective from April 1st, 2023, has a two-year term and an option to extend for an additional year. With this new agreement, SIA Engineering is expected to generate S$1.14 billion in revenue over the three-year term.

- Recovery in flight traffic. Based on recent data from the Singapore Tourism Board (STB), Singapore’s international visitor arrivals in February reached a new record high of 957,605 since the pandemic began. However, it is worth noting that these figures still fall below the pre-pandemic levels of 1.7 million visitors recorded in January 2020. With projected international visitor arrivals to Singapore ranging from 12mn to 14mn in 2023 and full tourism recovery expected by 2024, flight activities will continue to recover alongside the increasing tourism demand.

Visitor Arrivals by Air Travel trend

(Source: Singapore Tourism Analytics Network)

- Development of new talents. Through signing the Memorandum of Understanding (MOU), SIA Engineering Company (SIAEC) will collaborate with seven Institutes of Higher Learning (IHLs) to curate training curricula for industry-relevant skills, provide structured internships and industry attachments, increase employment placement opportunities, and engage in interdisciplinary projects and research with IHL students and academic staff. This partnership is an extension of SIAEC’s existing programs to support lifelong learning and ensure a continuous talent pipeline.

- 3Q22 results review. Revenue rose 48.6% YoY to S$208.1mn. Net profit declined by 61.4% YoY to S$12.8mn from S$33.2mn in 3Q21.

- Market consensus.

(Source: Bloomberg)

Yankuang Energy Group Co Ltd (1171 HK): Increase in factory activities

- BUY Entry – 26.2 Target – 29.2 Stop Loss – 24.7

- Yankuang Energy Group Co Ltd is a China-based international comprehensive energy company engaged in coal and coal chemical industry. The Company operates in five segments. The Coal Mining segment is engaged in underground and open-cut mining, preparation and sale of coal and potash mineral exploration. The Smart Logistics segment provides railway transportation services. The Electricity and Heating Supply segment provides electricity and related heat supply services. The Equipment Manufacturing segment is engaged in the manufacture of comprehensive coal mining and excavating equipment. The Chemical Products segment is engaged in the production and sale of chemical products. The coal products mainly include thermal coal, pulverized coal injection (PCI), and coking coal. The coal chemical products mainly include methanol, ethylene glycol, acetic acid, ethyl acetate and crude liquid wax, among others. The Company distributes products in the domestic market and to overseas markets.

- High demand for Coal in China. China’s coal imports have almost doubled in the first quarter of this year as its manufacturing sector got back into full swing following th pandemic. China’s consumption of coal is expected to pick up following the reopening of its economy from strict zero-COVID measures, supporting its activities such as railway maintenance, as well as to cater to the Electric Vehicle boom within China.

- Smart Mining Technologies to boost Coal production. China has called on coal-producing regions and enterprises to accelerate adoption of so-called ‘smart-mining’ technologies, replacingt human labour with unmanned mining vehicles controlled remotely from above-ground data centres. China has installed the technology at more than 1,000 working coal faces as part of this initiative, representing more than 620 million tonnes of annual coal production capacity.

- FY22 estimated earnings. The company expects to realise a net profit attributable to the shareholders of about RMB30,800 mn, an increase of about RMB14,500 mn or approximately 89% YoY, from RMB16,259 mn in FY21.

- Market Consensus

(Source: Bloomberg)

China Traditional Chinese Medicine Holdings Co. Ltd (570 HK): Health is Wealth

- RE-ITERATE BUY Entry – 4.30 Target – 4.70 Stop Loss – 4.10

- China Traditional Chinese Medicine Holdings Co. Limited is principally engaged in the manufacture and sales of traditional Chinese medicine (TCM) through its 12 subsidiaries.

- Reformed Healthcare insurance systems. Local governments recently announced reforming China’s healthcare system to improve the use of medical funds and help vulnerable populations like the elderly and those with chronic diseases, which is managed by the China authorities. The demand for and expenses associated with outpatient services are increasing as society develops. More individuals paying out of their pocket for common illnesses would be able to make use to these funds for treatment, hence increasing the demand for healthcare in China.

- Better medical and health systems. Chinese authorities has recently issued a set of guidelines to promote the sound development of the medical and health system in the country’s rural areas. The guideline highlighted the application of smart and digitalized technologies and the use of traditional Chinese medicine to allow residents to enjoy access to fairer and more systematical medical services in their vicinity.

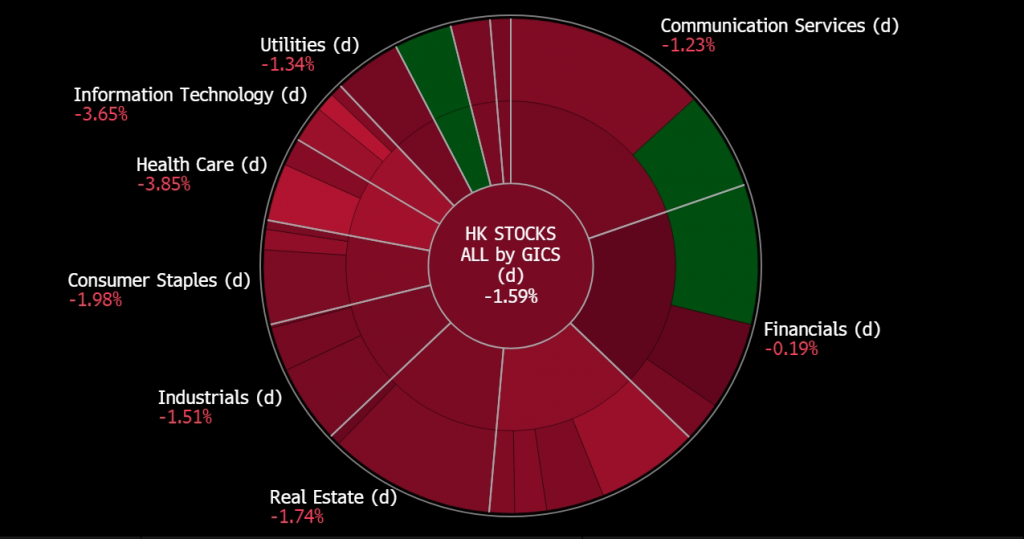

- A defensive stock amidst a market downturn. The Hong Kong market has been hammered by both a slowdown in China’s economic recovery and banking crisis. Growth, value, and cyclical sectors, as well as other thematic stocks, have been sold off indiscriminately. However, this stock is relatively outperforming the rest as its business is largely immune to inflation and systemic risks. The business driver is the sales volume rather than profit margins.

- 1H22 earnings. Revenue rose by 41.9% YoY to RMB431.18mn. Gross profit increased by 108.2% YoY to RMB27.41mn. GPM was at 6.4% for 1H22 compared to 4.3% for 1H21.

- Market consensus.

(Source: Bloomberg)

Microsoft Corporation (MSFT US): Revolutionary singularity

- RE-ITERATE BUY Entry – 275 Target – 295 Stop Loss – 265

- Microsoft Corporation develops, licenses, and supports software, services, devices, and solutions worldwide. The company operates in three segments: Productivity and Business Processes, Intelligent Cloud, and More Personal Computing.

- GPT-4 is the game changer. Recently, the current most popular artificial intelligence application ChatGPT had another significant upgrade from previous 3.5 to 4.0. GPT-4 is “multimodal”, meaning that it can generate content from both image and text prompts. GPT-3.5 is limited to about 3,000-word responses, while GPT-4 can generate responses of more than 25,000 words. GPT-4 can also understand and talke about pictures. According the GPT-4 Technical Report, GPT-4 is even able to score a 5 on several AP exams and ace a “simulated” bar exam, scoring among the top 10% of test takers on the exam. Microsoft had integrated ChatGPT to Bing chat and Azure previously. From text to images, ChatGPT’s evolution is exponential, and soon it probably can process video prompts.

- Banks’ losses could be good for the technology sector’s gains. The recent sell-off in the equity market, especially the finance sector, not only eased previous bigger rate hike expectations in the next week’s FOMC meeting but also bring forward the beginning of the rate cut cycle to 3Q23. Rate cut expectations are good for the technology sector.

Fed fund rate expectations

(Source: Bloomberg)

- 2Q23 earnings review. Revenue slight grew by 1.9% YoY to US$52.7bn, missing estimates by US$450mn. Non-GAAP EPS arrived at US$2.32, beating estimates by US$0.01. The company expected double-digit growth in revenue this year.

- Market Consensus

(Source: Bloomberg)

Uber Technologies, Inc. (UBER US): Year of turnaround

- RE-ITERATE BUY Entry – 30.8 Target – 34.8 Stop Loss –28.8

- Uber Technologies, Inc. develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and Asia excluding China and Southeast Asia. It operates through three segments: Mobility, Delivery, and Freight.

- Mobility business expansion. The company recently announced that it would make electric and common bicycles on its app in Latin America together with the Brazilian bike-sharing company Tembici. By the end of 2023, Uber expects 30,000 bicycles to run in Latin America, one-third out of which is electric.

- Ongoing restructuring. Previously, Uber was reported to consider a spin-off of its Freight logistics arm. Listing the freight business is more likely instead of selling to peers. On the other hand, the company also planned to remove 5,000 virtual brands from its Uber Eats delivery. According to the main press, these virtual brands are delivery businesses that do not have physical locations, make up more than 8% of Uber Eats’ storefront in the US and Canada, but less than 2% of bookings.

- Ready for recession. The abovementioned actions show that the company is preparing for the upcoming recession. Both bicycle-sharing development and the potential spin-off can be viewed as a way to reserve capital, and the removal of virtual brands is to optimise operating costs.

- 4Q22 earnings beat estimates. 4Q22 revenue jumped by 48.8% YoY to US$8.6bn, beating estimates by US$90mn. 4Q22 GAAP EPS was US$0.45, beating estimates by US$0.29. Gross Bookings grew by 19%YoY and 26% YoY (constant currency basis). The company guided 1Q23 Gross Bookings to grow by 20%-24% YoY on a constant currency basis.

- Market Consensus

(Source: Bloomberg)

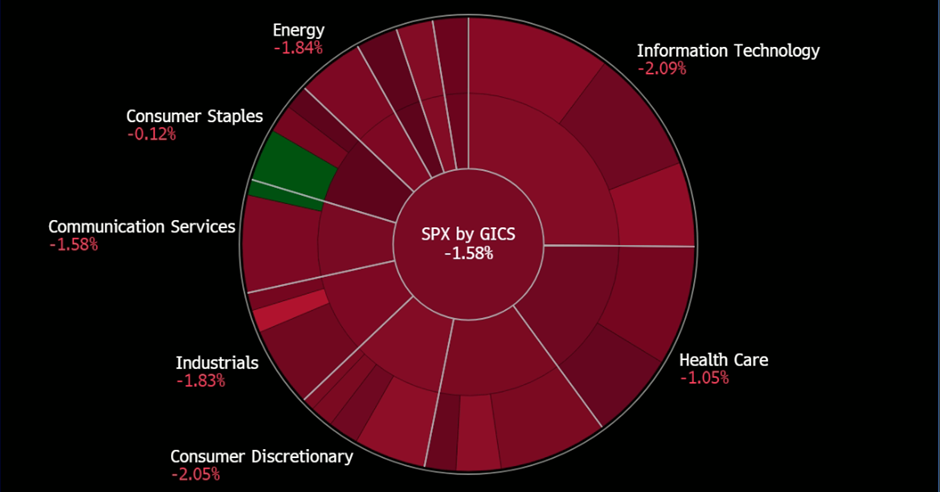

United States

Hong Kong

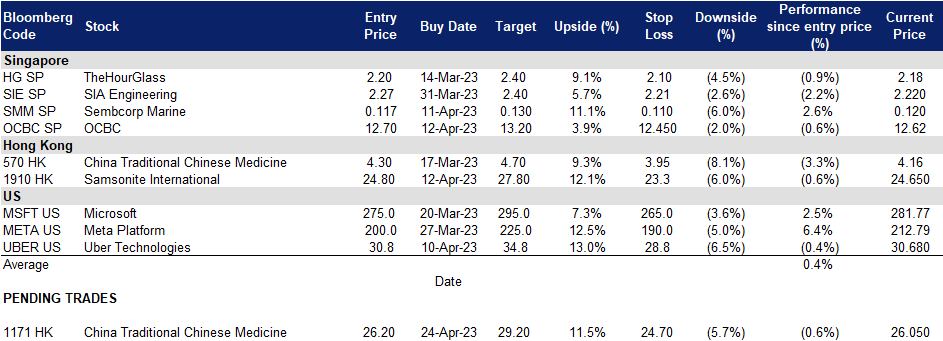

Trading Dashboard Update: No stock additions/deletions.