24 Dec 2021: Tianjin Zhongxin (TIAN SP), China Hongqiao Group Ltd (1378 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

Tianjin Zhongxin (TIAN SP): Left behind by the other half

- BUY Entry – 1.11 Target – 1.32 Stop Loss – 1.02

- TIAN’s businesses cover a wide range of products including Chinese patent medicine, Chinese medicinal drinks, Chinese medicinal raw materials, biotechnology medicine, chemical raw material medicine and preparations, and nutritional and health products. It has over 800 medicinal products in over 20 types of formulations.

- Left behind by its A-share counterpart. TIAN is dual-listed in China and Singapore. Shares of TIAN, having gained less than 5% in December, are currently lagging the 20% MTD rally of its A-share listed shares (600329). While the spread between the two widened over the past year, it contracted in the third quarter but began widening again in December. We think this is an excellent arbitrage opportunity.

- Analyst estimates. Both the A-share and SGX-listed shares are not well covered despite the US$2.9bn market cap of its Shanghai listed shares (as of 23 Dec), with only one buy rating and a TP of RMB50. Hence we may need to take forecasts with a huge dose of salt and apply a 30% discount. Even then, given a 30% discount to estimates, we still arrive at a 12M TP of RMB35, implying a 18% potential upside from the last close price.

Spread between the Shanghai listed shares and the Singapore listed shares have once again widened in December

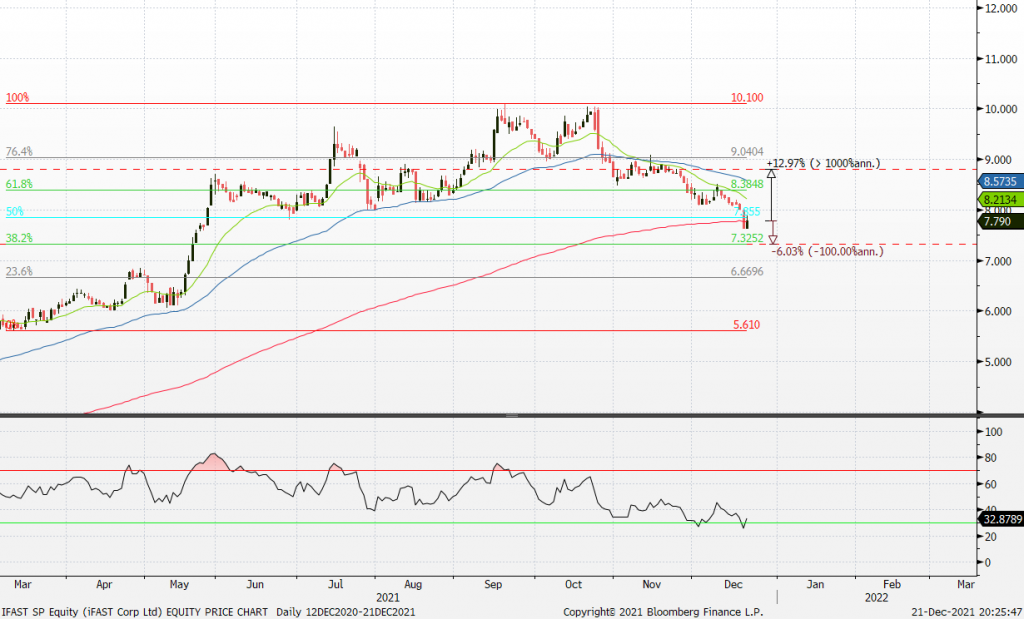

iFast Corp (IFAST SP): S$100bn by 2028

- REITERATE BUY Entry – 7.91 Target – 8.80 Stop Loss – 7.50

- iFast provides investment solutions to financial advisers, financial institutions, insurance companies, pension fund managers, retail and accredited investors, and multinational companies. The company’s investment platform offers a wide selection of investment products from many different product manufacturers into one consolidated portfolio.

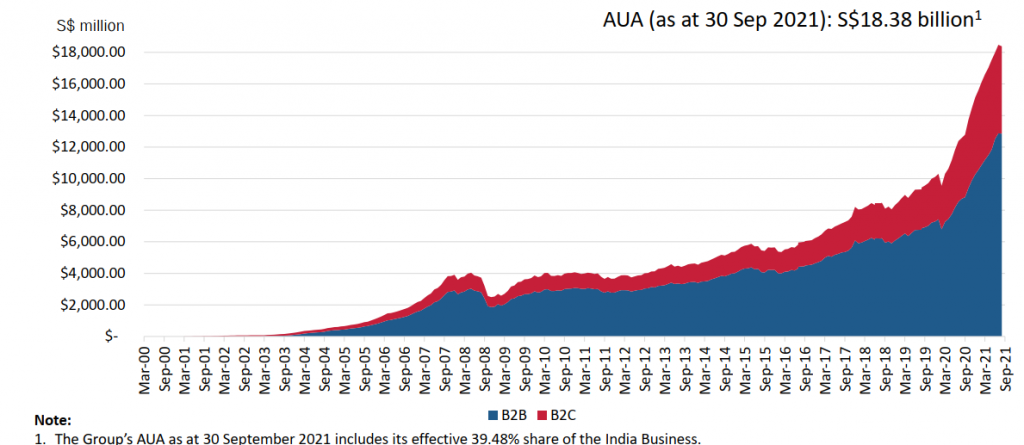

- Growing assets under administration (AUA). iFast’s AUA continued to register new record levels, reaching S$18.4bn as at 30 September 2021, a growth of 46% YoY and 27% year-to-date. The AUA of unit trusts, its key investment asset class, grew to a record S$13.5bn, a growth of 40% YoY and 24% year-to-date.

- Big hairy audacious goal. The group has set an AUA target of S$100bn by 2028 as it accelerates growth in HK, pursues more financial licenses in different jurisdictions, and makes more progress towards being a top Fintech wealth management player with a global business model. Reaching the S$100bn AUA target would imply a 27% CAGR from its current AUA of S$18.4bn.

- Positive consensus view. There are 4 BUYS / 1 HOLD / 1 SELL and a 12m average target price of S$10.32, implying a 33% upside potential from last close. EPS is forecasted to grow 54% YoY in FY21 and 25% YoY in FY22, bringing down forward P/Es to 65x and 52x.

iFast’s Assets under Administration growth has exploded since the pandemic began

HONG KONG

China Hongqiao Group Ltd (1378 HK): Joining the aluminium rally

- Buy Entry –8.15 Target – 9.64 Stop Loss – 7.29

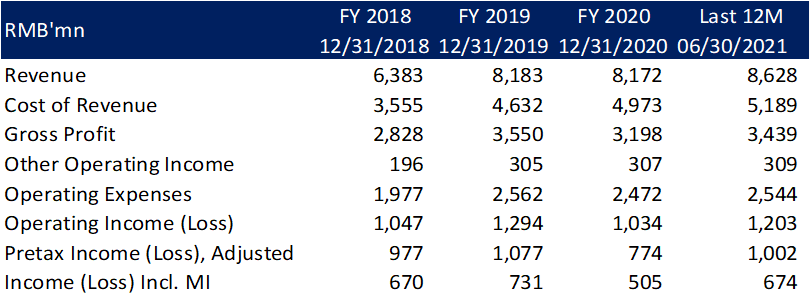

- China Hongqiao Group Limited, an investment holding company, manufactures and sells aluminium products in the People’s Republic of China and Indonesia. The company’s products include molten aluminium alloys, aluminium alloy ingots, aluminium busbars, and aluminium alloy processing products. It also engages in the research, development, and trading of bauxite; production and sale of electricity; and provision of financial leasing services.

- Strength in aluminium prices. Aluminium futures remained close to $2,700 per tonne in the third week of December, after reaching a 7-week high at $2,724 in the previous week on worries over tight supplies. Several Chinese regions have cut energy-intensive aluminium production this year in the face of pressure to reduce power consumption to meet climate goals and ease electricity shortages. However, China’s aluminium output 35.45mn tonnes in the period from January to November was up 5.7% on the year, on course for an annual record.

Generic 1st Primary Aluminium (LA1 Comdty)

- Outstanding 1H21 results. 1H21 revenue increased approximately 31.4% YoY to RMB 52,480,549,000, while profit increased approximately 200.4% to RMB8,423,717,000. The Board also declared an interim dividend for 2021 of HK45.0 cents per share, compared to the six months ended 30 June 2020 of HK15.0 cents.

- Positive consensus estimates. According to Bloomberg consensus estimates, China Hongqiao has ratings of 11 BUYS, 1 HOLD and 0 SELL, with a 12M target price of HK$13.51, representing an upside of 59.3% as of yesterday’s closing price.

Xtep International Holdings Ltd (1368 HK): In time for the winter olympics

- REITERATE Buy Entry – 11.28 Target – 14.41 Stop Loss – 9.76

- Xtep International Holdings Limited engages in the design, development, manufacture, sale, and marketing and brand management of sports footwear, apparel, and accessories. The company sells its products primarily under the XTEP brand, as well as Palladium, K-Swiss, Saucony, and Merrell brand names. It is also involved in the trading of sportswear products.

- Strong 1H21 financials. Xtep’s revenue rose 12% YoY to RMB 4.1bn in 1H21 and net profit grew by 72% YoY to RMB 427mn. Management also announced a very robust target of RMB 20 bn/RMB 4bn Xtep sales/new brands sales by FY25E, implying a 23%/30% sales CAGR during FY20-25E. Growth drivers include further expansion into T1 & T2 cities, aided by the launch of XDNA (a high-end product series that will start to have new stores in 2H21) and accelerated growth from lifestyle products.

- Catalyst: Winter olympics. The 2022 Winter Olympics, an upcoming international winter multi-sport event, is scheduled to take place from 4 to 20 February 2022 in Beijing and towns in the neighbouring Hebei province in the People’s Republic of China. Historically, prior to the international event, share prices of companies involved in sporting goods enjoyed a price rally. The chart below shows the price rally of Xtep, which began in early-mid December 2017 just before the PyeongChang 2018 Olympic Winter Games held between 9 and 25 February 2018.

- Positive consensus estimates. According to Bloomberg consensus estimates, Xtep has ratings of 26 BUYS, 0 HOLD and 2 SELL, with a 12M target price of HK$14.85, representing an upside of 21.9% as of yesterday’s closing price.

- Technical analysis. 20dMA has crossed the 60dMA and we recommend to long at the 20dMA, which is also around the previous resistance level. Shares are strongly supported at the 200dMA and RSI is on a gradual uptrend.

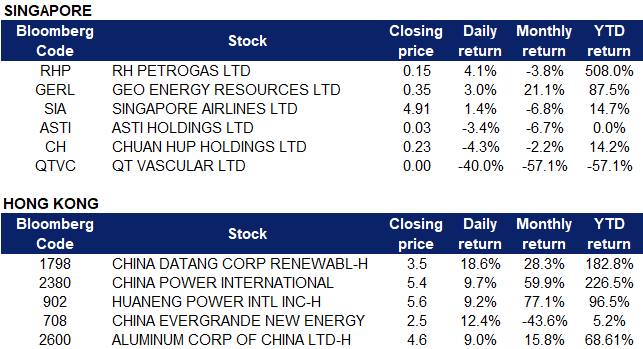

Market Movers

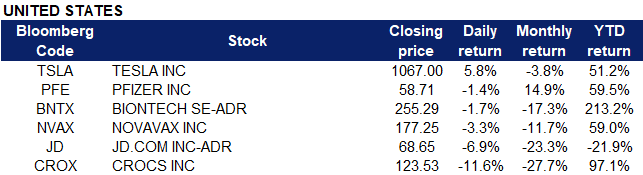

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Motor Vehicles | +3.5% | 5 Electric Vehicle Companies To Watch In 2022 |

| Aluminum | +2.6% | Shanghai zinc, aluminium prices jump over 2% on supply concerns |

| Semiconductors | +0.7% | Micron sees AI, 5G and EV drive memory demand growth |

Top Sector Losers

| Sector | Loss | Related News |

| Coal | -1.6% | Coal’s rebound is unlikely to extend to 2022, EIA says |

| Steel | -0.7% | China iron ore, steel prices fall on COVID-19, demand concerns |

| Homebuilding | -0.3% | NA |

- JD.com (JD US) declined 8% in premarket trading before closing 6.9% lower on news that Tencent would distribute most of its stake in the company to shareholders in the form of a $16.4 billion dividend.

- Tesla (TSLA US) shares extended its gains yesterday, jumping another 5.8% after Elon Musk said on a podcast interview that he has sold all that he intends to for now. Musk has sold 13.5 million Tesla shares to date, adding that he’s close enough to his goal to selling 10% of his shares

- Crocs (CROX US) shares plummeted 11.6% after the footwear brand said that it would buy Heydude, a privately-owned casual footwear brand, for $2.5 billion in cash and stock. The deal is expected to close in the first quarter of 2022.

- Novavax (NVAX US) shares declined 3.3% despite reporting positive results from studies evaluating its COVID-19 vaccine against the omicron variant. Increasing concerns about the omicron variant have put a strain on COVID-19 vaccine stocks recently, with Pfizer (PFE US) and BioNTech (BNTX US) shares sliding 1.4% and 1.7% respectively yesterday

Singapore

- Singapore Airlines (SIA SP) shares recovered yesterday, closing 1.5% higher. The Singapore government previously said that it was freezing ticket sales for Vaccinated Travel Lane (VTL) flights and buses into the country to reduce the country’s exposure to imported Omicron cases. Shares were heavily traded on Wednesday after the announcement.

- Asti Holdings (ASTI SP). Shares of the semiconductor manufacturer lost 3.5% yesterday after it announced that it will be retrenching its CEO Michael Loh to ensure the group’s survival. ASTI says that the group has been negatively impacted by the on-going geo-political tensions between China and US and the global pandemic, which in turn has devastated the global economy and have adversely affected global supply chains.

- QT Vascular (QTVC SP) shares plunged another 20% yesterday, amidst its ongoing boardroom tussle. The company said that its requisitioning shareholders have dropped the attempt to call for a third extraordinary general meeting to appoint new directors.

- Chuan Hup (CH SP) shares lost 4.3% yesterday. The company announced that its subsidiary Ventrade Australia will enter into a joint venture to acquire a 964 square metre land site located in Queensland for A$7.6 million, and develop it. Ventrade will hold a 50% stake in the JV.

- Energy stocks RH Petrogas (RHP SP) and Geo Energy Group (GERL SP) rebounded yesterday from a sharp drop on Monday, gaining 4.1% and 3% respectively. Oil prices previously settled at the highest level on Wednesday in nearly a month. WTI futures settled above $72 for the first time in two weeks.

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Alternative Energy | +5.47% | Energy Insider: China Expands Clean Power Generating Capacity |

| Electricity Supply | +4.97% | Energy Insider: China Expands Clean Power Generating Capacity |

| Nonferrous Metal | +3.09% | Shanghai zinc, aluminium prices jump over 2% on supply concerns |

Top Sector Losers

| Sector | Loss | Related News |

| E-commerce and Internet Services | -0.65% | China shines regulatory spotlight on livestream retail boom as crackdown claims biggest star |

| System Applications and IT Consulting | -0.60% | China regulator suspends cyber security deal with Alibaba Cloud |

| Securities | -0.51% | N/A |

- China Datang Corp Renewable Power Co Ltd (1798 HK), China Power International Dev Ltd (2380 HK), Huaneng Power International Inc (902 HK). Power sector shares rose collectively yesterday. Shares rose 18.6%, 9.7% and 9.2% respectively. Soochow Securities stated that the new power system brings structural opportunities. During the “14th Five-Year Plan” period, the total investments in power grids are expected to increase steadily. Power grid investments would focus on grid construction, distribution network intelligence, digitization and pumped storage, which will bring new opportunities. The space for growth in the context of wind power carbon neutrality opens up. Everbright Securities also released a research report stating that under China’s “Dual-Control” policy, coupled with technological progress, the cost of new energy power generation continues to fall, resulting in increased cost advantage, thereby accelerating its replacement of traditional energy power generation.

- China Evergrande New Energy Vehicle Group Ltd (3333 HK) shares rose 12.4% yesterday. Chinese property giant Evergrande said on Wednesday it would “actively engage” with its creditors following its recent missed debt repayments. “In view of the risks the Group is currently facing, the Risk Management Committee of China Evergrande Group is utilising its extensive resources and will actively engage with the Group’s creditors,” Evergrande said in a statement on the Hong Kong stock exchange.

- Aluminum Corporation of China Ltd (2600 HK) shares rose 9% yesterday, in tandem with rising aluminium prices. Aluminium futures remained close to $2,700 per tonne in the third week of December, after reaching a 7-week high at $2,724 in the previous week on worries over tight supplies. Several Chinese regions have cut energy-intensive aluminium production this year in the face of pressure to reduce power consumption to meet climate goals and ease electricity shortages. However, China’s aluminium output 35.45mn tonnes in the period from January to November was up 5.7% on the year, on course for an annual record.

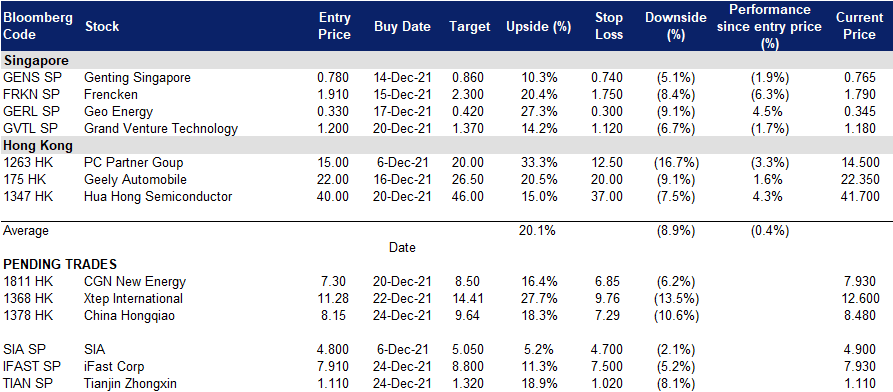

Trading Dashboard

(Click to enlarge image)

Related Posts: