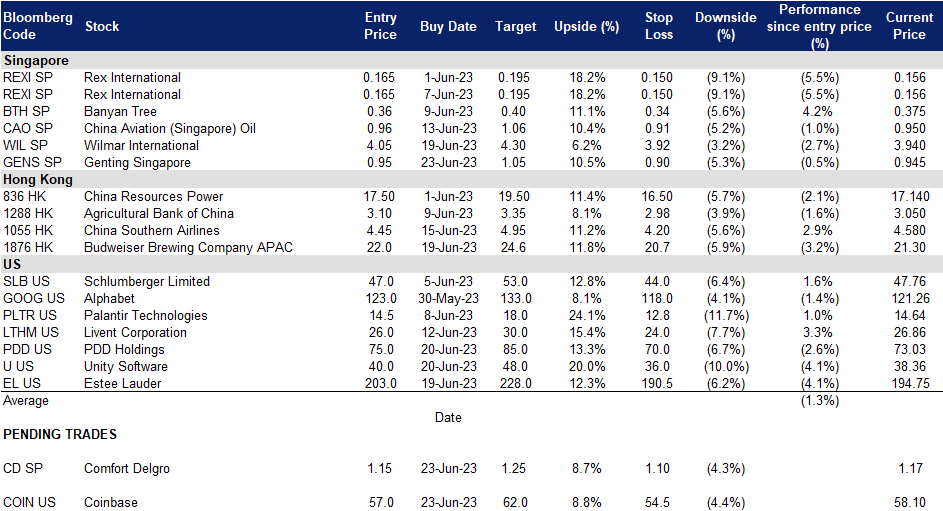

23 June 2023: ComfortDelgro (CD SP), China Southern Airlines Co. Ltd. (1055 HK), Coinbase Global Inc (COIN US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

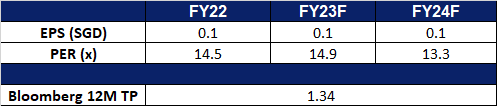

ComfortDelgro (CD SP): Peak Travel Season

- BUY Entry 1.15 – Target – 1.25 Stop Loss – 1.10

- ComfortDelGro Corporation Limited provides land transportation services. The Company offers bus, taxi, rail, car rental and leasing, automotive engineering services, inspection and testing services, driving center, insurance broking services, and outdoor advertising.

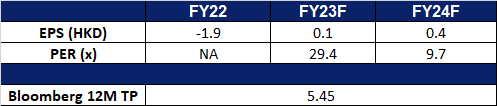

- Peak travel season drives demand for transportation. Longer waiting time were seen for taxis over peak travel season over the summer holidays. This boosted the demand for private transportation within Singapore, which was already recovering from the pandemic, as more employees return to the office. Supply of drivers has not been keeping up with the increase in demand for private transportation, as the supply of private drivers are only at around 80% of pre-pandemic levels, attributing to the long waiting time for ride-hailing passengers.

Comfort Delgro Seasonality Trend

(Source: Bloomberg)

Singapore Visitor Arrival Trend

(Source: Singapore Tourism Analytics Network)

(Source: Singapore Tourism Analytics Network)

- Platform fee to drive sales amidst higher demand. Comfort Delgro has recently made an announcement regarding their plans to implement a surcharge of 70 cents for taxi and private-hire car rides booked through their CDG Zig app starting from July 1, 2023. This platform fee has been introduced with the intention of further enhancing the quality of their point-to-point transport services. By implementing this additional fee, Comfort Delgro aims to leverage the increased demand for taxis during the peak travel period, ultimately boosting their sales.

- FY22 results review. Revenue rose by 7.94% YoY to S$3.708bn, compared to S$3.502bn in FY2021. Net profit rose by 40.7% YoY to S$173.1mn, compared to S$123.0mn in FY2021. EPS rose to 7.99 SG cents (+40.7% YoY) compared to 5.68 SG cents in FY2021.

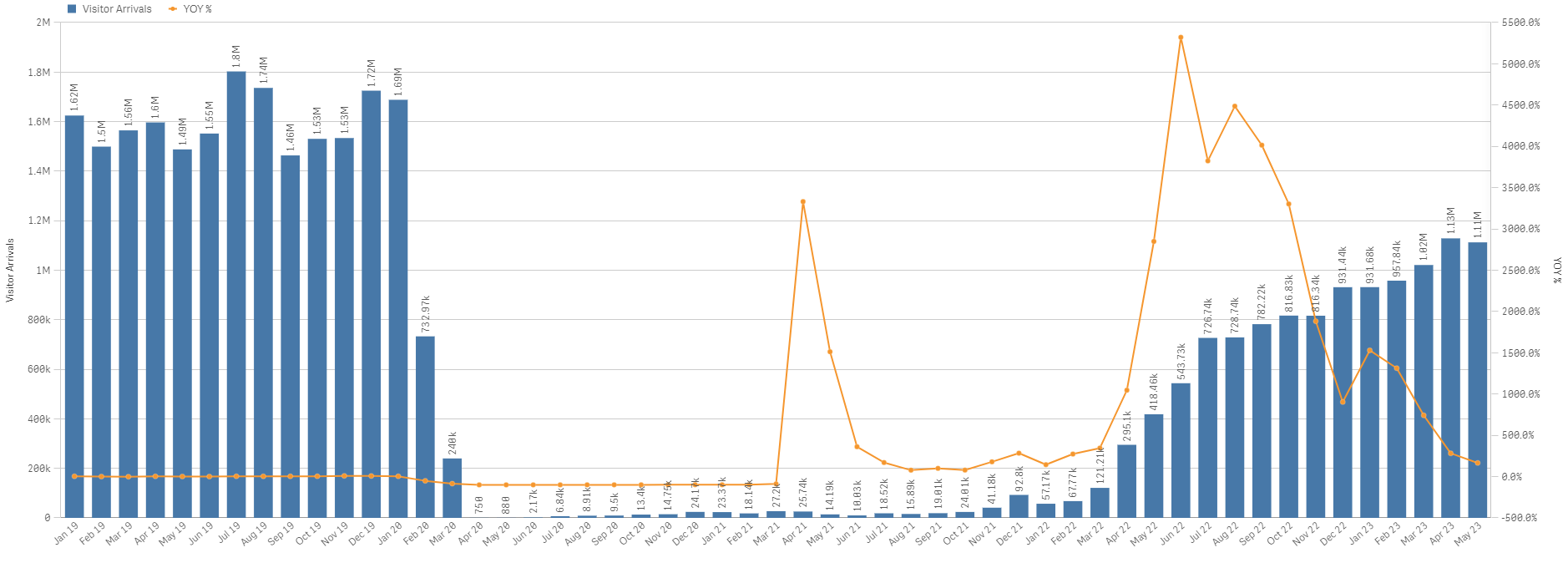

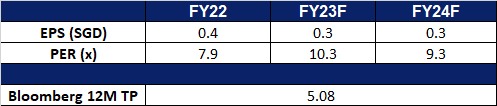

- Market consensus.

(Source: Bloomberg)

Wilmar International Ltd. (WIL SP): Sugar and palm oil prices rebounding

Wilmar International Ltd. (WIL SP): Sugar and palm oil prices rebounding

- RE-ITERATE BUY Entry 4.05 – Target – 4.30 Stop Loss – 3.92

- Wilmar International Limited operates as a food processing company. The Company offers oil palm cultivation, edible oil refining, crushing, and gains processing services, as well as provides sugar, flour, and rice. Wilmar International serves customers worldwide.

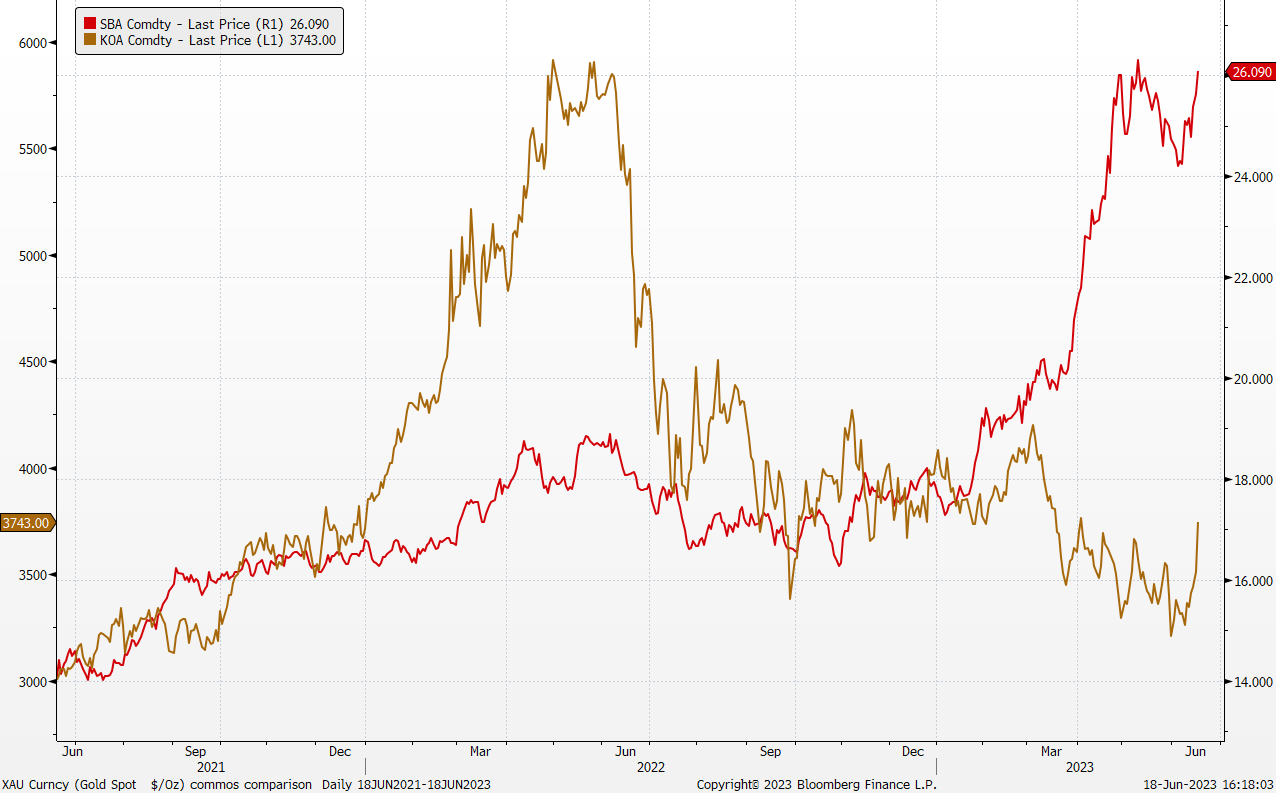

- Sugar futures prices rebounded. Raw sugar futures in the US rose above 25.4 US cents per pound, heading toward the 11-year high of 27 US cents touched on April 28th amid threats of lower supply. The Indian government stated that it will prohibit sugar exports until the second half of 2024 due to concerns that El Nino could reduce rainfall and lower yields. The world’s second-largest producer and exporter has already capped foreign sales in the current marketing year due to historic droughts in the Maharashtra region. In the meantime, gasoline taxes in Brazil continued to support the demand for biofuel alternatives, swaying cane producers to blend ethanol instead of crushing the sweetener, and effectively reducing sugar supply and availability for exports.

- Palm oil futures prices rebounded. Malaysian palm oil futures soared on Friday for a fourth day. The benchmark palm oil contract FCPOc3 closed at MYR3,743, setting it on course for an 11.17% weekly jump, as dry weather conditions curbed the prospects of palm and US soybean production.

Raw sugar (red) and crude palm oil (brown) futures price trend

(Source: Bloomberg)

(Source: Bloomberg)

- 1Q23 results review. Revenue dropped by 3.8% YoY to US$16.9bn. Net profit fell by 26.2% YoY to US$391.4mn. Food product sales volumes rose by 4.1% YoY to 7.2mn MT. Feed and Industrial Products sales volume jump by 15.2% YoY to 13.7mn MT.

- Market consensus.

(Source: Bloomberg)

(Source: Bloomberg)

China Southern Airlines Co. Ltd. (1055 HK): Incoming peak travelling season

- RE-ITERATE BUY Entry – 4.45 Target – 4.95 Stop Loss – 4.20

- China Southern Airlines Company Limited is principally engaged in the operation of civil aviation, including the provision of passenger, cargo, mail delivery and other extended transportation services. The Company operates through two business segments, including Airline Transportation segment and Other segment. Airline Transportation segment consist of passenger and cargo and mail operations. Other segment includes hotel and tour operation, ground services, cargo handling and other miscellaneous services. . The Company also provides services of general aviation and aircraft maintenance. The Company acts as an agency of domestic and foreign airlines, and other aviation and related business, such as personal accident insurance and agency business.

- More International flights. China Southern Airlines has recently unveiled a new flight route that connects Beijing and London. This development is part of the Chinese airlines’ ongoing efforts to expand their overseas routes in the wake of the pandemic. Operating seven times a week, the route departs from Beijing Daxing International Airport and arrives at London Heathrow Airport. It marks the first direct route operated by a Chinese airline between these two airports and offers a travel time of approximately 10 hours to reach London. This signifies the growing international travel demand worldwide, driven by China’s recovering economy and the gradual relaxation of post-pandemic restrictions.

- Peak travelling season. As the summer season approaches, many popular destinations in South East Asia and other parts of Asia such as Japan, anticipate a surge in tourist arrivals. Bookings in China for trips abroad have surge as China’s economy re-opens and consumers release their pent-up demand for travelling, presenting a increased in demand for international flights.

- 1Q23 earnings. The company saw a rise in Revenue to RMB34.06mn (+58.61% YoY), compared to RMB21.47mn in 1Q2022. Net Income rose 57.8% You to -RMB1.9bn. Basic EPS eased to -RMB0.1 compared to -RMB0.27 a year ago.

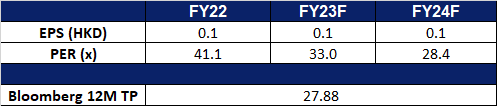

- Market Consensus.

(Source: Bloomberg)

Budweiser Brewing Company APAC Ltd. (1876 HK): A beer a day keeps the summer heat away

Budweiser Brewing Company APAC Ltd. (1876 HK): A beer a day keeps the summer heat away

- RE-ITERATE BUY Entry – 22.0 Target – 24.6 Stop Loss – 20.7

- Budweiser Brewing Company APAC Ltd is an investment holding company principally engaged in the brewing and distribution of beer. The Company produces, imports, markets, distributes and sells a portfolio of beer brands owned or licensed by the Company, including Budweiser, Stella Artois, Corona, Hoegaarden, Cass and Harbin. The Company also produces, markets, distributes and sells other non-beer beverages. The Company distributes its products primarily in China, South Korea, India, Vietnam and other Asia Pacific regions.

- Peak Travel Season. Anticipating the upcoming peak travel season during summer, the company foresees a surge in beer demand across Southeast Asia. As international travel restrictions are gradually lifted, more people will be able to travel, leading to increased demand for beer. Particularly, China is expected to experience significant growth in beer demand as pandemic-related restrictions are eased and travel demand returns to pre-pandemic levels. To capitalize on this trend, the company has already begun expanding its presence in various Chinese cities with its premium beer products. Following the country’s lifting of COVID-19 restrictions a few months ago, a rebound in demand has been observed. China has also witnessed a notable influx of tourists since reopening, and the resumption of shopping festivities further contributes to this trend. The recently held 6.18 shopping festival is expected to attract even more tourists to China, thus complementing the demand for beer. Taking these factors into account, Budweiser APAC, which encompasses over 50 brands and currently holds a 16%-17% share of China’s beer market, is well-positioned to benefit from the increased tourism levels.

- World Cup Sponsor Deal. Budweiser has recently made an announcement stating that it will continue to be the official beer of the FIFA World Cup, maintaining this prestigious partnership through the 2026 tournament set to take place in North America. This extension of Budweiser’s association with FIFA solidifies their ongoing relationship. As the FIFA World Cup stands as one of the most globally renowned sporting events, Budweiser is poised to reap the rewards of renewing its sponsorship with FIFA. The reported value of the sponsorship is estimated to be around US$75 million based on the previous World Cup Sponsorship deal, building on the success and visibility of Budweiser.

- 1Q23 earnings. The company revenue rose to US$1.7bn, +4.29% YoY compared to US$1.63bn 1Q22. The company’s net income fell slightly to US$297mn, -1.66% YoY, from US$302mn in 1Q22. Basic earning per share is US 2.27 cents.

- Market Consensus

(Source: Bloomberg)

Coinbase Global Inc (COIN US): Up, up and away

- BUY Entry – 57.0 Target – 62.0 Stop Loss – 54.5

- Coinbase Global, Inc. provides financial solutions. The Company offers platform to buy and sell cryptocurrencies.

- Bitcoin rallied to its highest level since April. Bitcoin experienced a three-day surge, driven by BlackRock’s recent filing for a bitcoin ETF and the launch of EDX Markets, a crypto exchange backed by Citadel Securities, Fidelity, and Schwab. Despite regulatory scrutiny, the global cryptocurrency industry remains optimistic. Bitcoin’s price rose by 5.5% to $29,881.00, with an 81% increase year-to-date. Traders are hopeful about institutional involvement, and Ether also saw a 4.8% increase. The market’s bullish sentiment is fueled by major institutions announcing spot Bitcoin ETF applications. Breaking key resistance levels could lead to further gains, with targets at $36,000 and potentially higher. The industry’s optimism is evident, with major players like BlackRock venturing into digital assets amid recent negative news and regulatory challenges.

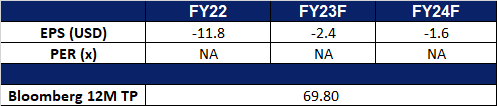

Bitcoin and Ethereum Price Chart

(Source: Bloomberg)

- More issuers joining the race. BlackRock filed paperwork with the SEC to establish the iShares Bitcoin Trust, a proposed ETF that aims to offer investors a simplified means of gaining exposure to Bitcoin’s investment potential without the complexities of direct ownership. Coinbase will serve as the custodian for the ETF’s Bitcoin holdings. The filing emphasizes the ETF’s objective to remove obstacles associated with direct Bitcoin investment while reflecting the trust’s Bitcoin holdings’ value. If approved, this ETF would be the first dedicated to Bitcoin on the market. This filing has sparked a flurry of similar applications from other issuers, such as WisdomTree, Invesco, Valkyrie and Citadel, indicating growing demand for regulated investment vehicles in the crypto space. However, the impact of the SEC’s stance on Bitcoin ETF approval remains uncertain.

- Repurchase of Convertible Senior Notes. Coinbase recently repurchased around $45.5mn in cash of its 0.50% Convertible Senior Notes due 2026, at a discounted rate of 29% below par value. These repurchases were carried out through private negotiations with specific note holders and aimed to deploy capital and benefit shareholders strategically. The move reflects Coinbase’s confidence in its business and improved competitive position while aligning with its focus on reducing debt and optimizing capital structure. The transaction left approximately $1.373bn of the notes outstanding. Despite regulatory challenges, Coinbase remains dedicated to navigating the cryptocurrency industry and prioritising long-term shareholder value through effective capital deployment strategies.

- 1Q23 earnings review. Revenue fell 33.4% YoY to $772.5mn, beating estimates by $119.2mn. GAAP earnings per share was -$0.34, $1.02 above expectations.

- Market consensus.

(Source: Bloomberg)

Estee Lauder Companies Inc (EL US): Rich and beautiful

Estee Lauder Companies Inc (EL US): Rich and beautiful

- RE-ITERATE BUY Entry – 203 Target – 228 Stop Loss – 190.5

- The Estee Lauder Companies Inc. manufactures and markets a wide range of skincare, makeup, fragrance, and hair care products. The Company’s products are sold in countries and territories around the world.

- Release of anti-ageing research. Estee Lauder announced its plan to unveil innovative clinical and preclinical results in the field of skin health and anti-ageing. The company will present these findings at the 25th World Congress of Dermatology in Singapore, in July, showcasing research from three brands in five separate presentations. The data will cover topics such as the effects of facial creams, the mechanobiology of the skin, the benefits of a targeted cosmetic serum, and the use of moisturisers. Estee Lauder will also host a symposium on sirtuins and longevity, exploring the relationship between sirtuins and their impact on skin. The company’s research reflects its commitment to scientific advancement and its focus on understanding the molecular pathways underlying inflammation and ageing.

- Rising beauty sales in China. China’s annual 6.18 shopping festival has provided a boost for beauty brands, with sales surging for both global giants and local Chinese brands. Major brands such as L’Oréal, Estée Lauder, Proya, Lancôme, and Dior experienced significant sales growth during the event, indicating a recovery for the country’s beauty industry after a pandemic-induced slump. Chinese consumers showed a willingness to spend again, with e-commerce playing a key role in the industry’s rebound. Domestic brands also performed well, leveraging their proximity to consumers and comprehensive marketing channels. Beauty device sales, high-tech skincare products, and new product launches were among the notable trends during the festival, highlighting the evolving preferences and shopping habits of Chinese consumers. Livestreams and interactive formats were utilised by beauty brands to engage customers and drive sales.

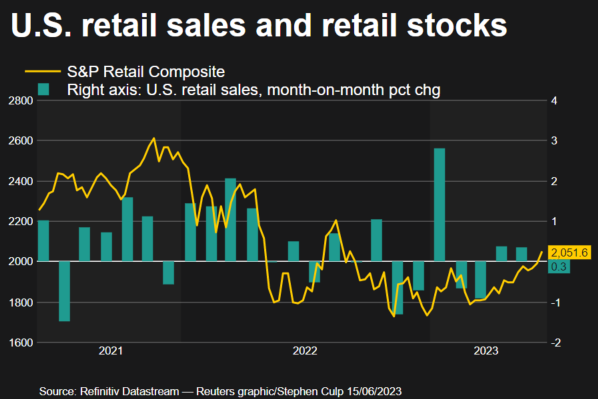

- Resilience in US retail sales. US retail sales in May surpassed expectations, rising by 0.3% and reflecting the strength of consumer spending, which accounts for more than two-thirds of the country’s economic activity. The strong growth in the first quarter offset the impact of inventory slowdowns. Factors contributing to the rise in retail sales include strong wage gains, easing inflation, and increased online sales. This positive trend supports the overall economic outlook and acts as a buffer against a recession. Despite concerns about higher interest rates, consumer demand remains robust, potentially leading to another rate hike. While there are signs of slower momentum in certain areas, the overall resilience of US retail sales indicates a positive outlook for the economy.

(Source: Reuters, Refinitiv)

- 3Q23 earnings review. Revenue fell 11.5% YoY to $3.76bn, beating estimates by $60mn. Non-GAAP earning per share was $0.47, $0.04 below expectations.

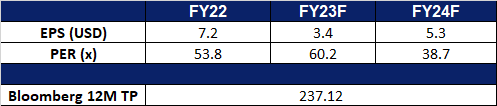

- Market consensus.

(Source: Bloomberg)

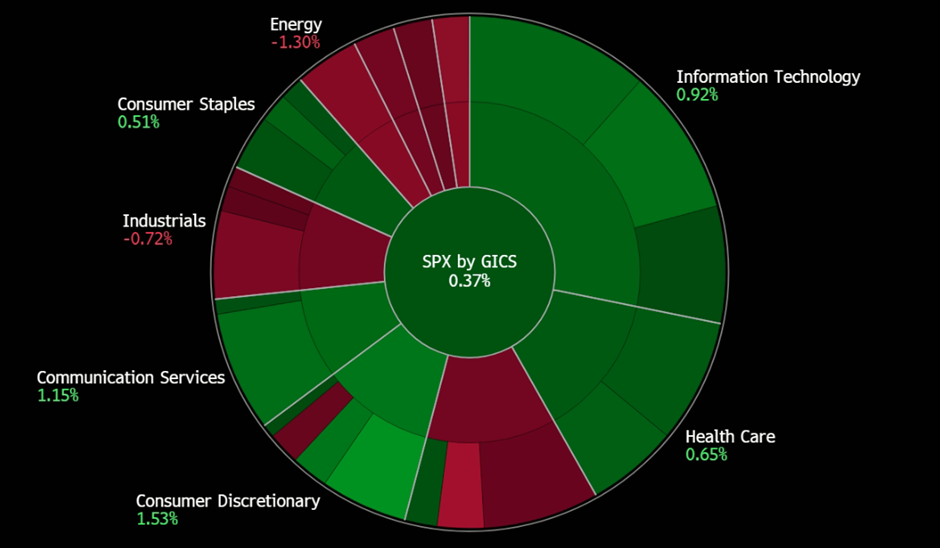

United States

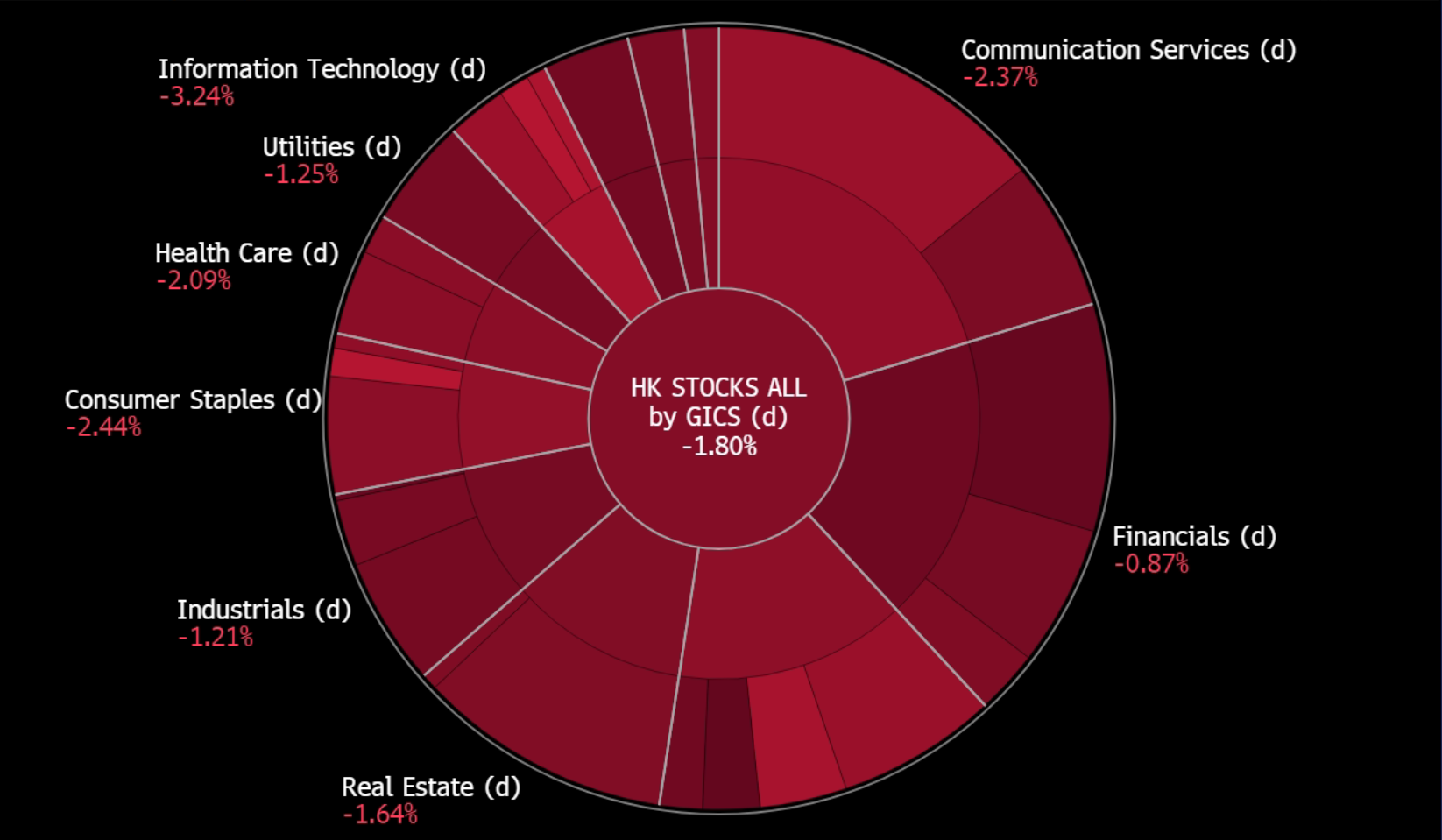

Hong Kong

Trading Dashboard Update: Add PDD Holdings (PDD US) at US$75.0, Unity Software (U US) at US$40.0, and Estee Lauder (EL US) at US$203.0. Cut loss on Kuaishou (1024 HK) at HK$56.6 and Tencent Holdings (700 HK) at HK$337.0.