KGI DAILY TRADING IDEAS – 23 July 2021

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

Don Agro International (DAG SP): Your source of bread and butter

- BUY Entry – 0.39 Target – 0.64 Stop Loss – 0.35

- Don Agro International (Don Agro) is one of the largest agricultural companies in Russia’s Rostov region. It has a stable track record of profitability over the last five years, with net income reaching a record in 2020.

- A bowl full of opportunities. Favourably located and well managed, Don Agro is in a sweet spot. Wheat demand, which is the key driver of the group, is forecasted to grow by almost 18% from 2019 to 2029, according to estimates by the US Department of Agriculture’s Foreign Agricultural Service (USDA FAS). Furthermore, wheat, as a staple food source, provides a resilient revenue stream for the group despite changing economic trends.

- Initiate with Outperform and TP of S$0.64. We initiate with Outperform and a TP of S$0.64 based on discounted cash flow, taking into account a WACC of 11.0% and terminal growth rate of 3.0%. Don Agro’s current valuations are attractive as it trades at only 6.0x FY2021F EPS. With a good track record and healthy outlook, Don Agro is well-positioned to ride on long-term global trends. Read our full report here.

Don Agro reported a record net profit of S$8.7mn in 2020, representing a 66% YoY increase and more than double its 2016-2017 net profit.

| S$’000 | 2016 | 2017 | 2018 | 2019 | 2020 |

| Revenue | 30,979 | 23,193 | 24,375 | 35,431 | 30,996 |

| Gross Profit | 5,913 | 6,747 | 9,062 | 8,589 | 14,626 |

| Net Profit | 4,203 | 4,096 | 6,388 | 5,223 | 8,696 |

Silverlake Axis (SILV SP): The future is digital

- BUY Entry – 0.26 Target – 0.30 Stop Loss – 0.24

- Silverlake Axis is a software company that provides banking solutions to banks in Asia. The company has been operating for more than 30 years. Of the top 20 largest banks in Southeast Asia, 40% of them use Silverlake’s core banking solutions.

- Parent’s new partner. Earlier this month, The Edge reported that private equity firm Ikhlas Capital is investing US$40mn in Silverlake Group, the holding company of the SGX-listed Silverlake Axis Ltd. Silverlake Group is the largest shareholder of Silverlake Axis. In turn, Ikhlas Capital is partly owned by former banker Datuk Seri Nazir Razak, and the firm is one of the partners of a conglomerate comprising other firms including AirAsia’s Group e-wallet unit Big Pay and Malaysian Industrial Development Finance (MIDF) vying for one of the five digital banking licenses to be awarded by the first quarter of 2022.

- New opportunities. Given Silverlake Axis’s experience and expertise in providing banking solutions over the past 30 years, combined with the recent news of investment by Ikhlas Capital into its parent company, we think that the award of one of the five digital banking licenses could provide a much-need catalyst to Silverlake’s share price. Silverlake’s share price is currently trading near its 8-year low, partly due to business slowdown over the years, and also due to a damaging short-seller report in 2015 which caused its market cap to almost halve in value.

10-year share price

HONG KONG

MMG Limited (1208 HK): Buy the breakout and turnaround in profitability

- Buy Entry – 3.78 Target – 4.53 Stop Loss – 3.44

- MMG Limited is an Australia-based investment holding company. MMG Limited and its subsidiaries are engaged in the exploration, development and mining of zinc, copper, gold, silver and lead deposits around the world. Its operations include the Las Bambas copper mine in Peru, Sepon copper mine in Laos, Kinsevere copper mine in the Democratic Republic of Congo, and the Rosebery polymetallic base metal mine and Dugald River zinc mine in Australia.

- The spike in share price and the breakout of the consolidation range was due to the positive profit guidance. Net profit after tax attributable to equity holders in 1H21 is expected to reach US$400 million, a significant reversal compared to the net loss after tax attributable to equity holders of US$158 million in 1H20.

- Major industrial metals (copper, steel, aluminium) prices dropped from the YTD peak in early May. The price correction coincided with the recent strengthening of the Dollar index. 10-Year US Treasury yield bottomed out from the recent low of 1.129%. Inflation concerns have been tapering. However, the supply chain disruption have not improved entirely. The recent decline of yields and uptrend of the Dollar index could reverse once the Delta variant concerns taper off. Therefore, commodity prices could see another round of bull run this summer.

- Updated market consensus of the EPS in FY21 and FY22 are HK$0.458 and HK$0.493 respectively, which translates to 8.4x and 7.8x forward PE. EPS in FY20 was -HK$0.06. Bloomberg consensus average 12-month target price is HK$5.61.

KWG Living Group Holdings Ltd (3913 HK): Fundamental intact but just a weak sentiment

- Reiterate Buy Entry – 8.15 Target – 10 Stop Loss – 7.50

- KWG Living Group Holdings Ltd is a holding company engaged in provision of property management services. The company operates two segments. The Residential Property Management Services segment provides pre-sale management services, property management services, community value-added services and public space value-added services. The Commercial Property Management and Operational Services segment provides pre-sale management services, commercial property management services, commercial operation services and other value-added services.

- Counter-inflation remains the main investment theme for investors this year, and property management services are viewed as an indirect hedge against rate hikes. The sector has positive investment attributes such as low capex, net cash positions, and stable dividend payout. All these are in line with the value sectors that investors are currently looking out for.

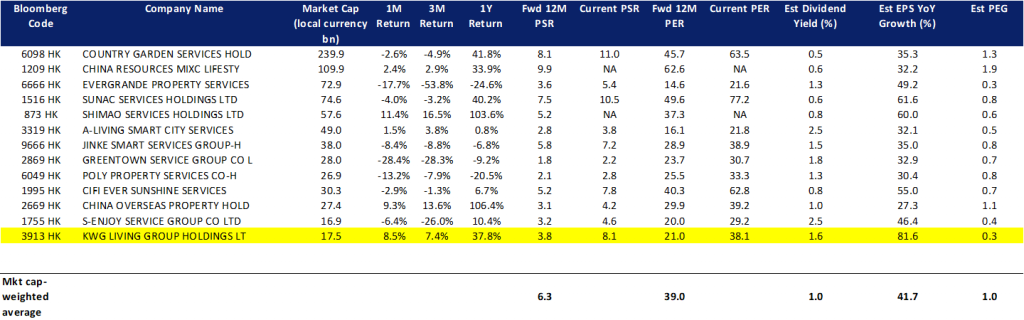

- The company has a relatively attractive valuation compared to peers in the property management sector. Its forward 12M PEG is the lowest among its peers, and the estimated dividend yield is decent compared to peers.

- Market consensus of net profit growth in FY21 and FY22 are 61.1% YoY and 43.7% YoY, which implies forward PERs of 21.0x and 13.0x. Current PER is 38.1x. Bloomberg consensus average 12-month target price is HK$12.48.

Market Movers

United States

- Domino’s Pizza (DPZ US). Shares of the pizza giant surged 14.6% to a record closing high of $538 following the release of its second-quarter results. Revenue rose 12% year-on-year to $1 billion as a result of new store openings and outstanding same-store sales growth. EPS climbed 4.3% to $3.12, while same-store sales rose 3.5% in the U.S. and 13.9% internationally.

- Snap (SNAP US) shares leapt more than 16% on Thursday after the social media company reported second-quarter results that beat analyst expectations. Adjusted EPS came in at $0.10 for the quarter, while analysts expected a $0.01 per share loss. Revenue surpassed analyst estimates, rising 116.2% YOY. Snap also reported 293 million daily active users, up nearly 5% from the 280 million the company reported in April 2021.

- Twitter (TWTR US) jumped more than 5% after hours. The company saw impressive results in its second-quarter financial results. Revenue rose 74% YOY, marking the company’s fastest growth since 2014. This was largely due to an 87% jump in advertising revenue. Daily active users came in at 206 million, up 7 million from three months ago.

- DiDi Global (DIDI US), the largest ride-sharing company on the planet, saw its share price plummet by more than 11% on Thursday. This could largely be attributed to a Bloomberg article published on Thursday morning. The article quoted sources saying Chinese regulators view DiDi’s decision to go public despite pushback from the Cyberspace Administration of China (CAC) as a challenge to Beijing’s authority, and are considering serious penalties for the company.

- Virgin Galactic (SPCE US) stock price was rapidly falling back to Earth, down more than 7% on Thursday. Mark Stucky (Virgin Galactic’s flight test director and pilot) announced his departure from Virgin Galactic for unspecified reasons on LinkedIn, commenting that he did not leave the company on amicable terms.

Singapore

- Abundance International Limited (ADI SP) Shares surged by 48% yesterday and closed at a 52-week high as the company announced a positive profit alert. The group is expected to be profitable in 1H21 as compared to the US$799K losses in 1H20. Performance for 1H21 was boosted by the group’s chemical trading business conducted under its subsidiary, Orient-Salt Chemicals Pte. Ltd., and its subsidiaries in China and Japan. In addition, there was a fair value gain from their investment of 3,610,108 shares in Jiangsu Sopo Chemical Co., Ltd. where issue price was RMB8.31 and last traded price was RMB15.34. Lastly, there was a significant reduction in non-cash interest expense on zero coupon bonds from US$573,000 for 1H20 to US$112,000 for 1H21, due to the maturation of coupon bonds on 31 Jan 21.

- Singapore Airlines Limited (SIA SP) Shares rose by 3.1% yesterday, rebounding from the 1 month technical support of S$4.78. Shares are trading range bound between S$4.78 and S$5.18 over the past month and may have a difficult time breaking out due to the ongoing restrictions on international travel. SIA saw an increase in passenger traffic but this will only lead to 33% of pre-Covid-19 levels by July. On a positive note, SIA Cargo registered a monthly cargo load factor (CLF) of 87.6%, which was 5.1 ppt higher YoY, as cargo traffic rose by 52.0% on the back of a capacity expansion of 43.3%. SATS, SIA’s catering arm, reported a positive 1Q21 earnings report yesterday which might have offered a glimmer of hope to investors that the worst is over and airline stocks might see a comeback soon.

- Keppel Corporation Limited (KEP SP) Shares rose by 2.9% and closed at a two week high yesterday, likely riding on the broad based rally in the market and oil prices. Consensus remains generally optimistic on Keppel Corp with 12 BUYS, 0 HOLD and 1 SELL rating, and a 12-month target price of S$6.40 (+20% upside potential).

- SATS Limited (SAT SP) Shares rose by 2.4% yesterday as the company announced positive 1Q21 earnings. SATS revenue grew 31.6% YoY as travel revenue rose 41.9%, while non travel related revenue increased by 22.6% YoY. Additionally, revenue from food solutions and gateway services rose by 8.4% and 77.4% respectively. Positive EBITDA was reported as well, with a turnaround of 197.1%. Overall, positive SATS results despite the ongoing pandemic might have given investors a boost in confidence that the worst is over and the company, or travel industry as a whole might see a comeback soon. This could have also resulted in a positive spillover for SIA shares.

- CapitaLand (CAPL SP) Shares are reacting positively to the company’s proposed restructuring, closing at its highest since 2013. CapitaLand shareholders are estimated to get an implied value of S$4.22 per share upon completion of the restructuring exercise, which we think may likely be by mid-September 2021. Each CapitaLand shareholder will get: a) shares in the newly listed asset management arm worth S$2.934 a share, b) a cash payout of S$0.951, and c) 0.155 units of its listed REIT business (CapitaLand Integrated Commercial Trust, or CICT). CapitaLand’s CEO and CFO will be presenting in a webinar tonight (7pm-8pm) to talk about the restructuring. Those keen to join may sign up here.

- Trading Dashboard: Add Riverstone (RSTON SP) at S$1.30. Remove ISDN (ISDN SP) at S$0.735

Hong Kong

- China Evergrande New Energy Vehicle Group Limited (708 HK) Shares jumped from a 52-week low. Evergrande Group (3333 HK) announced yesterday it had resolved a legal dispute with China Guangfa Bank over an overdue CNY132 million, or US$20.38 million, loan and that the two sides will deepen business cooperation. Meanwhile, EV maker Faraday Future (FFIE US) said shareholders approved its merger with blank-check company Property Solutions Acquisition Corp (PSAC US). The stock is expected to trade on the Nasdaq on Wednesday. Evergrande New Energy Vehicle Group holds a 20% stake in Faraday Future.

- Weimob Inc. (2013 HK) Shares jumped from a near 52-week low after the company announced the directors of the Company are generally authorized to repurchase Shares not exceeding 10% of the total number of issued Shares of the Company as at 29 June 2021.

- MMG Ltd (1208 HK) Shares closed at a one-month high after the company announced a positive profit guidance. Net profit after tax attributable to equity holders in 1H21 are expected to reach US$400 million, as compared to the net loss after tax attributable to equity holders of US$158 million in 1H20. An improvement in underlying operating conditions was due to higher commodity prices and the drawdown of stockpiled copper in concentrate from Las Bambas over the period.

- Orient Overseas International Ltd (316 HK) CSC Financial initiated coverage with a TP of HK$407 and a BUY rating. The report mentioned that its ROE of 17.04% is higher than the sector average level, and that the company had reached a net cash position. The outlook of the shipping sector remains positive in 2H21.

- China Youzan Ltd (8083 HK) Shares recovered from the recent 52-week low. There was no company specific news. The technical rebound could be due to Weimob’s share repurchase announcement which led to some positive sentiment in the SaaS sector.

Trading Dashboard

Related Posts: